Overview

The Swiss National Bank (SNB) is publishing the annual Swiss Balance of Payments and International Investment Position report today. This year, the report is being released earlier – in May instead of August, as in previous years. It is based on the dataset for the fourth quarter of 2015, which was released with the press release of 21 March 2016 headed ‘Swiss balance of payments and international investment position, Q4 2015 and review of the year 2015’.

The annual report comments on all positions in Switzerland’s balance of payments and international investment position, with the main focus on long-term developments. The report also features a special topic which takes a look at the varying presentation principles of direct investment in foreign trade statistics.

Comprehensive tables covering the balance of payments and international investment position can be found on the SNB’s data portal, data.snb.ch, Tables, International economic affairs.

Current accountReceiptsThe receipts surplus from foreign trade in goods amounted to CHF 54 billion (2014: CHF 49 billion). According to the foreign trade statistics (foreign trade total 1 of the Federal Customs Administration; FCA), the receipts surplus grew by CHF 7 billion to CHF 37 billion. Although both exports and imports decreased, the decline in imports (down 7%) was greater than that in exports (down 3%). For this reason, the balance contracted. Net receipts from merchanting equalled the previous year’s figure of CHF 25 billion. As regards trade in non-monetary gold, an import surplus of CHF 1 billion was recorded. In 2014, imports and exports had balanced each other out.

The receipts surplus from trade in services declined year-on-year by CHF 2 billion to CHF 16 billion. Receipts were down from CHF 109 billion to CHF 106 billion, while expenses decreased from CHF 90 billion to CHF 89 billion. The country breakdown of services exports and imports (excluding tourism in each case) showed the same sequence of countries – the most important trading partner was the US, followed by Germany and France.

Movements in the individual components of receipts varied. Financial services, the most important component of receipts, declined by 2%, as did receipts from tourism. A significant drop was also recorded in receipts from license fees (down 17%) and transport (down 16%). By contrast, exports of business services rose substantially (up 8%), as did those of telecommunications, computer and information services (up 15%).

ExpensesAn examination of expenses for foreign services also reveals differing movements for the individual components. On the one hand, a decline was recorded in expenses for tourism (down 2%), transport (down 25%) and license fees (down 8%). On the other, expenses rose for business services (the most important component of expenses), by 7%, and for telecommunications, computer and information services, by 5%. Imports of financial services remained unchanged, at CHF 4 billion.

NetFor primary income (labour and investment income), receipts amounted to CHF 124 billion and expenses to CHF 109 billion, resulting in a receipts surplus of CHF 15 billion, compared to CHF 6 billion in 2014. Receipts from investment abroad were down by CHF 16 billion to CHF 122 billion due to lower income from direct investment. Income from foreign investment in Switzerland (expenses) declined by CHF 25 billion to CHF 86 billion, with decreasing direct investment income being the key factor on the expenses side as well. The expenses surplus on labour income increased by CHF 1 billion to CHF 21 billion. Secondary income (current transfers) recorded an expenses surplus of CHF 12 billion, a decrease of CHF 5 billion from 2014.

|

|

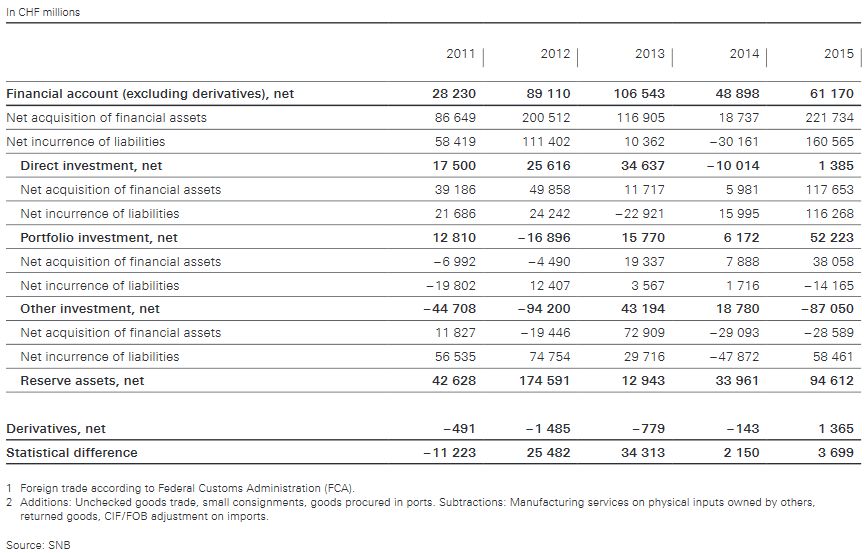

Financial accountNet acquisition of financial assetsIn 2015, net acquisition of financial assets amounted to CHF 222 billion (2014: CHF 19 billion). CHF 118 billion of this was accounted for by direct investment (2014: CHF 6 billion), with Swiss direct investors directing investments into existing foreign subsidiaries, in particular. Reserve assets recorded a net acquisition of assets amounting to CHF 95 billion (2014: CHF 34 billion). Furthermore, investors resident in Switzerland acquired securities issued abroad for CHF 38 billion (2014: CHF 8 billion); most of these were equity securities. Net reduction in assets under other investments, amounting to CHF 29 billion, was mainly due to the fact that domestic bank claims against foreign banks were reduced. A CHF 29 billion net reduction had already occurred under other investments in 2014.

Net incurrence of liabilitiesNet incurrence of liabilities amounted to CHF 161 billion (2014: net reduction of CHF 30 billion), due mainly to direct investment and other investment. Direct investment came to CHF 116 billion (2014: CHF 16 billion). While foreign direct investors increased capital invested in their subsidiaries in Switzerland, Swiss direct investors borrowed considerable funds from their foreign subsidiaries. Incurrence of liabilities under other investments amounted to CHF 58 billion (2014: net reduction of CHF 48 billion), and resulted from cross-border interbank business, in particular. Domestic banks increased their claims against banks abroad. Under portfolio investment, however, investors domiciled abroad sold securities issued by domestic borrowers amounting to CHF 14 billion, thereby ensuring a net reduction in liabilities (2014: net incurrence amounting to CHF 2 billion).

|

Switzerland Financial Account |

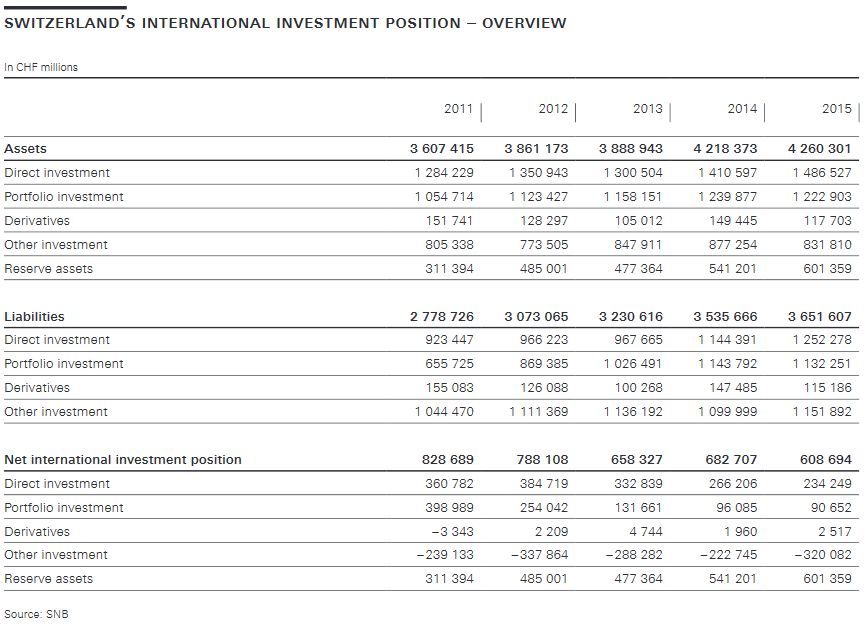

Switzerland’s international investment positionForeign assetsStocks of foreign assets were up by CHF 42 billion year-on-year, to CHF 4,260 billion. This is a significantly lower figure than the CHF 222 billion of net acquisitions which Switzerland stated in its financial account. The difference is attributable, in particular, to high valuation losses on foreign currency positions, driven by movements in exchange rates. The strongest rise under foreign assets was recorded by direct investment, which grew by CHF 76 billion to CHF 1,487 billion. Purchases of foreign exchange caused reserve assets to increase by CHF 60 billion to CHF 601 billion. Stocks of the other investment item, however, decreased by CHF 45 billion to CHF 832 billion. Portfolio investment was down by CHF 17 billion to CHF 1,223 billion, with stocks of derivatives dropping by CHF 32 billion to CHF 118 billion.

Foreign liabilitiesStocks of foreign liabilities rose by CHF 116 billion to CHF 3,652, although transactions in the financial account show a significantly higher figure (up CHF 161 billion). This was due to the exchange rate-related valuation losses which reduced the value of the stocks. As in the case of foreign assets, the increase in stocks of foreign liabilities was chiefly attributable to direct investment, which was up by CHF 108 billion to CHF 1,252 billion. Stocks of the other investment item rose by CHF 52 billion to CHF 1,152 billion. By contrast, stocks of derivatives declined by CHF 32 billion to CHF 115 billion, and those of portfolio investment by CHF 12 billion to CHF 1,132 billion.

|

Switzerland's International Investment Position |

Remarks

In 2015, the current account surplus amounted to CHF 73 billion, CHF 16 billion higher than in 2014. This was primarily due to an increase in the receipts surplus in investment income, which was up by CHF 10 billion to CHF 36 billion. The surplus of receipts from trade in goods and services also rose compared to the previous year, by CHF 2 billion to CHF 70 billion. The expenses surplus for secondary income (current transfers) was down by CHF 5 billion to CHF 12 billion.

In the financial account, net acquisition of financial assets amounted to CHF 222 billion (2014: CHF 19 billion). For assets, this is the highest net acquisition figure since 2007. They were acquired by Switzerland mainly in the form of direct investment and reserve assets. For liabilities, a net incurrence of CHF 161 billion was recorded (2014: net reduction of CHF 30 billion). This was attributable, in particular, to direct investment and other investment. The balance on the financial account, resulting from the net acquisition of financial assets minus the net incurrence of liabilities, and including net derivatives, came to CHF 63 billion.

In the international investment position, stocks of foreign assets increased by CHF 42 billion to CHF 4,260 billion. Transactions reported in the financial account were largely offset by valuation losses on foreign assets, attributable to exchange rate movements which reduced the value of foreign currency positions. Stocks of foreign liabilities were up by CHF 116 billion to CHF 3,652 billion. As the foreign currency share in liabilities was comparatively low, the exchange rate losses had less of an impact here. Furthermore, liabilities increased due to stock exchange gains on securities issued by domestic borrowers. Since foreign liabilities grew much more substantially than foreign assets, the net international investment position decreased by CHF 74 billion to CHF 609 billion.

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent