Interim results of the Swiss National Bank

|

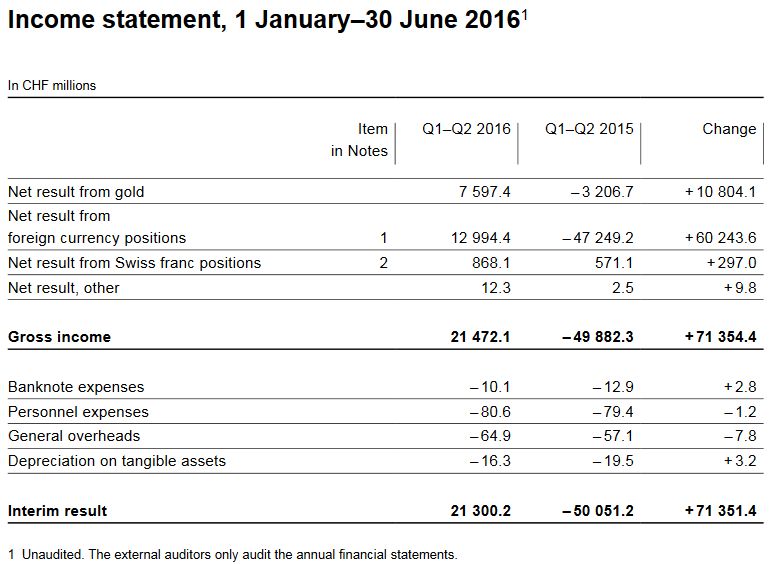

Income statement, 1 January–30 June 2016 |

||||||||||||||||||||||||||||||||||||

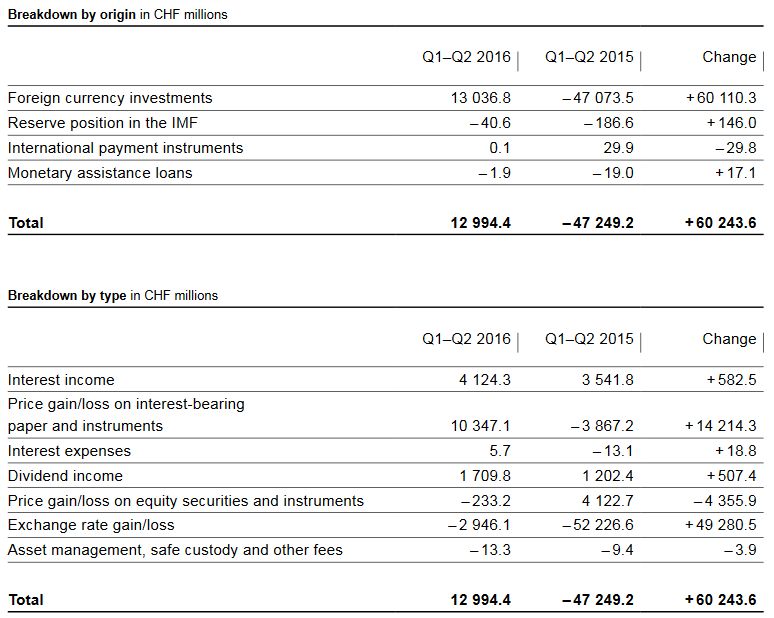

Profit on foreign currency positions

|

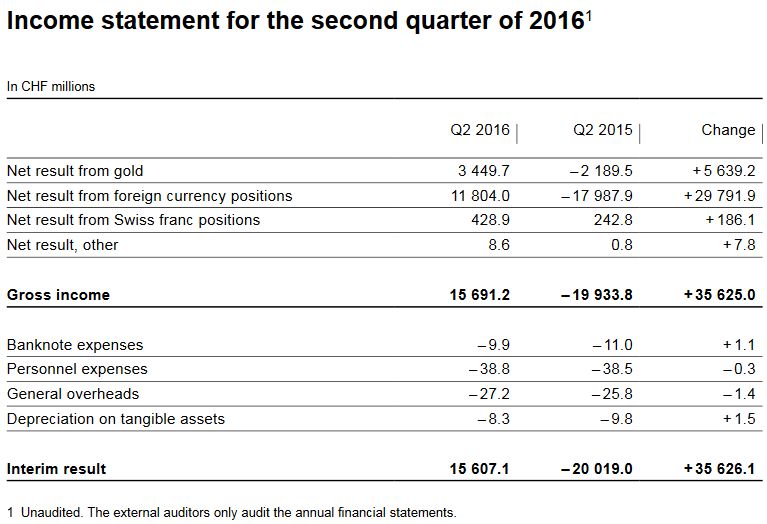

Income statement for the second quarter of 2016 |

||||||||||||||||||||||||||||||||||||

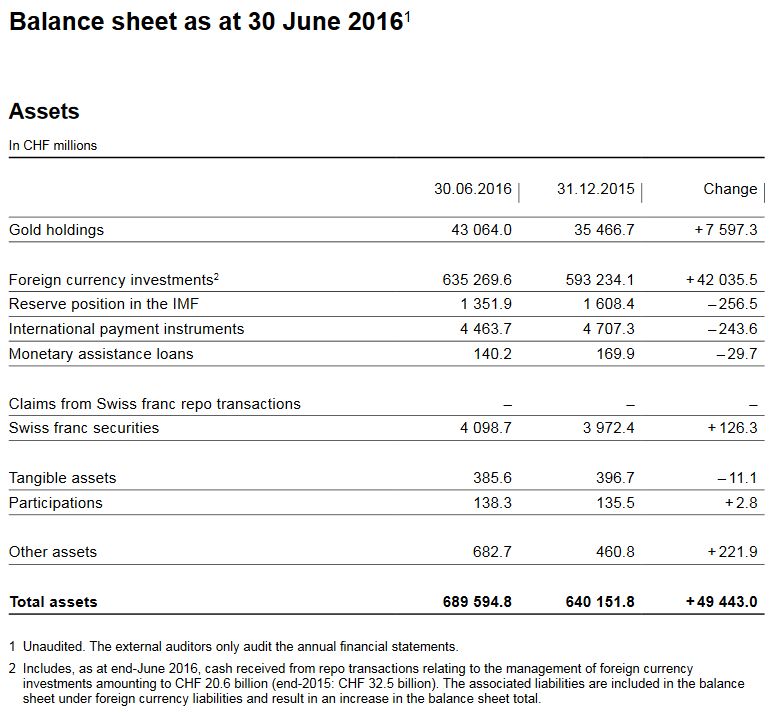

Valuation gain on gold holdingsA valuation gain of CHF 7.6 billion was achieved on gold holdings, which in volume terms have remained unchanged. Gold was trading at CHF 41,408 per kilogram at end-June 2016 (end-2015: CHF 34,103).

Percentage of gold to balance sheet

Balance Sheet The balance sheet has expanded by over 49.4 bn. francs by 7.66%.

|

Balance sheet as at 30 June 2016 |

||||||||||||||||||||||||||||||||||||

While the SNB supports foreign stock markets and foreign companies, it does not invest in Swiss stocks.

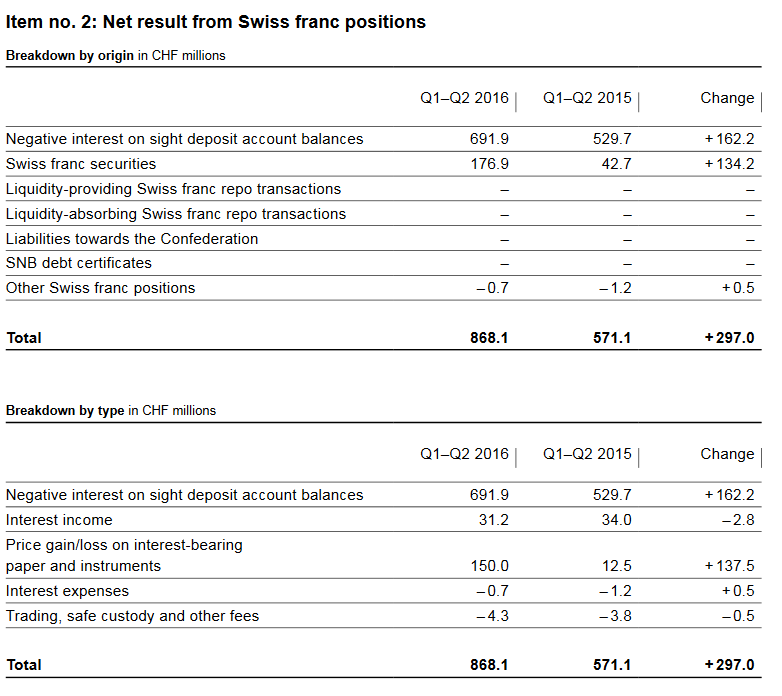

Profit on Swiss franc positionsThe SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

SNB Result for Swiss Franc Positions, H1 2016 |

||||||||||||||||||||||||||||||||||||

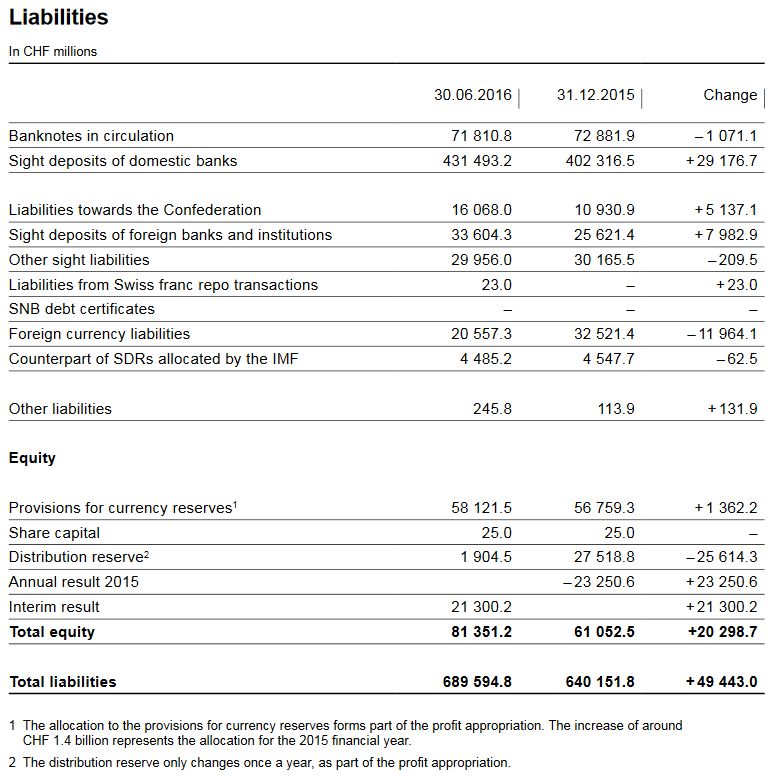

SNB LiabilitiesElectronic Money Printing: Sight Deposits Sight deposits is the biggest part of SNB interventions. Paper Printing

Banknotes in circulation: -1.07 bn francs to 72 bn. CHF

Provisions for currency reserves

|

|||||||||||||||||||||||||||||||||||||

AppendixAccounting and valuation principlesThe SNB is a special-statute joint-stock company with head offices in Berne and Zurich. These interim results have been drawn up in accordance with the provisions of the NBA and the Swiss Code of Obligations (CO) as well as the accounting principles detailed in the notes to the annual financial statements as at 31 December 2015. These results present a true and fair view of the financial position and the results of operations of the SNB. Unless otherwise stated, the accounting principles are based on the Swiss GAAP FER standards (Accounting and Reporting Recommendations). Departures from Swiss GAAP FER occur only if an accounting principle runs counter to the provisions of the NBA or if the special nature of the SNB needs to be taken into account. In a departure from Swiss GAAP FER, no cash flow statement has been prepared. The structure and designation of the items in the balance sheet and the income statement take into consideration the special character of the business conducted at a central bank.

Compared with the annual financial statements as at 31 December 2015, there were no changes to the accounting and valuation principles.

The SNB interim results as at 30 June 2016 constitute an interim report in accordance with Swiss GAAP FER 31, with condensations in presentation and disclosures.

Swiss GAAP FER 31 requires the presentation of earnings per share. This has no informative value in view of the special statutory provisions for the SNB. Shareholders’ rights are determined by the NBA and their dividends, in particular, may not exceed 6% of share capital (with a nominal value of CHF 250 per share, a maximum of CHF 15); the Confederation is entitled to one-third and the cantons to two-thirds of the remaining distributable profit. Therefore, no presentation of earnings per share is made.

|

Net result from foreign currency positions |

Full story here Are you the author? Previous post See more for Next post

Tags: SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank