Monthly Archive: January 2013

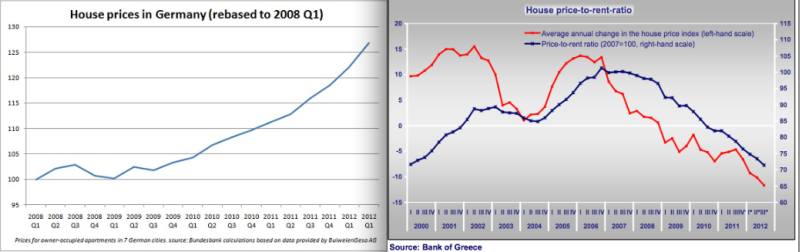

Sinn: The Euro Crisis Is Not Solved

In 2012, austerity, the commitment of ECB and Fed and the weak euro helped to reduce peripheral yields, current account and partially fiscal deficits. The euro zone has possibly won the war. Now the weak countries need to win the peace, namely generate growth via competitiveness says

Read More »

Read More »

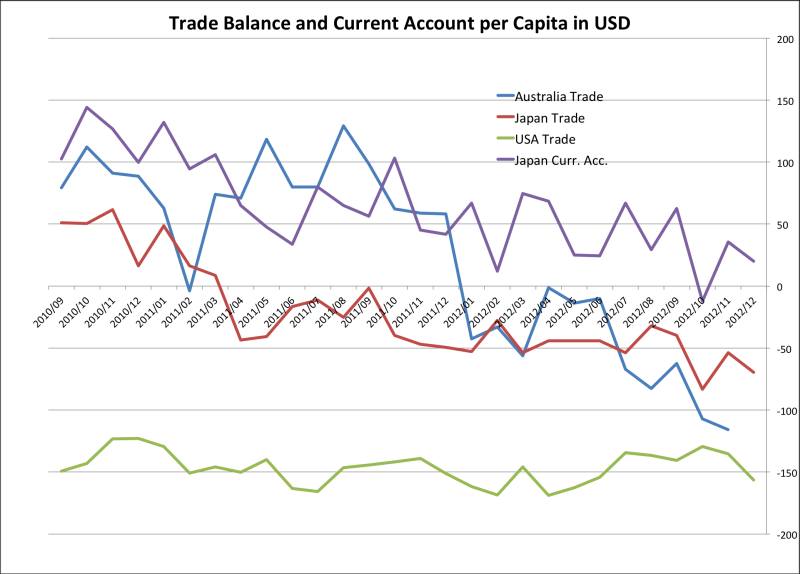

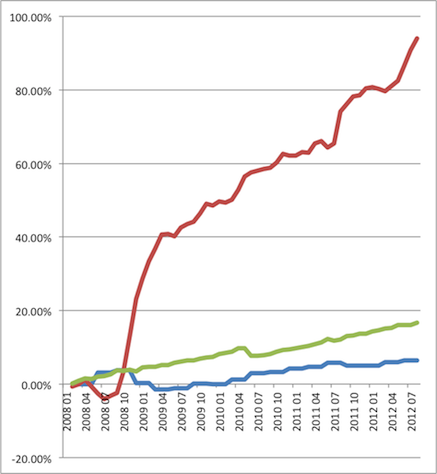

Japanese Currency Debasement, Part 1: Current Account and Japanese Bond Bears

In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Read More »

Read More »

Net Speculative Positions, Week January 28

Submitted by Mark Chandler, from marctomarkets.com It is difficult to talk about the US dollar’s performance over the past couple of weeks. There has been a key divergence. The dollar has been trading higher against most currencies except the euro and those currencies, like the Swiss franc or the Scandis, that move in the euro’s …

Read More »

Read More »

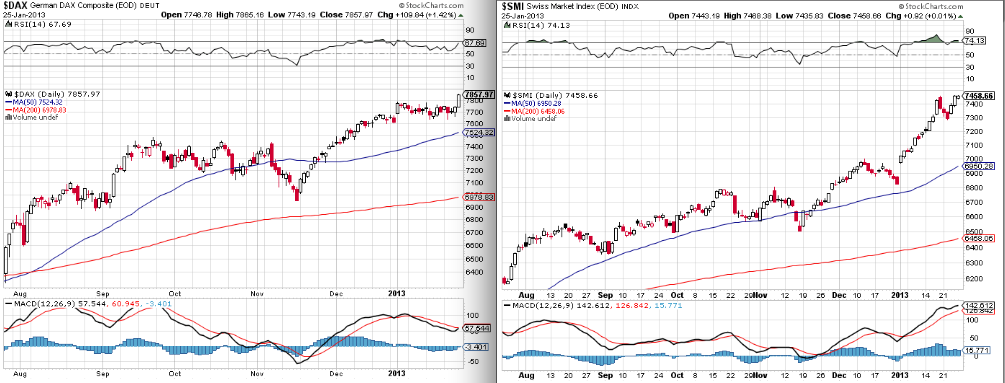

SNB Sight Deposits Rise by 100 Million CHF, Week January28

While FX traders and some hedge funds are long EUR/CHF and some short covering happened, sight deposits show a different picture. They rise again, this time with 100 million francs (see details) in one week. Risk-off investors are not convinced yet that the euro crisis is finished, while other investors keep profit of the rising SMI...

Read More »

Read More »

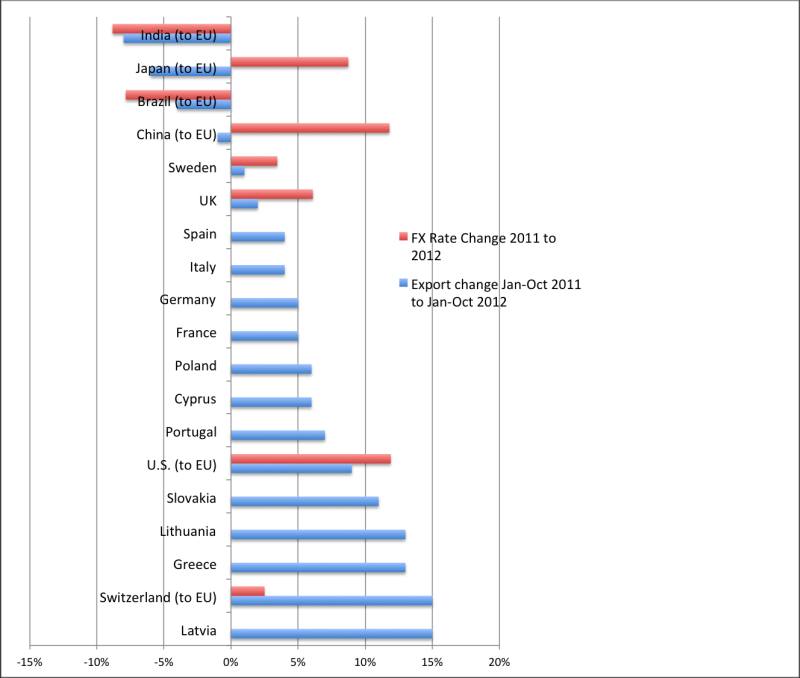

Comparing Trade Balances with FX Rates: Will the European Miracle End?

Eurostat recently published the European exports, imports and trade balance for the first ten months of 2012 compared to 2011. These show heavy improvements for the Southern member states but also a strong dependency on a weak euro.

Read More »

Read More »

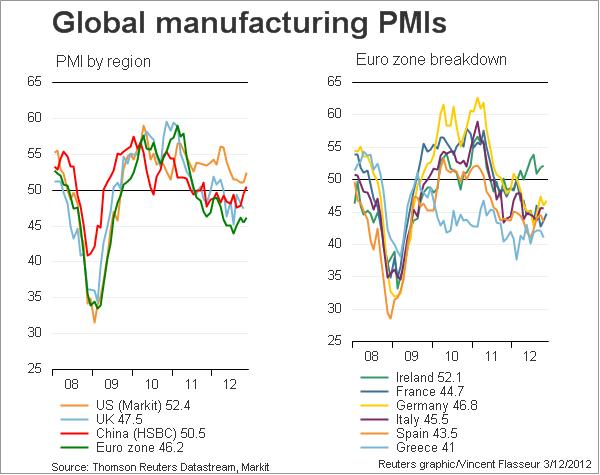

Global Purchasing Manager Indices, Update January 25

Manufacturing PMIs are considered to be the leading and most important economic indicators. After a strong slowing in summer 2012 and the Fed’s QE3, this is the fourth month of improvements in global PMIs January 25th Expansion-contraction ratio: There are 15 countries that show values above 50 and 14 with values under 50. Positive-negative-change ratio: …

Read More »

Read More »

Roubini and Deutsche Bank’s Sanjeev Sanyal: Still Waiting for the Chinese Consumer

Nouriel Roubini and Deutsche Bank’s Sanjeev Sanyal are quite pessimistic about future global and Chinese growth. They think that we need to wait a long time for the Chinese consumer that should boost global growth.

Read More »

Read More »

Deflationary Risks? Comparing Swiss, Swedish and Norwegian Inflation and Exchange Rates

When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Read More »

SNB Sight Deposits Rise by 2 Bln. Francs, M3 by 10 Bln., Week January 21

While FX traders and some hedge funds go long the EUR/CHF, sight deposits at the SNB rise by 2 bln. francs (see details) in one week, M3 by nearly 10 bln. (nearly 2%) francs in one single month (see

Read More »

Read More »

Net Speculative Positions, Week January 21

Submitted by Mark Chandler, from marctomarkets.com The technical tone of the major foreign currencies deteriorated in recent days. It appears to be a cascading effect. Favorite risk-on currencies, like the dollar-bloc, failed to participate in the move against the greenback. The Swiss franc took the dubious honor of being the weakest currency last week, losing 2.2% …

Read More »

Read More »

Pictet on the sudden EUR/CHF Appreciation

While we blamed FX traders, that were waiting months for some good European news to push down the CHF, Pictet finds some more explanations.

Read More »

Read More »

Franc-ly we’re delighted, said the SNB

Here’s the Swiss franc at its weakest level against the euro since the Swiss National Bank put its cap into place in September 2011: The euro hit SFr1.2485 on Thursday, up 3.3 per cent since the 10th of January and back to levels not seen since May 2...

Read More »

Read More »

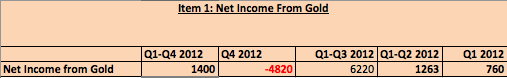

SNB Profit 6 Billion CHF over the Year, 10.9 Billion Loss in Q4/2012

The Swiss National Bank (SNB) obtained a profit of around 6 billion francs for the year 2012 (full statement). The profit was reduced from 16.9 billion francs between Q1 and Q3 2012, which means that in Q4/2012 the bank had a loss of around 10.9 billion francs. The profit in gold fell from 6.2 billion …

Read More »

Read More »

German Currency and Gold Reserves and the German Trade Surplus

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$. At the end of the 1960 and with …

Read More »

Read More »

SNB possibly Started some Sterilization, FX traders are gaming

While markets are long EUR/CHF and FX traders are playing currency games against each other, the SNB had to buy additional 1 billion CHF of reserves last week. In the first January week they possibly started...

Read More »

Read More »

Epic Shift in Monetary Policy: Japan goes SNB, Nuclear Option

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy.

Read More »

Read More »

Net Speculative Positions, Week January 14

Submitted by Mark Chandler, from marctomarkets.com There have been some large moves in the foreign exchange market in recent days. The euro posted its largest rally in four months last week. The yen has fallen to its lowest level against the dollar since June 2010 and extended the declining streak to nine consecutive weeks, something …

Read More »

Read More »

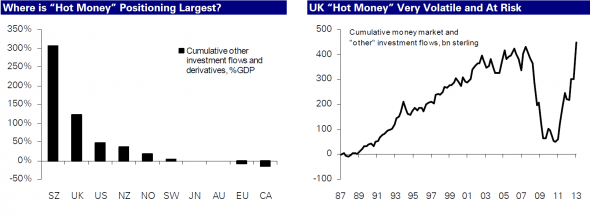

The wonders of the FX universe

Dark matter may more commonly be associated with physics, space exploration and Professor Brian Cox, but, according to Deutsche Bank’s FX strategist George Saravelos, there’s a good chance that it’s becoming a recognisable force in the world of forei...

Read More »

Read More »