Laughing at Blue Monday

On May 28, 1962 – dubbed “Blue Monday” – the market fell 6%… its worst single-day slide since 1929.

Peter Stormonth Darling was an investment manager at investment bank S. G. Warburg & Co. at the time. He strolled in to tell his boss, Tony Griffin, how much the market had fallen.

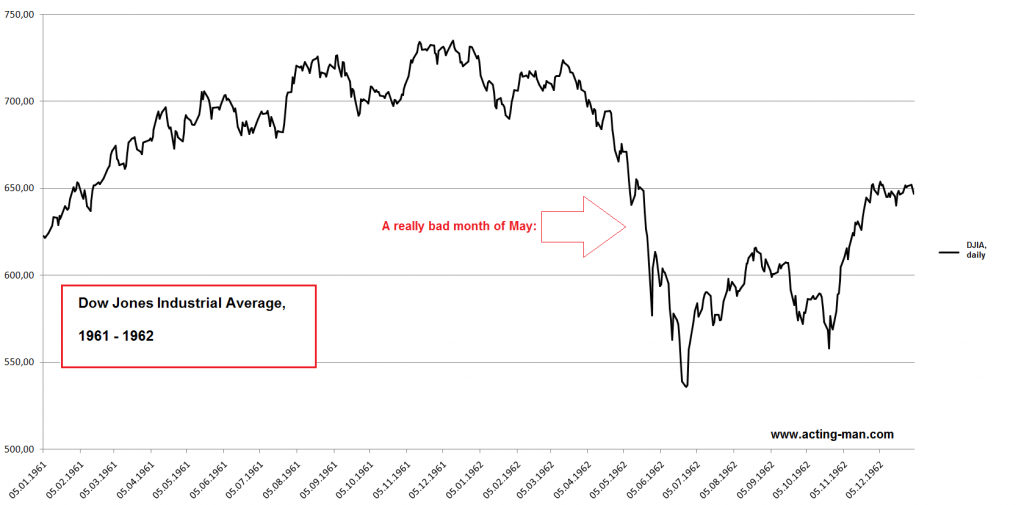

Dow Jones Industrial Average, 1961-1962The DJIA in 1961 – 1962. March – June 1962 delivered quite a scare to investors – in May the decline accelerated, as panic began to spread – click to enlarge. |

Darling recounts:

Tony sat back, paused to reflect a moment, and just laughed. This was not because he had anticipated the crash or sold his own investments – he had not. It was his way of keeping the event in perspective. I’m sure it was the right way to act.

It was a useful lesson, and it helped me to view with some equanimity subsequent market collapses, such as those in 1974, 1987, and 1998.

Darling would eventually become chairman of Mercury Asset Management from 1979 up until Merrill Lynch acquired it in 1992. During his storied career, he came to know a number of wealthy people, some of whom are also shrewd investors.

He studied them, trying to discover their methods. And he learned what successful investing is all about. By Darling’s account, shrewd investing comes down to these six actions:

- Set aside as much as you can for long-term investing in stocks

- Buy shares in a small number of companies in which you have great conviction

- Do not look at prices every day or every week – “you will only give in to fear and greed”

- As in collecting, buy the best – avoid the junk

- Only buy companies you can understand

- Hold indefinitely

Darling also has some interesting thoughts on the decline of Warburg, which a Swiss bank bought on the cheap in 1995. One reason for its decline is worth sharing here: The insiders at Warburg didn’t own much stock.

“While its executives were granted share options, their combined ownership of the firm was only about 1%. They seldom behaved like owners…”

This theme is threaded throughout Darling’s memoir. It’s common knowledge, he says, that people work more effectively if they have “a meaningful stake” in what they do.

“They may not work much harder, but they really care about profits and the value of the business. They even start remembering to turn out the lights when they leave the office, and they save the paper clips.”

It’s amazing to me how many investors and advisors never even bother to look at management’s stake. It’s common sense. And there’s plenty of research that shows how stocks with high ownership outperform.

One study found that CEOs who voluntarily hold at least a 5% ownership stake outperform the market by 10% annually. How much do insiders own of the companies in your portfolio?

Laughing at Blue Monday On May 28, 1962 – dubbed “Blue Monday” – the market fell 6%… its worst single-day slide since 1929. Peter Stormonth Darling was an investment manager at investment bank S. G. Warburg & Co. at the time. He strolled in to tell... - Click to enlarge

Siegmund Warburg, who founded investment bank S.G. Warburg & Co. in London in 1946. The bank was once a constituent of the FTSE 100 Index. As Peter Stormonth Darling writes about him in the Spectator: “Warburg believed that the ideal banker was an all-rounder with an appreciation of literature and the arts, rather than a specialist immersed in financial matters. He once said that the most important things to him were, in order, human beings, books, the sun and music, and that money was of ‘utterly secondary importance’.”

Chart by: acting-man.com

Chart and image captions by PT

The above article originally appeared as “Portfolio Insight” at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Full story here Are you the author? Previous post See more for Next postTags: Miscellaneous,newslettersent