Submitted by Mark Chandler, from marctomarkets.com

Moreover, there is great uncertainty over the implications for the dollar if the US does go over the fiscal cliff. Would the consequences lead to a dramatic risk-off trade (benefiting the dollar and yen), while those currencies and countries most sensitive to world growth (like the dollar-bloc and emerging markets) suffer? In a risk-off phase, European currencies typically perform poorly. If the fiscal cliff is somehow averted, minimized or postponed, could risk-on trades, which have typically undermined the dollar, return to favor? The other key driver in the foreign exchange market is Europe. The rally in Greek bonds on the back of strong signals that it will receive another tranche of aid so it can service it’s primarily official sector creditors, is indicative of the reduced tail risks of a Grexit that many had thought was inevitable and imminent at various points in the past six months. We are impressed with the success European officials have had essentially talking the market away from the edge of the abyss without spending a single penny. However, as the recent acrimonious and seemingly unproductive EU summit indicates, many hard decisions have yet be made and the divide between the creditors and debtors remains as stark as ever. The fiscal cliff/debt ceiling issue in the US will be resolved one way or the other in late Q4 or early Q1. The time frame of Europe’s challenges do not appear as constrained. Closure there remains considerably more elusive. We continue to believe the contradiction between relatively low implied volatility and the high degree of uncertainty and the numerous risk events on the horizon will be resolved with higher volatility. Euro: For the last several weeks, since early September, which ever direction the euro moves on Friday, it moves in the opposite direction on the following Monday (on a NY close to close basis) Although participants ought not put much stock in these short-term patterns, they are suggestive and cautions against looking for much follow through on Monday. The euro did accelerate through the down trend, cited last week, drawn off the mid-September and early October highs, only to falter in the second half of the week. Resistance is seen in the $1.3140-70 band. Initial support is seen in the $1.2980-$1.3000 area.Yen:

Sterling:

Swiss franc:

Canadian dollar:

Australian dollar:

Mexican peso:

week ending Oct 16

Commitment of Traders

(speculative position in thousand of contracts)

Net

Net(Prior Week)

Gross Long

Change of Gross Long

Gross Short

Change of Gross Short

Euro

-53.5

-72.6

42.0

2.1

95.5

-17.0

Yen

10.1

12.9

42.8

2.0

32.7

4.8

Sterling

19.6

22.6

54.0

-0.2

34.4

2.8

Swiss franc

-1.2

-0.3

10.3

-1.4

11.5

-0.5

C$

93.8

95.6

106.4

0.7

12.6

1.9

A$

38.4

39.8

77.8

-0.7

39.4

0.6

Mexican peso

135.0

136.0

139.8

0.4

4.3

1.3

| **Short covering in the euro continues to dominate position adjustment, producing the smallest gross short since Nov ’11. |

| **The net long yen position is the smallest nearly 3 months. |

| **New sterling shorts entered, but old longs were reluctant to capitulate, though some did later. |

| **Shifts in the franc‘s positioning reflect the pace that both long and shorts are exiting. |

| **Gross long Canadian dollar position rose first time in four weeks, even if marginally. |

| **Smallest net long Australian dollar position since late July. |

| **For three consecutive weeks there has been practically no change in net long peso position. |

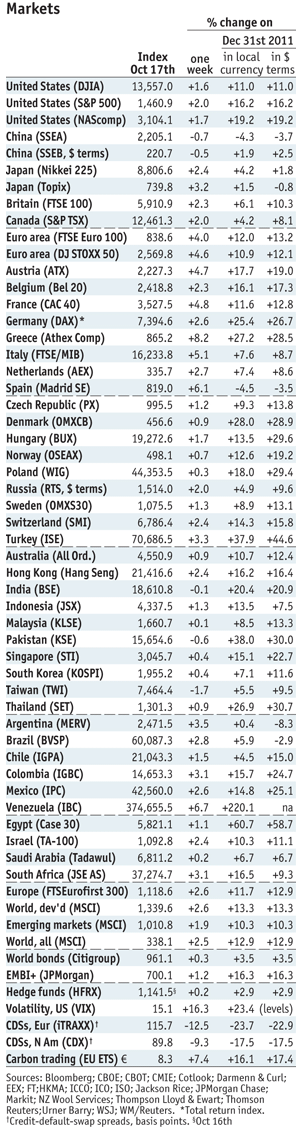

Global Stock Markets (by George Dorgan):

- Until the bigger contraction in prices last Friday, which are are part of our data, the last week was positive for stocks. Thanks to continued negative central bank interest rates, Denmark’s OMX still occupies the first place for stock markets with +28.9%. In the last week its advantage in $ terms against the German DAX (+26.7%) on the second and the NASDAQ on the third position (+19.2%) for this year.

- The Greek Athex index could break into this phalanx with a weekly increase of 8.2% and a total $ gain of 28.5% this year. Good European economic data, that Germany will probably allow for the third Greek tranche and recent Greek debt buy back speculations have given further enhancements.

- Chinese stocks continued its bad year performance also last week. Japanese ones finally showed some gains. Last week we maintained that they seemed to be strongly undervalued.The US, Britain and Canada saw moderate losses last week.In the euro area, the spanish IBEX and the italian FTSE/MIB followed the strong Greek weekly performance, but the IBEX is still negative for this year.

- Eastern Europe showed a bit weaker weekly performance than the periphery, but is still positive and very positive over the year. Poland’s WIG has appreciated even more than the OMX and the Athex, it has risen by 29.1% in $ terms. The Swiss SMI has achieved 14.3% return in CHF and 15.8% in USD terms.

- Emerging Asian markets showed mixed performance last week, even if Turkey, Thailand, Pakistan and Singapore have risen over 20% this year.In Latin America, Brazil and Argentina’s markets saw some strong gain after the losses this year. The investors’ hope is on Mexico and Columbia, because they offer higher rates and are more closely connected to the recovery in the United States.

- Stocks in developed economies continue to outpace emerging markets, the difference is 3% return in $ terms instead of 2.1% last week.

More related posts directly from Marc’s website:,

Tags: Bank of Canada,Canadian Dollar,Commitments of Traders,COT,Currency Positioning,FX Positioning,Hawk,Japanese yen,Marc Chandler,MXN,Net Position,Peso,Speculative Positions,Swiss National Bank