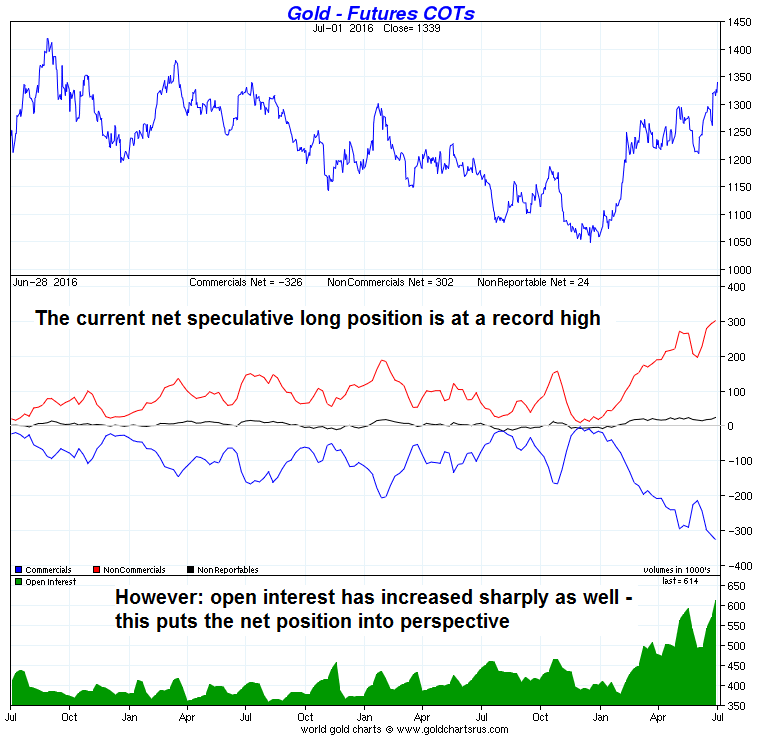

A Growing Bullish Chorus – With Somewhat Muted EnthusiasmA few days ago a well-known mainstream investment house (which shall remain nameless) informed the world that it now expects the gold price to reach “$1,500 by early 2017”. Our first thought was: “Now they tell us!”. You won’t be surprised to learn that the same house not too long ago had its eyes firmly fixed in the opposite direction. Why are we telling you this? We have noticed that sudden professions of new-found gold bullishness have begun to proliferate lately, relatively speaking at least. This is not only evident by these Canossa-like conversions of former bearish heretics, but also in the positioning data. We hasten to add that the bullish arguments are by and large sound – we agree with most of them (for a complete list of same, see this year’s “In Gold We Trust” report). We also want to point out that (as we have mentioned a recent article on the the CoT report – see “The Commitments of Traders” for the details) a certain finesse is required to properly interpret allegedly “extreme” positioning data. |

|

August gold, dailyLastly, it should be obvious that in order for a nascent bull market to continue, new converts are actually needed. While it is great fun to see prices rise while everybody is bearish (and vice versa), in a bull market that only gets you so far. At some point there has to be a “moment of recognition”, which prompts new investors to join the fun and make it more fun in the process. Friends of ours who share our intellectual and investment interest in gold, often send us tidbits of information which we then discuss. In recent weeks a number of analysts have actually upgraded a handful of gold stocks, while a yet others have been fighting the trend and have issued sell ratings – to little avail (repeatedly in some cases!). We have made a few observations worth sharing in the context of these upgrades, which often seem to prove the adage that one really doesn’t need analysts in a bull market (in a bear market, they are often considered a nuisance – when people are losing money, they don’t want to know why). Darts seem to work just as well. Obviously, we are saying this as someone who occasionally also posts such analyses, with decidedly mixed results over time (lately, the results were often quite good, but we ascribe this to luck rather than prescience – and darts would still have done the trick). What strikes us as noteworthy is only this: most of the upgrades seem to be quite timid. What does it mean when a stock that has just risen 350% from its low is upgraded from “underperform” to “neutral”, with a 12 month price target 25% above its current price level? Making a 25% return in a “no yield” world is usually considered rather mouth-watering. We’re not sure if we would resort to the term “neutral” in this context. On the other hand, we are talking about stocks that can at times move that much in two or three trading days, so it’s all relative. In that sense one can probably state that enthusiasm for the sector is not exactly at full blast just yet. Another observation, which is more of a general nature is that occasionally the very same things that were pronounced a big drag on the stock prices of gold miners while they were still going down, are now considered potential catalysts for further gains. This just goes to show that it is the market that “writes the news”, so to speak. |

|

Positioning Data and Resistance Levels RevisitedWe want to briefly revisit positioning data in gold futures and resistance levels in the HUI, two topics we have last discussed in April and May. First of all, net speculative length in gold futures is currently at a record high. Almost needless to say, this makes the market increasingly vulnerable to a correction, but it doesn’t mean other near term outcomes are impossible. |

|

Since the small speculator position cannot be seen very clearly on the above chart, we show it here separately:

Non-reportables have the largest net long position in quite some time, but it remains fairly small in historical terms.We would conclude from this that the danger of a correction is now quite high again – something one certainly needs to be aware of. However, one also has to keep in mind that there are a few details that indicate that the market at least has the potential to go even higher first. Apart from the fact that the positioning extreme has to be put into context, there is also the price pattern itself. For the correction danger to materialize, short term support levels will have to be violated first. This could very easily happen, but it hasn’t happened yet.

|

|

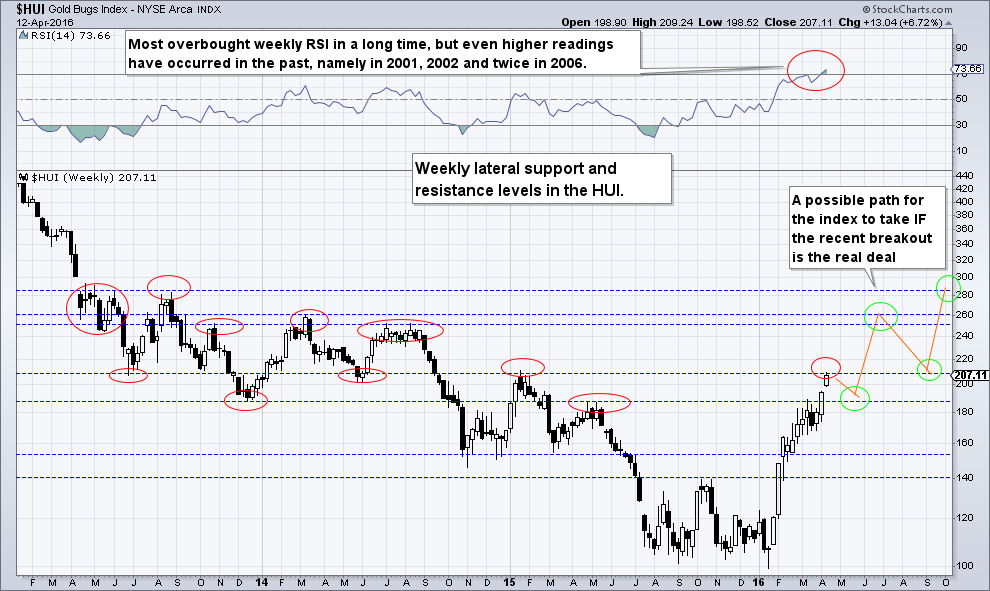

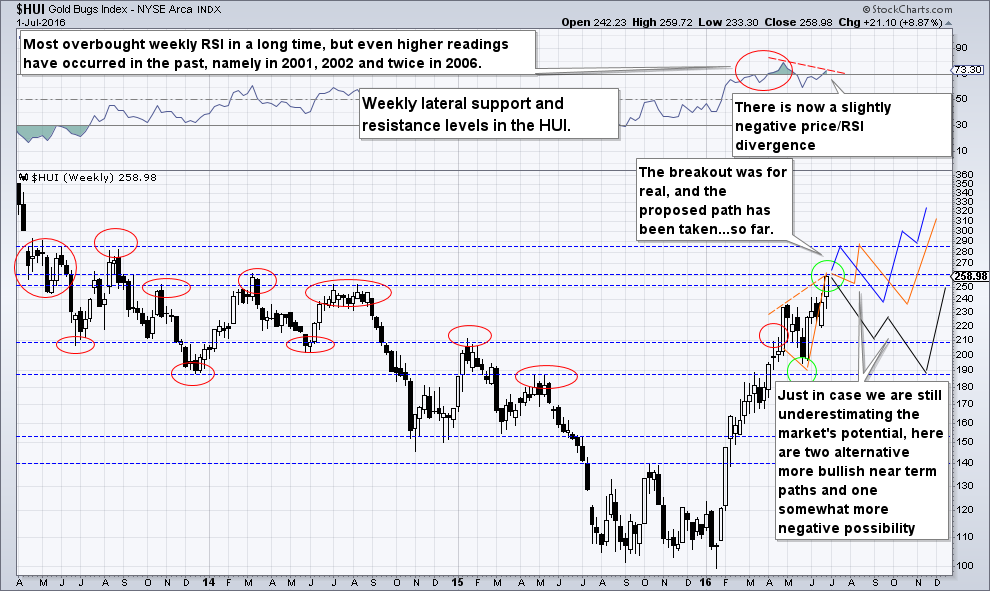

Gold Bugs IndexNext we want to look at the HUI’s resistance levels again, which we last discussed in April (see: “Weekly Resistance Levels in the HUI”). Below is the chart of lateral support and resistance levels we posted at the time – as you can see, the market has actually run into one of these major resistance areas at the end of last week. It is quite tempting to conclude that a pause is imminent: Of course, although we did guess right in April, for a while we underestimated the rally quite a bit. We originally thought the first bigger correction would set in at around 165 – 170 points at the latest (equivalent to the 2000-2001 initial advance) – but instead the market went higher and corrected by marking time rather than producing a sharp price decline. So below is an updated version of the above chart, which shows three alternatives as to how things could continue from here. Two of those assume a slightly stronger market in the near term with a little less correction potential than shown above, and one a slightly weaker near term outcome with bigger correction potential. |

|

Updated weekly resistance chart with alternative paths.All of these scenarios assume that a larger degree bull market remains in force – an idea that remains operative as long as no major support levels are violated. Note that the rising 50-day moving average at currently approx. 222 points and the likewise rising 200-day ma at currently approx. 159 points also represent important support levels (near term, resp. long term). So one of the possibilities we are entertaining is that the index will still manage to run to the next resistance level in the near term (in July – August, orange and blue lines), which happens to coincide with a gap on the weekly chart which was left open in 2013 on the way down. For karmic balance, there is also a slightly bigger correction penciled in that starts more or less immediately (the black line). Obviously, some mixture of these potential paths is imaginable as well. Note with respect to the RSI that is is currently diverging bearishly from price, although not by a whole lot. Since it didn’t streak even higher when we made the original version of this chart, it still retains the potential to do so. |

Conclusion:

The air for gold and gold stocks is clearly getting thinner in the short term, but so far prices have not yet signaled anything untoward. New weekly highs have just been put in last week, which is obviously never a bad thing, as such. This means there may well be even more upside before a correction begins. However, from a risk-reward perspective, it is fair to say that the potential risk now probably exceeds the potential reward in the near to medium term.

Long term, the very same things that make the market look a bit stretched in the near term should actually be considered a bullish datum. Historically such strong rallies have exhibited a strong tendency to turn into long term uptrends.

Stay tuned – in our next update we will take a look at an updated 1970s bull market comparison, which is quite interesting as well.

Charts by: BarChart, StockCharts, ShareLynx.

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,Precious Metals