The weekly summary of global fundamental news with focus on CHF and gold price movements.

Friday, September 13:

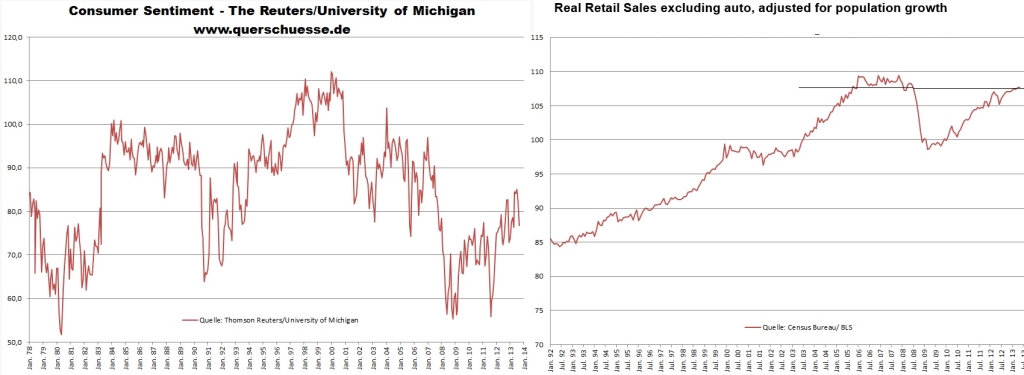

The leading news came from U.S. retail sales and the Michigan consumer sentiment. Retail sales were up +0.2% instead of 0.5% expected, sales excluding autos and gas +0.1% (vs +0.3% exp.) The Michigan consumer sentiment disappointed at 76.8 vs. 82.0 expected.

The euro could not take advantage of the weaker U.S. data because European unemployment was down -1% y/y (vs. -0.9% exp.). The Eurostat report confronts the y/y employment increases in Germany, Austria, in the UK and in the Baltics between 0.6% and 3% with jobs losses in Southern Europe between -2.2% for Italy and -6.1% for Cyprus. Due to weak Emerging Markets and sluggish car demand, export-oriented nations like the Netherlands, Finland, Slovakia or Poland shed jobs, too. DJ reports said that Obama has not made any decisions if Summers will be Fed chair. First gold continued the technical movement to 1308$, finally it recovered to 1326$. We think that fundamental U.S. data helped metals and not the news about Summers. Thanks to bad US data and despite rising stocks, the safe-havens JPY and CHF improved, while most risk-on currencies were lower against the greenback. Both SEK and NOK were hit by the fall of Swedish GDP by 0.2% against Q1. EUR/CHF fell by 0.12% to 1.2362 and USD/CHF 0.11% to 0.9296. The Swiss PPI of +0.2% m/m did not have an influence.

Thursday, September 12:

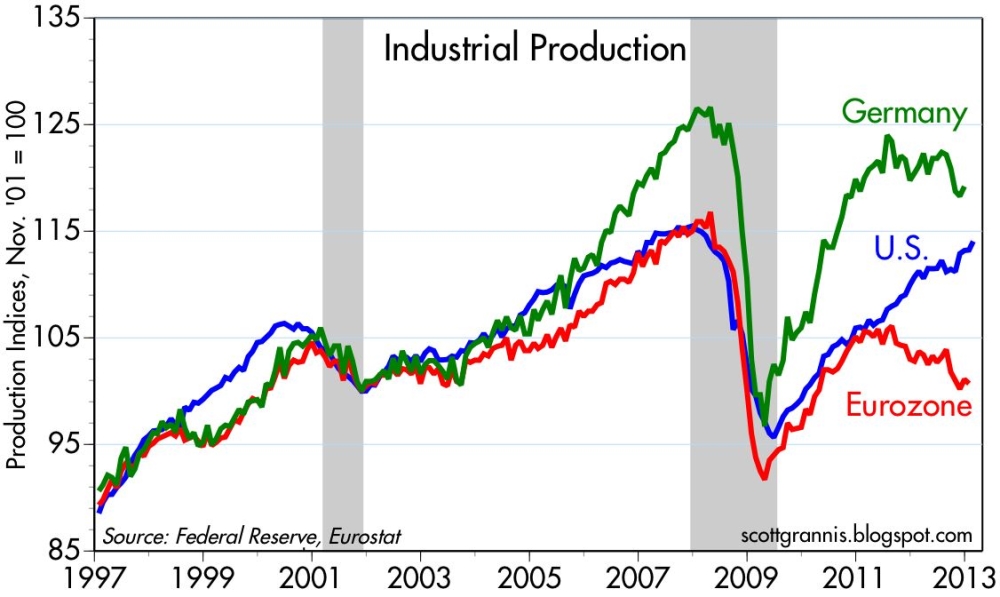

Gold and silver prices suffered a collapse. Speculations that the more hawkish Lawrence Summers could be the new Fed chairman came in only on Friday and they are therefore not responsible. We think that technical factors and future traders are more important for gold and silver prices than they are for currency valuations. The break of the 1350-1355$ support further weakened the yellow metal, it fell to 1327$ by nearly 3%. Several fundamental factors plus the absence of (recently very good) news from China triggered this development. The most important one was the strong decrease of U.S. initial unemployment claims (from 330K down to 292K). They were, however, driven by a under-reporting in two states. The second reason was the weaker industrial production in the Euro zone in July. We think that sluggish demand from China and other Emerging Markets during the PBoC tightening period in June/July dampened especially German industrial production, for us a temporary movement. The following chart shows how Germany took advantage of the strong advances of China and Emerging Markets aided by Fed Quantitative Easing between 2009 and 2011, while since 2010 the rest of the Euro zone has clearly under-performed the U.S. Given that the euro crisis. austerity and the Southern European house price collapse really started in 2010/2011, this under-performance is no wonder.

Another driver for lower gold prices was the 1960s-style proxy war between the U.S. and Russia/China called “Syrian civil war”: The Russians yesterday achieved yet another accomplishment against an American attack on Assad, when Syria vowed the chemical-weapons ban. But oil prices did not react to this, solely gold and silver depreciated. With weaker stocks the safe-havens JPY, CHF and the US dollar were the strongest, while most risk-on currencies fell, especially the Aussie after bad higher unemployment. The euro depreciated slightly against CHF, while the dollar slightly improved.

Wednesday, September 11:

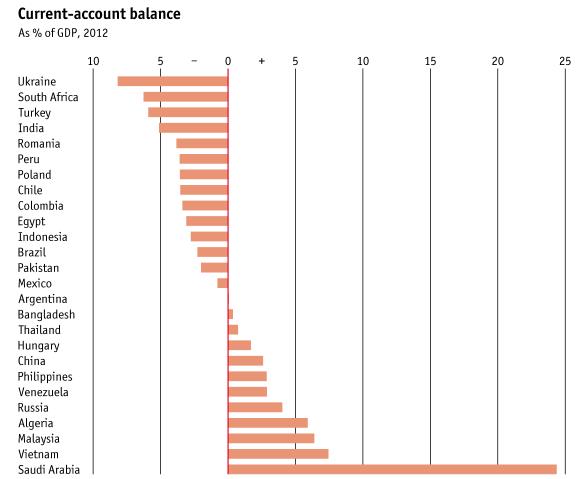

Markets decided once again that fundamentals were more important than news on Syria. Hence they reevaluated yesterday’s good Chinese data combined with the relatively high 2.4% y/y increase in Japanese producer prices (CGPI). As a consequence, the whole Asian bloc appreciated after some like JPY and CHF were “innocently hit” by the Syria news yesterday. The bearish currencies of the Asian Bloc led this time: JPY, CHF and SGD, while the risk-on currencies NZD, AUD and KRW had smaller increases against the dollar. With the Chinese recovery, we judge that RBNZ’s Wheeler will have a hard time to weaken the NZD against markets. Stocks rose again and so did the risk-on currencies of the American Bloc: BRL, MXN and CAD. With the weak US NFP numbers, the attacks against BRL seem to be over, USD/BRL has fallen from a top of 2.45 on August 21 to 2.27. The attacks against Indian INR and Indonesian IDR, however, might continue a bit longer because these two countries have far weaker current accounts and higher inflation.

Thanks to stronger Asian data, USD/CHF depreciated 0.50% to 0.9302 and EUR/CHF 0.15% to 1.2385. Gold was nearly unchanged.

Tuesday, September 10:

Once again China delivered: 10.4% y/y rise in industrial production (vs. 9.9% expected or only +8.9% on July 15th). Fixed asset investments were again on a regular yearly increase of 20.4% and retail sales were on 13.4% after the slowing in June/July. As a consequence, the carry trade continued and the risk-on currencies of the Asian bloc improved: NOK, that was additionally helped by higher than expected inflation, improved most, followed by AUD, NZD and KRW. The news that Assad accepted the Russian plan to hand over the chemical weapons to international control, sustained stocks and the greenback, but this weakened oil, gold (down 1.58% to 1365$), silver and the funding currency JPY. Thanks to cheaper oil prices USD/CHF appreciated to 0.9346 (+0.25%), even if CHF usually reacts positively to good China news. EUR/CHF even inched up to 1.2400 (+0.35%).

Monday, September 9:

Continuing the good Chinese data, 7.2% higher YoY exports (vs. 5.5% expected) raised hopes on a new global carry trade against JPY and – after Friday’s weak NFP numbers – also against the dollar. The bad US NFP, the slight miss in Japanese GDP (0.9% vs. 1.0% expected) and the weaker than expected Japanese GDP deflator of -0.5% raised hopes on more BoJ easing. This boosted the Nikkei and weakened the yen. Risk-on currencies, but also the ones with high current account surpluses (i.e. NOK, SEK, SGD, CHF and EUR), inched up against the dollar in the following order: BRL led, then NOK, SEK, SGD, MXN, EUR, CHF, AUD and NZD. Cable was close to a new 6 months high. The USD/CHF rate fell to 0.9323 (-0.53%), EUR/CHF was unchanged at 1.2357. Once again fundamentals were more important for currencies than Syria news: the carry trade of commodity and risk-on currencies ignored the collapse of oil prices after Russia proposed to hand over the Syrian chemical weapons to international control. Gold was nearly unchanged at 1386$: good Chinese data sustained the yellow metal while fewer fears about Syria weakened it.

It was proven again that Swiss data does not matter for the CHF FX rate: the franc improved despite weak Swiss retail sales (+0.8% y/y vs. 3.2% exp.) and a n unconvincing unemployment reading: 3.0% unchanged seasonally adjusted unemployment, but 8.5% more unemployed people than one year ago. On the other side, Swiss Statistics, published some weeks ago, showed that employment has risen by 1.7% y/y. Strangely both unemployment and employment were higher – the reason: continuing immigration to Switzerland.

Weekly summary:

Thanks to stronger China the Asian bloc currencies NZD, NOK and RUB were the winners. Sterling achieved new highs, while the greenback lagged. Due to rising unemployment, the Aussie could not follow its Asian bloc counterparts . Technical movements weakened gold and silver finally ended its winning long-lasting winning streak.

This post is an extract of our CHF and Gold News Bar on our home page. It explains daily CHF and gold price movements based on the most important fundamental indicators in a few sentences. Keep in mind that the only Swiss fundamental data that is able to move the CHF must come from the SNB and from Swiss inflation data – from 1% y/y CPI the SNB should remove the CHF cap. The other data is global macro: mostly US and German data, some European and Chinese/Japanese news publications determine CHF behaviour. CHF is positively correlated to good data from Germany and to some extent China and Japan. Good data from the United States lets CHF fall against both USD and EUR; it is hence negatively correlated to good US news. As for EUR/CHF, the Swissie is negatively correlated to good Southern European and French data. Understand the terms “American bloc” and “Asian bloc” (read here). As for gold prices please understand the basis here. Remember also that the currency movement over months is a combination of the daily movements explained here.

Are you the author? See more for Next postTags: American bloc,Asian bloc,FX news,Germany Industrial Production,Gold,silver,U.S. Consumer Confidence,U.S. Retail Sales