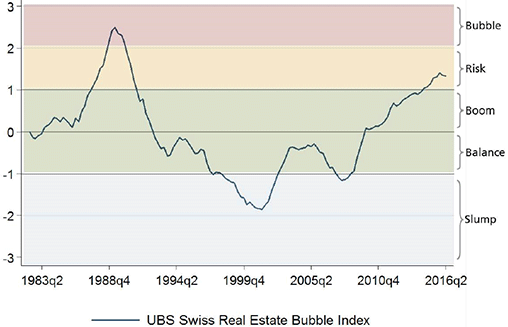

The major reason for rising British and American home prices is for us the relatively new phenomenon that they are to able to finance at cheap rates. Swiss or Germans have seen relatively low mortgage rates for more than three decades (with a short exception in the mid 1990s after the German reunification).

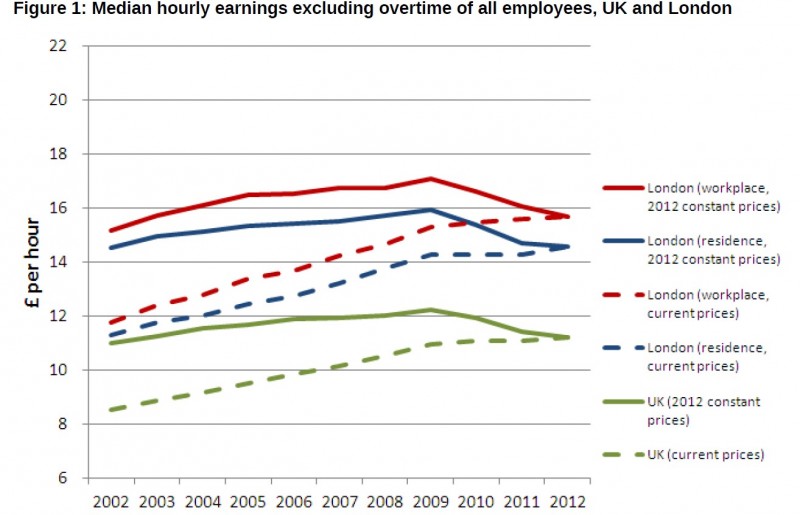

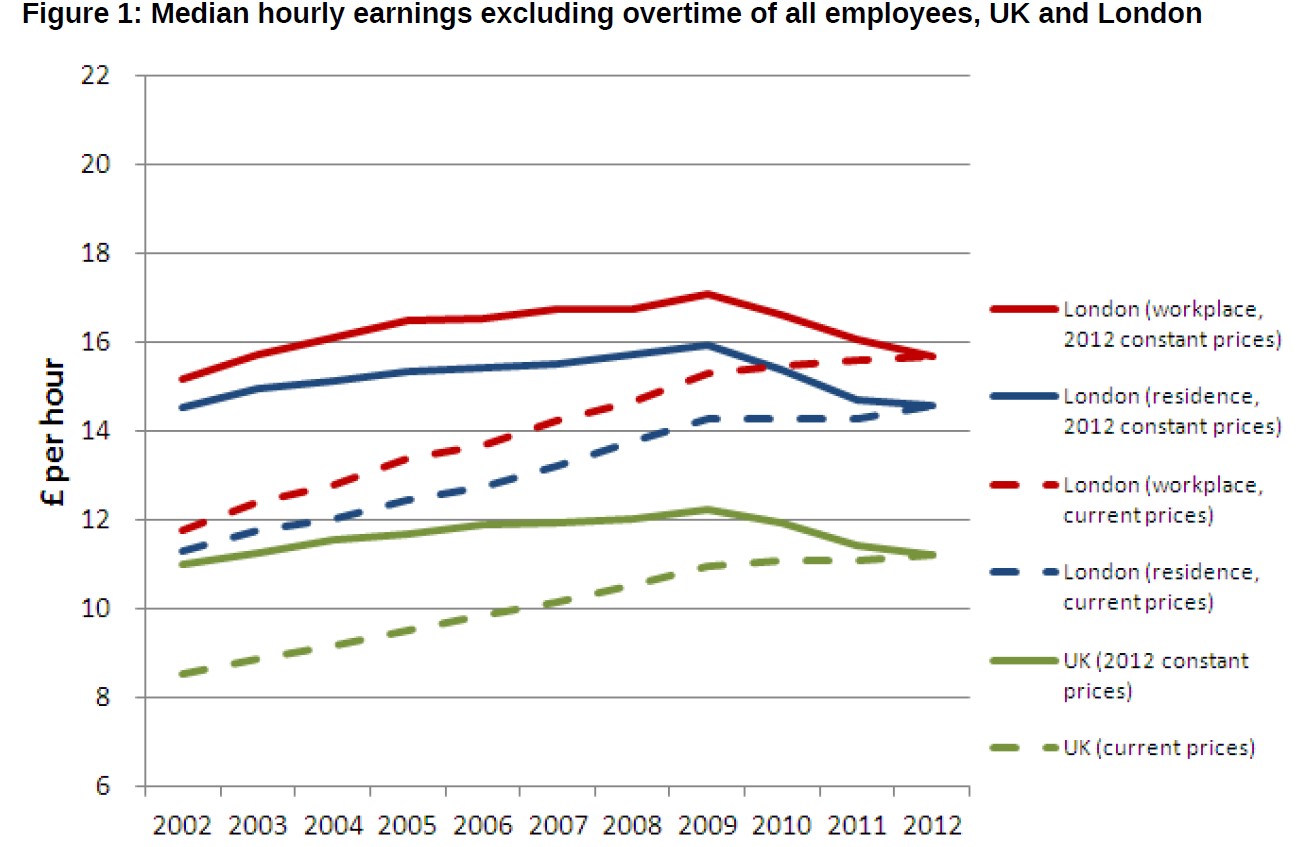

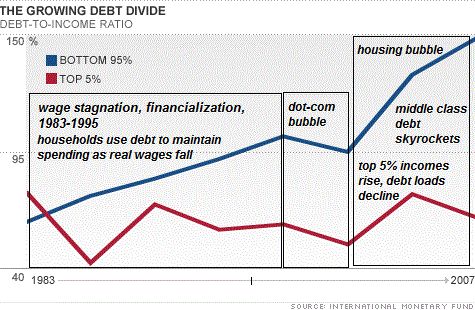

The main driver of low rates in the UK and the U.S. are, bizarrely, stagnating salaries while until the 1990s wages still rose quite quickly. Wages are and remain the main driver of inflation and interest rates.

Germans or Swiss, however, are used to slowly rising wages and low interest rates for a far longer time; low rates are for them no important reason to buy.

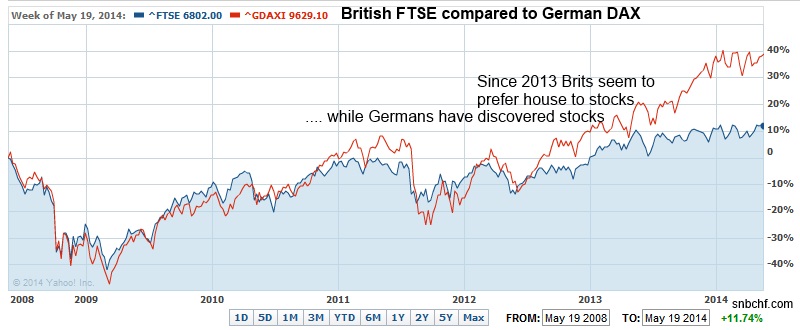

Needless to say that higher (German or Swiss) income after housing/loan expenses leaves room for higher spending or savings in other forms of assets. Brits effectively seem to prefer houses to stocks since mid 2012, while Germans have discovered stocks. Or markets think that German competitiveness is higher.1.

I might even say:

The reader may decide how long British labour remains less competitive in a global scale. During that period salaries will remain depressed and home prices will continue to rise. Continuing cheap labour immigration is undeniably a factor that will prolong depressed salaries and the resulting housing boom for some time.

Wonderful new central bank world !

Read more in our comparison of American, British, Swiss and German long term home price developments.

- The FX rate has no influence, it is nearly unchanged since mid 2012 [↩]

Tags: home prices