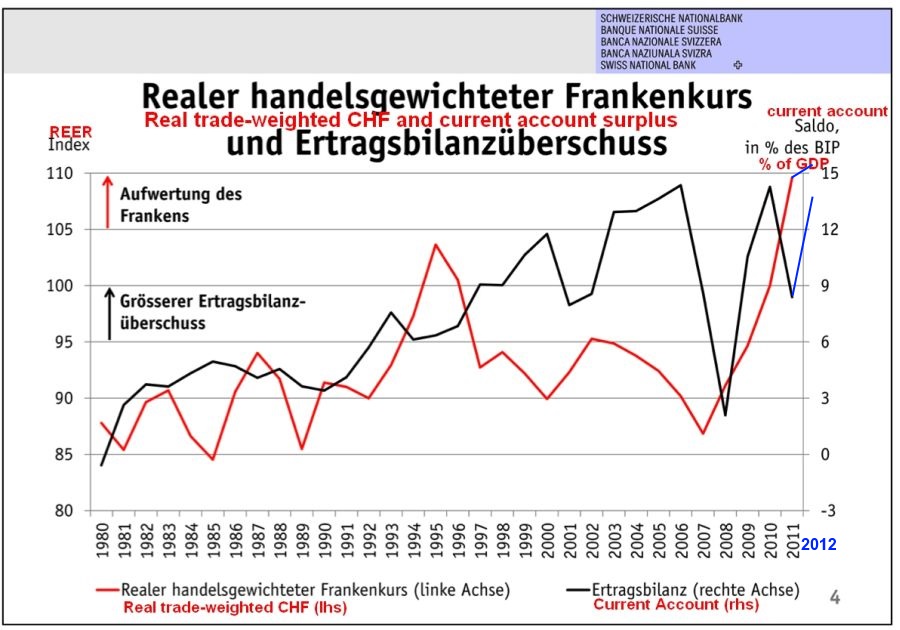

According to latest IMF data the Swiss current account surplus rose from 49 billion CHF in 2011 to 80 billion in 2012, this is from 8.5% of GDP to 13.5%.

Real effective exchange rate CHF and Current Account Switzerland 2012 (sources SNB presentation by T. Jordan , 2012 data added by author, data source SNB monthly bulletins and IMF data)

After the Swiss National Bank (SNB) stopped the appreciation of the Swiss franc in September 2011, the current account surplus managed to recover from 8.5% of GDP in 2011 to 13.5% of GDP as for 2012. In a recent speech chairman Thomas Jordan explained that the Swiss franc is a proxy for investments in the global economy and especially in emerging market. This is done via Swiss multinationals and is mirrored in the capital income component of the current account.

While until 2008 investors preferred to pile in global investments using the franc as carry trade currency, things have after changed with the financial crisis. Between 2008 and 2011 the CHFstrongly appreciated because of risk aversion and the possibility to profit on the success of Swiss firms that sell to consumers worldwide. Effectively, the Swiss capital income component rose to a profit of 48 billion francs (source).

According to the IMF data, the real effective exchange rate of the franc has risen only slightly to 111.6 (see graph above).

Thomas Jordan regularly tells the public that the EUR/CHF will appreciate will time; in reality it is the current account surplus and Swiss inflation.

Are you the author? Previous post See more for Next postTags: balance of payments,current account,Swiss economy,Thomas Jordan