Acket: “Too much transparency is working against the SNB”

Julius Baer Group Chief Economist Janwillem Acket argues today that by publishing weekly sight deposits, the SNB is telling the market too much. A more-mysterious SNB is a fresh option for a central bank that appears out of ideas. He also argues that using a basket of currencies, rather than the euro would allow them more flexibility. He points to Singapore as a successful example.

EUR/CHF rallies, SNB could win by heading into the shadows

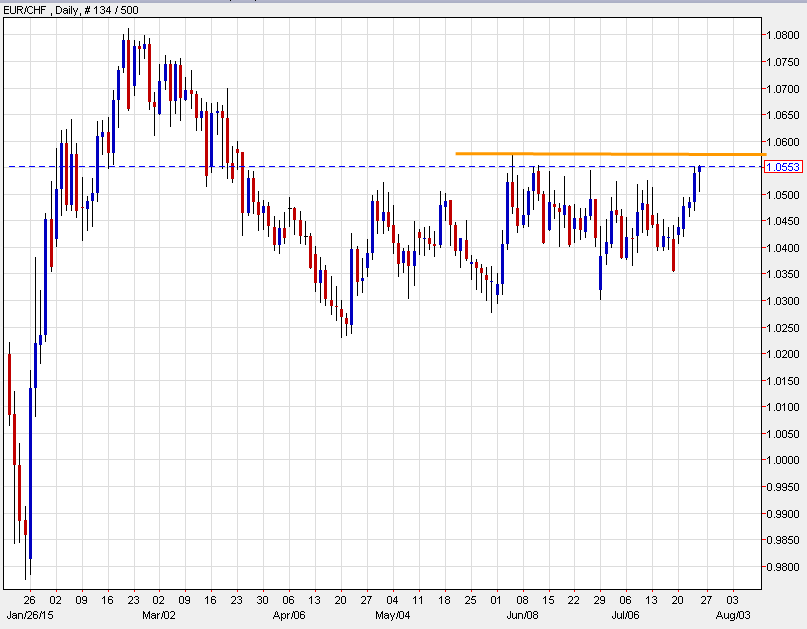

EUR/CHF has gained this week but it’s still far below where the Swiss National Bank thinks it should be as they fight a recession and disinflation. EUR/CHF has made another quick, somewhat mysterious move higher today in the past hour, rising to 1.0552 from 1.0514. The June high of 1.0573 is resistance.

EURCHF daily

EURCHF daily

Bloomberg writes about it today. “Singapore’s model — with an undisclosed basket, no accounts of meetings and few media interviews — discloses only very little information,” the report says.

Realistically, it seems highly unlikely with people and the government in Switzerland pushing for more transparency. But it’s a lesson to other central banks when the next round of currency wars intensifies.

Comment by George Dorgan, snbchf.com

Comment by George Dorgan, snbchf.com

Yes, perfect!

And Swiss customs shall not publish the trade data any more!

Despite the so-called “strong franc” – the massive Swiss trade surplus has remained unchanged! The trade surplus reflects the strong performance of Swiss companies and their CHF-denominated stocks in comparison to the rest of the world.

And the SECO shall not publish GDP data neither! Swiss GDP will rise again, once the importers (CHF-denominated stocks) have given more than the current tiny bit of their import profits to the consumers (compare the PPI change to CPI change).

And last but not least, CHF-denominated stocks shall not publish any quarterly reports any more! With this loss of transparency, nobody will buy these CHF-denominated stocks any more and the demand for CHF will subsequently fall. Absurdity!

How stupid to think that CHF is driven only by “safe-haven” cash movements! The outflow of capital does not happen because Swiss companies are too strong.

Portfolio investments in the balance of payments

The following table is a quick wrap-up of the recent Swiss balance of payments. It shows the insufficient export of capital, in particular by portfolio investments during the year 2014. Net porfolio investment outflows are very low.

No wonder Swiss companies had a very strong year, profits were at highs. About 70 or 80% of portfolio investments are equities, the bond share is for the Swiss a bit higher than the U.S. or for Europe. But with the QE announcement in Q1/2015, the ECB destroyed the expectation of higher interest rates and the hope that Swiss investors would buy more European bonds.

Swiss Balance of Payments 2014 and Q1 2015

in bln. CHF

(+ for surplus/inflows,

- for outflows) | 2014 | 2014 I | 2014 II | 2014 III | 2014 IV | 2015 I |

| Current Account | +45.3 | +8.8 | +8.1 | +11.1 | +17.3 | +13.7 |

| Trade Surplus | +71.1 | +16.4 | +15.9 | +17.6 | +21.1 | +17.1 |

| Direct Investments Net | +4.7 | +8.3 | -7.5 | -2.6 | +6.7 | -10.3 |

| Portfolio Investments Net | -5.9 | -9.4 | -2.9 | -3.5 | +9.9 | -39.0 |

Other Investments Net

| -11.1 | -17.2 | -0.6 | +3.6 | +3.0 | +81.0 |

Total Capital Account

(excl. SNB) | -12.3 | -18.4 | -11.3 | -2.4 | +19.5 | +52.3 |

Change in SNB Reserves

- is outflow (valuation gain or intervention) | -34.8 | -3.4 | -4.7 | -1.0 | -25.6 | -58.8 |

Q4/2014 saw more portfolio inflows than outflows, this in addition to the strong current account surplus, the second most important reason to give up the peg.

As visibile in the portfolio investments, many Swiss investors effectively bought foreign papers in Q1/2015, there was a net outflow of 38 billion. But Draghi’s QE attracted heavy cash and lending inflows (in “other investments”). It is evident that when Drahi speaks about QE, it does not make sense to hide SNB sight deposits to the public.

@Adam:

How many of the 550 billion CHF in foreign currency, have they sold this week? I guess about zero.

The positive movement for the euro are driven by FX traders, but those are irrelevant for long-term FX rates. They will close their long positions at the latest on events like January 15, 2015.

Nonetheless we expect a slightly stronger EUR/CHF in the upcoming years thanks to an FX position building in favor of the SNB. The franc will become far stronger again when US inflation will come back in maybe four or five years. More on that in the

two phases of CHF appreciation.

Interestingly to know which zombie banks Jan Willem wanted to close in 2012. I guess not the central bank mentioned above.

See more for 1.) CHF

Comment by Adam Button, Forex Live

Comment by Adam Button, Forex LiveEURCHF daily

Comment by George Dorgan, snbchf.com

Comment by George Dorgan, snbchf.com