There are two broad developments in speculative positioning in the Commitment of Traders report in the week ending February 9. First, the market turbulence saw speculators reduce exposure. Of the 16 gross positions we track, 11 were reducing positions by liquidating longs or covering shorts.

Second, there were an unusual amount of significant gross position adjustments, by which we mean a change of 10k contracts of more in a gross position. There were six such adjustments, and they were equally divided between increasing and reducing exposures.

The gross long euro position rose by 18.6k contracts to 114.6k. The bears largely hung fast; covering 5.2k short contracts to reduce to gross short position to 177.9k. The net short position of 63.3k is the smallest since last October.

The yen bears could not take any more heat. More than a quarter of the gross short position was covered (12.3k contracts), leaving them with 32.6k contracts. The bulls were content to take some profits and cut the gross longs by 6.3k contracts to 75.8k. The net speculative long position edged up to 43.2k contracts from 37.2k.

Sterling bears covered 10.4k gross short contracts, bringing their exposure to 67.3k contracts. The gross longs were trimmed by 1.7k contracts to 31.0k. The net short position slipped to 36.3k contracts.

The bulls added 12.6k contracts to their gross long Australian dollar position, which raised it to 64.0k contracts. The shorts covered 7.9k contracts, leaving the gross short position at 69.6k contracts. The net short position fell to 5.6k contracts, the smallest since last June.

Speculators seem to sense a bottom in the Mexican peso, which dovetails now with our technical view. The gross long position rose by 16.8k contracts to 41.7k. The gross shorts were cut by 15.3k contracts to 88.3k. This reduced the net short position to 46.5k contracts, the smallest in two months.

Speculators are also picking a top in US 10-year Treasury notes. The net position swung dramatically back to favor the shorts. The net short position of 62.3k contracts compares with a net long position of almost 6k contracts in the previous reporting period. The bulls took profits on 29.3k contracts, leaving them with 460.3k contracts. The bears added 38.9k contracts to their gross short position, which stood at 522.7k contracts at the end of the reporting period.

Speculators took the volatility in the oil market in stride, making only small adjustments to their positions. The bulls trimmed their gross long position by 1k contract, giving them 359.6k contracts. The bears added 8k contracts, leaving 356.9k gross short contracts. This generated a 9k contract decline in the net long position, which stood at 187.9k contracts.

| 9-Feb | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -63.3 | -87.1 | 114.6 | 18.6 | 177.9 | -5.2 |

| Yen | 43.2 | 37.2 | 75.8 | -6.3 | 32.6 | -12.3 |

| Sterling | -36.3 | -45.0 | 31.0 | -1.7 | 67.3 | -10.4 |

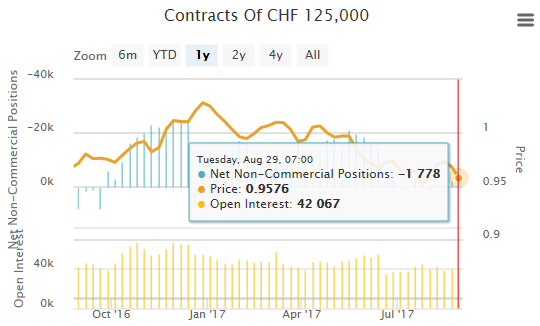

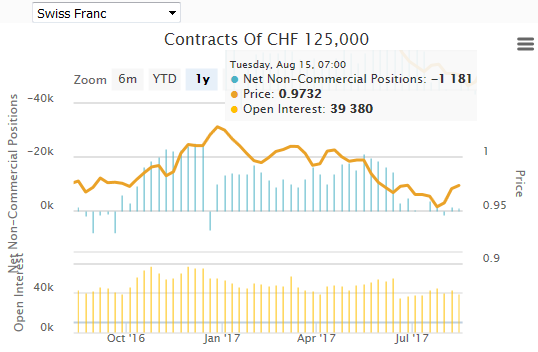

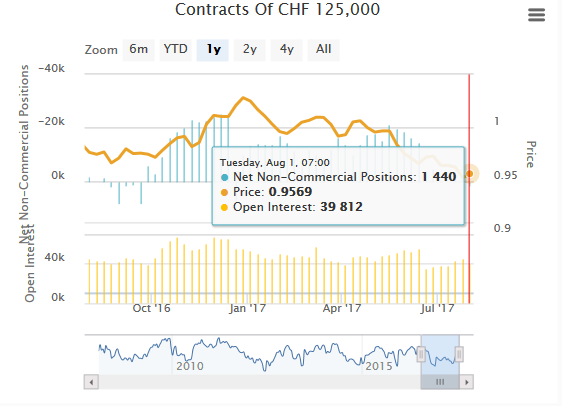

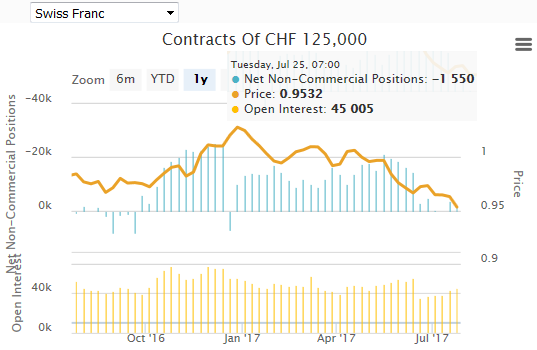

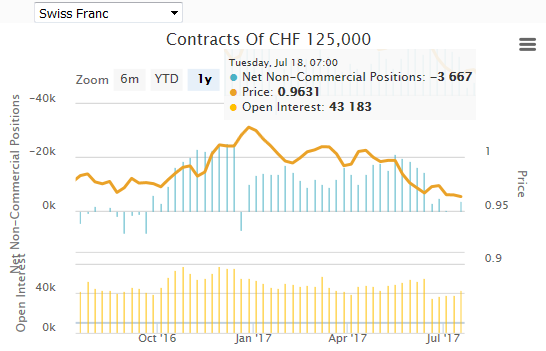

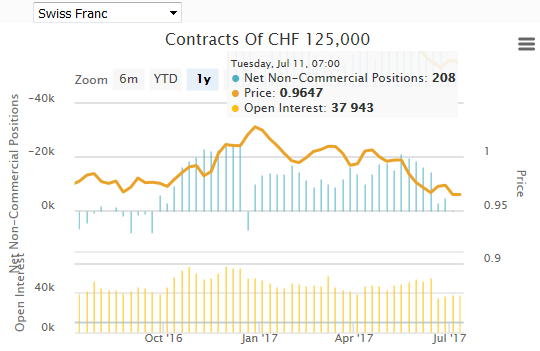

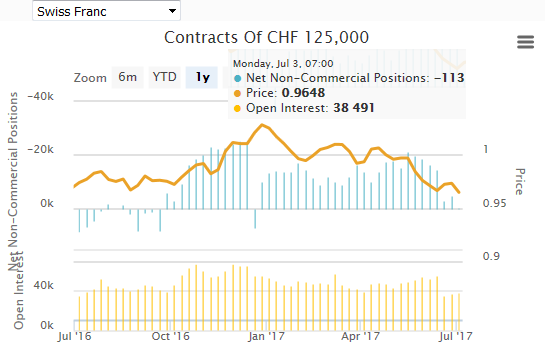

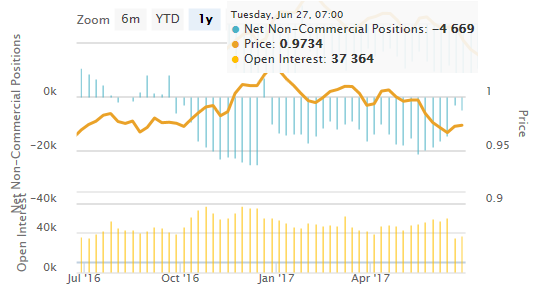

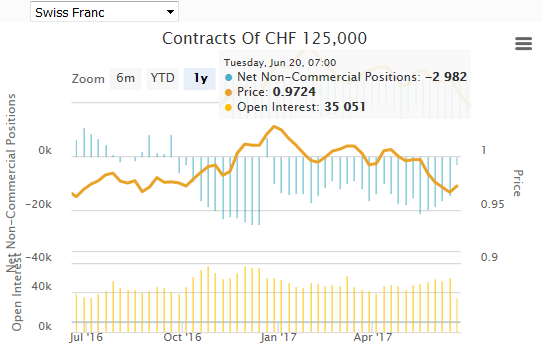

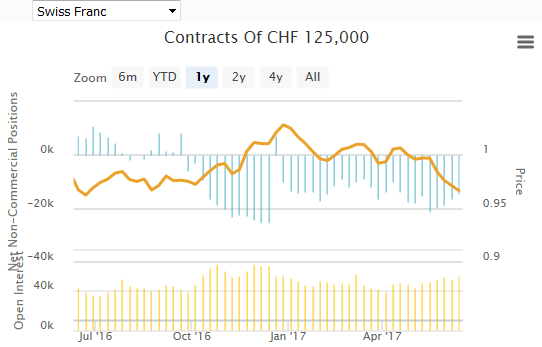

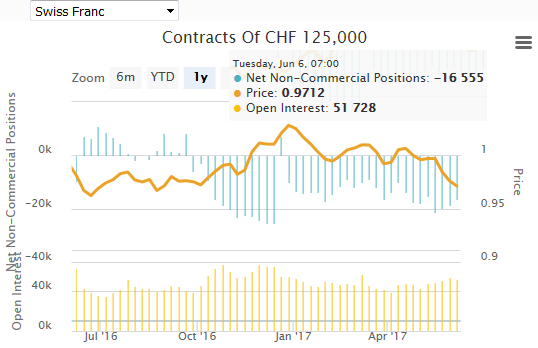

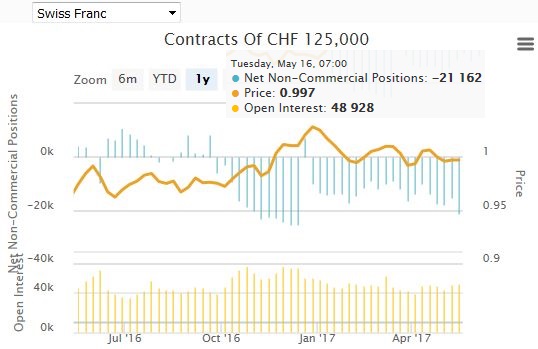

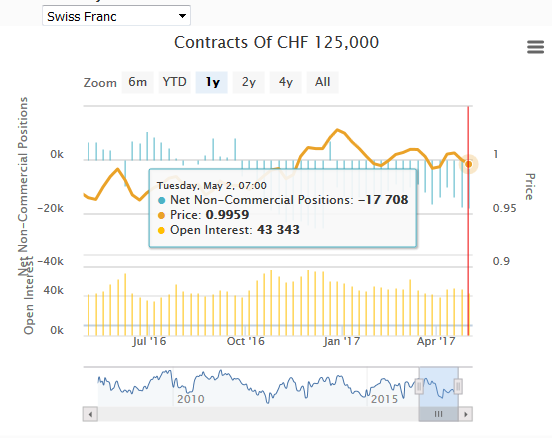

| Swiss Franc | -7.3 | -4.7 | 20.4 | -5.6 | 27.6 | -3.0 |

| C$ | -51.9 | -52.4 | 27.3 | -2.8 | 79.2 | -3.3 |

| A$ | -5.6 | -26.2 | 64.0 | 12.6 | 69.6 | -7.9 |

| NZ$ | -9.1 | -8.4 | 13.7 | 0.2 | 22.8 | 0.9 |

| Mexican Peso | -46.5 | -78.6 | 41.7 | 16.8 | 88.3 | -15.3 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Speculative Positions