Submitted by Mark Chandler, from marctomarkets.com

The US Dollar Index reached its best level in more than six weeks on Friday. Yet it managed to only close a couple of ticks higher, as if warning short-term participants against ideas that a breakout is at hand. This also appears to be the message of the yen’s dramatic recovery from four-month lows.

Caught between what appears to be renewed deterioration of conditions in the euro area and US electoral and fiscal uncertainties, investors are paralyzed. Key events this week include policy meetings by the Japanese and Norwegian central banks, the new month PMI readings, and the US jobs and auto sales reports.

The economic data is unlikely to tell investors anything new. The euro zone economy is experiencing a shallow contraction for the second consecutive quarter. The UK data is likely to lend to our view that Q3 growth exaggerates the strength of the underlying economy. Meanwhile the US should continue to post modest net job creation. The Bloomberg consensus call for 125k rise in non-farm payrolls, which would be smack in the middle of the 3-month average (145k) and 6-month average (104k).

The auto sector, from production to sales to financing, has been an important part of the US recovery (and capital market segments, like asset-backed securities). US auto sales are expected to continue to be running near 3 1/2 year highs.

The Norges Bank meeting on Wednesday is unlikely to produce a change in policy, but like the recent central bank meetings in the US, Sweden, New Zealand and Canada, it may signal a rate hike a bit further off than previously indicated.

Attention is more directed at the Bank of Japan meeting. Speculation on additional action has mounted over the past couple of weeks. This is one of the key factors often cited for the yen’s decline. However, low interest rates and QE have hardly been a powerful explanatory factor or predictive variable. It is not clear what another JPY10 trillion, the rumored increased of the BOJ assets purchases (QE), will accomplish what the JPY80 before it has not been able to do.

Other speculation has it that the BOJ will demonstrate its commitment to end deflation by calling 1% inflation not its target but its goal. Ironically, although there is often talk about the US (and/or Europe) going down the same financial path as Japan, Japanese policy makers may take a look at the US debate on targeting nominal GDP. This might be more effective than changing labels.

Yen futures were actively sold in the latest reporting period, with the net position swinging to the short side for the first time in four months. Longs bailed and new shorts were established Many commentators have also been swayed by the price action. We are less sanguine and suspect the market is vulnerable to “sell rumor and buy the fact” type of yen trading.

The net Swiss franc position switched to longs for the first time in eleven months. However, this was not a function of a bullish franc view. The real reason for the switch was the closing out of some short franc positions.

Euro:

The near-term range appears to be $1.2880-$1.3030 within the larger $1.28-$1.32 broader range. The pattern by which the euro moves in the opposite direction on Monday from Friday is now nearly two months old. If the pattern is to remain intact, the euro would have to rise on Monday

.

Yen:

The dollar posted a potential key reversal on Friday, having traded at new (four-month) highs for the move against the yen before taking out and closing below the previous day’s low. Follow through dollar selling on Monday would confirm the pattern. However, we suspect the dollar to be sticky with initial support near JPY79.45 and then JPY79.15. A break of this latter level would likely be understood as confirmation that the JPY80 level has been rejected. Late yen shorts seem vulnerable and may help explain its recovery at the end of last week.

Sterling:

After turning lower from down trend drawn off Sept and mid-Oct higher, sterling found better footing after the stronger than expected initial Q3 GDP report and growing skepticism over the extension of the gilt purchases program, which is set be completed shortly. The trend line comes in near $1.6120 on Monday. A convincing break could signal a retest on the year’s high just above $1.6300.

Swiss franc:

As noted here last week, the 50- and 200-day moving averages are crossing in the major European currencies. Sterling’s 50-day moving average crossed above the 200-day moving average last month and the euro’s averages crossed before the weekend. The averages are poised to cross in the franc in the coming sessions. We recognize this as the ideals sequence: sterling leads the euro and the franc confirms it. However, we are intentionally playing the bullish implications of the so-called Golden Cross because we think it is a function of the one-off portfolio adjustments following the successful reduction of the extreme tail risk in Europe.

Canadian dollar:

The market initially focused on the Bank of Canada’s reiteration of its assessment that monetary accommodation would have to be removed at some juncture and this spurred a further advance in the Canadian dollar. However, participants quickly realized, and the point was driven home in the monetary policy statement the following day, that such a move is not imminent. In fact, it appears that the BoC pushed it out further. We continue to look for the US dollar to test the CAD1.0040 area. Support is seen just below CAD0.9900.

Australian dollar:

Second thoughts on whether the Reserve Bank of Australia will deliver back-to back rate cuts encouraged bottom pickers in the Aussie. We have argued that Australia’s reserve growth reflects official dissatisfaction with the level of the Australian dollar. Another rate cut would still leave Australia with the highest nominal rates in the G7 and relatively high real rates. The $1.04 area may pose a formidable challenge. Key support is seen near $1.0260.

Mexican peso:

Before the weekend, the dollar reached its best level against the peso since September 11. However, once again good peso bids emerged on the pullback. The relatively high yield the peso pays (and hawkish talk by the central bank) gives the bulls greater ability to withstand the relatively small slippage in the spot peso. We look for the dollar to surrender its recent gains and return to the lower end of its recent range, which comes in around MXN12.75-MXN12.80.

| week ending Oct 26 | Commitment of Traders | |||||

| (speculative position in ‘000s of contracts) | ||||||

| Net | Prior Week | Gross Long | Change Gross Long | Gross Short | Change Gross Short | |

| Euro | -55.2 | -53.5 | 38.2 | -3.9 | 93.4 | -2.1 |

| Yen | -18.2 | 10.1 | 25.6 | -17.2 | 43.7 | 11.1 |

| Sterling | 18.4 | 19.6 | 54.9 | 0.9 | 36.5 | 2.1 |

| Swiss franc | 2.4 | -1.2 | 10.8 | 0.5 | 8.4 | -3.1 |

| C$ | 89.1 | 93.8 | 98.6 | -7.8 | 9.5 | -3.1 |

| A$ | 45.7 | 38.4 | 83.6 | 5.8 | 38.0 | -1.4 |

| Mexican Peso | 132.0 | 135.0 | 13.7 | -3.1 | 4.3 | -0.1 |

| Gross long euro positions are 30% below end of September peak. |

| First net short yen position since June. Largest gross short since May. |

| Gross sterling positions were little changed. |

| First net long franc position since Nov ’11. |

| Smallest gross short Canadian dollar position since June ’11. |

| First increase in gross longs Australian dollar positions in a month. |

| Fourth week with little change in net and gross peso positions. |

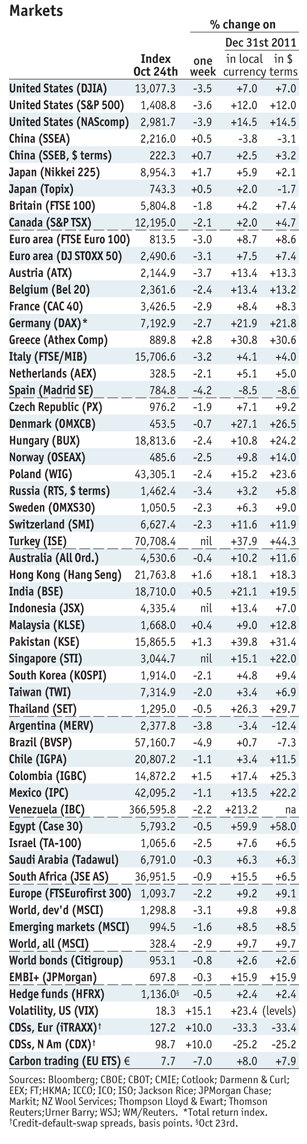

Global Stock Markets (by George Dorgan):

Global Stock Markets (by George Dorgan):

- The last week was in general negative for stocks, especially for the US, where the strong dollar drags. Thanks to continued negative central bank interest rates, Denmark’s OMX still occupies the first place for stock markets with +28.9% for developed markets, if we exclude the Greek Athex. In the last week the OMX advantage in US$ terms against the German DAX (+21.9%) on the second and the NASDAQ on the third position (+14.5%) increased.

- The Greek Athex index could break into this phalanx with another weekly increase of 2.8% and a total $ gain of 30% this year.

- Contrarians like we continue to buy Chinese and Japanese stocks. Two weeks ago we maintained that they seemed to be strongly undervalued.The US, Britain and Canada saw moderate losses last week.In the euro area, the spanish IBEX and the italian FTSE/MIB could not follow the strong Greek weekly performance and lost ground.

- Eastern Europe showed a bit better weekly performance than the periphery, their indices are very positive over the year. The Swiss SMI has achieved 11.6% return in CHF and 11.9% in USD terms.

- Emerging Asian markets showed mixed performance last week, after Turkey, Thailand, Pakistan and Singapore have risen over 20% this year in $ terms. In Latin America, Brazil and Argentina’s markets saw again strong losses. The investors’ hope is on Mexico and Columbia, because they offer higher rates and are more closely connected to the recovery in the United States.

- Stocks in developed economies continue to outpace emerging markets, but the difference is now only 1.3% return in $ terms instead of 3% last week.

More related posts directly from Marc’s website:,

Tags: Bank of Canada,Canadian Dollar,Commitments of Traders,COT,Currency Positioning,Dollar Index,FX Positioning,Hawk,Japanese yen,Marc Chandler,MXP,Net Position,Non-Farm,Peso,Speculative Positions,U.S. Nonfarm Payrolls