- In this Cross Asset Global Macro Analysis we name our reasons for the current dollar strength.

- The main causes are ECB’s euro “downtalk”, tight monetary policy in Emerging Markets, rising savings of the aging populations. This leads to weak global spending and growth.

- With the help of Fed-financed higher asset prices and falling gasoline prices, Americans feel more wealthy and finally “Buy American”.

- Another reason is that FX traders and investors try to imitate the late 1990s irrational exuberance.

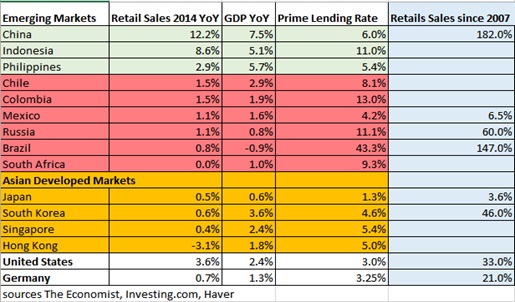

The world economy has reached a stage of very slow growth: apart from the now more consumption-driven China, retail sales and spending rise very slowly in Europe and in the previously so strongly expanding Emerging Markets (EM). As usual, the dollar is the winner of this phase.

Let’s have a closer look at the reasons for the stronger dollar on the supply side:

There are some slight and often overestimated effects from the U.S. shale industry. But the Fed’s years-long dollar bashing and higher wages in EMs have achieved a nice effect: with the weaker dollar, American labor is relatively cheap on a global scale – or at least it was until the dollar appreciated.

Secondly, American companies benefited from the USD reserve currency status and had less problems obtaining credit. Still, firms preferred to invest abroad and to globalize their supply chains with cheaper labor abroad. While in the U.S. those were mostly the bigger companies in the S&P 500, in Germany or Switzerland even medium enterprises followed that strategy. Logically, the S&P 500 clearly outperformed smaller U.S. companies; U.S. small business confidence is far under the values seen before 2008.

Reasons on the demand side for the stronger dollar are:

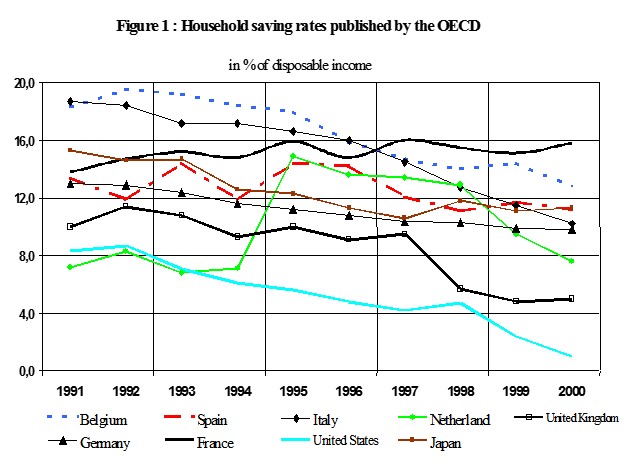

1) Central banks in the EMs responded with higher interest rates to the higher inflation caused by the breakdown of their currencies in June 2013 and slowing investment inflows. This tight monetary policy is visible in the prime lending rates in the table above and positive real interest rates. People in many EMs, in particular in the “fragile five” and in Russia, decided to profit on high rates and to save rather than spend. Europeans continue their austerity based on the desire to save for retirement instead of relying on perceived “near-bankrupt governments and social systems”. No wonder: Europeans live a couple of years longer than Americans. The weak demand depressed spending and investments in Europe and EMs, and consequently oil and commodity prices.

2) The dollar is inversely related to oil prices. Due to lower fuel taxes and higher distances, gasoline takes up a significantly higher and more volatile part in the US consumption basket than in the European one. Lower gas prices, however, help spending on things that are not so essential; for example, a typical American car that consumes more than a European one.

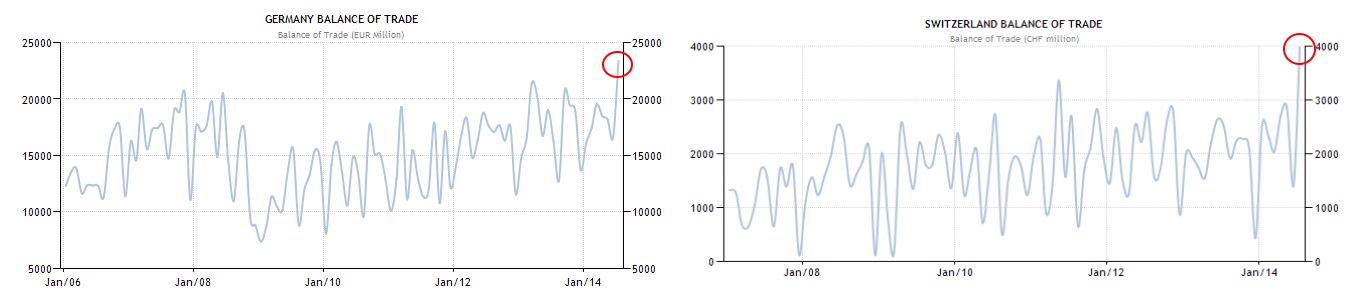

Lower oil prices and Draghi’s “Euro-Abenomics” policy, namely the artificial downtalk of the currency when deflation was in sight, has finally triggered a period of a stronger dollar. The first effect of a weaker euro and higher prices for imported durable goods is that the ones that ought to spend, namely the Germans, are not doing so. Instead, weaker currencies helped Germans and the closely related Swiss to obtain record high trade surpluses and stronger machinery exports to the U.S. and non-euro countries.

But with slower growth in their export partners in China, Russia and Southern Europe, Germans remain reluctant to invest and to spend.

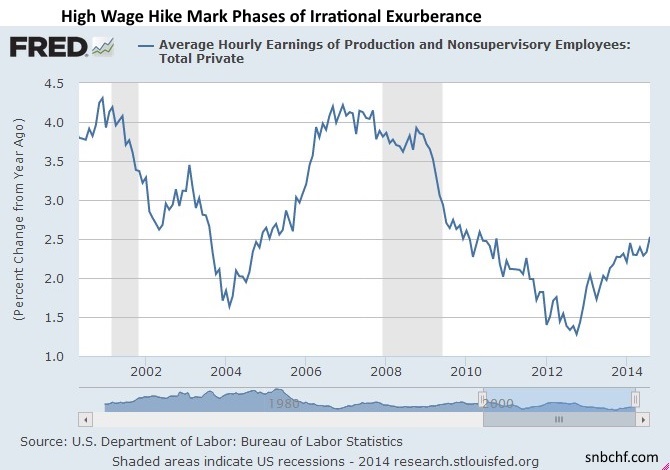

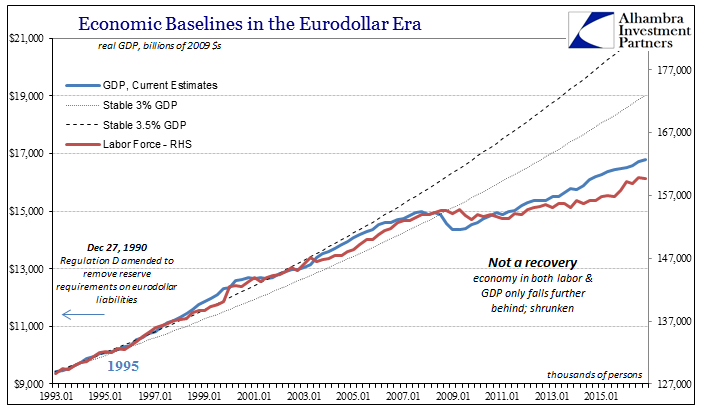

The American economy is far less interconnected – only 5% of sales go into EMs. Hence the status quo of global austerity could lead to a new period of unsustainable U.S. growth, as during previous Asian-European austerity phases. In the late 1990s Europe was in the euro introduction austerity period and Asia in its 1998 crisis. While Asia and Europe slowed spending, American companies hiked wages, US households increased spending and debt, and they all, including foreign investors, prayed to the technology idol of the “New Economy”. Alan Greenspan and Robert Shiller named this phase “irrational exuberance”.

A new phase of irrational exuberance is already visible in economic indicators, such as the strong manufacturing ISM: the causes might be higher asset prices, the American car industry and lower gasoline prices. With increasing perceived wealth, people are less attentive to prices and now many buy American, or they buy goods where “made in U.S.A.” is written on the product and they ignore the global supply chain content. The combination of strong global competition in the supply chain and higher sale prices charged to the consumer may have inflated profits of U.S. firms. For comparison, higher real estate prices were something that the Japanese were never allowed to see during their twenty-year-long deflation between 1991 and 2011, but wage deflation kept their companies competitive, trade surpluses high and in most periods the yen strong.

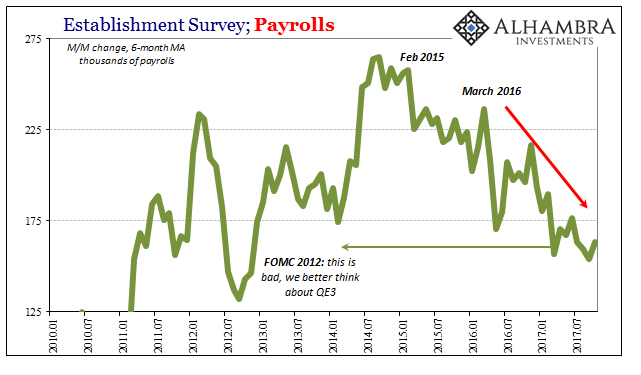

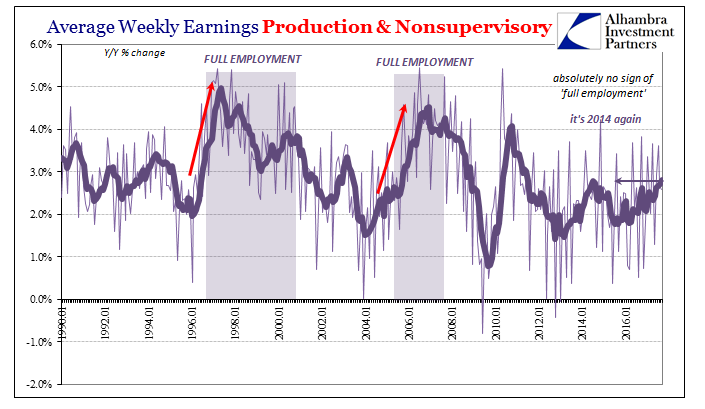

U.S. firms are now ready to pay a total wage increase of 7.5% annualized in Q1 and 5.8% in Q2. This number comes from two effects: more employment and 2.7% higher pay per hour. Apart from high-income earners and stock owners, the irrational exuberance has not yet arrived with the “normal American” and the small businesses mentioned above. Effectively, Americans have increased their savings rate from 0.4% in 2007 to 5.7% recently; many are still paying down debt. The median Americans wealth is one of the lowest in OECD countries.

U.S. firms are now ready to pay a total wage increase of 7.5% annualized in Q1 and 5.8% in Q2. This number comes from two effects: more employment and 2.7% higher pay per hour. Apart from high-income earners and stock owners, the irrational exuberance has not yet arrived with the “normal American” and the small businesses mentioned above. Effectively, Americans have increased their savings rate from 0.4% in 2007 to 5.7% recently; many are still paying down debt. The median Americans wealth is one of the lowest in OECD countries.

Due to weak median savings and wealth we do not believe that Americans will consume as much and repeat irrational exuberance this time. For us, the stronger dollar is the effect of higher savings in both the U.S. and elsewhere in the world.

Today’s irrational exuberance – visible in extremely stretched and rising CFTC positions against the euro – is an indicator of global weakness but not of American strength. The hype happens only in the heads of investors and FX traders that try to imitate history, namely the phase from the late 1990s. The problems with that thinking is as follows:

- An American technology idol like the “New Economy” is missing. Apple and Microsoft seem to lose their competitiveness in silo thinking without the great visioneers they had before, Google could follow. Investors are more intelligent today and mistrusted the Facebook and Twitter IPOs.

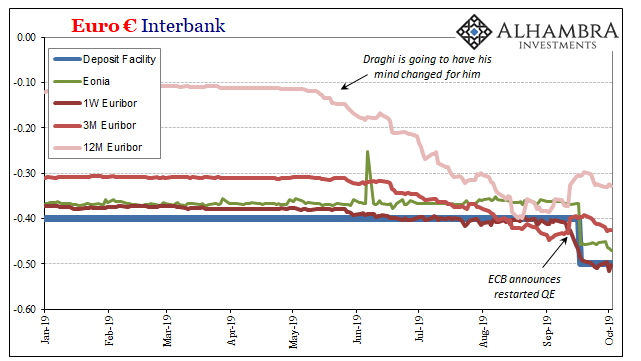

- This time the Fed will not follow with strong interest rate hikes. Asset price inflation, visible in the 2.9% increase in shelter, drives inflation and the recent 2.7% nominal increase in hourly pay. Fed’s preferred indicator, the Core PCE inflation is at 1.47%. The stronger dollar, weak global demand and the desire of ordinary Americans to pay down debt could reduce U.S. inflation further.

- In the last 1990s, Germany was the “sick man of Europe”; now it is very strong. This is visible in the massive trade surpluses that can be reduced – as many say – only with a Euro at 1.60. Nowadays, Germans would be the final sponsors of U.S. spending and a new irrational exuberance phase.

- Last but not least, China is actually not an EM any more as it was in 1999, but it is able to finance itself autonomously. It rather represents Japan as of 1981 or Germany as of 1974, i.e. strong growth with relatively weak inflation. The weakness of oil and commodities mostly hangs on the availability of cheap credit in China via so-called “social financing” but finally on the mercy of the People’s Bank of China. That, however, exercises tight monetary policy that weakens the Chinese housing investments and therefore oil prices, but it improves the trade balance. For two years now China has seen strong competition and producer price deflation. For the U.S. this means imported “total factor productivity” and imported deflation – details in my presentation at the CFA Society.

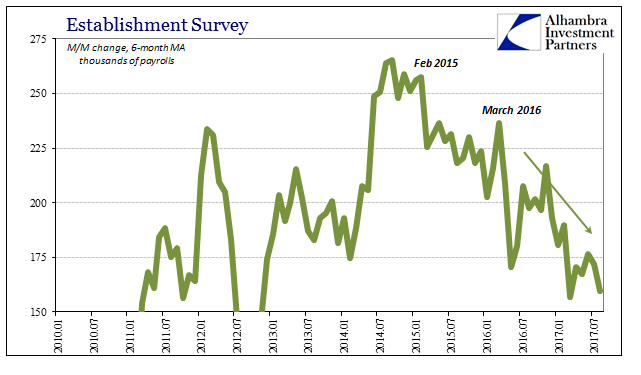

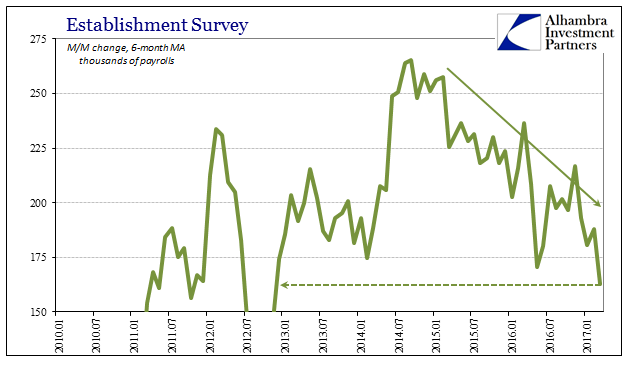

As already visible in the latest job reports – the reality is probably different than the ISM suggests. S&P 500 companies may use the stronger dollar to invest and to create jobs abroad again or outsource and use cheaper pieces provided by global suppliers. The irrational exuberance of FX traders might not translate into the real economy.

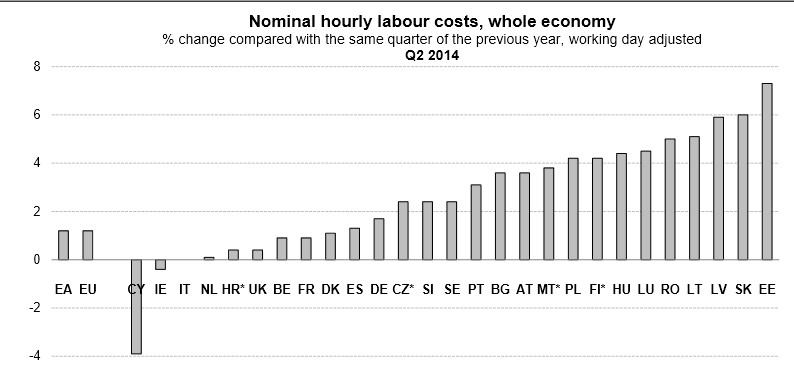

The ECB, however, might obtain her wishes. The weak euro (NYSEARCA:FXE) and higher imported inflation in Germany may effectively lead to higher German wage demands – after Buba president Weidmann raised the 3% wage hike cause. Recently, strikes stopped both German air and train traffic, a clear indication of labor shortages. Due to wage downward stickiness, France and Italy were not able to re-adjust their 20% relative wage increase since 1999 compared to Germany.

More quickly rising wages and home prices combined with a historically relatively high savings rate resulted in weaker French and Italian company profits but higher median wealth – as visible above. And finally also in higher unemployment rates.

source OECD

The ECB, however, might obtain her wishes. The weak euro (FXE) and higher imported inflation in Germany may effectively lead to higher German wage demands – after Buba president Weidmann raised the 3% wage hike cause. Recently, strikes stopped both German air and train traffic, a clear indication of labor shortages. Due to wage downward stickiness, France and Italy were not able to re-adjust their 20% relative wage increase since 1999 compared to Germany. More quickly rising wages and home prices combined with a relatively high savings rate resulted in weaker company profits but higher French and Italian median wealth – as visible above. But finally also in higher unemployment.

The calculus is obvious: the weak euro will make European labor cheaper and do the necessary adjustments: higher German wage demands and German spending and the reduction of unemployment in the rest of Europe.

According to data from the French statistics bureau, the re-adjustment of wages between France and Germany only started in 2013 with a 2.6% increase in Germany compared to 1.7% in France, while in 2011 and 2012 the wage hikes were comparable. The necessary adjustment path will probably continue in 2014 and for many years more, while Draghi already speaks of fiscal aid to stop the adjustments and the – for us – necessary deflation. Food and energy are causing the current weak French inflation figures but not wages or services (+1.9%) yet. Finally, these wage adjustments should translate into slowing prices of services and – hopefully – more French dis- and deflation and stronger competiveness.

According to data from the French statistics bureau, the re-adjustment of wages between France and Germany only started in 2013 with a 2.6% increase in Germany compared to 1.7% in France, while in 2011 and 2012 the wage hikes were comparable. The necessary adjustment path will probably continue in 2014 and for many years more, while Draghi already speaks of fiscal aid to stop the adjustments and the – for us – necessary deflation. Food and energy are causing the current weak French inflation figures but not wages or services (+1.9%) yet. Finally, these wage adjustments should translate into slowing prices of services and – hopefully – more French dis- and deflation and stronger competiveness.

Apart from Eastern countries, European labor costs rise far more slowly than the 2.7% higher pay in the United States. Italy has finally started to readjust and to become more competitive.

Attention should be paid to any sign of higher German spending and inflation that might quickly translate into a collapse of the CFTC speculators’ positions against the euro and a rapid improvement of the euro exchange rate. Due to the necessary adjustment of wages, we rather think that euro zone inflation and, therefore the euro, will remain weak over the next few years.

We admit that our previous euro bullish position, such as “The euro is poised for a steady rise. Expect $1.50 in 2 to 4 years“, was countered by the global desire to save and to cut spending as well as by the strong belief of FX traders in Mr Draghi. As Keynes said: “The FX market can remain longer irrational than you solvent”. Still, as opposed to the ever falling yen, the high European current account surpluses and the Fed’s potentially years-long hesitance to hike rates should limit the potential for a weaker euro.

Instead of buying the European currency, we continue our contrarian strategy: we bet on continuing low global inflation and buy still undervalued Southern European stocks on dips (do not expect quick economic wonders!), in particular Italy (EWI) and Greece (GREK). In these countries, current accounts and LTRO-induced bank profits on government bonds continue to improve, while high unemployment successfully deflates wages and increases the eagerness to work. Improvements in the European stock markets should be able to offset the euro weakness. Moreover, we bet on euro-denominated debt like Eurobonds issued by EMs. What we do not buy any more are German or American stocks. In irrational exuberance phases with weak inflation and a weak euro, Gold (GLD) purchases are risky even at current cheap valuations.

Are you the author? Previous post See more for Next post

Tags: Draghi,U.S. Average Earnings

1 comments

john_y

2014-11-07 at 01:34 (UTC 2) Link to this comment

thank you, very insightful article. If I’d have to transfer a considerable amount of EUR into USD, what entrypoint should I consider? 1.25? now the pair is at 1.238, more or less.