In the first part we described the main three drivers of bond yields which are inflation expectations, wealth and central banks.

- Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the development of wages and unit labor costs; this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag.

- Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically increased by high savings.

- Regular and irregular influences on bond yields by central banks

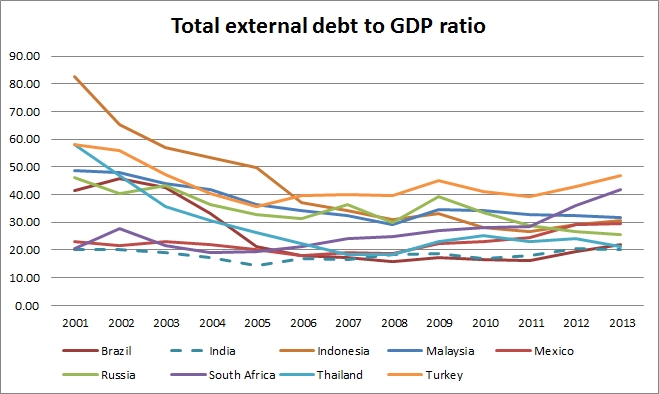

In advanced economies, the difference between wage increases and ULC movements is typically small. This is different in Emerging Markets (EM). Capital per capital is still insufficient compared to advanced economies. Thanks to the Cobb-Douglas, however, an increase capital has a higher effectiveness. By consequence wages often increase far more rapidly than Unit Labor Costs, resulting in real wage growth.

This implies that capital is essential for the often investment-driven growth in EM. If a country has relatively low wealth or a weak savings rate then foreigners must help with the needed capital formation. They with the purchase of bonds and the following factors 4 and 5 become relevant. Those are important, in particular for emerging markets and poorer nations.

Criterion 4: High (foreign) debt slows GDP growth and increases government bond yields

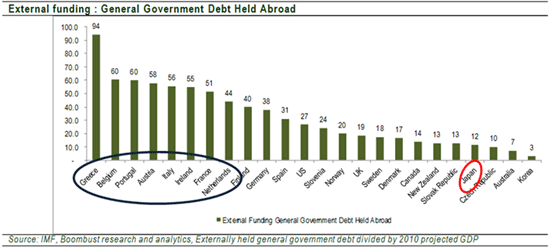

Risk-averse investors for example insurances or pension funds, do not like holding bonds in foreign currency. Currencies fluctuate in price, even far more than the usually volatile stocks. Therefore they prefer bonds in local currency. Richer nations have enough wealth; therefore those do not really need foreign bond holders. Developing nations and countries with smaller wealth, however, need more foreign funds.

But the low debt rule was not always restricted to Emerging Markets and foreign debt. At the end of the 1990s, investors eyed the rapid increase of German debt and the falling German Mark and the euro against the dollar. The German government was obliged to pay 5% on 10 year bonds despite inflation levels of only 1%. The 5% yield was needed to match the strong American growth and the high yield expectations of US assets. Read more.

Until 2008, more and more European investors bought foreign bonds denominated in euro. The common European currency eliminated the currency risk and helped to reduce the difference between bond yields of European countries with high and low wealth. The dependency of Southern Europe on foreign bond holders increased (see below).

In particular Emerging Markets and poorer countries depend on foreign investors, but they have considerably reduced this dependency in recent years.

The economists Reinhard and Rogoff tried to show that high public debt slowed countries.

In a new paper presented Monday at the annual meeting of the American Economic Association, Carmen Reinhart of the University of Maryland and Kenneth Rogoff of Harvard study the link between different levels of debt and countries’ economic growth over the last two centuries. One finding: Countries with a gross public debt debt exceeding about 90% of annual economic output tended to grow a lot more slowly. For advanced countries above the 90% threshold, average annual growth was about two percentage points lower than for countries with public debt of less than 30% of GDP. The relationship between government debt burdens and growth is even stronger for emerging-market economies, Ms. Reinhart and Mr. Rogoff find. For countries above the 90% threshold, average annual growth was about three percentage points lower than for countries with public debt of less than 30% of GDP. The countries above the threshold also experienced much higher inflation: prices rose more than twice as fast as in countries with small debt burdens. (source WSJ)

Check here for Roggoff's Reinhard's book. Later, this theory was partially rejected, but the essence remains:

Government deficits crowd out private investments and may slow growth.

According to the “saving-finances-investment”-theory (often called the loanable funds theory), households have to save first, bring their money to the bank so that firms can borrow and invest – as long as government deficits have not taken away the precious savings from firms. From this it follows that more household saving and lower government deficits are the best way to promote investment: More saving leads to a higher supply of credit and thus more investment. Zero government deficits avoid crowding out private investment. And so if investment is not high enough, both households and the government should save more by cutting their spending and thus allow banks to increase credit. … This is the paradox of thrift: households’ plans to save more leads to a decrease in aggregate revenues and expenditures – and no financial saving has actually taken place. Since firms are also likely to cut back their investment, overall saving will have fallen. The government could of course counteract the whole process by spending more where households spend less – but if the government also believes in loanable funds theory, it will cut spending itself and consequently the private sector’s revenues – welcome in recession-land. Or rather: welcome in euro-land. (source)

Criterion 5: A weak net investment position and a current account deficit increases government bond yields

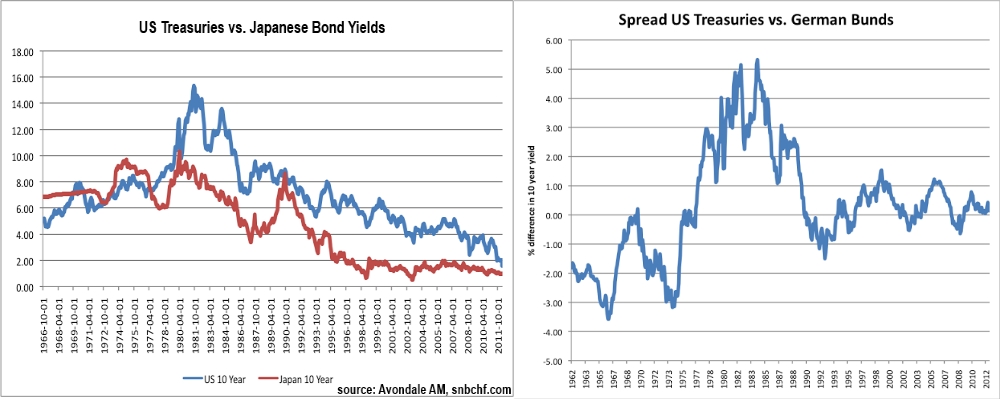

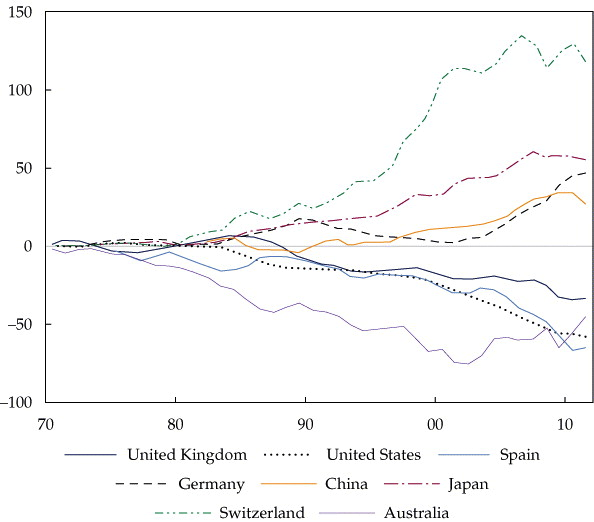

Countries with current account surpluses and a strong international investment position (NIIP) typically have lower government bond yields. The best examples are Germany, Switzerland and Japan. The bond yields of those countries have been lower than U.S. Treasury yields since the mid 1970s – with a few exceptions for Germany due to the strong investment and inflation after the German reunification 1990 and during the financial crisis in 2008.

sources Avondale Asset Management (left graph and right graph)

The following graph shows the cumulative current account surplus for different countries as a percentage of GDP since the year 1970.

Two additional criteria important for Emerging Markets: High foreign debt, a weak net investment position and a current account deficit increases government bond yields. - Click to enlarge

- The net international investment position (NIIP, criterion 5a) is the long-term result of the

- yearly current account balances (criterion 5b)

The NIIP constitutes an essential part of wealth and – as for bond yields – is probably more important than the current account.

Will public debt or the ability to issue its own currency become more important than inflation and wealth?

After the financial crisis, risk has become a very important criterion for the valuation of currencies and bonds. The Czech economist Tomáš Sedláček reckons that Western governments adopted a perverted version of a main Keynesian principle, namely that governments must spend during bad times and save during good times. In most countries, debt rose between 1998 and 2007, during the good times. But after the financial crisis, governments used Keynes’ arguments to increase debt even further.

Economists like Kyle Bass of Hayman Capital insist that in the future government debt levels, our driver number 4 for government bond yields, will be the key driver of government bond yields. This is in particular valid for Japan from the moment when criterion 5b, the current account balance, becomes negative. Moreover Bass claims that the level for total government debt, not only the level of foreign debt, is important.In a new investor letter -- posted on ZeroHedge -- Bass takes aim at critics who think that Japan (or the US, presumably) can create money at will, and not have to worry about their burgeoning national debt loads. "The fallacy of the belief that countries that print their own currency are immune to sovereign crisis will be disproven in the coming months and years. Those that treat this belief as axiomatic will most likely be the biggest losers. A handful of investors and asset managers have recently discussed an emerging school of thought [MMT], which postulates that countries, as the sole manufacturer of their currency, can never become insolvent, and in this sense, governments are not dependent on credit markets to remain fiscally operational. It is precisely this line of thinking which will ultimately lead the sheep to slaughter. " (Source Business Insider)Kyle Bass' arguments are rejected by many opinion leaders that maintain that inflation remains far too important as a driver for government bond yields for countries with high wealth and low foreign debt:

Another way of saying this is that Japan and the USA cannot “run out of money” while a nation like Greece most certainly can. There is a very real solvency constraint in Greece so bond traders have different concerns than they might in Japan or the USA. It’s been widely reported that Hayman’s funds have suffered substantial losses in the last few years in large part due to this trade. The flaw in the Kyle Bass thesis is that interest rates will surge due to market fears over high debt. But seasoned bond traders know that solvency is not the concern in a nation like Japan or the USA. They know that these nations cannot run out of money due to institutional design. So the focus then, is always inflation. And the reason Japan’s bond market has continued to rally throughout the years is due to persistent stagnant economic conditions and low inflation as a result. We feel that the environment in the USA is remarkably similar to the environment in Japan. But more importantly, we must note that it is crucial to understand this institutional design structure before entering into potentially misguided trades based on an apples to oranges (Europe vs Japan) comparison. (Source Cullen Roche, ORCAM Macro)

While Cullen Roche seems to be right on "stagnant economic conditions" and implicitly inflation expectations, he is apparently wrong on peripheral bond yields: Falling and stagnating wages have also depressed yields of peripheral bonds so that for a certain period even Spanish bonds yielded less than US Treasuries.

A mistake in the MMT thinking? Why are Europe and Japan different if wages in the periphery are falling and euro zone austerity policy helps to avoid inflation and default risks?

Furthermore, why does MMT exclude the possibility that in an ageing society the smaller and smaller share of workers demand higher salaries with time? What is when Japan's wages rise by 5% each year: Won't inflation rise to around 5% and bond yields maybe too? Could bond yields even rise to values higher than the inflation rate? In the year 1998, Germany saw bond yields bond yield rise to 5% despite inflation levels of 1%.

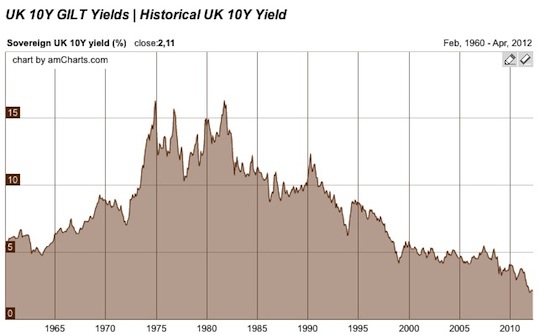

And maybe over time, high debt leads to a weaker currency, higher (imported) inflation and potentially even to a wage-price spiral and high bond yields? The history of UK bond yields, a country that is able to issue its own currency and a former world reserve currency, shows what can happen in a wage-price spiral.

At the time in the 1970s, the UK had low debt levels and quite strong nominal GDP growth. But imagine nowadays when all remaining debt needs to be rolled over with high interest rates.

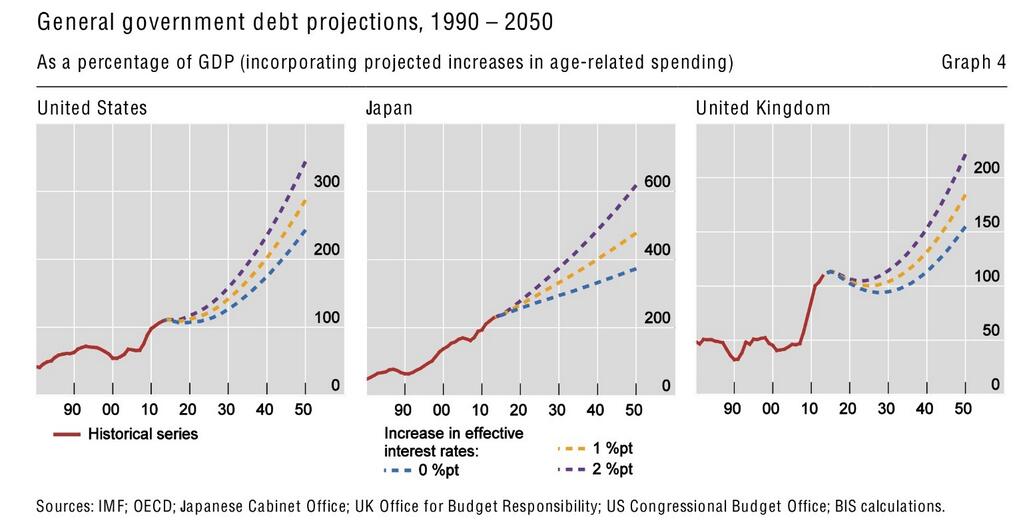

The Bank of International Settlement (BIS) gives the following consequences of higher interest rates: An explosion of public debt.

At the time in the 1970s, the UK had low debt levels and quite strong nominal GDP growth. But imagine nowadays when all remaining debt needs to be rolled over with high interest rates.

The Bank of International Settlement (BIS) gives the following consequences of higher interest rates: An explosion of public debt.

Why MMT's "apples to oranges (Europe vs Japan) comparison" was wrong: The new Widow Maker trade: Shorting Italian government bonds

Further Reading on our pages

- FX Theory: Wealth and International Investment Position

- Inflation, Central Banks and Interest Rates

- The relationship between private savings and current accounts, criteria 2 and 5b above.

- Debt, the Financial Cycle Determinant between 2011 and 2017

Further Bibliography

Bass, Kyle, Hayman Capital, The Central Bankers’ Potemkin Village, Online link

International Monetary Fund, 2014, The Trillion Dollar Question: Who Owns Emerging Market Government Debt?, Online link

Mankiew Greg, Harvard University and NBER & Douglas W. Elmendorf, Federal Reserve Board: Government Debt, Online link

Roche, Cullen, ORCAM Macro, 2012, Is it Time to Take on the “Widow Maker”?, Online link

VoxEU, “Debt and Growth Revisited” (with Carmen Reinhart), (pdf), August 11, 2010.

University of Harvard: Papers of Kenneth Roggoff