Secular StagnationOUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for help. His technique is simple. He takes the boy on his knee. Then he begins by explaining the role of money in the economy, subsequent to 1971. If that fails to do the trick, he follows with a discourse on Fed policy mistakes. Within minutes James has fallen fast asleep… |

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for help. - Click to enlarge |

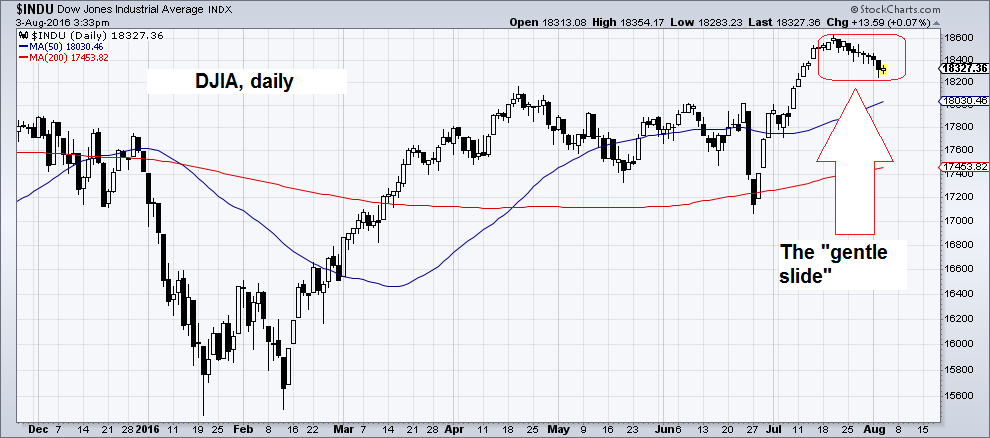

| The stock market is usually quiet in August. Investors, speculators, and manipulators tend to be on vacation. They’re applying sunscreen or swatting mosquitoes rather than paying attention to their equity positions or Fed policies.

The Dow has been gently falling for a few days in a row. But the index still trades near its all-time high. Friday’s GDP report brought no joy, but little worry either. The market realized volatility over the past two weeks was so small, it is statistically speaking a “once in every 10,000 years” event. Readers should keep in mind that periods of uncommonly low volatility are usually followed by the exact opposite. We don’t know what will trigger it, but as JP Morgan’s quantitative analyst Marko Kolanovic notes: “Over the past 3 weeks, the amount of call options exceeding put options (in terms of gamma exposure) averaged almost $40bn (per 1%), which is the largest call to put gamma imbalance ever observed.” Our guess is that this will eventually invite a few wild moves – all that is needed is a trigger (especially after the options pressure rolls off, as Mr. K. also states). |

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for help. - Click to enlarge |

| The numbers showed only half the growth economists expected. Plus, the authorities revised downward the numbers from the previous two quarters. The result: The U.S. economy grew at a pace of roughly 1% for the past three consecutive quarters. And even that is doubtful.

We explained to grandson James that the calculation of economic growth depends on something called the “GDP deflator” – which tracks changes in consumer prices, and is subject to guesswork and manipulation. Given the range of error and the tendency of the feds to flatter growth, the economy may actually have been in a depression for the last several years. “Secular stagnation” is what former Treasury secretary Larry Summers calls it. But this is just an excuse – designed to disguise the real cause of the slump he and his fellow insiders caused. They believed they could improve the system – by managing its money supply, its interest rates, and its bank lending policies. Now, they’ve made a mess of it. James’s face twitched when we mentioned Summers. Perhaps he inherited from his grandfather an instinctive skepticism of Summers, Bernanke, Krugman, Reich, Rubin, Yellen, Draghi – and all the other know-it-all world improvers. He appeared to be sound asleep. But we continued anyway (dear readers are advised to turn down the lights and get in a comfortable, horizontal position). |

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for help. - Click to enlarge |

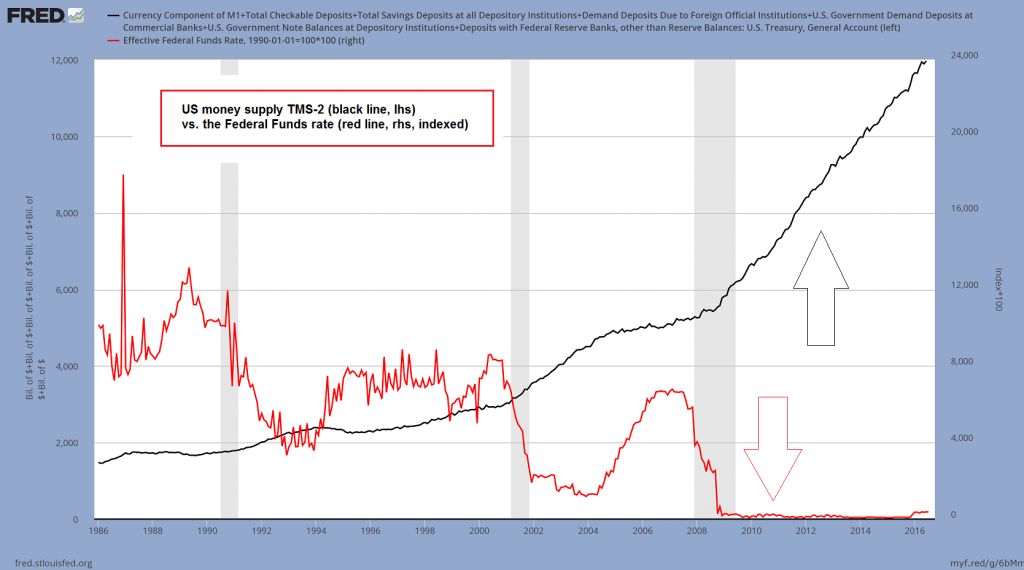

Jumping the “Hurdle”In a healthy economy, interest rates naturally follow – very roughly – economic growth. Little growth means little demand for savings. Companies are not expanding. Consumers are not buying. Investors are not speculating. Interest rates fall in response to the lower demand. Then as the economy heats up, interest rates should rise, reflecting the greater demand for capital. You will note that this is a self-correcting, cyclical system. Higher interest rates raise the “hurdle” that new ventures must face. They must be more profitable to clear the hurdle. So, business leaders and investors must be more careful. If their project fails to produce enough new revenue (wealth) to pay the costs of the resources devoted to it – including the cost of money (the interest rate) – they will lose money. This is the essential truth of a real economy. Capital is always scarce. You must use it wisely. Interest rates just tell you how scarce it is. Typically, rising interest rates pinch off new ventures, cool down the economy, and then turn down themselves. Then, as the hurdle is lowered, entrepreneurs take on new projects. And the economy warms again. From this simple description, PhD economists like Summers leaped to absurdity. If high interest rates cool an economy… and low interest rates heat it up… all we have to do, they reasoned, is lower interest rates. Then the economy will run hot all the time! See how easy it is? Just lower interest rates to zilch and pump up the money supply! How else are we going to achieve eternal prosperity? If you don’t believe us, just ask Larry, Ben, Janet, Mario, Haruhiko-san, Paul K., Joseph S., etc., etc. – they are the experts after all!. |

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for help. - Click to enlarge |

What Recovery?Eight years ago, the Fed – not for the first time – put this plan into service. It lowered interest rates to the “zero bound” in an attempt to stimulate a recovery. This way, the Fed signaled to entrepreneurs that capital was available in almost infinite amounts at negligible cost. No need to be careful. No need to use it wisely. Just go ahead and buy… invest… speculate! But wait – what’s this? Where’s the recovery? President Reagan’s budget director David Stockman calculates that the average American now earns 40% less – properly adjusted for increases in living costs – than he did at the beginning of this century. What happened? The feds gave the economy enough “stimulus” to raise the dead. But instead of raising GDP growth, the economy seems to have followed the Fed’s phony interest rate – down. 1-year average GDP growth on a quarterly basis since 1948, via Lance Roberts. The blue shaded areas are recession periods as determined by the National Bureau of Economic Research (NBER), the red dotted line facilitates the comparison of the current 1.20% reading vs. past readings. It’s fair to say that this is not exactly the most rip-roaring recovery ever. It must seem impossible to the childlike minds at the Fed. But depressing interest rates seems to have depressed the economy, too. How could that be? James stirred a little. We thought he might be waking up. So, we continued… |

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for help. - Click to enlarge |

Dangerous NoiseIn a healthy economy, interest rates mark the balance between the availability of surplus capital and the demand for it. They contain valuable information, like the number of seconds you can hold a hand grenade before it blows up. The same goes for money. Money is not the same as wealth any more than a claim ticket for an automobile left in a parking garage is the same as the car. The claim ticket is information, not wealth. This is why an economy does not magically produce more wealth simply because you falsify interest rates to make more fake dollars available. You might as well print up more claim tickets! The number of cars in the garage will not increase. Real claim tickets are valuable information. Phony claim tickets are dangerous noise – misleading and fraudulent. They do not make the economy run more smoothly, efficiently, and productively. They just make a mess of it, as Summers et al have done – and make people poorer. More to come… |

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for help. - Click to enlarge |

Charts by: StockCharts, St. Louis Federal Reserve Research, Lance Roberts / Alhambra Partners

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.

Full story here Are you the author? Previous post See more for Next post

Tags: Lance Roberts,Larry Summers,newslettersent,On Economy,On Politics