(Greetings from Dublin, where I have begun my European fall trip. Commentary may be less regular over the next fortnight)

Swiss Franc |

|

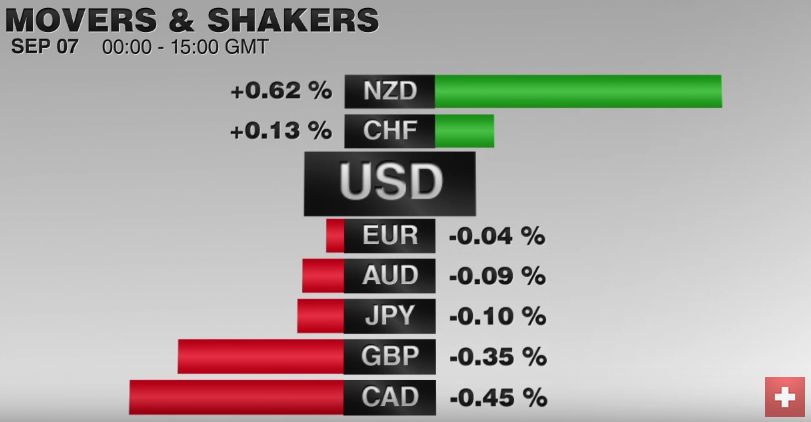

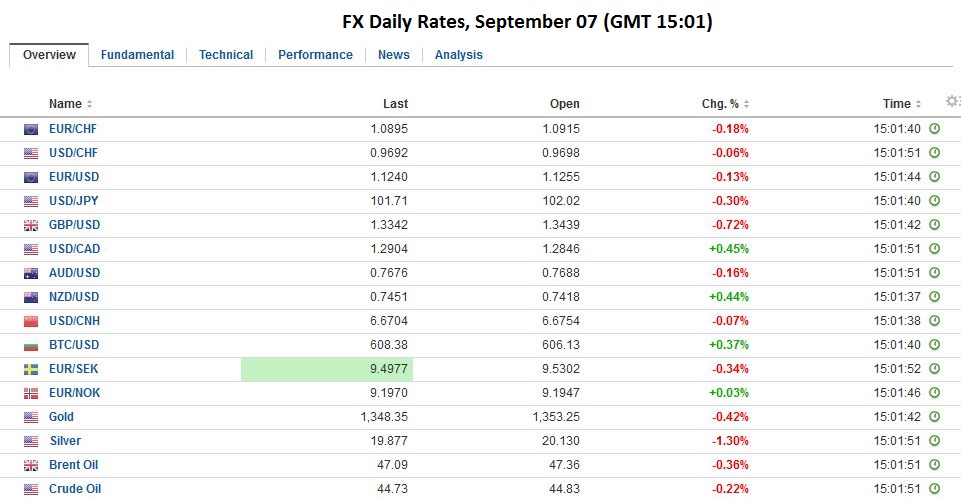

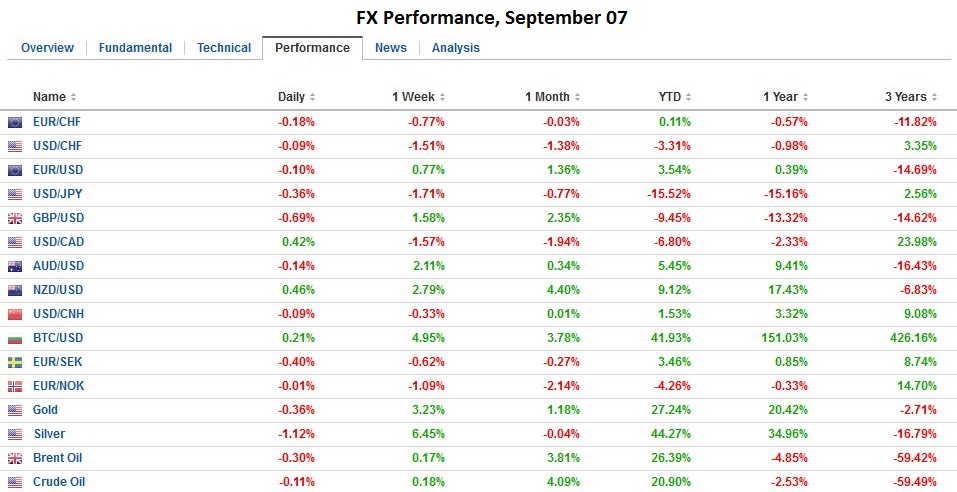

FX RatesDisappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday’s shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro’s strength is not a function of superior yields than the US. |

|

|

The euro has been fairly resilient, though ahead of tomorrow’s ECB meeting, it is unlikely to push through $1.1275. Still, pullbacks have been shallow, and the risk is that this area is penetrated tomorrow. The near objective is near $1.1350.

The decline in US rates and fading hopes of further easing by the BOJ has seen the dollar crater to the JPY101.20 area. Intraday technicals warns that a low may not be in place. There is some talk of a retest on JPY100. |

|

| Australia’s Q2 GDP rose 0.5% for an enviable 3.3% year-over-year rate. It has bee a quarter of a century since the Australian economy experienced a recession. In line with the US dollar bounce, the Aussie was pushed lower, away from $0.7700, but dip was shallower and found eager buyers. Higher milk prices a high yields, sees the New Zealand dollar buck the trend and is the strongest of the majors today, gaining more than 0.5%.

Sweden’s Riksbank met with no fanfare, as expected. It is pursuing an aggressive monetary policy, while deflation forces have ended and the economy is expanding, with the help of a large external surplus. Attention turns to the Bank of Canada, the third central bank to meet this week. It is expected to also leave policy unchanged. |

|

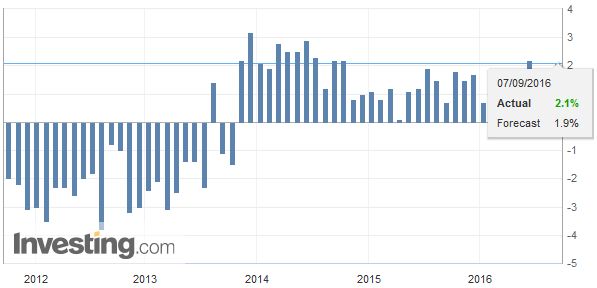

United KingdomSterling had approached the upper end of its post-referendum range (~$1.35), but the 0.9% decline in manufacturing output, three-times more than the median expectation saw sterling sag toward $1.3350. |

U.K. Manufacturing Production YoY Click to enlarge. Source Investing.com |

| The broader measure of industrial output eked out a 0.1% gain, with the help of a 5.6% increase in oil and gas. |

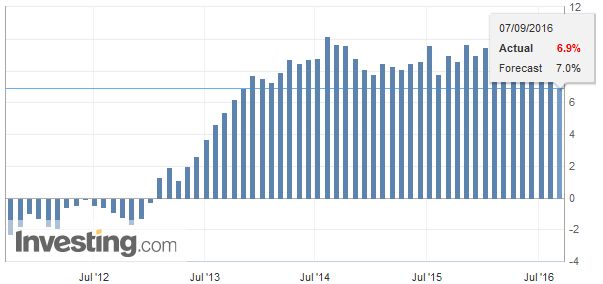

U.K. Industrial Production YoY(see more posts on U.K. Industrial Production, ) Click to enlarge. Source Investing.com |

| The BOE forecasts that the economy is likely expanding at a 0.1% quarter-over-quarter clip here in Q3. However, the August PMIs were above expectations, suggesting that psychology may have been hit harder than the real economy. Still, the impact of the referendum is likely to be seen over time. Separately, we note that Halifax reported a 0.2% fall in house prices in August. It is the second consecutive monthly decline. |

U.K. Halifax House Price Index YoY Click to enlarge. Source Investing.com |

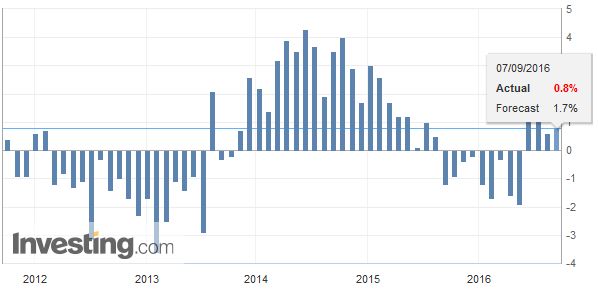

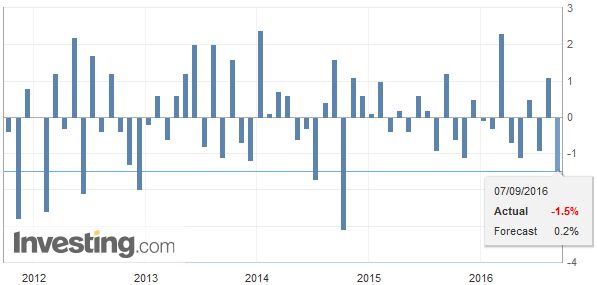

GermanyArguably the Germany miss is even more important. German industrial output fell 1.5% in July. It is the biggest drop in two years. It was led by a 2.3% drop in manufacturing output, largely concentrated in capital goods. It is not immediately clear the impact of seasonal factors. We suspect that it is a bit of both, with seasonal considerations exacerbating a weakness, which we suspect is partly a consequence of softer demand from China. The decline in manufacturing output concealed a 2.6% increase in both construction and energy. |

Germany Industrial Production(see more posts on Germany Industrial Production, ) Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,FX Daily,Germany Industrial Production,Japanese yen,newslettersent,U.K. Industrial Production