Summary:

Money markets and the Swiss franc have diverged despite a presumed increase in event risk from the U.S. Presidential election.

Moreover, shorts against the Swiss franc have risen.

This surprising divergence opens up a presumed opportunity use the franc as a hedge against a surprise outcome from the election.

This time Duru agrees with the strategy even as he suspects that, once again, any subsequent incremental strength in the Swiss franc will be short-lived.

Analysts are once again making a case for using the Swiss franc (NYSEARCA:FXF) as a hedge against a big event. Last time, the franc was supposed to be a hedge against Brexit. I argued at the time that the currency was a poor choice. That argument happened to prove correct although my extrapolation to a bottoming for the British pound (NYSEARCA:FXB) was premature (more on that bottoming process in a coming piece). This time around, analysts are arguing that the franc would serve as a good hedge against the U.S. Presidential election… and THIS time, I agree.

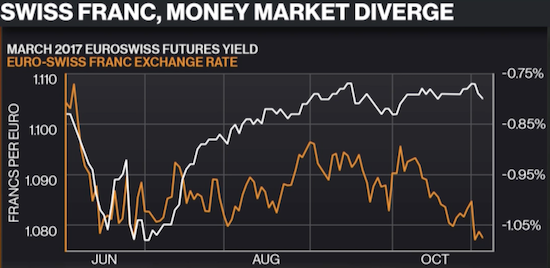

Bloomberg lays out the argument in “Swiss Franc Offers Best of Both Worlds for Hedging U.S. Election” (mostly in the accompanying video). Essentially, there is a surprising divergence between the Euroswiss futures yield and the Swiss franc. During Brexit, the two levels stayed converged and only diverged once the initial post-Brexit panic transformed into a sharp rally in global stock markets. Presumably, if the U.S. Presidential election delivers a surprise result then money will rush into the money market, drive yields lower, and push the Swiss franc higher. I do not believe it matters whose victory creates the surprise, only that financial markets act out in surprise to the result. Yet note that conventional wisdom marks up a Donald Trump victory as the surprise outcome.

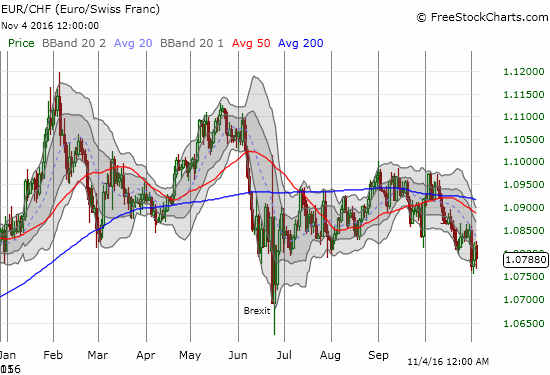

Swiss Franc, Money Market DivergeJust as with the Brexit hedging argument, analysts assume the franc will not move much on the expected outcome of the U.S. Presidential election. Thus, the Swiss franc is a strong buy ahead of the election as a hedge against a surprise result. EUR/CHF is one of the more common pairs to trade on the franc. EUR/CHF has declined over the past month and seems already headed toward a post-Brexit low. In fact, EUR/CHF trades right around its level right before the Brexit vote. |

Swiss Franc, Money Market Diverge A trading opportunity has arrived in the form of rate/currency divergence despite presumed event risk from the U.S. Presidential election. Source: Bloomberg - Click to enlarge |

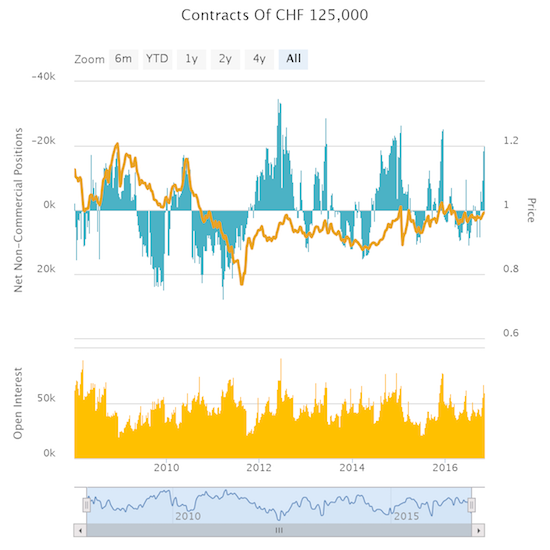

EUR/CHFSpeculative positioning also suggests there is an opportunity to use the franc as a hedge. While the franc is strengthening against the euro, net speculative shorts against the franc are rising. The latest CFTC Commitment of Traders report shows net speculative shorts close to 20,000 contracts. Since 2008, this level of net short positioning is near peak levels except for the euro (NYSEARCA:FXE) crisis version 2012. If event risk drives panicked traders into the franc, the unwind of these net shorts could add fuel to the fire. Note well that ahead of Brexit speculators generally stayed long the franc. |

EUR/CHF(see more posts on EUR/CHF, ) EUR/CHF is near the post-Brexit low and its low for the year, but still well above levels seen for almost half of 2015. Source: FreeStockCharts - Click to enlarge |

Speculative Position CHFI have not traded the Swiss franc in a very long time. Like many traders, I have absolutely no trust in the Swiss National Bank (SNB) after last year’s sudden capitulation on its 1.20 floor on EUR/CHF. Moreover, the SNB still claims it is ready to intervene in currency markets to weaken the franc, so traders should be on alert in the case of an event-driven surge in franc strength. The hedge is not likely to work for long under such conditions. Indeed, Brexit marked a PEAK in franc strength. The main difference this time around is that the franc hedge is not insurance against another currency’s problems. This time, the franc is a much more palpable hedge against a more fundamental and lasting surge in risk aversion if the world’s largest economy roils post-election. For example, the potential for flows out of the U.S. carries much more weight than the potential for flows out of the United Kingdom. |

Speculative Position CHF(see more posts on Commitment of Traders, Speculative Positions, ) Net shorts are on the move against the Swiss franc. Source: Oanda - Click to enlarge |

Are you the author? Previous post See more for Next post

Tags: Commitment of Traders,EUR/CHF,newslettersent,Speculative Positions,Swiss National Bank