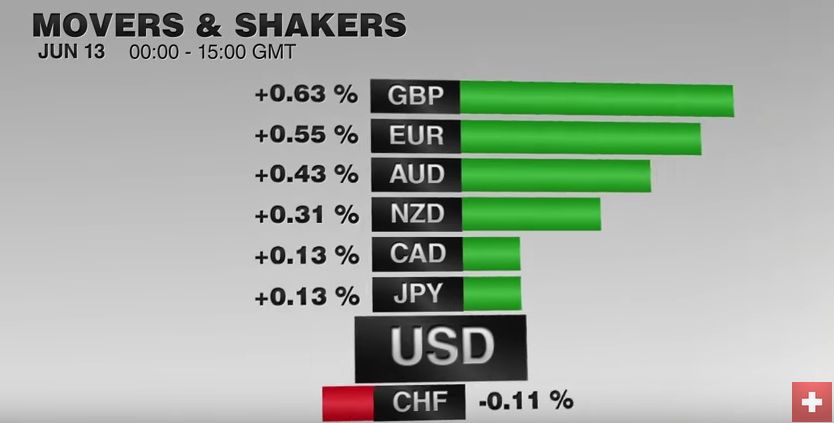

Swiss FrancChandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. |

See the Dukascopy Video |

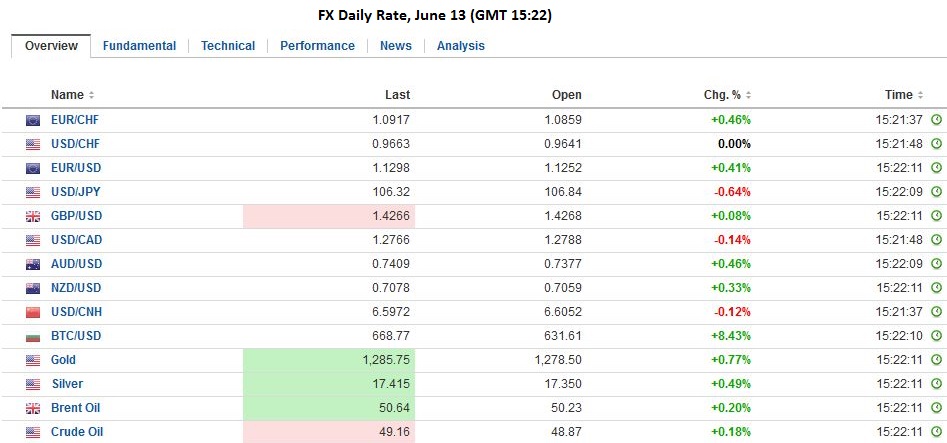

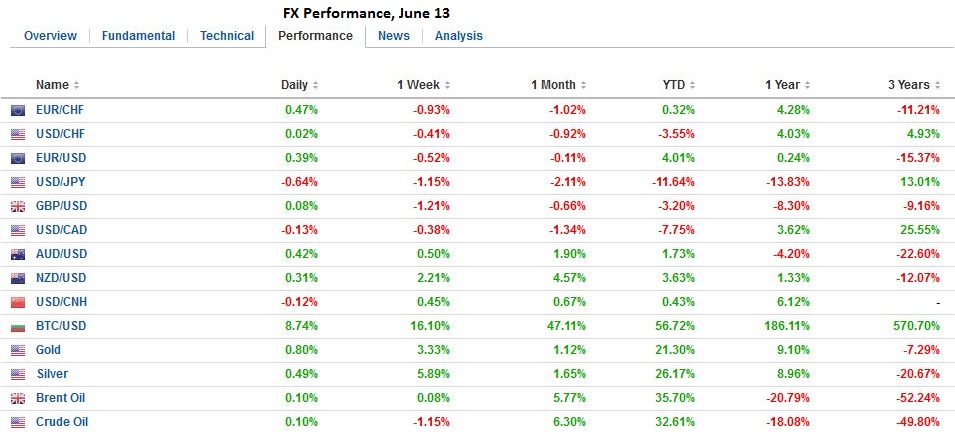

FX RatesThe risk that the UK votes to leave the EU next week is the dominant force in the capital markets. It is a continuation of what was seen at the end of last week. Sterling fell 1.4% against the US dollar before the weekend and is off another 1% today. A week ago it traded as high as $1.4530. Now it is nearing $1.41. |

|

| There have been several polls showing those wanting to leave are ahead. The event markets show an elevated risk, but still favor those that want to remain in the EU. The bookmakers in the UK have also tightened the odds, but also favor the remain camp. In the week through last Tuesday, speculators piled into short sterling positions by the most in five years. Short-dated implied sterling volatility is soaring. Consider that before the weekend, two-week volatility stood at 31%, which was double the previous close as the referendum moved within the two-week time frame. The vol is now quoted near 38%. |

This is encouraging a wave of risk-off through the capital markets. Global equity markets are tanking. The MSCI Asia-Pacific Index is off 2%, the most since April 1. All markets were lower. Australian markets were closed for a national holiday and will likely play catch-up tomorrow. The Shanghai Composite was off 3.2%, the most since February. The Nikkei was off 3.5%, the most in two months. The MSCI Emerging Market equity index is off 1.8%, which is also the largest drop since February.

European shares are faring slightly better with the Dow Jones Stoxx 600 off 1.3%, with all sectors under water. Financials are faring the worst with a 3.4% slide. The losing streak now stands at four sessions. Ironically, the UK’s FTSE is hanging in the best, with almost a 0.%% decline, helped by advances in health care and consumer staples, which are seen as defensive in nature.

Bond markets are mixed. Core bond yields are mostly lower. New record low yields have been seen in the Japan, UK, but also South Korea and Taiwan. Peripheral yields are mostly 4-6 bp higher. The US 10-year Treasury yield is off nearly three bp today to 1.61%. Of note, remember the ECB’s sovereign bond purchase program is limited to bonds that yield is more than the minus 40 bp deposit rate. The ECB has to go beyond five years in duration now, which plays on fears of a shortage of German paper.

This is the environment that favors the yen. The dollar is trading near six-week lows against the yen, just ahead of the May 3 low near JPY105.50. A break of JPY105 would spur speculation of a move toward JPY100. The BOJ meets later this week. Despite the surge in the yen, few expect the BOJ to move now, preferring to wait until next month.

Many thought the Swiss franc could be a safe haven as well. However, speculators in the futures market saw things differently. They extended the gross short position and trimmed the gross longs. This resulted in the largest net short franc position since last December. Today, the dollar is trading at four-day highs against the franc. The euro initially extended last week’s 2% fall against the franc (to ~CHF1.0840) before recovering. The euro is up marginally against the franc for the first time since June 3.

In an otherwise light news day, we note two other developments in addition to the UK referendum driver. First, China’s data was mostly softer. Industrial production and retail sales showed little changed and were largely in line with expectations. The investment data were considerably weak than expected. Foreign direct investment (year-over-year) fell 1.0% in May after a 6.0% rise in April. It is a relatively new times series and is the weakest of the year. Fixed investment slowed to 9.6% (year-over-year) from 10.5% in April. It is the slowest in 16 years. Private investment slowed to 3.9% year-over-year. Public investment rose 23.3%. The PBOC returning from a four-day holiday fixed the dollar at CNY6.5805, up from CNY6.5593, reflecting the dollar’s rise at the end of last week.

Oil PricesThe second development is the drop in oil prices for the third consecutive session. News that the US rig count rose for the second consecutive week is weighing on sentiment. The increased drilling has yet to turn into an output increase in the US, but many are watching carefully for it. The July light sweet crude oil futures contract slumped to almost $48.20. Last Thursday it peaked just below $51.70. The 20-day average is near $49.20, and today could be the first day since 7 April that its remains below this average for an entire session. |

|

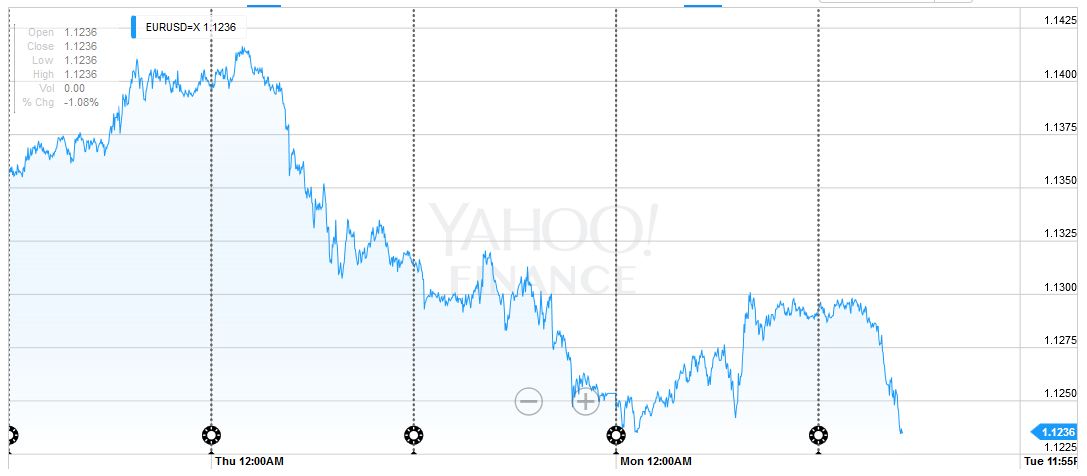

EuroThe euro found support near its 20-day moving average (~$1.1235) and just ahead of the 61.8% retracement of the rally off the May 30 low a touch below $1.11. Additional support is seen near $1.1200. Initial resistance is seen in the $1.1275-$1.1305 area. |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: Brexit,FX Daily,Japanese yen