Weekly summary of fundamental news with a focus on CHF and gold price movements.

The St. Louis Fed president James Bullard explained that the Fed was close to tapering 10 bln. $ and that markets overreacted after the FOMC with their strong performance. As a consequence the S&P500 inched down by 0.6% while both gold and silver got destroyed again: the yellow metal lost 2.7% to 1332$. In the absence of major fundamental news, Fitch’s downgrade of Malta and Croatia might have weakened markets a bit. Risk-on currencies were down, led by NOK, then MXN, BRL, SEK and AUD. Both EUR and CHF depreciated slightly against USD: EUR/CHF was at 1.2316, the dollar at 0.9107. It is September, the month when USD/CHF regularly achieves new lows.

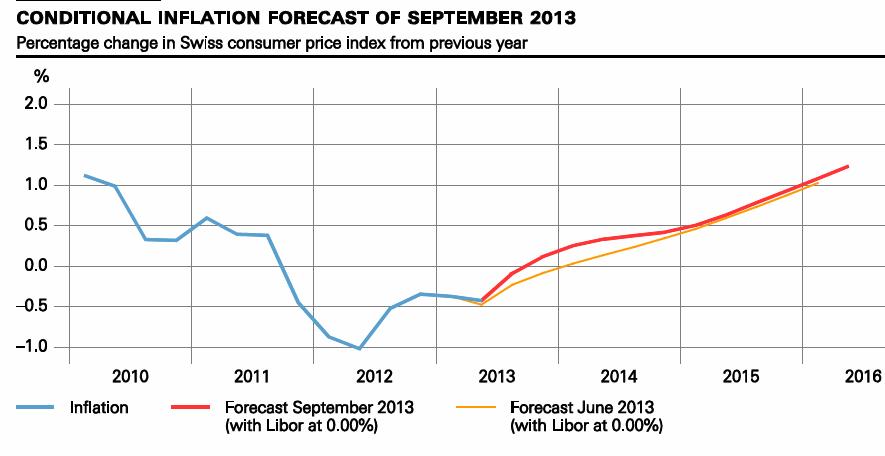

The Swiss National Bank repeated the usual messages: it maintains the CHF cap and is ready to buy foreign currency in unlimited quantities. As very often in recent years, it upgraded GDP growth expectations (by 0.5% to 1.5%-2%), and this time also inflation expectations (by around 0.2%).

After the strong fall of USD/JPY after the FOMC, markets quickly remembered that the principal funding currency is currently the yen and not the dollar. A JPY 5 trn stimulus package that includes about JPY 1.4 trn of corporate tax cuts weakened the yen additionally. After moderate, 0.6%, stock price increases yesterday, the S&P500 added another 1.2% and the yen depreciated by 1.34%. Better than expected home sales, a very good Phily Fed (22.3 vs. 10 exp., in-line with the strong ISM) and lower than expected jobless claims helped the greenback to improve. The whole Asian bloc inched down, JPY fell the most, followed by AUD, NOK, SGD and NZD. But also the American risk-on currencies BRL, MXN and CAD fell after strong gains yesterday. The SECO upgraded Swiss growth from 1.4% to 1.8% – no surprise after the 2.5% YoY increase in Q2. Maybe because of this news, or potentially due to higher expected Swiss inflation, both USD and EUR weakened by -0.12% against CHF despite good US fundamentals. Due to better US data, gold fell slightly.

After the strong fall of USD/JPY after the FOMC, markets quickly remembered that the principal funding currency is currently the yen and not the dollar. A JPY 5 trn stimulus package that includes about JPY 1.4 trn of corporate tax cuts weakened the yen additionally. After moderate, 0.6%, stock price increases yesterday, the S&P500 added another 1.2% and the yen depreciated by 1.34%. Better than expected home sales, a very good Phily Fed (22.3 vs. 10 exp., in-line with the strong ISM) and lower than expected jobless claims helped the greenback to improve. The whole Asian bloc inched down, JPY fell the most, followed by AUD, NOK, SGD and NZD. But also the American risk-on currencies BRL, MXN and CAD fell after strong gains yesterday. The SECO upgraded Swiss growth from 1.4% to 1.8% – no surprise after the 2.5% YoY increase in Q2. Maybe because of this news, or potentially due to higher expected Swiss inflation, both USD and EUR weakened by -0.12% against CHF despite good US fundamentals. Due to better US data, gold fell slightly.For about one year quantitative easing supported the U.S. housing market. With today’s decision not to taper, the dollar strongly depreciated. Markets were anticipating that money would leave the United States, which may imply that there will be less available funds for the U.S. housing market. Why, by the way, did investors put their money in U.S. housing? Simply because U.S. housing was cheap and there was no better place. Europe was doing austerity. Emerging Markets had too high wage increases, they were experiencing high inflation and their exports were hit by European austerity. Remember that the U.S. can only grow more strongly than the rest of the world and the dollar can only appreciate when oil is cheap and money is expensive – like during the 1980s when high interest rates slowed Emerging Markets and the rest of the world. But we do not live in this world any more, the leading emerging economy, China, has its own financing via current account surpluses and high central bank reserves.

Our regular pattern is achieved again: when the Fed does quantitative easing, then EUR/USD reaches a new high, but also the USD/CHF a new low, and – as usual – the EUR/CHF weakens. The dollar was down against all major currencies. USD/CHF down 1.51% to 0.9117 and EUR/CHF -0.23 to 1.2340. Gold inched up 4.7% to 1365$.

Major fundamental news came from China, once again positive data: foreign direct investments in China rose by a strong 6.37%. US core inflation rose slighly to 1.8%, while the headline figure fell to 1.5% y/y from 2.0% y/y. The main reason for this decline was that one year ago between July and August 2012 energy prices surged – after Draghi’s “whatever it takes”. Hence, energy commodities inched up 1% y/y in July 2013, but they were down -2.2% y/y in August. Eurostat data showed that in July the euro zone trade surplus increased again to 18.2 bln. euro. With better Chinese data and lower U.S. inflation, the whole Asian bloc improved, led by NZD, then AUD, SGD, CHF and NOK. A rather dovish stance of the Australian RBA could not stop the increase of the AUD; both NZD and AUD are for us mostly driven by Chinese news and the relatively high Aussie and Kiwi rates. Commodities were weaker again, led by losses in Brent oil that fell on the evidence that Assad has used sarin. Gold followed the weaker oil price and fell slightly to 1310. USD/CHF was down 0.16% to 0.9258 and EUR/CHF was nearly unchanged.

The news that the “more hawkish” Lawrence Summers dropped out of the race for the new Fed chairman, let the dollar fall against all other majors initially. The euro inched up to 1.3385 intra-day. But finally markets decided based on fundamental news. The strong 0.4% increase in U.S. industrial production and the weak European inflation of 1.3% helped the greenback to recover and finish the day positively. The NY Empire State Manufacturing Index, however, did not confirm the strong ISM index and was only slightly in expansion territory. In Europe the inversion of trade balances continued: the Norwegian surplus is shrinking and the Italian one rising. The reason is simple, Norwegians are consuming and imports are rising, while exports, especially to the euro zone, are shrinking. Italian imports, however, are falling due to austerity and exports are unchanged. The falling Norwegian trade surplus combined with dovish monetary policy are the reasons why NOK has depreciated this year. USD/CHF inched up 0.19% to 0.9270 and EUR/CHF was nearly unchanged at 1.2364. With stronger U.S. data, gold was weaker again to 1313 (-1.3%) and completely unimpressed by the Summers exit, a fact that should have strengthened gold.

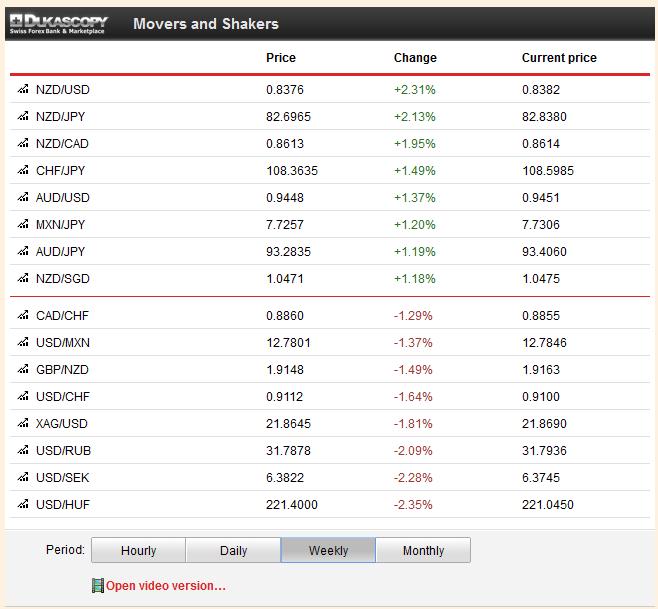

Weekly Price Movements

This post is an extract of our CHF and Gold News Bar on our home page or at this address.

It explains daily CHF and gold price movements based on the most important fundamental indicators in a few sentences. Keep in mind that the only Swiss fundamental data that is able to move the CHF must come from the SNB and from Swiss inflation data – from 1% y/y CPI the SNB should remove the CHF cap. The other data is global macro: mostly US and German data, some European and Chinese/Japanese news publications determine CHF behaviour. CHF is positively correlated to good data from Germany and to some extent China and Japan. Good data from the United States lets CHF fall against both USD and EUR; it is hence negatively correlated to good US news. As for EUR/CHF, the Swissie is negatively correlated to good Southern European and French data. Understand the terms “American bloc” and “Asian bloc” (read here). As for gold prices please understand the basis here. Remember also that the currency movement over months is a combination of the daily movements explained here.

Are you the author? Previous post See more for Next postTags: American bloc,Asian bloc,FX news,Gold,Norway,silver,Switzerland Trade Balance,U.S. Industrial Production (ZH),U.S. NY Empire State Manufacturing Index