It seemed that it was only after Asian equity markets fell did reports begin suggesting disappointment with the G20 meeting. The narrative followed the price action rather than the other way around. Before that, at least, one newswire claimed China was the winner of at the G20 meeting.

Its currency policy was not criticized. Many, including US Treasury Secretary Lew, welcomed China's clear communication and commitment to avoid a large depreciation of the yuan. The final statement expressed interest in looking into the expansion of the SDR, a favorite hobby-horse of the PBOC.

However, this is to exaggerate expectations that the G20 were going to launch a new initiative. Although the IMF seemed to call for some unspecified global coordinated effort, there was not political will for it, and that was obvious before the weekend. Moreover, the key concern about China is about the divergence between what officials say and what they do. The intentions of officials remain opaque.

Today's is the fifth consecutive session that the yuan has fallen. It closed at its weakest level since the markets closed for the Lunar New Year.

On the other hand, China hinted at scope for monetary and fiscal support, and it wasted no time. After local markets closed, the central bank announced a 0.5% cut in the required reserve ratio. It now stands at 17%. While it was too late to help Chinese shares (Shanghai off 2.9% and Shenzhen off 5.4%), the reserve cut helped European bourses recoup some earlier losses. Near midday in London, the Dow Jones Stoxx 600 is off about 0.65%, lead by a 1.1% drop in financials. Banks and diversified financials are bearing the brunt. The S&P 500 also recovered from earlier steeper losses.

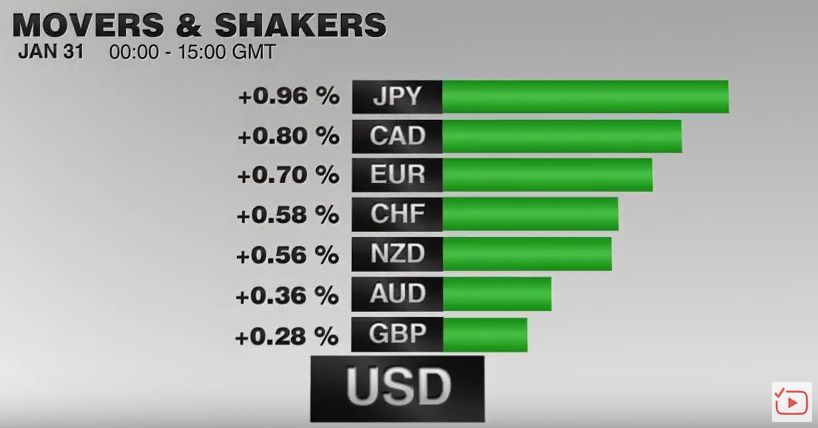

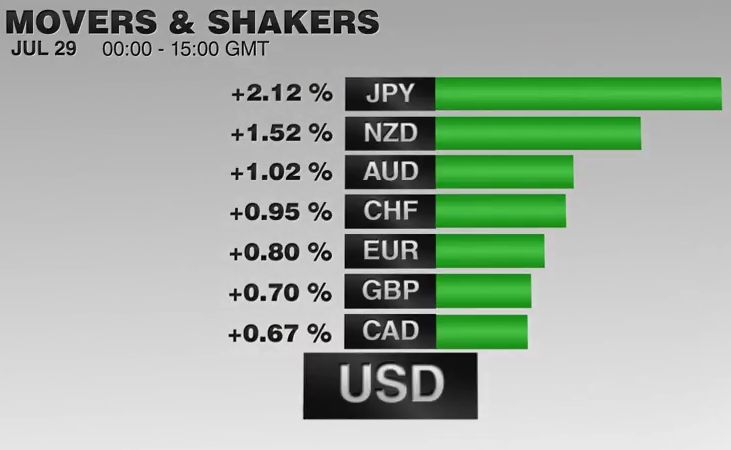

The Japanese yen gained nearly 1% since late-Friday. The weakness in equities and the easing US yields play a role. The G20 meeting seemed more concerned about yen weakness than yuan's decline, and this despite the strong rise in February (~7.25%). However, the discussion probably means that the bar is high for BOJ intervention, which it has confirmed it did not conduct this month (contrary to some market rumors) and for fresh monetary action at the BOJ meeting in mid-March.

However, Japan reported poor economic data. It is true that January industrial output jumped 3.7% (consensus was 3.2% after 1.7% decline in December). However, this seems to be a seasonal distortion. It was the strongest report since January 2015 when industrial production rose 4.1%. Perhaps more telling is the 3.8% year-over-year decline, twice the pace in December.

Separately, Japan reported a 1.1% drop in January retail sales. It was expected to have risen 0.1% after the 0.3% fall in December. Despite the weakness in the economy and retail sales, in particular, Prime Minister Abe has confirmed intentions to stick with the retail sales tax hike planned for April 2017.

The eurozone's February inflation report disappointed and this weighed on the euro as it is seen adding to the likelihood that the ECB eases policy next week. The headline rate tumbled to -0.2% from 0.3% in January. This is the first negative price since last September and matches the decline posted last February. It is tempting to blame it on energy prices, and no doubt it played a role. However, the core rate fell to 0.7% from 1.0%. The euro traded with a $1.08 handle for the first time since February 2.

The news stream is not all poor. Sweden reported nearly twice the growth as the consensus forecast for Q4 15. The 1.3% quarter-over-quarter pace compares with a 0.7% consensus guesstimate. It was no fluke. Growth in Q3 was revised to 1.0% from 0.8%. The year-over-year pace accelerated to 4.5% from a revised 4.1%. The krona strengthened on the news to its best level against the euro since the start of the month.

The euro is toying with the 61.8% retracement of this year's advance that took it from SEK9.1220 on December 30 to SEK9.6130 on February 11. That objective is found near SEK9.31. Although Sweden is experiencing lowflation and the central bank is engaged in aggressive, unorthodox policies (bond purchases as well as negative rates), the economic growth is among the strongest in Europe.

The UK reported slightly better than expected consumer credit and mortgage approval data. However, Brexit fears dominate, and after a poor pre-weekend session, the sell-off has continued. Sterling’s losses were extended to almost $1.3840. Before the conclusion of the EU summit and before London Mayor Johnson explicitly endorsed Brexit, sterling had closed on February 19 just above $1.44.

It will take another day or two to finalize the count from the Irish election. However, with 90% of the 158 seats spoken for, a fragmented result will make it hard to forge a government. The parties have until March 10. Otherwise, a new election will needed. Ireland’s 10-year bond is underperforming, with yields are off less than one bp. This is in line with Spain’s where parliament is to vote in the middle of the week supporting a minority government led by the Socialists. The investiture vote may fail on the first round, but the second round, possibly before the weekend, is more promising when a simple majority is needed.

The North American session features the forward-looking pending US home sales and the Chicago PMI. The key reports are tomorrow’s auto sales and Friday’s national jobs report. The ADP steals some of the thunder from the jobs report with its estimate in the middle of the week. Although the Fed funds futures show a higher risk than a week ago of a March hike, a June move is more likely, we think. Canada reports its Q4 current account and January industrial and raw material prices. The US dollar has made a three-day base near CAD1.35. The first target on the upside is near CAD1.3620.

Tags: U.S. Chicago PMI