Monthly Archive: December 2016

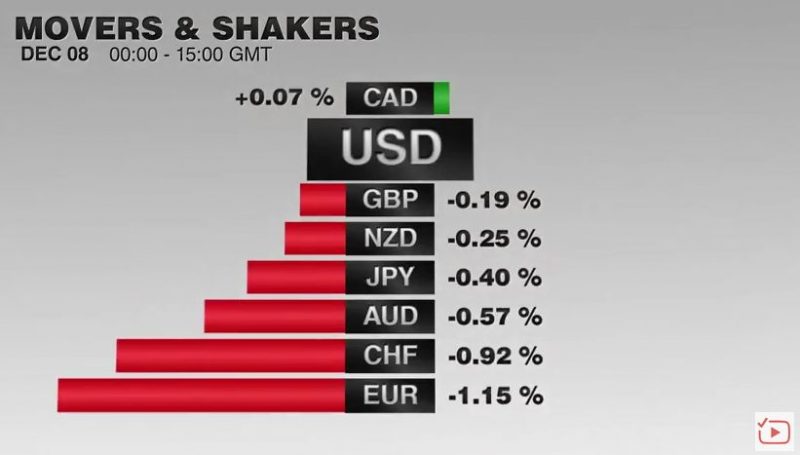

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

ECB: Dovish Taper or Hawkish Ease?

Purchases increased for longer but at a lower level; overall, more purchases than anticipated. Euro spiked higher on the announcement, but has subsequently dropped 2 cents. Lower inflation forecast for 2019 shows scope for a further extension.

Read More »

Read More »

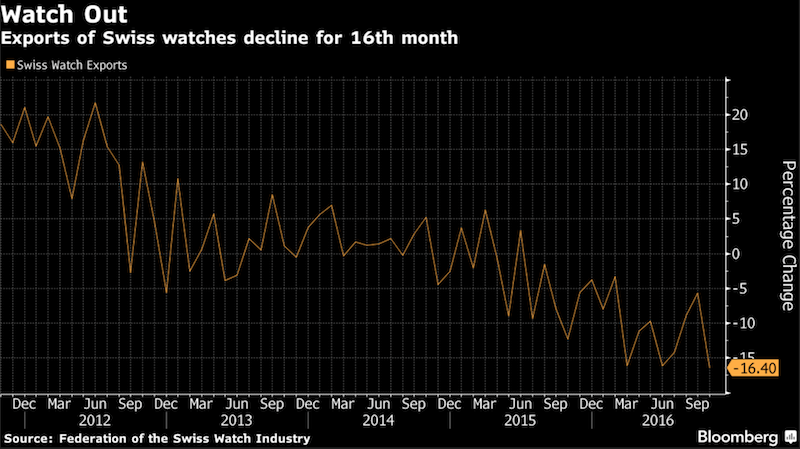

Richemont cuts send shockwaves from Geneva to mountain valleys

Richemont’s plan to slash 210 watchmaking jobs in Switzerland is sending shockwaves from Geneva to some of the country’s remote mountain villages, the cradle of high-end watch manufacturing. In Le Sentier, a town perched in the middle of the Jura mountain range, straddling the border between France and Switzerland, some 400 people protested Thursday against plans to cut the workforce of Vacheron Constantin and Piaget.

Read More »

Read More »

Cool Video: Discussing the ECB on Bloomberg TV

Tired of reading what analysts are saying? Here is a 4.3 minute video clip of my discussion earlier today on Bloomberg TV about the outlook for tomorrow's ECB meeting. The discussion covers various aspects of the ECB's decision.

Read More »

Read More »

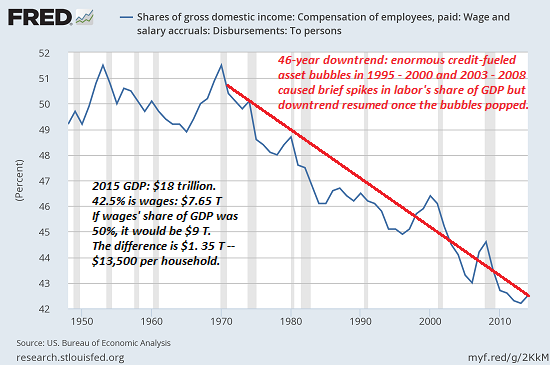

Populism in America: “Follow the Money”

If you want to understand today's populism, don't look to the mainstream media's comically buffoonish propaganda blaming the Russians: look at the four issues listed below. One of the most disturbing failures of the mainstream media in this election cycle was its complete lack of historical context for Trump's brand of populism.If you consumed the mainstream media's coverage of the campaign and election, you noted their obsession with speech acts...

Read More »

Read More »

ECB and the Future of QE

ECB will likely extend asset purchases in full. It may modify the rules by which it buys securities. It may adjust the rules of engagement for its securities lending program.

Read More »

Read More »

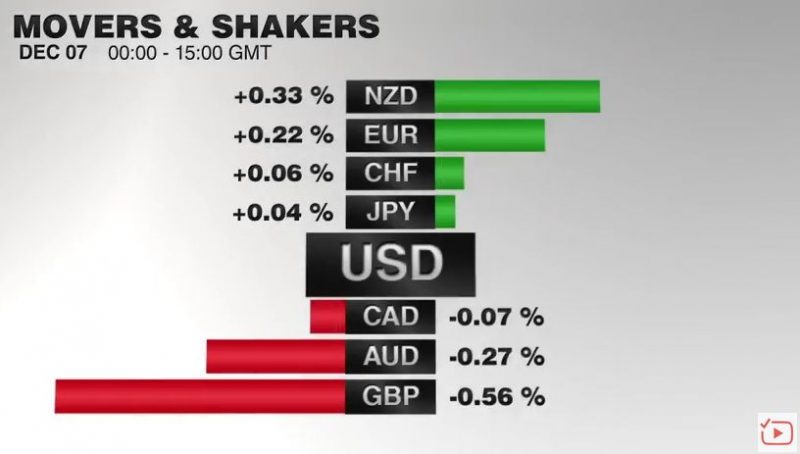

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

Wie die SNB durch Kapitalsteuern die Schweizer Wirtschaft belastet

Vor dem Hintergrund eines angeblich „schwachen Wirtschaftswachstums“ rechtfertigte SNB-Chef Thomas Jordan neulich in einem Interview in der Tagespresse die SNB-Negativzinsen und bezeichnete diese als „expansiv“. Nur: Sind Negativzinsen wirklich „expansiv“? Sind diese nicht viel eher „restriktiv“ und bremsen unsere Wirtschaft – bewirken also genau das Gegenteil von dem, was die SNB behauptet?

Read More »

Read More »

Over 4,000 studios for rent. Standing room only. Telephone included.

The contractural requirement for Swisscom to provide every commune with a telephone box comes to an end at the end of next year. Late last week, the Federal Council adopted a new plan that will come into force in 2018. Internet subscriptions without a fixed phone contract should also be part of the new plan.

Read More »

Read More »

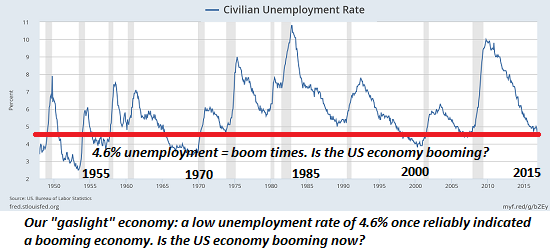

Our “Gaslight” Economy

If you don't like what these charts are saying, please notify The Washington Post to add the St. Louis Federal Reserve to its list of Russian propaganda sites. Yesterday I described our gaslight financial system. Today we'll look at our gaslight economy. Correspondent Jason H. alerted me to the work of author Thomas Sheridan ( Puzzling People: The Labyrinth of the Psychopath), who claims to have coined the term gaslighting.

Read More »

Read More »

Greek Bonds may Soon be Included in ECB Purchases

The ECB accepts Greek bonds as collateral but does not include them in its asset purchases. A new staff-level agreement by the end of the year could change that. Finance ministers imply that Greece's debt is sustainable, but the IMF disagrees.

Read More »

Read More »

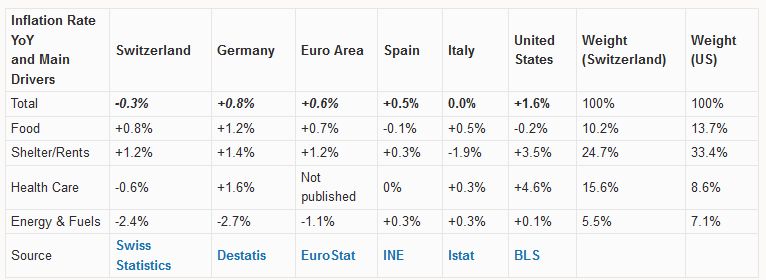

Switzerland Consumer Price Index in November 2016: -0.3 percent against 2015, -0.2 percent against last month

Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter. In Europe, we see the opposite phenomenon: Rents in Italy or Spain are steady or falling. In Germany and Switzerland rent control prevents that asset price inflation moves into consumer prices. In Switzerland, more and...

Read More »

Read More »

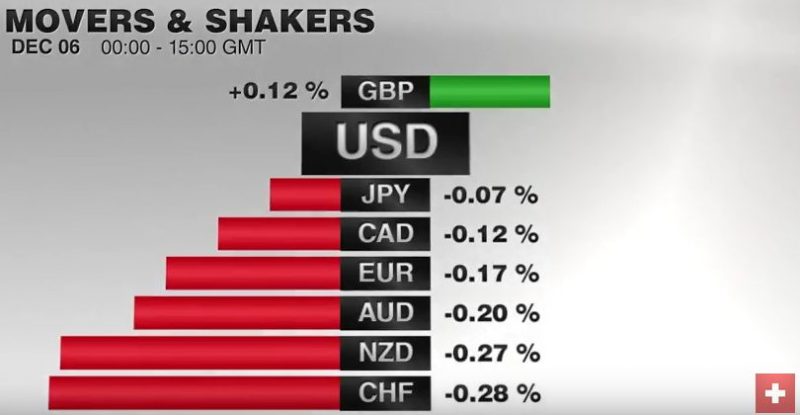

FX Daily, December 06: You Can Almost Hear a Pin Drop

The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback's downside correction after strong gains last month may not be complete.

Read More »

Read More »

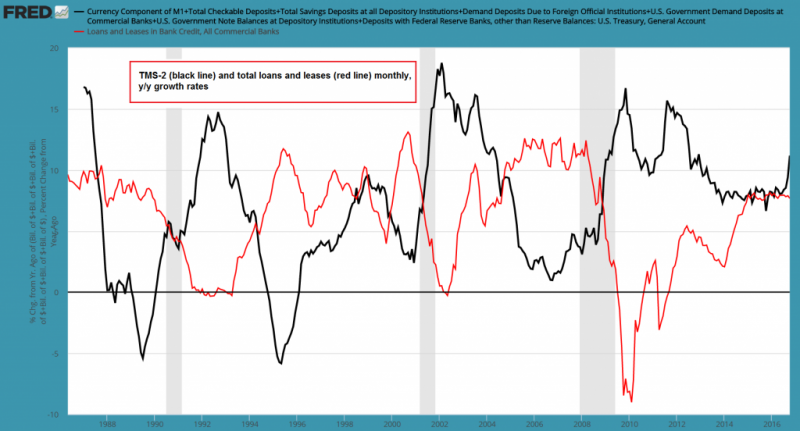

US True Money Supply Growth Jumps, Part 1: A Shift in Liabilities

The growth rates of various “Austrian” measures of the US money supply (such as TMS-2 and money AMS) have accelerated significantly in recent months. That is quite surprising, as the Fed hasn’t been engaged in QE for quite some time and year-on-year growth in commercial bank credit has actually slowed down rather than accelerating of late. The only exception to this is mortgage lending growth – at least until recently. Growth in mortgage loans is...

Read More »

Read More »

Yen and US Yields

Dollar-yen has been driven by the sharp rise in US bond yields. There are some (dollar) bearish divergences in the JPY/USD technicals. US 10-year yields may also be putting in a near-term top.

Read More »

Read More »

Great Graphic: Dollar Index Update

The Dollar Index's technical tone has deteriorated. It is corresponding to the easing of US rates and a narrowing differential. The risk is that the correction can continue in the coming days.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »