Update March 21, 2014:

Total SNB sight deposits increased to 367.8 bln. CHF, but flows reverted a bit. Foreign banks and “non-banks” reduced their CHF exposure at the SNB to 50.8 bln, possibly converting a part of the difference into USD. Dollars are more useful when sanctions will hurt both Russian and German firms. On the other side, sight deposits for Swiss banks increased, implying that with the Crimea crisis investors seek more safety.

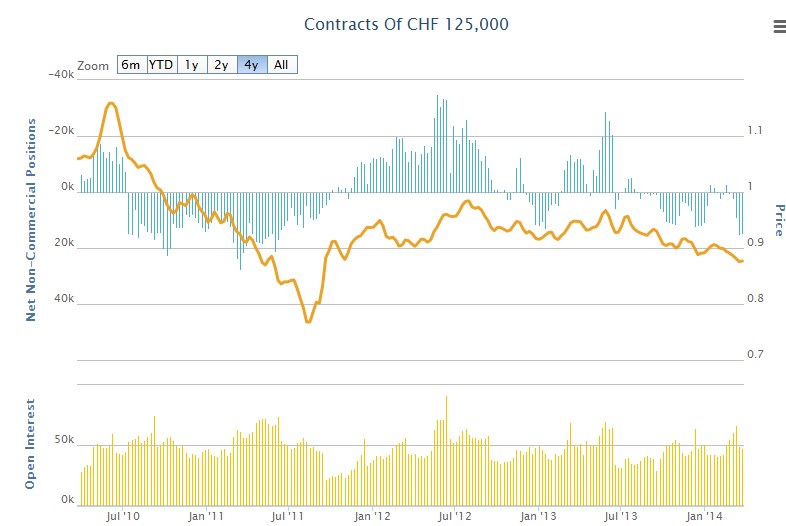

Oanda shows a pretty strong 15K contracts long CHF trader position against USD, the strongest long position since July 2011. The dollar is currently more expensive than in July 2011, with 0.89 compared to 0.83. Both speculators and long-term investors (visible in rising SNB sight deposits) are long CHF. There are far more FX speculators long the EUR against USD; therefore we think that SNB interventions on behalf of the euro are not happening, but – as explained below – on behalf of other currencies,possibly in favor of the dollar. Effectively the USD fell to 0.8750 CHF until March 27, but the euro remained pretty stable against CHF.

Update March 7, 2014:

Total sight deposits remained steady at 366.6 bln. CHF. But “other sight deposits”, the proxy for the ones of “non-banks” and foreign banks have risen again to 52 bln.

Oanda finally shows a long CHF CFTC Commitment of Traders position of 2500 contracts against USD. Since the EUR/USD long position is far higher with 25K contracts, SNB, euro interventions to secure the floor are probably not happening. The rising CHF position confirms our view that Swiss banks removed reserves in order to use them for lending or selling to foreign banks, but not that the funds were leaving Switzerland.

Update February 25, 2014:

Sight deposits have risen to 366.6 bln. CHF, of which “other sight deposits”, from 47 to 50 bln.

Once again, clients of foreign banks and of “non-banks” (for example independent financial advisors) have decided to hold more cash or securities in Swiss francs. The SNB possibly intervened; the counter currency is difficult to determine; but it is probably not the (still stable) euro. Since the start of the Emerging Markets Crisis deposits by foreign banks and “non-banks” have risen by 7 billion CHF, this should be the intervention amount.

Sight deposits of Swiss banks, however, are slightly smaller now, but this cash remains in CHF: For us it implies that Swiss banks might lend or sell their excess reserves to foreign banks. (see the BoE paper why they cannot lend them to the public).

The SNB might be trying to smooth the inflows and the FX rate by interventions. But it could be also FX speculators that do the smoothing job for the central bank: They bet against CHF based on their faith in the SNB.

Oanda shows a short CHF CFTC position against dollar of 3000 contracts, 125K each, which are $ 375 million; this certainly not enough for 7 billion CHF inflows by long-terms investors. But CFTC does certainly not reflect the whole FX market. Moreover, the CFTC data shows that the market is long EUR/USD, hence many FX traders could be long EUR/CHF.1 Global macro funds contribute to smaller volatility of the EUR/CHF; the closer it gets to 1.20, too. These funds typically reflect fundamental macro events and balance of payments data, e.g. that foreigners buy more Swiss assets or the opposite.

Update January 24th:

SNB sight deposits have risen from 363.8 two weeks ago to 365.9 bln. francs. In particular, “other sight deposits”, which contain the ones from foreign banks, are up from 43 to 47 bln. Still, compared to 2012, the changes are far smaller. Due to massive SNB interventions, total sight deposits increased by 50 bln. per month from May to July 2012.

There are two explanations:

- The SNB is doing outright currency interventions, sight deposits are (currently) the major method of financing SNB foreign currency purchases.

- Investors were seeking high quality and have deposited their funds at Swiss banks and changed them into francs. Together with continuing Swiss current account surpluses, this meant that the money at banks increased excessively. Banks decided to deposit some of this excess liquidity at the SNB. For banks it is the most secure way, as assets at central banks do not weaken their leverage ratios. Lending in foreign currency, like they starting doing in it Q2/Q3 2013, eventually removes sight deposits in CHF. However, it requires more equity because the borrowers (e.g. European banks) do not have the same rating as a central bank.

A big part of global flows into Swiss safety are absorbed by speculators that bet on a weaker franc and buy dollars instead. Those speculative positions often do not touch Switzerland and the SNB. In the week of January 17th, the CHF speculative position against the dollar turned negative again.

Therefore, we think that the SNB is not intervening against euro, but the absorption of some excess liquidity required the SNB to increase FX reserves.

- The yen market is certainly far worse: Long-term investors buy yen-denominated Nikkei, but speculators are massively short the yen, which again helps Japanese companies and the Nikkei [↩]

Tags: excess reserves,intervention,SNB sight deposits,Swiss National Bank,Switzerland Gross Domestic Product