Monthly Archive: December 2016

SMI set to end 2016 in negative territory

In the last week of the year, the Swiss Market Index deepened its loss for the year as banks continued lower on low trading volumes. The SMI is set to end 2016 with an annual loss of 6.8% as banking and pharmaceutical giants pulled the index down in a year of turbulent trading. A volatile 2016 started with a brutal equity sell off as investors dumped global stocks on fears of an accelerating economic slowdown in China. The Brexit vote in June...

Read More »

Read More »

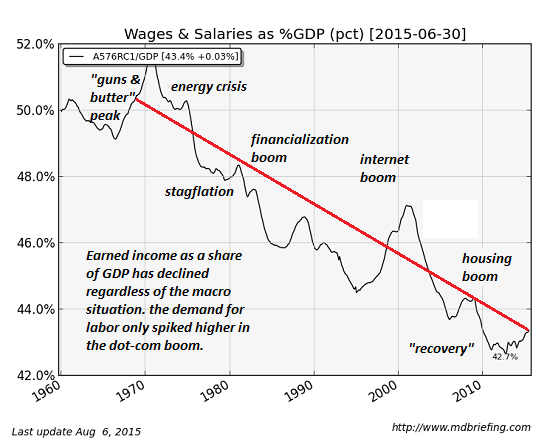

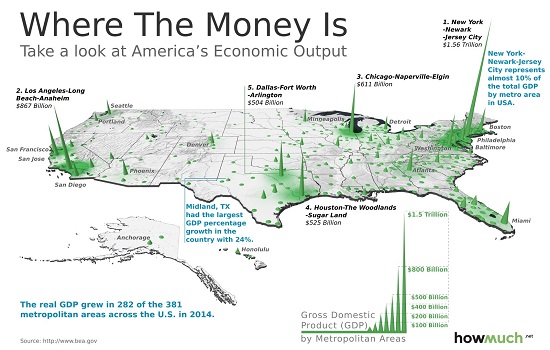

Will Tax Cuts and More Federal Borrowing/Spending Fix What’s Broken?

Charles Hugh Smith combines the best graphs on the declining wage share of GDP in this post. He answers the question if the tax cuts and more federal borrowing and spending can solve what is broken in the U.S. economy.

Read More »

Read More »

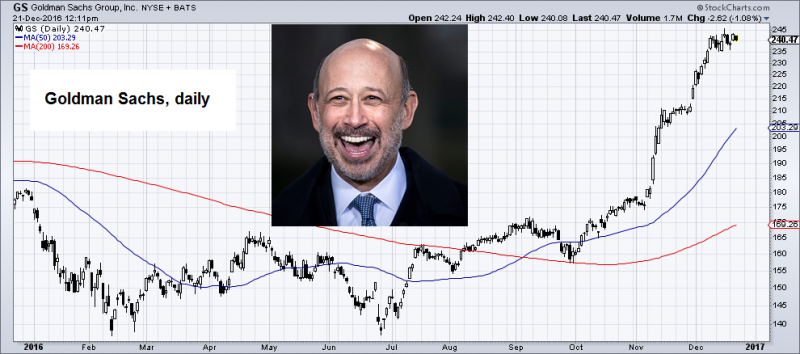

How You Become a Crony

BALTIMORE – Who’s the biggest winner so far? “Government Sachs!” Fortune magazine reports that the winningest person since Trump’s election is Goldman Sachs CEO Lloyd Blankfein.

Read More »

Read More »

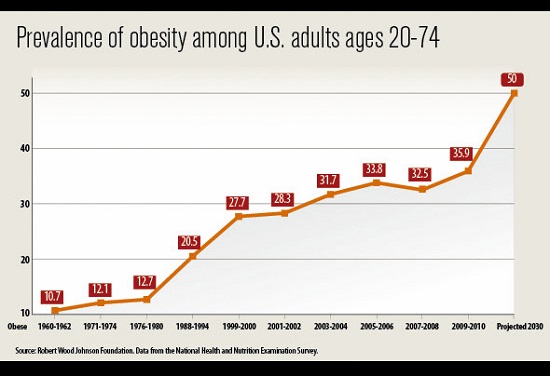

When Did Our Elites Become Self-Serving Parasites?

When did our financial and political elites become self-serving parasites? Some will answer that elites have always been self-serving parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.

Read More »

Read More »

FX Daily, December 30: Dollar Slips into Year End

In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions.

Read More »

Read More »

Miners, including Swiss-based Glencore, unearth a profit bonanza with rally set to last into 2017

Miners had been digging in one of Australia’s oldest collieries for almost a century until operations wound down a year ago, the victim of plunging global commodity prices.

Read More »

Read More »

Fake News, Mass Hysteria and Induced Insanity

We've heard a lot about "fake news" from those whose master narratives are threatened by alternative sources and analyses. We've heard less about the master narratives being threatened.

Read More »

Read More »

India’s Rapid Progression Toward a Police State

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, and Part-V, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

Read More »

Read More »

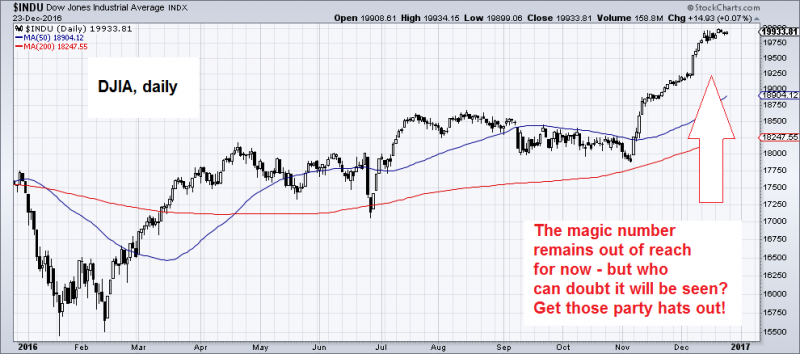

Wreck the Halls

Despite the best efforts of the bulls to make history happen, they’ve been unable to ‘git-r-done.’ At the time of this writing, the Dow is facing another bout of arrested development; it has yet to notch 20,000 for the very first time.

Read More »

Read More »

FX Daily, December 29: Dollar, Equities and Yields Fall

In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer.

Read More »

Read More »

Davos Staff May Sleep In Shipping Containers As Billionaires Swarm Resort

With January just around the corner, the world's billionaires, CEOs, politicians and oligarchs prepare to take their private planes to Davos, Switzerland for their annual convocation at the World Economic Forum, where they discuss such diverse topics as global warming due to greenhouse gases (which exempts Gulfstream jets) and the dangers of record wealth inequality (which exempts them), while snacking on $39 hot dogs and $50 Caesar salads.

Read More »

Read More »

Fake News? It’s All Fake!

BALTIMORE – In January of this year, the Empire Herald reported that a “meth-addled couple” had eaten a homeless man in New York City’s Central Park. Later, Now8News reported that a can of cookie dough had “exploded in a woman’s vagina”; the woman was alleged to be shoplifting.

Read More »

Read More »

A Tale of Two Housing Markets: Hot and Not So Hot

If we had to guess which areas will likely experience the smallest declines in prices and recover the soonest, which markets would you bet on?

Read More »

Read More »

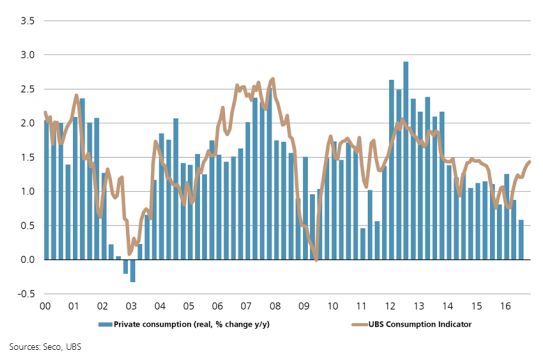

Switzerland UBS Consumption Indicator November: Subdued private consumption in 2017 despite solid November figures

The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid start is to be expected for 2017, but momentum is expected to subside.

Read More »

Read More »

Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available.

Read More »

Read More »

FX Daily, December 28: Short Note for Holiday Markets

Economic data: Japan stands out with industrial production in Nov rising 1.5%, the most in five months. It was a little less than expected, but the expectations for Dec (2%) and Jan (2.2%) are constructive.

Read More »

Read More »

Great Graphic: Real Wages

This Great Graphic caught my eye. It was tweeted by Ninja Economics. Her point was about immigration. German had much higher immigration than the UK, but also saw real wage increase of nearly 14% in the 2007-2015 period, while real wages in the UK fell nearly 10.5%.

Read More »

Read More »

Grab-Bag of Resolutions for 2017

Here's a grab-bag of resolutions with something for just about every persuasion. I resolve to never utter or write the word "Trump" in 2017. (Good luck with that...)

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

The Fed has hiked rates and with this fait accomplis speculators sold the news. They closed their short CHF and opened new CHF longs. The SNB, however, intervened again for 0.5 billion CHF.

Read More »

Read More »