For those who thought that the world's biggest company losing over $40 billion in market cap in an instant on disappointing Apple earnings, would have been sufficient to put a dent in US equity futures, we have some disappointing news: with just over 7 hours until the FOMC reveals its April statement, futures are practically unchanged, even though the Nasdaq appears set for an early bruising in the aftermath of what is becoming a disturbing quarter for tech companies. "It’s pretty disappointing,” Angus Nicholson, an analyst at IG Ltd., told Bloomberg. "These aren’t good numbers out of the China segment which people are most concerned about, and if that continues to play out it will be a concern going forward."

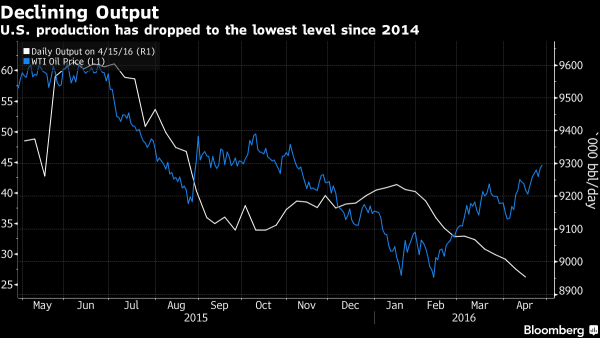

Instead of tech leading, however, the upside has once again come from the energy complex where moments ago WTI rose above $45 a barrel for the first time since November after yesterday's unexpected 1.07 million barrel API inventory drawdown.

Adding to the oil move, the World Bank boosted its forecast for oil prices this year, projecting that refinery demand will pick up and U.S. output cuts will steepen in the second half of 2016. "The recent leg higher in oil prices is due to the tightening of the supply side of the market,” Jens Naervig Pedersen, an analyst at Danske Bank A/S in Oslo, said by e-mail. “U.S. production is edging lower, the rig count suggests there’s more to come, and the API figures from yesterday pointing to stock draws further confirm this development."

So with oil back over the critical $45 level at which point US shale producers resume fracking, it is increasingly looking like the Morgan Stanley deja vu forecast, which sees 2016 being a repeat of 2015 is coming true.

Elsewhere, treasuries rose perhaps following Gundlach's recommendation from yesterday afternoon to start buying, sending 10-year yields lower for the first time in eight days, and the dollar weakened, as markets signaled caution before the Federal Reserve’s latest interest rate decision. As Bloomberg reports, benchmark 10-year note yields retreated from the highest level in a month before the Fed’s policy announcement.

Looking ahead to today's Fed meeting, virtually nobody expects Yellen to surprise and Fed Funds futures reflect zero chance of an interest-rate hike on Wednesday, though the central bank’s comments will be scrutinized for any hints of a move in coming meetings. "Whether they will still remain a little bit dovish, that is the key thing for us,” said Jens Peter Soerensen, chief analyst at Danske Bank A/S in Copenhagen. “Given that data has been not too strong but not too bad either, the risk is still very balanced. People are a bit reluctant to go in and buy the dollar until they see what the Fed does tonight."

Here is what DB's Jim Reid thinks will happen:

Markets have been feeling the chill so far this week but the conclusion of the FOMC meeting this evening should heat things up. With no press conference, all the focus will be on the tone of the associated statement. The Fed will want to leave the door open for a June hike but it's hard to imagine that they'll dramatically change market pricing for it. The futures contracts have nudged up to pricing a 22% probability of a June hike from as low as 14% mid-way through this month. How much this changes will likely hinge on what extent the Fed continues to acknowledge concerns about global growth and risks abroad. US data has been mixed of late. After getting back close to neutral at the start of April, economic surprise indices have trended steadily lower into negative territory as the month has passed. On the positive side the weaker US Dollar should give the Fed some confidence. Since the March Fed meeting, the Dollar index has weakened just over 2%. That’s partly helped to support a near $8/bbl gain for WTI and 4% rally for the S&P 500 to YTD highs. We think much of the rebound in markets since early February has been due to the Fed's about turn and re-found dovishness. This leaves them trapped in our opinion.

Meanwhile, confusion reigns: "People are questioning valuations because earnings growth just isn’t there,” said Francois Savary, chief investment officer at Prime Partners in Geneva. “It will be very difficult for stocks to gain more ground, especially with the higher euro. There’s also the issue of Fed credibility, and the fact that Yellen is looking at international events as a reason to not raise rates."

More important than the FOMC will be tonight's BOJ announcement, where there is a substantial probability of surprise by Kuroda. The Bank of Japan will review monetary policy on Thursday and Prime Minister Shinzo Abe’s economic adviser said Tuesday it’s possible that purchases of government bonds and exchange-traded funds will be stepped up.

In Asia, shares fell with U.S. equity index futures as Apple’s earnings added to the gloom around the current reporting season for technology companies. Barclays Plc and Total SA advanced on better-than-expected reports. Australia’s dollar weakened versus all 31 major peers. Crude oil in New York rose to the highest since November.

Greek government bonds slid, pushing the yield on shorter-dated notes up by the most in more than three weeks, as Prime Minister Alexis Tsipras sought a meeting of euro-area leaders to resolve disagreements between the government and creditors, a move echoing last year’s drama when a quarrel over bailout terms almost pushed the country out of the currency bloc.

The Stoxx Europe 600 Index declined 0.1 percent amid mixed earnings results. Barclays climbed 2.7 percent as revenue at the investment bank fell less than expected. Adidas AG jumped 7.2 percent to a record after raising its annual profit forecast as consumers spend more before this year’s 2016 UEFA European Championship. Total SA added 1.4 percent after posting a smaller-than-projected drop in quarterly earnings, and Statoil ASA, Norway’s largest oil company, climbed 2.8 percent after reporting a surprise profit. Rio Tinto Group and BHP Billiton Ltd. dragged a gauge of miners lower as iron ore retreated. Societe BIC SA sank 5.5 percent after reporting a decline in margins.

Standard & Poor’s 500 Index futures slipped 0.2%, while contracts on the Nasdaq 100 slumped 1.1 percent. Apple fell 7.1 percent in premarket trading as waning demand for the iPhone weighed on its results. Twitter Inc. tumbled 13 percent after forecasting current-quarter revenue that will fall short of analysts’ estimates. Facebook Inc. and PayPal Holdings Inc. are among companies reporting earnings after the close of markets Wednesday.

Market Snapshot

- S&P 500 futures down 0.2% to 2084

- Stoxx 600 up 0.1% to 348

- FTSE 100 down less than 0.1% to 6280

- DAX up 0.3% to 10290

- German 10Yr yield down less than 1bp to 0.29%

- Italian 10Yr yield down 4bps to 1.49%

- Spanish 10Yr yield down 7bps to 1.57%

- S&P GSCI Index up 1.2% to 356.1

- MSCI Asia Pacific down 0.8% to 131

- Nikkei 225 down 0.4% to 17290

- Hang Seng down 0.2% to 21362

- Shanghai Composite down 0.4% to 2954

- S&P/ASX 200 down 0.6% to 5188

- US 10-yr yield down 2bps to 1.91%

- Dollar Index down 0.12% to 94.46

- WTI Crude futures up 2.2% to $45.01

- Brent Futures up 2.6% to $46.92

- Gold spot up 0.2% to $1,246

- Silver spot up 0.9% to $17.32

Top Global News

- Apple’s Waning Smartphone Sales End 51-Quarter Growth Streak: Fewer iPhone upgrades lead to 16% decline in shipments; sees FY3Q rev. $41b-$43b vs est. $47.35b, 2Q EPS $1.90 vs est. $2.00; Apple Suppliers Fall After Forecast for Slowing IPhone Sales; Earnings No Help for Apple Stock Set to Become Dow’s Biggest Dog; Samsung Planning $9 Billion Down Payment on IPhone Displays

- Twitter Gains in Users Aren’t Enough to Spur Advertising Growth: sees 2Q rev. $590m-$610m vs est. $677.1m, sees 2Q adj. Ebitda $145m-$155m vs est. $172.9m; 1Q rev. $595m vs est. $607.5m; says rev. came in at low end of forecast range because brand marketers didn’t raise spending as fast as expected in 1Q

- EBay Forecast Beats Estimates as Traffic Efforts Pay Off: Sees 2Q rev. $2.14b-$2.19b, est. $2.14b, sees 2Q adj. EPS cont. ops 40c-42c, est. 44c; 1Q adj. EPS 47c, est. 45c

- Comcast in Discussions to Buy DreamWorks Animation, WSJ Says:

- U.S. Oil Rises Above $45 a Barrel for First Time Since November: Nationwide stockpiles drop 1.07m barrels last week: API

- AT&T Profit Tops Estimates; Company Sees Net TV Customer Loss: 1Q adj. EPS 72c, est. 69c; added 129k monthly subscribers, below projections

- Trump Declares He’s ‘Presumptive Nominee’ as Clinton Wins Four: Trump won all five states holding votes Tuesday -- Pennsylvania, Connecticut, Maryland, Delaware and Rhode Island; Clinton beat Bernie Sanders in Connecticut, Pennsylvania, Delaware and Maryland, Sanders won in Rhode Island

- NYSE Joins Nasdaq Assailing Plan to Overhaul Trading Fees: Proposed test will hurt investors, NYSE president says

- Bond Inflation Outlook Sets Nine-Month High Ahead of Fed Meeting: Inflation seen at 1.57% pace next 5 yrs, yields show

- Near-Zero Growth Happens Often in Slow-Motion U.S. Economy: Sluggish first quarter would be third in as many years, economists forecast GDP to rise 0.6%

- Exxon Mobil Loses Top Credit Rating It Held Since Depression: Standard & Poor’s on Tuesday stripped Exxon of its highest AAA measure of credit-worthiness, cutting it to AA+

- Adidas Lifts Profit Forecast Ahead of Euro Soccer Tournament: Now sees 2016 net income from cont. ops up 15%-18%, had seen up 10%-12%; raised outlook for 2nd time in less than 3 months

- Chipotle Sales Tumble 23% as Food-Safety Fallout Persists: Restaurant chain reports first loss since going public

- FBI Officials Said to Urge Against Review of IPhone Hacking Tool: Have recommended against conducting a review to determine whether the vulnerability that was used to hack into a dead terrorist’s iPhone should be disclosed to Apple

Looking at regional markets, Asian stocks traded mixed following the tentative lead from Wall St. as participants remained weary ahead of the upcoming FOMC & BoJ meetings, while disappointing earnings from Apple also weighed on Asian suppliers. ASX 200 (-0.3%) initially outperformed after WTI climbed to YTD highs following an unexpected API drawdown, while weak domestic CPI data also boosted RBA rate cut hopes. However, the index was then dragged into negative territory alongside the risk-averse tone in the region. Nikkei 225 (-0.3%) fell as participants remain cautious as the BoJ kicked off its 2-day policy meeting, while Apple suppliers in the region also suffering following poor Q2 results from the tech giant which missed on earnings, revenue and forecasts, while iPhone sales declined for the 1st time Y/Y. Shanghai Comp (-0.4%) had been initially supported by strong Industrial Profits which rose 11.1 % Y/Y, although declines in Chinese commodity prices and default concerns saw the index reserve its earlier gains. 10yr JGBs weakened with participants side-lined ahead of the upcoming policy decision, while the absence of the BoJ in the market also contributed to the lack of demand.

Top Asian News

- Nomura Posts Surprise Quarterly Loss on Trading, Brokerage Slump: 4Q net loss 19.2b yen vs est. 23.4b yen profit

- Galaxy Ent.’s Profit Trails Estimates on Dearth of High- Rollers: 1Q adj. Ebitda HK$2.4b vs est. HK$2.47b

- Nintendo Forecasts Miss Analyst Estimates; NX Release March 2017: Sees op. profit +37% to 45b yen vs est. 65.6b yen

- Mitsubishi Motors Withholds Earnings Forecast on Test Fraud: Co.may have to compensate customers, Nissan, govt

- Australia Core Inflation Slows to Record, Puts Rate Cut in Play: CPI falls 0.2% q/q, first decline since 2008 crisis

- China Debt Headache Swells as Bank Breaches Bad-Loan Buffer: Bank of China’s coverage ratio falls below 150% for first time

- Asia Hedge Fund Outflows Highest in Seven Years, eVestment Says: March redemptions from Asia-based funds neared $2b

- Rupee Bulls See Volatility Damped as Oil Enters Goldilocks Phase: Currency’s implied volatility fell to 4-mo. low last week

- Samsung Planning $9 Billion Down Payment on IPhone Displays: Co. said to be in talks to supply for next iPhone model

In Europe, stocks have traded in modest negative territory through much of the morning before seeing a pickup in recent trade to pare earlier losses. Sentiment in equity markets has been somewhat uncertain after the downbeat CPI data overnight from Australia and ahead of the key risk events of the week in the form of the Fed and BoJ rate decisions. Equities however reversed course amid the positive impact from the upside seen in the energy complex. This comes as WTI and Brent both continue to trade at YTD highs in the wake of the surprise API drawdown last night (-1100k vs. Exp. 2400k) and the continued upside seen in oil seen over the past few weeks. In terms of equity specific news, earnings season is in full flow with the likes of Adidas (+6.6%) and Barclays (+2.6%) among the best performers after premarket releases.

Fixed income markets remain modestly higher on the day, in fitting with the general risk off sentiment. As such, Bunds remain at elevated levels, subsequently tracking USTs higher with the curve notably flatter amid outperformance in the long end.

Top European News

- Barclays Shares Rise as Investment Bank Weathers Market Turmoil: Pretax profit fell 25% to GBP793m, rev. dropped 13% to GBP4.6b, topping GBP4.48b avg. estimate; investment bank posted smaller revenue declines than U.S. rivals

- U.K. Economy Loses Pace as Services Slow, Manufacturing Shrinks: Growth slowed to 0.4% from 0.6% in the final three months of 2015, as forecast in a Bloomberg survey of economists

- Total Quarterly Profit Beats Estimates, Helped by Refining: 1Q adj. net $1.64b beats average est. $1.25b; co. plans to limit capex to

- Hutchison-VimpelCom Italian Deal Said to Face EU Objections: EU antitrust complaint listing concerns could come in June

- Steinhoff Folds in Darty Auction, Handing Victory to Fnac: aid Steinhoff says it won’t raise its offer for Darty, Fnac’s 170p/shr bid supported by shareholders owning majority stake

- Munich Re Shares Decline After First-Quarter Profit Warning: says 1Q result “well below” expectations, also well below year-earlier figure

- Santander Jumps as Bank Beats Profit Estimates, Builds Buffer: 1Q Net EU1.63b, est. EU1.5b; provisions for bad loans fall, as capital ratio rises

- Nordea Girds for Sanctions It Says May Follow Panama Probe: Posted 28% decline in profit last quarter

- Iberdrola Profit Drops as Currencies, Electricity Prices Slide: 1Q Ebitda EU2b; est. EU2.06b

- Deutsche Bank Struggles to Shake Winter Blues in Credit Markets: Cost of insuring against losses on Deutsche Bank’s debt is 67% higher than average for 12 of its biggest peers

- ECB May Reshape Euro Corporate Debt by Driving Long-Term Issues: Central bank to purchase bonds with maturities up to 30 years

In FX, it has been a busy morning ahead of the key FOMC meeting tonight, with yet more USD sales to note against selected majors, but enough to pull the USD index lower again. Stand out has been GBP earlier in the week, but EUR/USD gains have seen us back into the low-mid 1.1300's again, while a WTI surge to $45.0 has sent USD/CAD through 1.2600 and below the lows from Friday. The move has also stemmed the sell-off in AUD/USD, which slumped from the mid .7700's in the wake of the surprise Australian CPI read which was much lower than expected — Q1 yoy 1.3% vs 1.8% previously. We tested .7600, but unsuccessfully as yet. Big data release in the UK in Q1 GDP, but coming in largely as expected, pre data positioning saw early selling above 1.4600 reversed, but 1.4545-50 levels have held up so far. Tuesday's 1.4638 high is intact as yet. USD/JPY has every reason to stand pat with the BoJ decision hot on the heels from that of the Fed. Support holding up, but stock market weakness creeping in (Apple miss) to cap the topside for now.

In commotieis, heading into the North American crossover, WTI and Brent crude futures have extended on gains following yesterday's surprising drawdown in the latest API crude oil inventory report. Subsequently, crude prices now trade at YTD highs with WTI breaking above USD 45.00/bbl which is the first time since Nov'15. Gold (+0.1 %) prices remained near yesterday's highs as a cautious tone and USD weakness underpinned. Elsewhere, copper and Dalian iron ore futures extended on losses in Asian trade with the latter declining 6% to hit limit down on Chinese concerns and a continuation of the selling since China increased transaction costs.

Datawise in the US this afternoon it’s worth keeping a close eye on the advance goods trade balance reading for March with respect to its influence on GDP, before March pending home sales data is released. This all of course comes before the main event this afternoon with the conclusion of the two-day FOMC meeting. Meanwhile it’s another bumper day for earnings today with 41 S&P 500 companies set to report, the highlights of which include Boeing, Facebook and General Dynamics.

Bulletin Headline Summary from Bloomberg and RanSquawk

- Uncertainty looms across equities as participants weigh risk events in the form of the Fed and BoJ rate decisions with the surge higher in crude prices.

- GBP finds support to remain near 1.4600 following UK GDP figures, while commodity linked currencies strengthens against the USD amid the surge in crude prices.

- Looking ahead, highlights include Fed, RBNZ and Brazilian rate decisions and US Pending Home Sales.

- Treasuries rose during overnight trading after falling seven straight days amid equity weakness in Asia and Apple posted its first quarterly-revenue drop in more than a decade; FOMC statement expected at 2pm, no press conference.

- Fed will keep rates on hold at April 26-27 mtg, won’t signal a rate increase is likely at following mtg, should continue to watch risks posed by global developments, based on published research from economists/strategists

- The U.K. economy lost momentum in the first quarter as services posted their weakest performance for almost a year and industrial production continued to decline

- Oil climbed above $45 a barrel in New York for the first time since November after U.S. industry data showed a decline in crude stockpiles

- The “black hole” of Japanese and European interest rates will be the thing that drags down Australian bond yields, according to HSBC

- Greek government bonds tumbled, pushing the yield on shorter-dated notes up by the most in more than three weeks, after the nation failed to resolve disagreements with creditors, prompting Prime Minister Alexis Tsipras to seek a euro-area leaders’ summit

- Nomura Holdings Inc. unexpectedly posted a quarterly loss for the first time in more than four years, as trading income and brokerage commissions slumped and it set aside cash for payouts tied to job cuts

- Here’s one trademark of the slow-motion U.S. economic expansion: Near-zero growth in any given quarter is nothing to panic about. Yet if 2014 and 2015 are any indication, GDP will rebound in the subsequent quarter as consumer demand picks up and keeps the expansion moving ahead

- Republican Donald Trump declared himself the “presumptive nominee” and Hillary Clinton all but sealed the Democratic race as both scored dominating wins in northeastern state presidential primaries

- Sovereign 10Y bond yields mostly lower; European equity markets higher, Asian markets drop; U.S. equity-index futures fall. WTI crude oil, metals both higher

US Event Calendar

- 7am: MBA Mortgage Applications, April 22 (prior 1.30%)

- 8:30am: Advance Goods Trade Balance, March, est. -$62.8b (prior -$62.864b)

- 10am: Pending Home Sales m/m, March, est. 0.5% (prior 3.5%)

- 10:30am: DOE Energy Inventories

- 2pm: FOMC Rate Decision

DB's Jim Reid concludes the overnight wrap

Well the weather in Europe yesterday certainly saw four seasons in one day. Actually thinking about it there was nothing resembling summer as London had snow, I got caught in a freezing hail downpour in Holland and then arrived late last night in Munich to sleet with no signs of any imminent rise in temperature. Goodness knows how cold it would have been without man made global warming. Pity our poor Dutch friends who are off for King's Day today with the forecast being that it will be colder than Xmas 4 months ago.

Markets have been feeling the chill so far this week but the conclusion of the FOMC meeting this evening should heat things up. With no press conference, all the focus will be on the tone of the associated statement. The Fed will want to leave the door open for a June hike but it's hard to imagine that they'll dramatically change market pricing for it. The futures contracts have nudged up to pricing a 22% probability of a June hike from as low as 14% mid-way through this month. How much this changes will likely hinge on what extent the Fed continues to acknowledge concerns about global growth and risks abroad. US data has been mixed of late. After getting back close to neutral at the start of April, economic surprise indices have trended steadily lower into negative territory as the month has passed. On the positive side the weaker US Dollar should give the Fed some confidence. Since the March Fed meeting, the Dollar index has weakened just over 2%. That’s partly helped to support a near $8/bbl gain for WTI and 4% rally for the S&P 500 to YTD highs. We think much of the rebound in markets since early February has been due to the Fed's about turn and re-found dovishness. This leaves them trapped in our opinion.

All that at 7pm BST tonight then. Meanwhile, while yesterday was another fairly directionless and unconvincing day of price action for markets ahead of the bigger events this week, the first of these big events came after the closing bell in the US last night with the release of the Apple Q2 results. The headline news saw the first quarterly drop in revenues in over a decade. This was expected but the magnitude of the decline wasn’t, with revenues declining nearly $1.5bn more than the consensus estimate. Earnings also missed with the tech giant posting EPS of $1.90 (vs. $2.00 expected). Also disappointing was the guidance for Q3 with revenues expected to fall materially more than the market had previously been expecting. Unit sales of iPhones and iPads actually exceeded expectations during the quarter, although sales in other products disappointed while the steep decline in revenues in Greater China for Apple was also highlighted as a concern.

All this culminated in a nearly 8% fall for Apple shares in extended trading, while some soft results from Twitter which saw shares plummet 9% in after hours compounded the pain for the sector. This morning we’ve seen Nasdaq futures weaken over 1% in early trading, with other US equity index futures also in the red. Bourses in Asia are a little more mixed. The Nikkei is -0.58% while Mainland and Greater China bourses are flattish. The Kospi is -0.22% although the ASX has jumped +0.66% after Australia posted a markedly softer than expected CPI print which has seen the Aussie Dollar plummet 1.4% in the aftermath. There has been better news out of China with the latest industrial profits data reporting a +11.1% yoy gain in March, a remarkable rebound from the -4.7% reported at the end of 2015.

The other news this morning is coming out of the US Presidential campaign where the WSJ is reporting that Trump has won all five Republican primaries overnight. The exact number of delegates is yet to be released but the victories will further extend Trump’s lead. Meanwhile the same wire is reporting that Clinton was the big winner in the Democratic Party race, winning four of the five primaries over closest rival Sanders.

Moving on. The big mover again yesterday was Oil with WTI closing up over 3% and a shade above $44/bbl to mark a fresh YTD high. Much of this reflected a weaker day for the US Dollar with the Dollar index (-0.28%) closing lower for the second consecutive day post some disappointing durable and capital goods orders data (more shortly). Interestingly, the benign return across both equity markets (S&P 500 +0.19%, Stoxx 600 +0.18%) and credit markets (CDX IG -0.1bps, Main unchanged) suggested that we may be seeing some decoupling between commodity markets and wider risk assets. In fact iron ore sold off nearly 5%, while Copper was down close to 1%. Sovereign bond yields continue to edge higher meanwhile with 10y Bunds now close to testing 0.30% (up 4bps yesterday) and 10y Treasury yields also extending their move up above 1.9% to close yesterday at 1.928% (up 1.4bps), the seventh consecutive session yields have edged higher.

With regards to that data, it was the softer than expected reads for durable and capital goods orders in March which got the main attention. Headline durable goods orders were reported as increasing +0.8% mom (vs. +1.9% expected) with the ex-transportation reading (-0.2% mom vs. +0.5% expected) also missing. Core capex orders were unchanged in March meanwhile (vs. +0.6% expected), while shipments rose a less than expected +0.3% mom (vs. +0.9% expected). Our US economists noted yesterday that the -9.6% annualized decline in Q1 2016 core shipments marks the weakest quarter since Q2 2009 (-21.2%), when the economy was just about to emerge from recession. They note also that spending outside the energy sector also plunged last quarter. In fact if you remove the impact of the machinery component from the shipments data, which is where energy related spending is captured, then shipments were down -13.8% last quarter.

Meanwhile there was also some disappointment to be had in the April consumer confidence index reading which fell 1.9pts to 94.2 (vs. 95.8 expected) although there was a silver lining in a reported increase in the present conditions index. Further evidence of disappointment in the manufacturing sector was revealed this month with a decline in the Richmond Fed manufacturing survey by 8pts to 14 (vs. 12 expected). On the positive side the flash April services PMI rose 0.8pts to 52.1 (vs. 52.0 expected). Finally the S&P/Case-Shiller home price index rose +0.7% mom in February in the 20 main cities so as to be up +5.4% yoy.

Switching to the micro where there were a couple of interesting snippets of news to make mention of, all of which came in the energy/commodity sector. First there was some positive news to take away from the Q1 BP earnings which revealed an unexpected profit during the quarter supported by gains in trading and refining, after analysts had been forecasting a loss for the period. Meanwhile, Glencore returned to the new issue market yesterday for the first time in about a year which in that time has seen the company weather a huge commodity rout and subsequent asset sale process. The company issued 250m of Swiss Franc denominated bonds yesterday which according to the FT was an upsized deal from the early indication. Lastly and on a slightly damper note for the sector, Exxon Mobil was stripped of its AAA credit rating from S&P yesterday after being downgraded by one notch to AA+. According to Bloomberg Exxon had held that rating since 1930 and it means the S&P AAA corporate club in the US public space now has just two members in Microsoft and Johnson & Johnson.

Before we look at today’s calendar, a quick mention of the latest in Spain where new elections this summer is looking likely after talks between potential coalition party leaders ended without agreement yesterday. Much of the commentary is suggesting that a new ballot would be likely to take place on June 26th, interestingly just 3 days after the Brexit referendum vote.

Looking ahead to today, this morning in Europe we’re kicking off in Germany where we’ll get the import price index for March, along with the latest consumer confidence data. Shortly following that we’ll get money supply data for the Euro area as well as the advanced reading for Q1 GDP in the UK (expected to print at +0.4% qoq). Datawise in the US this afternoon it’s worth keeping a close eye on the advance goods trade balance reading for March with respect to its influence on GDP, before March pending home sales data is released. This all of course comes before the main event this afternoon with the conclusion of the two-day FOMC meeting. Meanwhile it’s another bumper day for earnings today with 41 S&P 500 companies set to report, the highlights of which include Boeing, Facebook and General Dynamics. Total and Statoil will report during European hours in the energy sector.

Tags: Australia,Bank of Japan,Barclays Bank,Bernie Sanders,Bond yield,China,Copper,creditors,Crude Oil,default,Donald Trump,Equity Markets,fixed,Glencore,Japan,Japanese yen,Jim Reid,Monetary Policy,Morgan Stanley,NASDAQ,Nasdaq 100,Nikkei,Price Action,recession,SNB Apple Holdings,Switzerland Money Supply,Trade Balance,Twitter,U.K. Gross Domestic Product,U.S. Consumer Confidence,USD/JPY,Volatility,World Bank