Update September 2014:

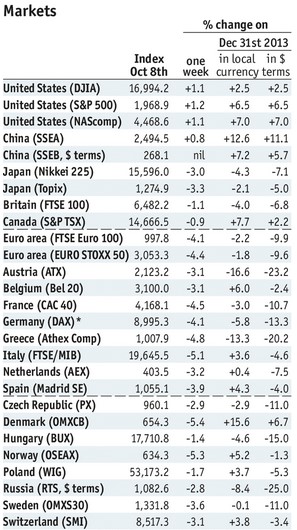

The Italian stock market index was one of the best European performers in 2014: While the German DAX was negative by 6%, the Italian FTSE MIB rose by 3.6%. What we were hoping in 2013, has become reality: Italy has joined the deflation club. CPI Y/Y is finally negative. Costs for companies, as measured with producer price and import price index are falling, wages are slightly up. Together with an increasing trade surplus, this means rising real income for both entrepreneurs and wage earners. Still we would like to see falling wages. On the other side, Italian home prices have fallen by 4.6% y/y, this tells us that deflation has only started. Deflation and disinflation should fortunately continue for years and make Italian labor competitive again.

Stock Markets Performance 2014 Source The Economist

In principal, there are two standard ways out of a recession. The United States prefers the way of higher spending (Keynes’ law), enhanced by expansionary monetary policy, which pushes up home prices. This feeling of being wealthy leads to a reduction of households’ and company’s savings rate and therewith to more spending and to more employment. However, at the end, rising wages lead to inflation and less competitiveness.

The second way is to increase savings and achieve higher exports. This was the path Germany took when it was still called “Europe’s sick man”. Strongly incited by European leaders, Italy seems to be going this way and increase competitiveness first.

However, the German success story went against Say’s law: namely, to increase both savings and investments. Germans increased savings but many German investments were outside of Germany. German companies have built global supply chains from Eastern Europe to China.

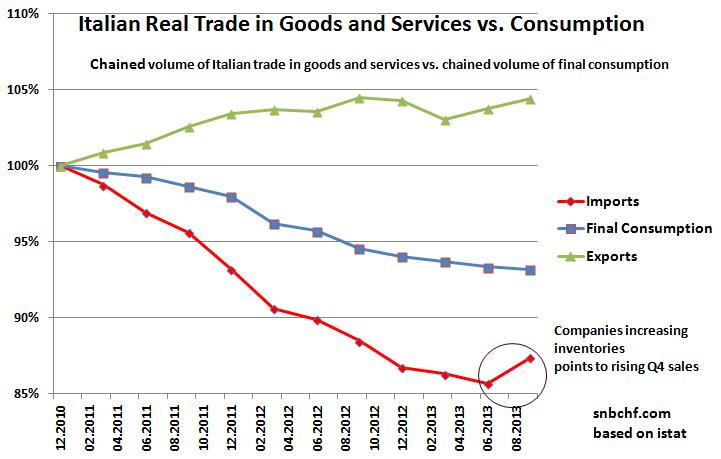

The following data is from 2013, we will provide an update for data until Q3/2014. The tendency for 2014, remains the same, final consumption is weak, but the gap between exports and imports, the trade surplus is rising.

Years of unsustainable growth

Between 2002 and 2008, France and Southern Europe lived a period of unsustainable growth, similar to the UK; the must-read by Harvard Professor Simon Wren-Lewis:

Organisations like the OECD and IMF now calculate that in 2007 output gaps were large and positive. The latest OECD Economic Outlook gives 3.3% for the OECD area as a whole, 3.5% for the Euro area, 2.9% for the US and 4.4% for the UK. That is not what these organisations were saying at the time. In the June 2008 Economic Outlook, the equivalent numbers were 0.4%, 0.0%, 0.4% and 0.2%.

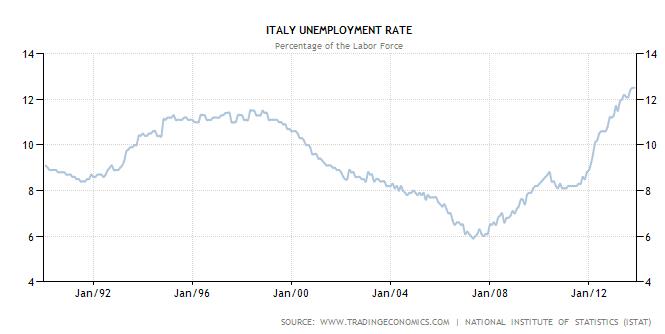

Many Italians still view their country quite negatively. Sure, GDP strongly correlates to the negative trend in consumption depicted above. Unemployment has returned to pre-euro levels.

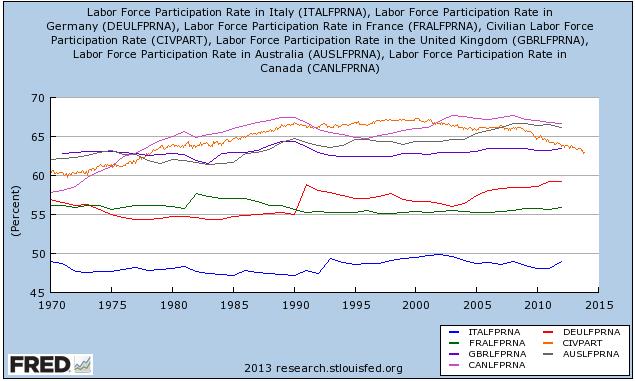

Interestingly labor participation rates in Italy and other European nations are rising despite increasing unemployment.

Due to cultural issues, Italy has always had a weak labor participation rate of under 50%, but recently it has ticked up . The U.S. participation rate has fallen from 68% in times of unsustainable U.S. growth in the year 2000 to 62-63% recently. (Suggested reading on unsustainable growth: “Greenspan is still trying to justify his bad decisions” by Nobel Prize Winner Robert Solow.)

Structural reforms versus cutting labor costs

Many emphasized that Italy needs structural reforms, one important reading is former ECB Smaghi’s Austerity and Stupidity. The Economist claims that reforms have not been done yet.

The rising participation rate above, is an indicator that the period of “Italian stupidity”, in particular the low participation of Italian women, is slowly finishing.

We suggest that European leaders have succeeded in some important improvements:

- An increased savings rate.

- Current account surpluses in Italy and (nearly) in Spain.

- The most important, however, is cutting labor costs. In Spain this “wage moderation” is effectively structural reforms, read more.

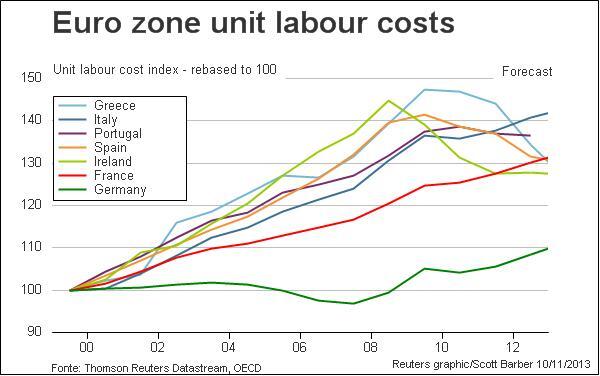

With increased labor supply from the former communist part, Germany started cutting labor costs relative to the rest of the world in the early 2000s. Consequently Germany remained competitive against the rising Chinese and Asians. By 2013, Italy and France are the only European weak member states that have not yet cut wages and labor costs.

Italian contractual wages are up 1.4% YoY. Despite continuous increases in wages, Italian companies have managed to reduce producer prices by 2.7% YoY, while countries like Spain (despite falling wages) or France were less successful.

Italian companies seem to successfully hide their competitiveness.

Let’s hope that Italy finally joins the European deflation club, this would make Italian companies (even) more competitive in a global context and it could reduce unemployment. Unfortunately, Italian workers have bad habits: the remains of the “scala mobile”, the automatic upwards wage adjustments to inflation, are still felt today.

Similar to what Germans did during the last decade, Italian companies might prefer to invest abroad. Future sales are in the Emerging Markets. Producing there is cheaper than in Italy. Evidently, Europeans are leading in foreign direct investments (FDI) in China. They are up 17% for this year. Since 2007, Italian companies have been investing more abroad than foreigners in Italy. FDI outflows are continuously higher than FDI inflows.

Read also:

How Fed and ECB Applied Keynes’ and Say’s Law at the Same Time

See more for