About the trade-off between economic recovery and financial stability

In the recent post on gold prices, we maintained that the Fed will raise interest rates far later than most FOMC members admit. This would imply that the years of financial repression will continue and investors will push up asset prices, incl. gold, instead. Many libertarians keep on playing Kassandras and affirm that these bubbles will definitely end in another bust; this time possibly in China and other emerging markets. On the other side, Keynesian “helicopter money” theories want the Fed to continue printing money even if inflation rises to 3% and more. They want QE3 to be really unlimited.

One of the Fed’s limited numbers of hawks, Narayana Kocherlakota brings the dilemma to the point:

- If real interest rates are low, we are likely to see financial market outcomes that signify instability.

- Raising the real interest rate may reduce the risk of a financial crisis.

- Raising the real interest rate will definitely lead to lower employment and prices.

European leaders have decided to reduce current account deficits and to keep interest rates relatively high when compared to the U.S. Given Dijsselbloem’s comments on Cyprus, it seems to be clear that they primarily fight in favor of financial stability. Since it is difficult to integrate diverse opinions, often cacophony dominates, but we think that Europeans are going the right way.

To our minds, the combination of ultra-lose US policy in the form of QE3 and the emphasize on financial stability in Europe in the form of conditionality contained in ECB’s Outright Monetary Transactions (OMT) has rescued the global economy. Slower growth of China and falling oil prices have helped to reduce inflation and to increase financial stability, visible e.g. in the stock prices of Italian or Spanish banks over the last week.

In the following, Tim Duy clearly explains the dilemma – or possibly a trilemma – the Fed is confronted with in more details. (Original source)

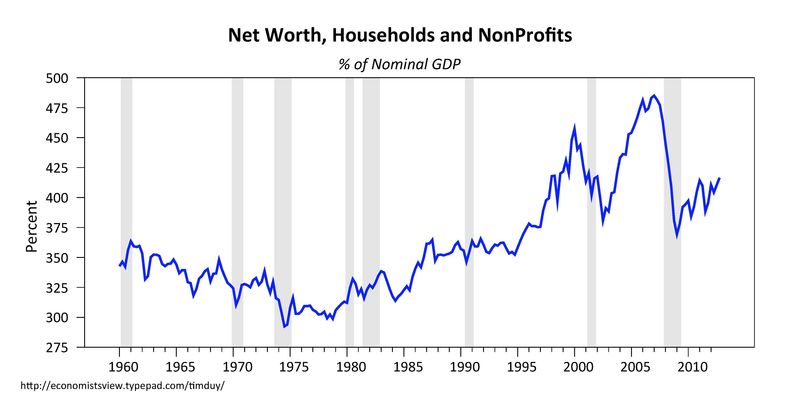

“If the objective of monetary policy is a combination of low inflation and unemployment, I think it is difficult to argue that the Federal Reserve pursued an overly loose policy stance in the periods of the internet and housing bubbles. Indeed, it is arguable that asset price bubbles were integral in fostering low unemployment.

With this in mind, consider this conclusion from Minneapolis Federal Reserve President Narayana Kocherlakota, speaking at the 22nd Annual Hyman P. Minsky conference:

In this way, unusually low real interest rates should be expected to be linked with inflated asset prices, high asset return volatility and heightened merger activity. All of these financial market outcomes are often interpreted as signifying financial market instability. And this observation brings me to a key conclusion. I’ve suggested that it is likely that, for a number of years to come, the FOMC will only achieve its dual mandate of maximum employment and price stability if it keeps real interest rates unusually low. I’ve also argued that when real interest rates are low, we are likely to see financial market outcomes that signify instability. It follows that, for a considerable period of time, the FOMC may only be to achieve its macroeconomic objectives in association with signs of instability in financial markets.

This sounds like Kocherlakota believes that it is not possible for the Federal Reserve to accomplish its dual mandate in the absence of asset bubbles, excessive credit growth, etc. This leads to issue of how should the Federal Reserve deal with such instability:

To answer this question, the Committee will need to confront an ongoing probabilistic cost-benefit calculation. On the one hand, raising the real interest rate will definitely lead to lower employment and prices. On the other hand, raising the real interest rate may reduce the risk of a financial crisis—a crisis which could give rise to a much larger fall in employment and prices. Thus, the Committee has to weigh the certainty of a costly deviation from its dual mandate objectives against the benefit of reducing the probability of an even larger deviation from those objectives.

In other words, if they raise interest rates, they will clearly deviate from their objectives, but if they don’t there is only a chance of suffering a larger deviation. So they should refrain from addressing financial instability (through raising interest rates) until it is clearly evident that it poses a significant risk to the dual mandate.

But how might one measure financial instability? A new paper by Claudio Borio, Piti Disyatat, and Mikael Juselius offers a fresh look at potential output that incorporates information about the financial cycle. Note that traditional measures of potential output focus on the inflationary consequences of level of actual output. If inflation remains contained or falling, then by definition actual output is equal to or less than potential output. Borio et al, however, note that the economy may be on an unsustainable path even when inflation remains contained. Arguably, measures of potential output should incorporate information about financial factors that might signal the economy is on such a path.

Why might be expect that we might be on a unsustainable path even under conditions of low and stable inflation? The authors summarize:

There are at least four reasons for this. One is that unusually strong financial booms are likely to coincide with positive supply side shocks (eg Drehmann et al (2012))….A second reason is that the economic expansions may themselves weaken supply constraints. Prolonged and robust expansions can induce increases in the labour supply, either through higher participation rates or, more significantly, immigration….A third reason is that financial booms are often associated with a tendency for the currency to appreciate, as domestic assets become more attractive and capital flows surge. The appreciation puts downward pressure on inflation. A fourth, under-appreciated, reason is that unsustainability may have to do more with the sectoral misallocation of resources than with overall capacity constraints. The sectors typically involved are especially sensitive to credit, such as real estate.

Thus, unsustainable financial booms can be especially treacherous, as it is all too easy to be lulled into a false sense of security. Economic activity appears deceptively robust. Financial and real developments mask the underlying financial vulnerabilities that eventually bring the expansion to an end…

The author’s estimate what they describe as “finance neutral” output gaps via an expanded version of an H-P filter. Among their findings is that applying a Taylor rule to their output gap suggests that the Federal Funds rate was set too low during much of the 2000’s, and possibly now as well. Still, the authors stop short of advocating that interest rate policy should be used to lean against financial headwinds. Tighter monetary policy might ease financial instabilities, but aggravate recovery from a balance sheet recession.

Arguably, the current environment is a case where it would be imprudent to lean against potential financial instabilities. The Federal Reserve is holding interest rates low for a protracted period and thus fueling fears they are laying the groundwork for the next financial crisis. But raising rates doesn’t seem like an appropriate option considering the economy is far from fully recovered from the recession. This speaks to Kocherlakota’s comment. And those of Federal Reserve Chairman Ben Bernanke as said in a recent speech:

One might argue that the right response to these risks is to tighten monetary policy, raising long-term interest rates with the aim of forestalling any undesirable buildup of risk. I hope my discussion this evening has convinced you that, at least in economic circumstances of the sort that prevail today, such an approach could be quite costly and might well be counterproductive from the standpoint of promoting financial stability. Long-term interest rates in the major industrial countries are low for good reason: Inflation is low and stable and, given expectations of weak growth, expected real short rates are low. Premature rate increases would carry a high risk of short-circuiting the recovery, possibly leading–ironically enough–to an even longer period of low long-term rates. Only a strong economy can deliver persistently high real returns to savers and investors, and the economies of the major industrial countries are still in the recovery phase.

Admittedly, this is frustrating. It is as if we we are faced with a tradeoff between economic recovery and financial stability. But this begs an even greater question. Why do we have to make this tradeoff? Why is maintaining full-employment dependent on destabilizing asset bubbles?

Central Banks’ new Trilemma: Between Inflation, Unemployment and Financial Stability

Commenting on this speech, Ryan Avent asks if the current dynamics are a result of the Fed’s never-ending pursuit of low inflation:

…one very clear implication…price stability is keeping nominal rates low and is therefore an impediment to financial and macroeconomic stability. One has to weigh costs and benefits, of course, but one cannot miss the trade-off: the more you worry about low rates the less low and stable inflation should look like a good thing…

…It is perhaps premature to declare the existence of a new monetary trilemma, that over the medium-term central banks can choose at most two of the following: low inflation, low unemployment, and financial stability. But if Mr Bernanke continues arguing this effectively in favour of higher inflation, we may need to ask why he isn’t pursuing it as an explicit goal.

Has the pursuit of low inflation brought us to a point where we can maintain the Fed’s dual mandate only at the presence of financial instability? That unless we allow for somewhat higher inflation, we are making a deliberate choice to follow only “inflation-neutral” measures of the output gap and ignore “finance-neutral” measures? And, importantly, might it not be the case that the costs of somewhat higher inflation are in fact less than the costs associated with the financial instabilities that seem to be part and parcel of the current low-inflation regime?

Bottom Line: If Kocherlakota is correct and monetary policy can only pursue the dual mandate in the context of financial – and, by extension – macroeconomic instability, then we really need to consider which part of the dual mandate needs to be loosened to reduce the reliance on financial instability. My fear is that if Fed policy makers were asked this question, they would unanimously answer that it is the full-employment portion of the mandate that should be jetisoned.”

Tim Duy is Professor of Economics at the University of Oregon

Tags: Asset Price Bubble,Helicopter Money,Kocherlakota,Minsky