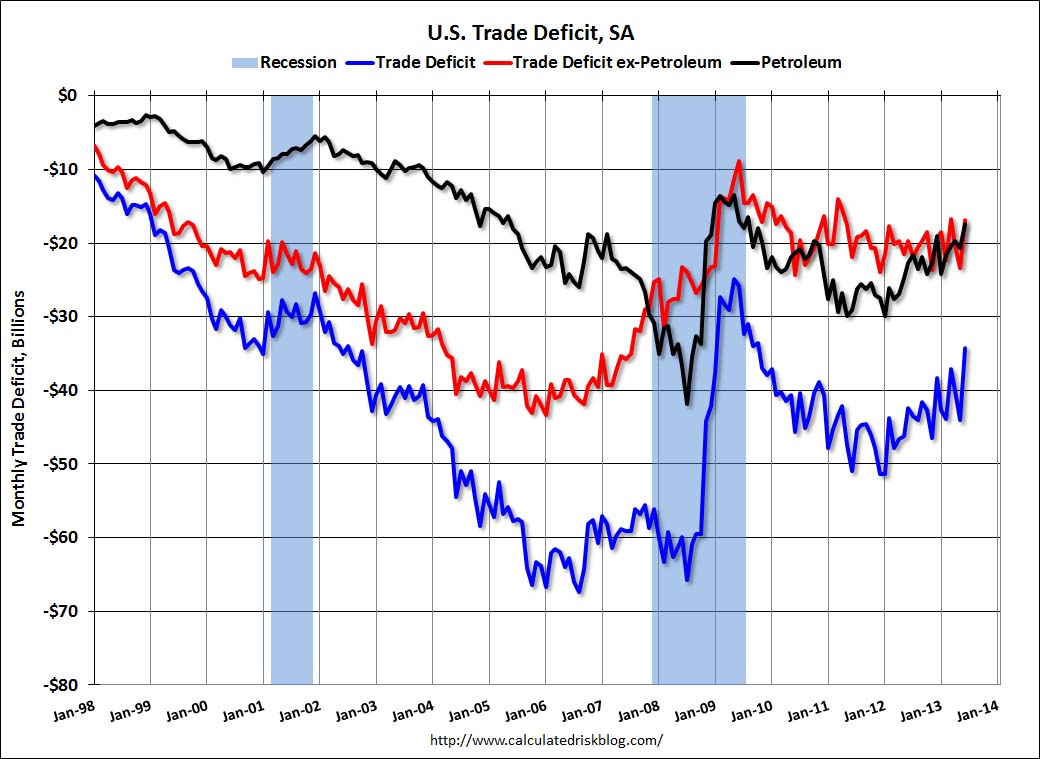

The United States trade balance has strengthened to a deficit of only -34.2 bln USD in June 2013. This is nearly half the record-high trade deficit of 62 bln. $ in August 2008 and not too far from record-lows of 26 bln. $ in July 2009, when oil was really cheap.

In the first six months of 2013 the trade deficit for petroleum has narrowed to 124 bln. US$ vs. 158 bln. in 2012, a difference of 30 bln.

Reason for us was the improvement of trade deficit with oil producer countries.

US trade deficit with oil producers narrows

The figures from January to June 2013 (compared to the same period of 2012):

- Mexico -28 bln. $ (-34)

- Canada -16 (-17)

- OPEC -33 (-57)

- Africa-10 (-20), most of them North African oil producers.

One reason was certainly the weaker oil price, especially in June, but also that consumers in oil producer countries continue spending, the total difference is 40 bln. $, 10 bln. more than the improvement in petroleum.

On the other side the trade deficit with China-147 bln. $ (-144) and Europe-60(-56) deepened, for Japan it became a bit smaller -36(-39).

Oil prices are 3.5% to 5% cheaper than in 2012.

Jan-June 2013 (vs. same period in 2012):

- average WTI crude oil 94.50 (98.15)

- average Brent oil 107.56 (113.61)

Pickensplan expects 400 bln. $ deficit due to oil imports in 2013 vs. 434 bln. $ in 2012. This would be a 10% improvement, the remaining 4 to 6 percent would be thanks to US oil production.

By July, however, crude oil became 10% more expensive, the trade balance should weaken again.

Tags: Brent Oil,OPEC,petroleum,trade deficit