We felt strongly that the FOMC minutes would be more hawkish than the statement that followed the meeting, and we were not disappointed. However, our caveat remains: the minutes dilute the signal that emanates from the Fed’s leadership, Yellen, Fischer, and Dudley.

The latter two speak in the NY morning. Fischer and Dudley’s comment will be scrutinized for confirmation of the hawkish read of the FOMC minutes. Yellen speaks at Harvard at the end of next week. Her comments at the Economic Club of NY at the end of March squashed the earlier discussion by several regional presidents about the appropriateness of a hike last month.

Many observers may not sufficiently appreciate the unique organization structure of the Federal Reserve and how one typically becomes a regional Fed president. They are often confused by the cacophony of voices. We insist that the signal more often and most consistently comes from the leadership.

Many put emphasis on the statement in the minutes that indicated a majority of the Fed thought that a rate hike next month could be appropriate if there was continued improvement. That is not new. That continues to be the Fed’s position. The FOMC minutes go on to acknowledge that there were a range of views of whether the conditions could be met by June.

Combining the two elements here suggests nothing new materially has been revealed. Nevertheless, we recognize something important is taking place. Some have expressed concern about the Fed’s credibility and capability of raising interest rates again. Several large pools of capital have announced preference for no yielding gold to dollar-denominated paper.

There was a large gap between what the Fed was saying was likely to be appropriate (two hikes) and what the investors thought probable (not always fully convinced of one). This gap threatens to limit the Fed’s degrees of freedom without risking market disruption. The Fed has regained the upper hand here. It has reasserted its ability to hike rates in June. Moreover, the response by the dollar and the interest rate markets suggests monetary policy still matters.

Fed funds futures

The implied yield of the June Fed funds futures contract is 41 bp. Currently, the effective Fed funds rate is 37 bp. This implies about a 30% chance of a hike is now discounted. Yet given the potential for a significant market disruption emanating from the UK referendum, which some Fed officials have already referred to, the risk/reward from a policymaking point of view would likely be willing to wait six weeks.

Given the lag and lack of precision of many economic metrics, there would not be much of a difference in the economic impact. However, the rub here is that there is not press conference after the July meeting. Calling an impromptu press conference without tipping its hand, we suspect there would be some operational challenges, but nevertheless, could be done. And as many investors and policymakers have discovered, the importance of communication cannot be overstated. We prefer the Fed having a press conference after every meeting, like the ECB and the BOJ. However, second best is raising rates a meeting not followed by a press conference.

The July meeting is too late in the month for the Fed funds futures to be particularly helpful, but the August contract can be used to see the probability of June of July hike. Fair value if there were to be a hike is 62 bp, and the contract closed yesterday at 52 bp. This is equivalent to a 40% chance of a hike in June or July. This is up 7.5 bp this month and is back to levels seen before Yellen’s speech at the end of March.

In this context, it may be interesting to look at the December contract. After the FOMC minutes, the implied yield rose to 64 bp. This is a ten basis point increase since the end of April. If the Fed were to raise rates at any meeting before December, fair value for the December contract would be at least 62 bp.

The extra two basis points may reflect two considerations. First, the contract settles at the average effective Fed funds rate for the month. Year-end factors may create more volatility. Second, it may reflect the small but increasing recognition by investors of the possibility the Fed is right.

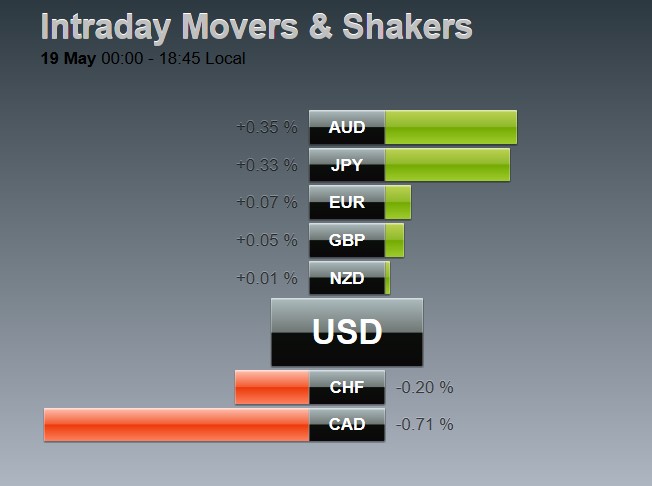

FX Rates

|

Monetary policy is also a key factor in the Australian dollar. The rate cut and dovish posture of the RBA has seen accelerated the retracement of the Aussie’s run-up in the first four months. Softer employment data keeps the pressure on the Australian dollar. Full-time jobs were lost for the second consecutive month. The participation rate eased while the unemployment rate was unchanged. The point here is that the speculative market is still unwinding a substantial long position accumulated in recent months, and prospects of another rate cut, provides strong encouragement.

The $.7200 area that the Aussie is flirting with is important. A convincing break signal a move to $0.7000, which is technical objective. The low set in mid-January is near $0.6830, and in the bigger picture where we think it is heading.

|

|

|

The dollar is consolidating yesterday’s gains in Asia. The greenback’s advance above JPY110 is likely to modify the G7 meeting this weekend. In some important ways, it supports the US Treasury’s argument. Intervention is not necessary. It is not one-way market. Volatility is not extreme. The markets are fairly orderly.

|

At the last G20 meeting, Japan may have been questioned about its unexpected rate cut at the end of January. There was caution repeated (the fact that the G20 has said it before suggests no need for a secret agreement about it) about over-reliance on monetary policy. Japan will go to this G7 meeting with the Diet having approved a JPY778 bln earthquake relief and reconstruction bill, which Abe later is expected to unveil, is part of a larger fiscal program.

After seeing the strength of the consumption component of the better than expected Q1 GDP, some observers think it may be difficult for Abe to postpone the retail sales tax increase, due next April. We are less convinced. The sales tax increase is poor politics and poor economics. Despite Q1’s upside surprise, when struggling to grow on a sustained basis, why tax the component that drives 60% of it? Postponing the tax increase would also not likely cost Abe or the LDP a single vote in the July election.

What was resistance should now act as support for the dollar. Provided the JPY109.30-JPY109.65 area holds, the dollar can retest the highs seen before the BOJ kept policy unchanged at the end of April, which are located in the JPY111.80-JPY112.00 area. We note that the US premium over Japan on 10-year money widened seven bp yesterday to 194 bp, and is 14 bp fatter on the week.

Sterling is consolidating yesterday’s gains apparently spurred by an opinion poll, the second of the week, that showed a swing for the Remain camp. Sterling overshot by little the 61.8% retracement of the decline since the reversal on May 3 after reaching a four-month high near $1.4770. That retracement objective was found a little above $1.4600. A move now below $1.4550 would be an early signal that stronger dollar environment may prove more important for sterling’s outlook, and a break of $1.4500 would be convincing.

Brexit Fears

The place where the fear of Brexit was being expressed seemed clearer in the options market than the spot market. Implied volatility did ease over the past two sessions and the premium for sterling puts over calls narrowed. Remember starting next week, the focus will shift to one-month options.

The UK reports April retail sales today. A modest bounce (~0.6% is expected) after a 1.3% decline in March. Excluding autos, the year-over-year pace is expected to increase to 2.0% from 1.8%, according the median forecast in the Bloomberg survey. The data is unlikely to have much impact, as Brexit risks dominate discussions. The market does not appear to be discounting a BOE rate hike until late next year.

The US two-year premium over Germany widened by nearly six basis points yesterday and is 14 bp wider on the week. It was the biggest advance in a little more than two months, and at 141 bp it is at levels not seen since mid-March. The euro has barely been able to bounce off its lows just ahead of $1.1200. This is an important technical area. A break of it may see the euro fall first to $1.1145 on its way to $1.1070.

Eurozone Current Account Tomorrow

The eurozone current account is not a market mover, and investors are likely to take only passing interest in the ECB’s record from its last meeting. The April meeting was as much of a non-event as Draghi’s tenure has seen. Many of those who push the secret Shanghai Agreement narrative push aside is the ECB’s dramatic easing was announced a fortnight later and did cut interest rates.

That Draghi suggested that interest rates may have bottomed, which he has said before, was walked back from by several officials including himself. Also, the reason that the ECB has not done anything else is that it is busy implementing the new programs, not because the ECB promised or agreed (or now some suggest “reached an understanding”) to something at G20.

We suspect leadership from the North American markets is awaited. Will the market continue to move closer to the Fed’s position by extending yesterday’s moves or will it consolidate? The inability of the dollar-bloc currencies to sustain even small upticks suggests the bias will be to buy the greenback.

Weekly jobless claims may draw more attention than usual after last week’s jump (from NY, and may be related to a labor dispute). The Leading Economic Indicator will also be reported. It is composite of other data, so it has little information content. However, the 0.4% gain expected, is twice the 12-month average, and would be the second consecutive gain after contracting in the December-February period. It provides a broad signal that the US economy is emerging for the six-month soft patch here in Q2.

Tags: Japanese yen,newslettersent,U.S. Participation Rate