1. Given the large moves in prices shortly after the CFTC reporting period ended on 1 December renders the latest Commitment of Traders report more dated than is usually the case.

2. The Thanksgiving holiday that closed US markets reduced participation in the currency futures. Of the 16 gross positions of the eight currency futures we track, none had a significant adjustment (more than 10k contracts). The 9.8k contract increase of speculative gross shorts euro futures (to 261.6k) was the largest adjustment. The 8,5k contract reduction of the speculative gross short Australian dollar contracts was the second largest position adjustment.

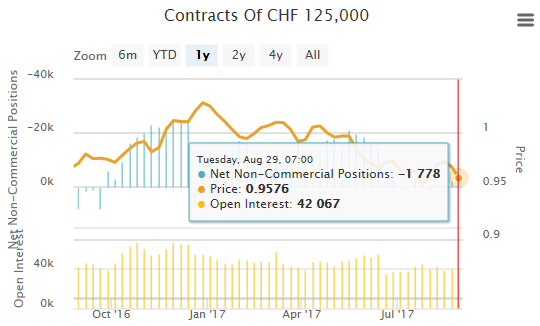

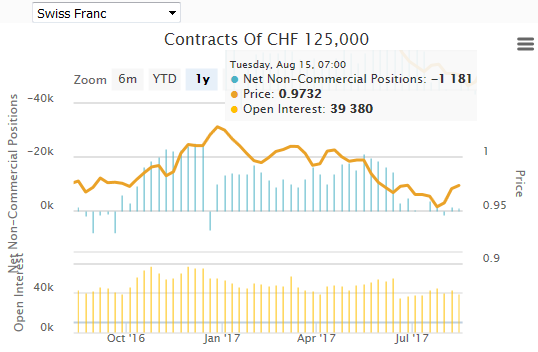

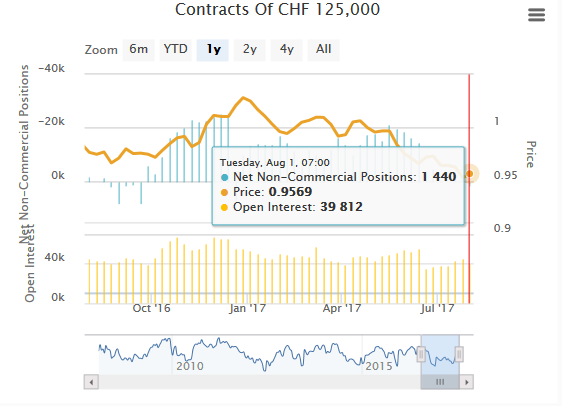

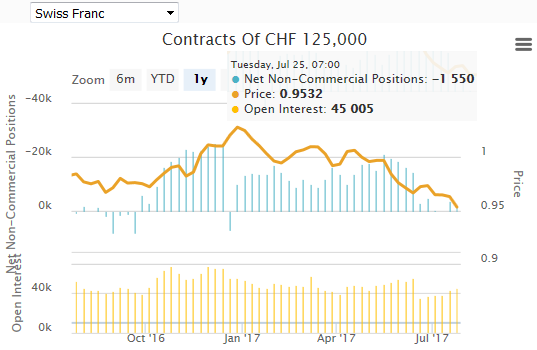

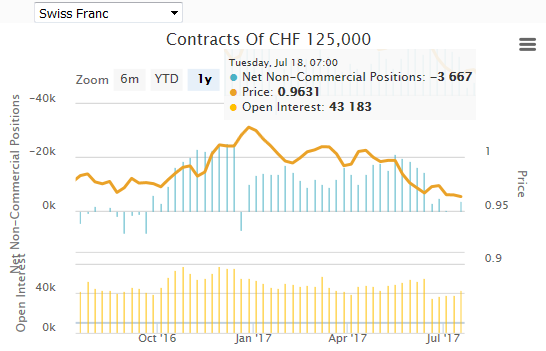

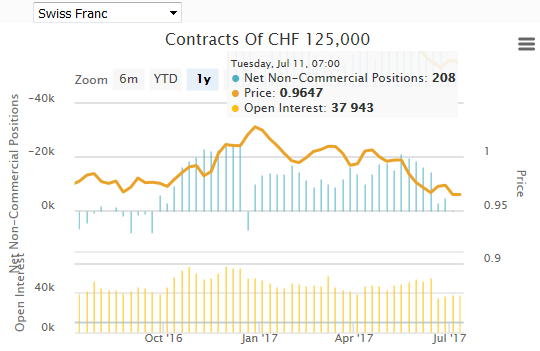

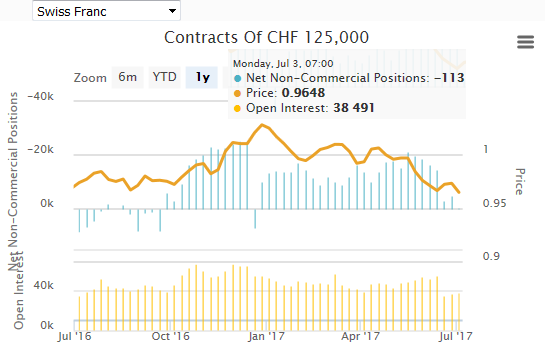

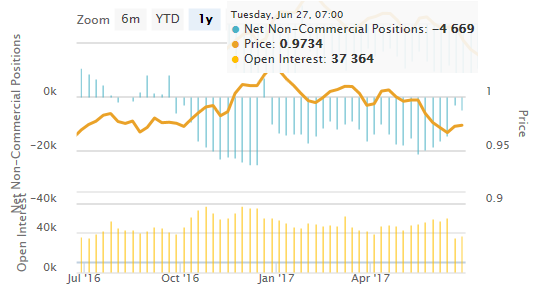

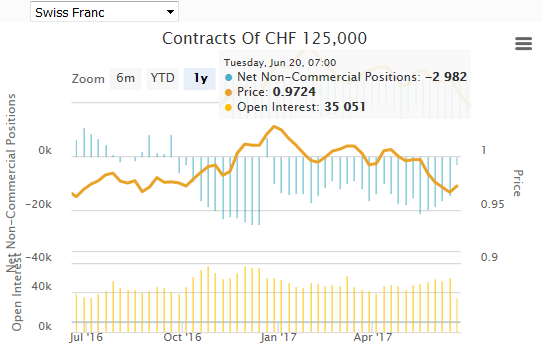

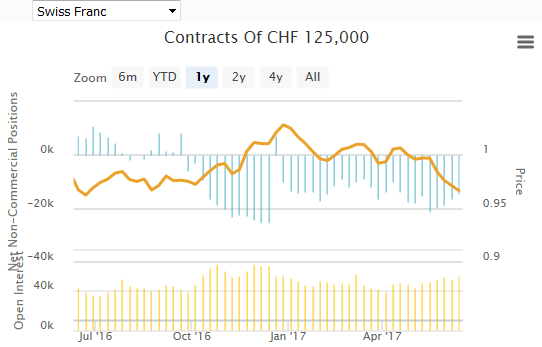

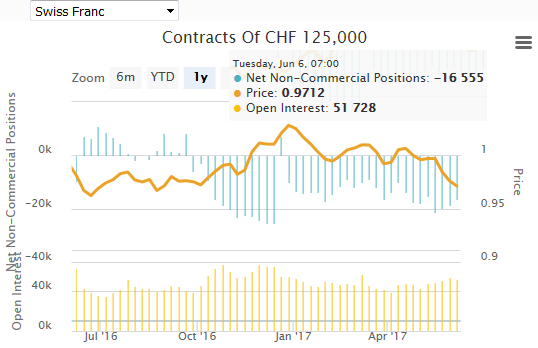

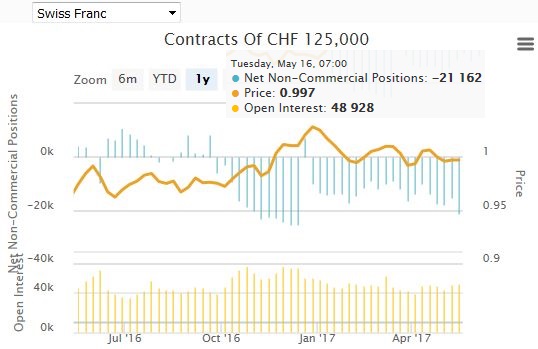

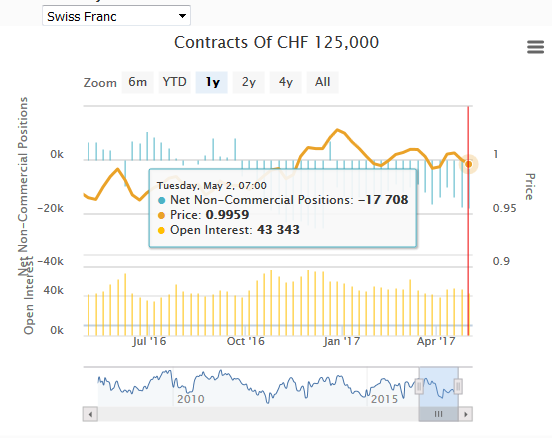

3. The value of the review of the speculative positioning illustrates the vulnerability of the market to a sell the rumor, buy the fact type of activity, even if the ECB hadn't disappointed participants. For example, the gross short euro position is near at eight-month high after having nearly doubled since late-October The net short euro position has nearly tripled to 182k contracts since then. The net short yen position stood at 74.9k contracts two days before the ECB meet. In late-October it was the net short position was 3.7k contracts, a 20-fold increase. The bears have built a 24.k contract net short Swiss franc future position. In late-October, they were long 625 franc future contracts.

4. If there was a pattern among the speculative activity in the days leading up to the ECB meeting and US jobs data, it was to add to long currency futures positions and cover some shorts. Of the eight currencies we track, the gross long position increased in six (the exceptions were the Canadian dollar and Mexican peso). The gross short positions were reduced in five (the exceptions were the euro, sterling, and Swiss francs).

5. The net speculative long position in light sweet crude oil futures were trimmed by 3.5k contracts in the days before the OPEC meeting to 208.5k contracts. This was a function, however, of an increase in gross longs (3.3k contracts to 475.6k) and a somewhat larger increase in gross shorts (6.9k contracts to 267.1k),

6. Bulls and bears thought they saw opportunities in the US 10-year Treasury futures. The bulls increased their net long position by 24.6k contracts, lifting their holdings to 460.1k contracts. The bears added 44.2k contracts to their gross short position, bring it to 444.6k contracts. This left the net a net long position of 15.5k contracts. The previous week it swung from net short to net long. The sell-off that took place after the reporting period ended brought the December 2016 futures contract to three-week lows.

Tags: Commitments of Traders,Speculative Positions