Nomura Touts EUR/CHF Longs

Strategists there advise going long around the current levels, they say the floor will not break. They target 1.24.

I have to agree. To me, it’s a question of buying low or buying a bit lower.

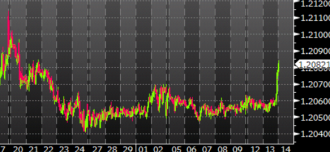

EUR/CHF Touches One-Month Low

- Bounced off 1.2040

It’s been edging lower since the spike to 1.2145 mid-month. I don’t see any need to rush in and buy until around or below the January high at 1.2031. A break of 0.9000 in USD/CHF could spark selling (spot at 0.9017).

HSBC Says CHF Rally Not Caused By Inflows

HSBC says last year’s rally in the Swiss franc was not caused by an inflow of safety-seeking investors but rather by a stop in the outflow of Swiss-based investors who no longer saw opportunities in Europe.

“If the story regarding euro-zone break-up fears were true, we should have seen a big inflow on the portfolio accounts by foreigners. That is foreigners rushing into Swiss franc assets. However, in the third quarter of 2011 net portfolio investment saw an outflow of CHF10 billion,” HSBC said Monday in a note to clients.

The looked at Switzerland’s balance of payments system.

I’m skeptical but there is no denying the unwillingness of well-heeled investors to take any risk over the past several years (as we see in the Treasury market). EUR/CHF at 1.2049.

EUR/CHF: Fails To Hang On To Gains

The bulls, and there are plenty of them, were happy yesterday when EUR/CHF got back up to 1.2130 and they were no doubt dreaming of a big payday but any market that is sitting long to such an extent, will struggle to maintain those gains for any length of time. Nevertheless, the SNB is still expected to be on the bid at 1.2025, at the latest, and they may even show up a bit sooner than that. Real money offers near 1.2150 continue to provide the topside cap. The stop-loss sell orders below 1.1995 are said to exceed EUR25 billion.

Citi Says EUR/CHF Could Reach 1.25 Without SNB

An analyst at Citigroup is out with a note saying EUR/CHF could rise to 1.25 in the next few months due to interest rate differentials and surprisingly strong European economy. They say a USD rally will spur a more aggressive sell off in CHF than EUR.

Real Money Buying EUR/CHF

They were seen buying into the dip after the SNB announced no change, but vowed to defend the peg.

We’ve just bounced back up to 1.2114 after a a dip to 1.2085

Swiss National Bank Will Enforce Cap On Franc Of 1.2000

No change in peg then, shock horror!!

EUR/CHF slips below 1.2100, presently at 1.2090.

- Prepared to buy fx in unlimited quantities

SNB 3-month libor band 0.0%-0.25%, unchanged and as expected

- Will keep money market liquidity extraordinarily high

- No risk of inflation in Switzerland

- SNB does not see inflation approaching 2% price stability threshold for entire forecast horizon

- Ready to take further measures at any time if the economic outlook, risk of deflation so require

Swiss National Bank Rate Decision Looms

At 08:30 GMT.

Strong consensus no change in policy will be the outcome.

Rumours circulating yesterday of a change in the 1.2000 peg seem to me to be just so much wishful thinking.

Don’t get me wrong, I’d love to see them hike the darn thing. Then I could give numbnuts over the pond some serious earache

EUR/CHF relatively steady at 1.2115.

I’m A EUR/CHF Bull But…

I’m taking profits on EUR/CHF longs here.

The SNB can come out tomorrow and say just about anything but unless they hike the peg, it’s hard to see this pair going higher. The market is so long that any upside move will be overwhelmed by profit taking.

For me, the trade is to buy at 1.2030/40, sell at 1.2100/20 and repeat. Spot is at 1.2135.

USD/CHF is getting squeezed, up to 0.9322 as stops above 0.9300 gave way.

EUR/CHF Continues To Make Headway

The broad risk trade is hitting CHF and it looks as though some major flows are driving this pair up. We hear from the SNB on Thursday but there is nothing on the calendar beforehand.

EUR/CHF Nudged Out Of Its Slumber

The 15-pip rally since the FOMC decision has been enough to send the pair to the highest since Feb 22. USD/CHF buying is driving the news as risk appetite soars.

With Europe closed for the day, it’s difficult to chase this move but it will be something to watch if we can hold above 1.2069 until London comes online.

Time To Square Up And Get Ready For A Nice Relaxing Weekend

I’ve taken my 32 pip loss in the EUR/JPY and after also squaring up my AUD/USD shorts yesterday, that means I can have a relatively stress free Friday night and Monday morning. I’ve still got my bottom drawer GBP/AUD longs, but thats more of a set and forget trade (and hope the carry doesn’t kill me ).

As on every Friday I will once again ask all those EUR/CHF longs out there, is it worth being long over the weekend with EUR25 billion worth of stops below 1.2000?

SNB Spent About 17.8 Bln Swiss Francs In 2011 For Intervention

- FX purchases with Swiss, international counterparties

- Purchases were made to ‘combat massive overvaluation’

Bloomberg reporting.

Tags: balance of payments,FOMC,Swiss National Bank,Switzerland