The tenets of the Efficient Market Hypothesis and Modern Portfolio Theory

It is widely held that financial asset markets always fully reflect all available and relevant information, and that adjustment to new information is virtually instantaneous.

Burton G. Malkiels bestseller “A Random Walk Down Wall Street”, which introduced EMH to the hoi-polloi. In a nutshell, the book suggests that self-directed investors cannot possibly outperform the market over the long term, because prices at all times already reflect all known information. It would be quite easy to refute this assertion empirically; even the existence of a single investor who regularly beats the market invalidates the hypothesis, and there is not just one such investor, there are probably thousands. But can EMH be refuted theoretically as well? Yes it can, as Dr. Shostak shows here (we would be inclined to suggest that the book’s greatest achievement was to fill the coffers of Burton Malkiel and his publishers).

This way of thinking which is known as the Efficient Market Hypothesis (EMH) is closely linked with the modern portfolio theory (MPT), which postulates that market participants are at least as good at price forecasting as is any model that a financial market scholar can come up with, given the available information.

The view that everyone is as good a forecaster as any model implies that their forecasts do not display systematic biases. In other words, their forecasts are right on average. According to the MPT, by using available information, all market participants arrive at “rational expectations” forecasts of future security returns, and these forecasts become fully reflected in the prices that are observed in financial markets.

Changes in asset prices will occur on account of news which cannot be predicted in any systematic manner. Asset prices respond only to the unexpected part of any news, since the expected part of the news is already embedded in prices. For instance, if the central bank raises interest rates by 0.5 percent, and if this action was anticipated by market participants, the effect of this anticipation will be manifested in asset prices prior to the central bank raising interest rates.

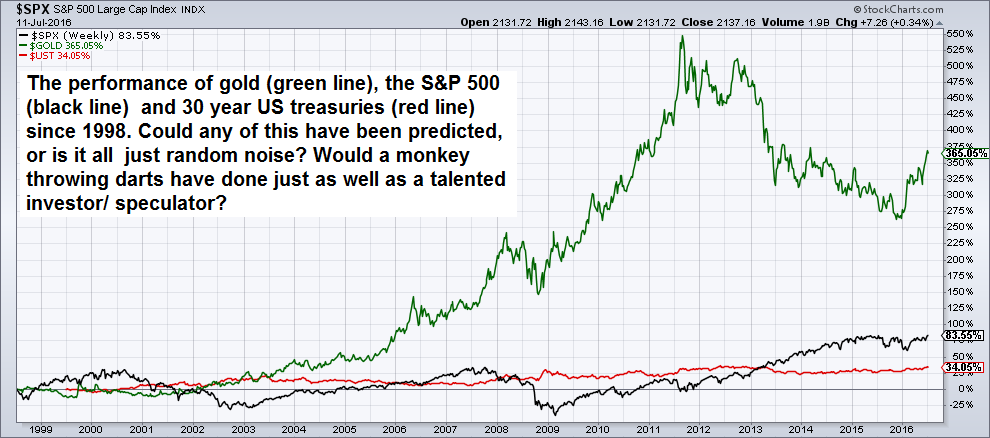

The performance of three major markets since 1998 – was it really “unpredictable”?In other words, this increase will have no effect on asset prices. Should, however, the central bank raise interest rates by 1 percent, rather than the 0.5 percent expected by market participants, then the prices of financial assets will react to this increase. The efficiency of the market means that the individual investor cannot outwit the market by trading on the basis of the available information. This means that analysis of past data is of little help since whatever information this analysis will reveal is already contained in asset prices. |

|

Proponents of the MPT argue that if past data contains no information for the prediction of future prices, then it follows that there is no point in paying attention to fundamental analysis. A simple policy of random buying and holding will do the trick as asserted by one of the pioneers of the MPT, Burton G. Malkiel, in his famous book A Random Walk Down Wall Street:

Consequently, Malkiel also suggests that,

|

According to this way of thinking, stock market prices move in response to new, unexpected information. Since, by definition the unexpected cannot be known, it implies that an individual’s chances of anticipating the general direction of the market are as good as anyone else’s chances.

This suggests that since the future direction of the stock market cannot be known then the only way of earning above average returns is to assume greater risk (it is accepted by the practitioners of MPT that risk is associated with the degree of dispersion of returns around the average of returns).

A security whose returns are not expected to deviate significantly from its historical average is termed as a low risk. A security whose returns are volatile from year to year is regarded as risky. MPT assumes that investors are risk averse and they want high guaranteed returns.

To comply with this assumption the MPT instructs investors how to combine stocks in their portfolios to give them the least possible risk consistent with the return they seek. MPT shows that if an investor wants to reduce investment risk he should practice diversification.

Consider the following simple example:

Activity A Activity B Cold Weather 20% -10% Warm Weather -10% 20%

Let us assume that on average, half of the time the weather is cold and half of the time it is warm. According to the table, investment in activity A will yield a 20% return in cold weather and in warm weather will produce a loss of 10%. On average the return by investing in A will be 5%. The same outcome will be obtained with regard to investment in activity B.

MPT in chart formThe MPT then suggests that if the investor diversifies and invests one dollar in A and one dollar in B then he will be guaranteed a 5% return regardless of weather conditions. In warm weather, one dollar invested in B will produce a 20% return, whilst one dollar invested in A will produce a 10% loss. Investors’ total return on two dollars invested in A and B will be 5%. Exactly the same result will be obtained for cold weather conditions. This example illustrates that through the magic of diversification regardless of weather conditions one can obtain risk free 5% return on investment. This must be contrasted with the fact that the two investments A and B are highly risky, because the frequency of a cold or a warm season in a particular year cannot be always ascertained. All that we know is that on average, over a prolonged period of time, half of the time the weather is cold and half of the time it is warm. This however, doesn’t mean that every year this will be so. This example shows that as long as activities are affected differently by given factors there is a place for diversification, which will eliminate risk. |

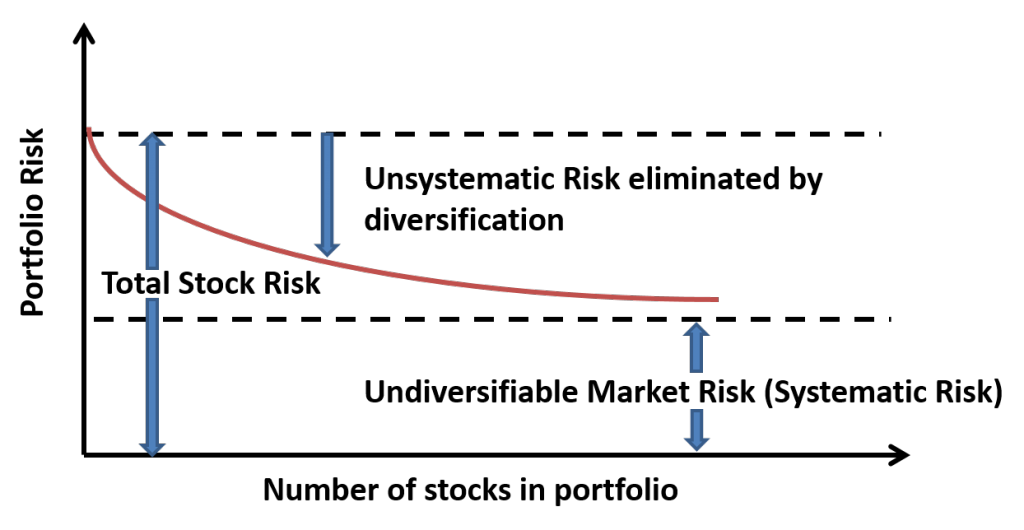

The basic idea of MPT is that a portfolio of volatile stocks, i.e. risky stocks, can be combined together and this in turn will lead to the reduction of the overall risk. The guiding principle for combining stocks is that each stock represents activities that are affected by given factors differently. Once combined, these differences will cancel each other out, thereby reducing the total risk.

The theory indicates that risk can be broken into two parts. The first part is associated with the tendency of returns on a stock to move in the same direction as the general market. The other part of the risk results from factors peculiar to a particular company. The first part of the risk is labeled systematic risk, the second part, unsystematic.

According to MPT, through diversification, only unsystematic risk is eliminated. Systematic risk cannot be removed through diversification. Consequently it is held that return on any stock or portfolio will be always related to the systematic risk, i.e. the higher the systematic risk the higher the return.

The systematic risk of stocks captures the reaction of individual stocks to general market movements. Some stocks tend to be more sensitive to market movements while other stocks display less sensitivity.

The relative sensitivity to market moves is estimated by means of statistical methods and is known as beta (beta is the numerical description of systematic risk). If a stock has a beta of 2 it means that on average it swings twice as much as the market. If the market goes up 10% the stock tends to rise 20%. If however, the stock has a beta of 0.5% then it tends to be more stable than the market.

Does the MPT Framework Make Sense?The major problem with the MPT is that it assumes that all market participants arrive at a rational expectations forecast. This, however, means that all market participants have the same expectations about future securities returns. Yet, if participants are alike in the sense of having homogeneous expectations, then why should there be trade? After all, trade implies the existence of heterogeneous expectations. This is what bulls and bears are all about. A buyer expects a rise in the asset price, while the seller expects a fall in the price. Even if we were to accept that modern technology enables all market participants equal access to news, there is still the issue of news interpretations. The MPT framework implies that market participants have the same knowledge. Forecasts of asset prices by market participants are clustered around the true value, with deviations from the true value randomly distributed, implying that profits or losses are random phenomena. |

|

| It also means that since, on average, everybody knows the true intrinsic value then no one will need to learn from past errors since these errors are random and therefore any learning will be futile. Yet, if every individual has different knowledge, then this difference will have an effect on his forecast.

A success or a failure in predicting asset prices will not be completely random, as the MPT suggests, but must also be attributed to each individual’s knowledge. In the words of Hans-Hermann Hoppe:

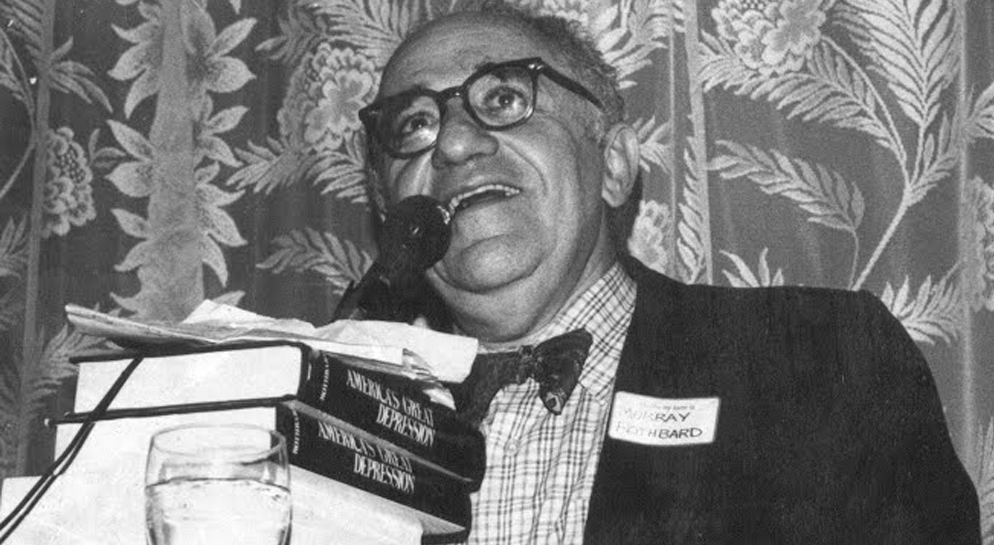

The MPT framework also gives the impression that the stock market can exist separately from the real world. However, the stock market doesn’t have a life of its own. That is why an investment in stocks should be regarded as an investment in business as such, and not just as an investment in stocks. On this Rothbard says in America’s Great Depression, p.79, that

By becoming an investor in a business, an individual has engaged in an entrepreneurial activity. He has committed his capital with a view to supply the most urgent needs of consumers. |

|

For an entrepreneur the ultimate criteria for investing his capital is to employ it in those activities which will produce goods and services that are on the highest priority list of consumers. It is this striving to satisfy the most urgent needs of consumers that produces profits, and it is this alone that guides entrepreneurs. According to Ludwig von Mises in Human Action:

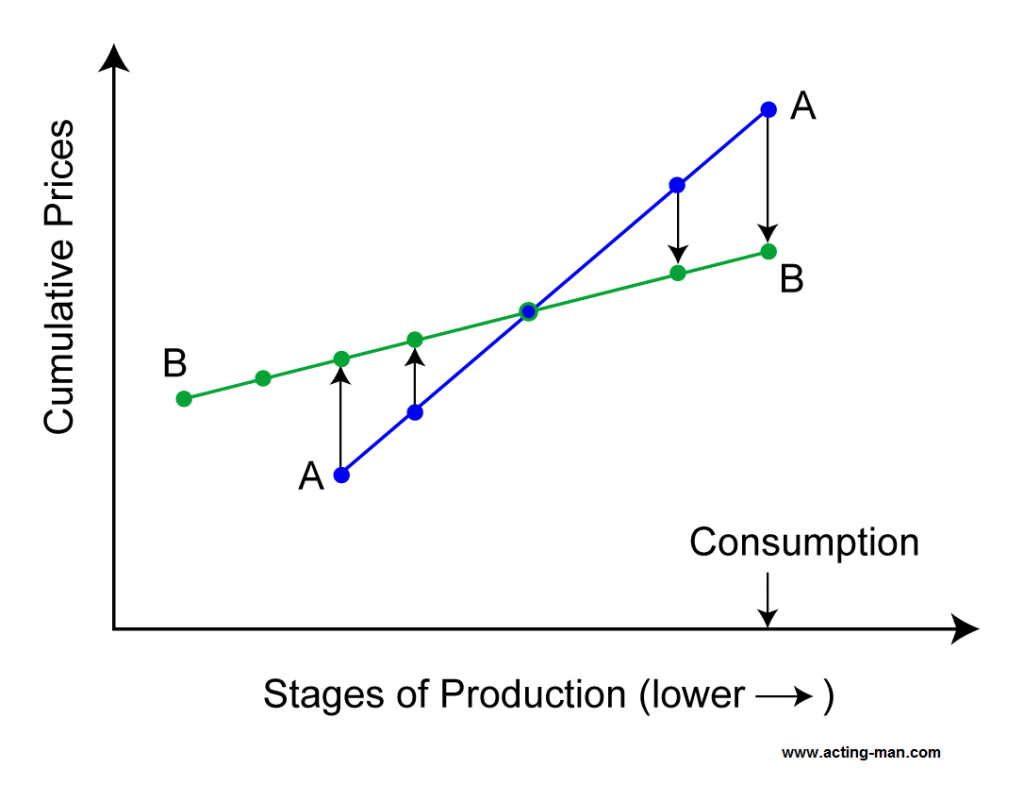

Is it valid to argue that past information is completely imbedded in prices and therefore of no consequence? It is questionable whether the duration and the strength of effects of various causes can be discounted by the market participants. For instance, according to MPT a market-anticipated lowering of interest rates by the central bank, while being regarded as old news and therefore not supposed to have real effects, will in fact set in motion the process of the boom-bust cycle. Also, various causes once set in motion, initially only “affect some individuals’ real income. As time goes by however, the effect of these causes spreads across a wider spectrum of individuals. Obviously, these changes in the real incomes of individuals will lead to changes in the relative prices of assets. To suggest, then, that somehow the market will quickly incorporate all future changes of various present causes without telling us how it is done is questionable. |

It has to be realized that markets are comprised of individual investors who require time to understand the implications of various causes and their implications for the prices of financial assets.

Even if a particular cause was anticipated by the market, that doesn’t mean that it was understood correctly and therefore discounted. It is hard to imagine that the effect of a particular cause which begins with a few individuals and then spreads over time across many individuals can be assessed and understood instantaneously.

For this to be so, it would mean that market participants can immediately assess future consumers’ responses and counter responses to a given cause. This, of course, must mean that market participants not only must know consumers’ preferences but also how these preferences are going to change. Note though, consumer preferences cannot be revealed before consumers have acted.

We have seen that the basic idea of MPT is that a portfolio of volatile stocks, i.e. risky stocks, can be combined together and this in turn will lead to the reduction of the overall risk. The guiding principle for combining stocks is that each stock represents activities that are affected by given factors differently.

Once combined, these differences will cancel each other out, thereby reducing the total risk. However, this not necessary always works this way. During a large financial crisis various assets that normally had an inverse correlation become positively correlated and fall together.

The moment the primary consideration of investment becomes the reduction of risk rather than the attainment of the highest possible profit, then all kind of strange decisions may emerge. For instance, strictly following MPT, one may deliberately invest in an asset that offers a negative return in order to reduce the overall portfolio risk.

However, no sane investor deliberately chooses a badly performing investment. It is only the emergence of conditions not properly forecast by the investor that leads to a bad investment.

Negative yields to maturity on government bonds such as on the JGB (10 year Japanese government bond) depicted above can probably be called an example of “modern portfolio theory insanity”

Are Profits Random Phenomena?The proponents of the MPT claim that the main message of their framework is that excessive profits cannot be secured out of public information. They maintain that any successful method of making profits must ultimately be self-defeating. Now, it is true that profits as such can never be a sustainable phenomenon. However, the reasons for this are not those presented by the MPT. Profit emerges once an entrepreneur discovers that the prices of certain factors are undervalued relative to the potential value of the products that these factors, once employed, could produce. By recognizing the discrepancy and doing something about it, an entrepreneur removes the discrepancy, i.e., eliminates the potential for a further profit. According to Murray N. Rothbard in Man, Economy, and State:

The recognition of the existence of potential profits means that an entrepreneur had particular knowledge that other people didn’t have. This unique knowledge means that profits are not the outcome of random events, as the MPT suggests. |

|

| For an entrepreneur to make profits, he must engage in planning and anticipate consumer preferences. Consequently, those entrepreneurs who excel in their forecasting of consumers’ future preferences will make profits.

Planning and research however can never guarantee that profit will be secured. Various unforeseen events can upset entrepreneurial forecasts. Errors which lead to losses in the market economy are an essential part of the navigational tools which direct the process of allocation of resources in an uncertain environment in line with what consumers dictate. Uncertainty is part of the human environment, and it forces individuals to adopt active positions, rather than resign to passivity, as implied by the MPT. The MPT framework views the act of investment as no different from casino gambling. In the words of Ludwig von Mises in Human Action:

Mises then suggests,

|

|

Mises then adds,

The MPT framework presents the stock market as a gambling place which is detached from the real world. However, as Mises suggests,

Further to this,

(emphasis added) Furthermore, in an attempt to minimize risk, practitioners of MPT tend to institute a high degree of diversification. However, having a large number of stocks in a portfolio might leave little time to analyze the stocks and understand their fundamentals. This could raise the likelihood of putting too much money in bad investments. This way of conducting business would not be an entrepreneurial investment but rather gambling. |

Conclusion

The MPT gives the impression that there is a difference between investing in the stock market and investing in a business. However, the stock market doesn’t have a life of its own.

Proponents of modern portfolio theory argue that diversification is the key to the creation of the best possible consistent returns. In fact, the key should be profitability of various investments and not diversification as such.

Charts by stockcharts, investopedia, bigcharts, Murray Rothbard/acting-man.com

Chart and image captions by PT

This article appeared originally at the Ludwig von Mises Institute and is republished with permission.

Full story here Are you the author? Previous post See more for Next post

Tags: Ludwig von Mises,Murray Rothbard,newslettersent,On Economy