The availability of funds – wealth and the net international investment position (NIIP) – are one of the five key indicators for FX rates. Often currencies of countries with a high availability of funds appreciate when markets decline. In our overview post “What determines FX rates?” we indicated that the financial position of the concerned country and the availability of funds are one of the five key indicators for foreign exchange rates. We divide the financial position into the following components:

- Net Worth or Wealth

- Net International Investment Position

Net Worth and Wealth

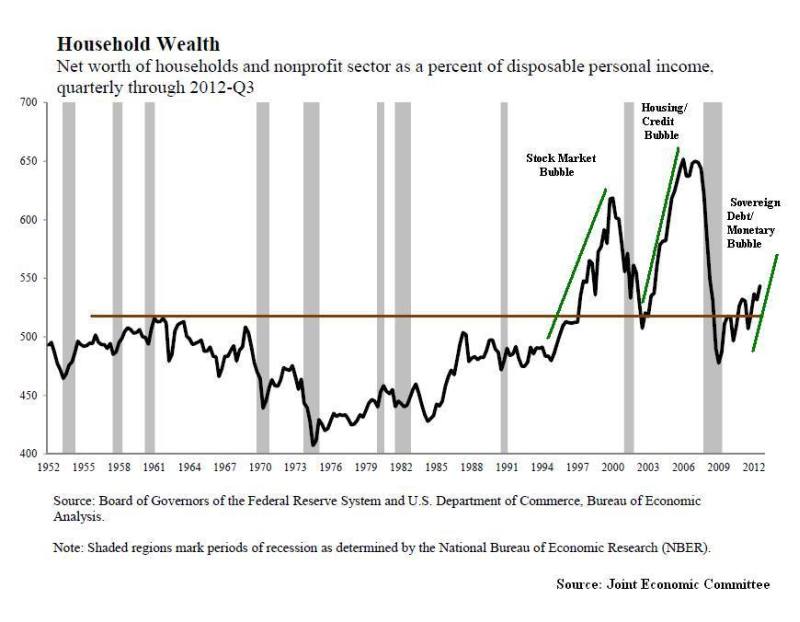

Net worth, or net wealth, is the difference between assets and liabilities for a person or a state/government. The development of private net worth in the United States is highly dependent on real estate and stock market developments, as the following chart shows.

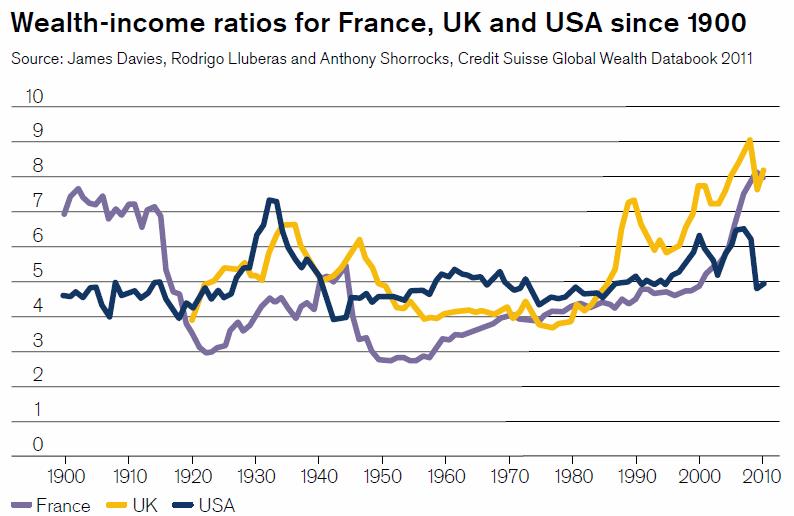

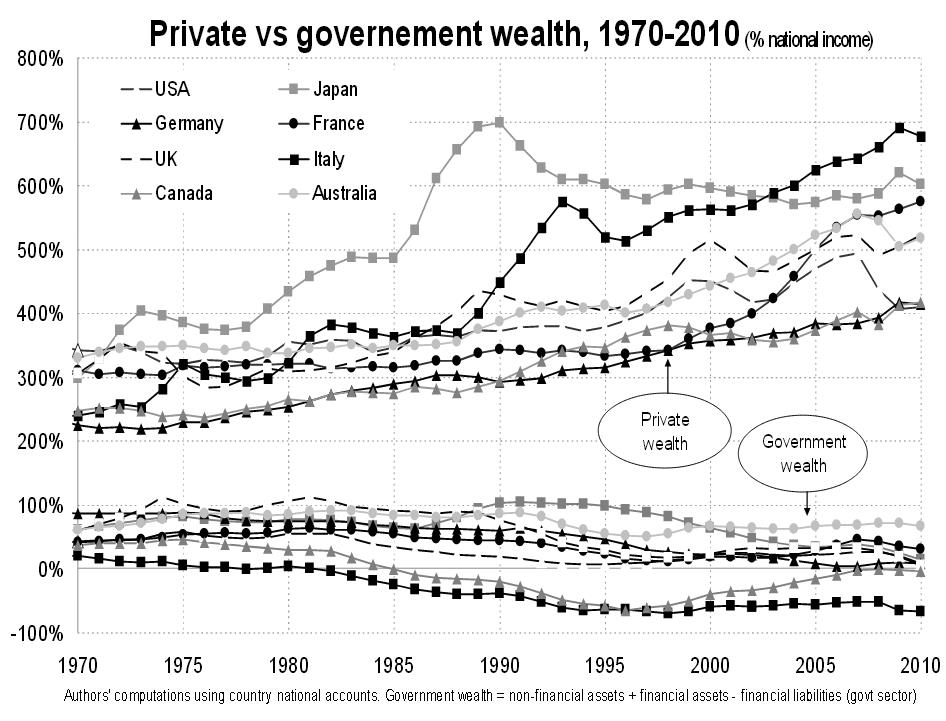

The same development is visible in other nations: since the 1976, and for France since 1950, wealth to income ratios have been rising. In countries like Italy and France private wealth strongly increased, in particular from the euro introduction on, when under the influence of cheap central bank rates house prices heavily improved.

click on image to expand , source Prof. Picketty, University of Paris

On the other side, government wealth +declined: in Italy from 20% in 1970 to -70%, in Japan from +120% in 1990 to close to zero today.

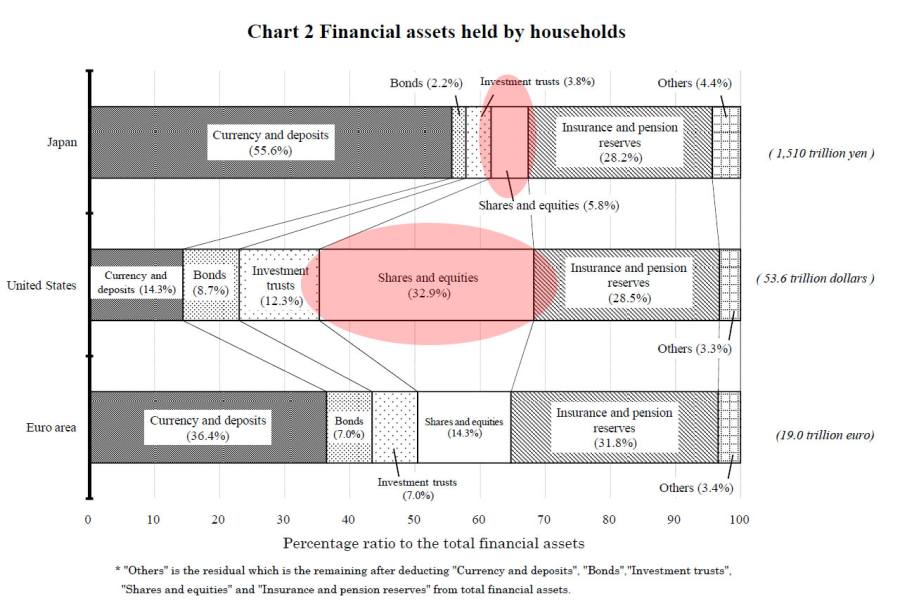

The following is a wealth decomposition for financial assets. As opposed to other countries, Americans and British prefer to invest their financial wealth more in shares and equities.

Wealth in form of asset prices is just an accounting entry that moves up and down with central bank policy. Higher mortgage and interest rates leads to falling, lower ones to rising asset prices. The net international investment position often shows more stability and is more resistant to central bank manipulation.

Read on the next page about the net international investment position

See more for