Rather than right the ship, the "easy fix" is to distribute "free money"--not just to billionaires and corporations but to everyone.

Read More »

Category Archive: 8d.) Monetary Policy

Albert Edwards: Investors Should Brace For A World Of Negative Rates, 15percent Budget Deficits And Helicopter Money

Eariler this week, when the San Fran Fed published a paper that suggested that the recovery would have been stronger if only the Fed had cut rates to negative, we proposed that this is nothing more than a trial balloon for the next recession/depression, one in which the Federal Reserve will seek affirmative "empirical evidence" that greenlights this unprecedented NIRPy step (in addition to QE of course).

Read More »

Read More »

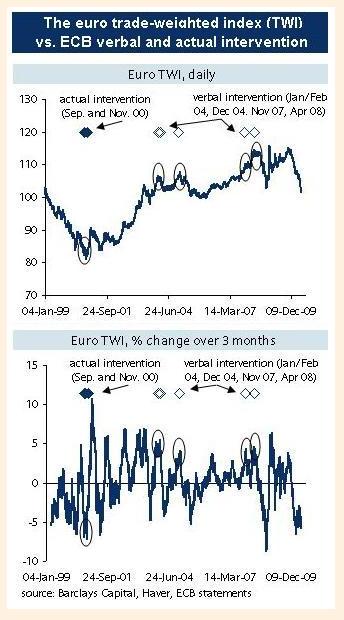

Currency intervention for Central Banks: When and at which level?

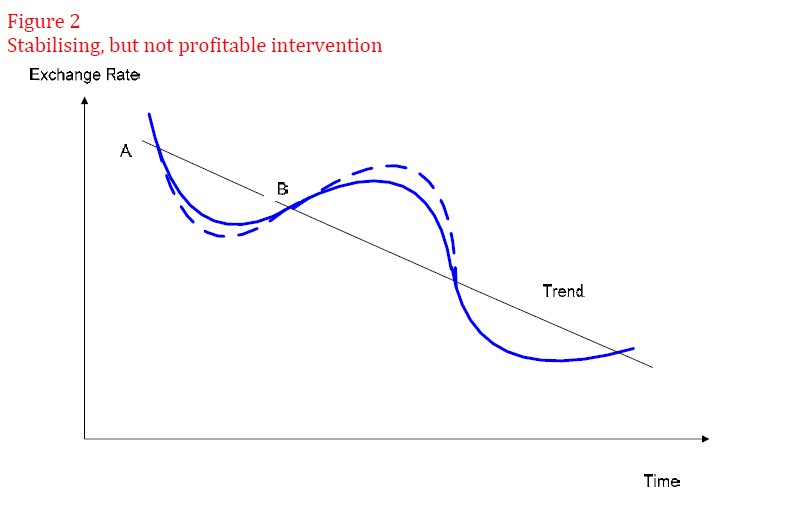

The papers from the Reserve Bank of New Zealand describes in easy words where central banks should intervene based on economic history and experience. It avoids the often used econometric considerations. For FX rates those often do not incorporate sufficient long-term data.

Read More »

Read More »

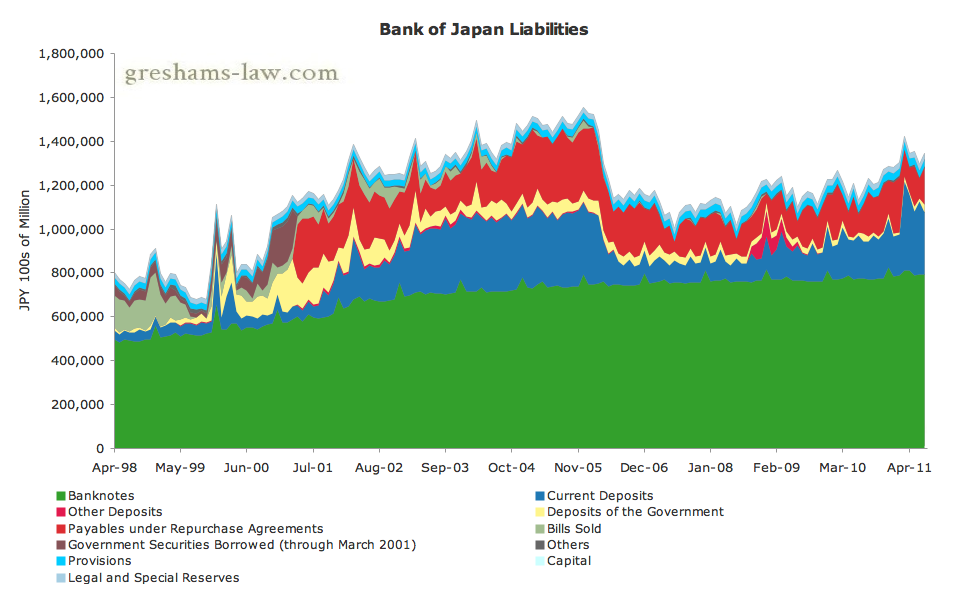

History of Bank of Japan Interventions

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.

As opposed to the Swiss National Bank, the Japanese only talk, they do not fight.

Read More »

Read More »

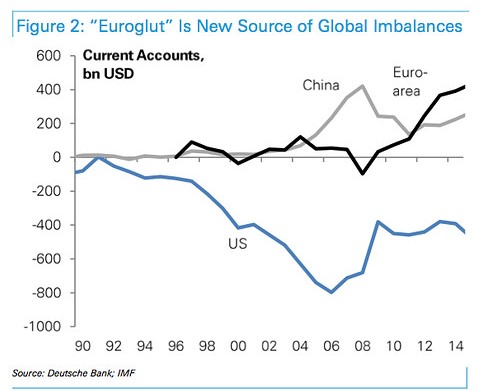

The Euro Glut: The Summer 2015 Update

Deutsche Bank's George Saravelos was one of the first to use the term "euro glut". He anticipated a massive capital outflow from Europe that countered the huge European current account surplus. The Euro glut also led to the end of the EUR/CHF peg. Reasons are missing investment opportunities in Europe despite the high savings rate.

Read More »

Read More »

What Drives the Economy: Consumer Spending or Saving/Investment?

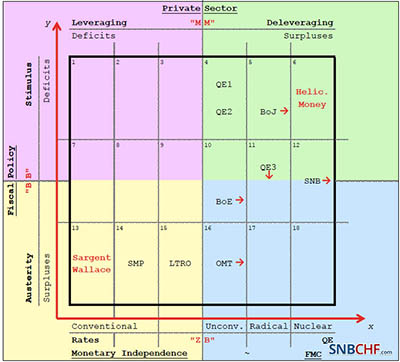

The concerted actions in September 2012 between the two big central banks reflected two fundamental economic principles: The Fed opted for Keynes' law, the ECB for Say's Law with conditionality. And apparently the ECB was successful.

Read More »

Read More »

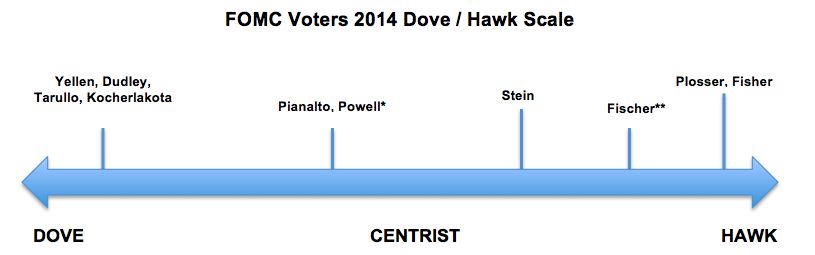

Fed FOMC: Who is Hawk, Who is Dove? 2015 Update

Composition of the Fed's Federal Open Market Committee (FOMC composition), needed to know if the Fed is opting for quantitative easing or not.

Read More »

Read More »

Quantitative Easing, its Indicators and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

When Will the Renminbi Become a Reserve Currency?

We recently explained that China will overtake the United States not only for GDP but also for wealth. In this post we explain what is still missing to become a world reserve currency and how quickly this could happen.

Read More »

Read More »

Inflation Expectations = Real GDP Growth = Ten-Year Treasury Yields – 0.5%?

Inflation expectations drive the Fed's and markets behaviour. Bond yields adjust, often but not always, with an inflation premium against short-term rates.

Read More »

Read More »

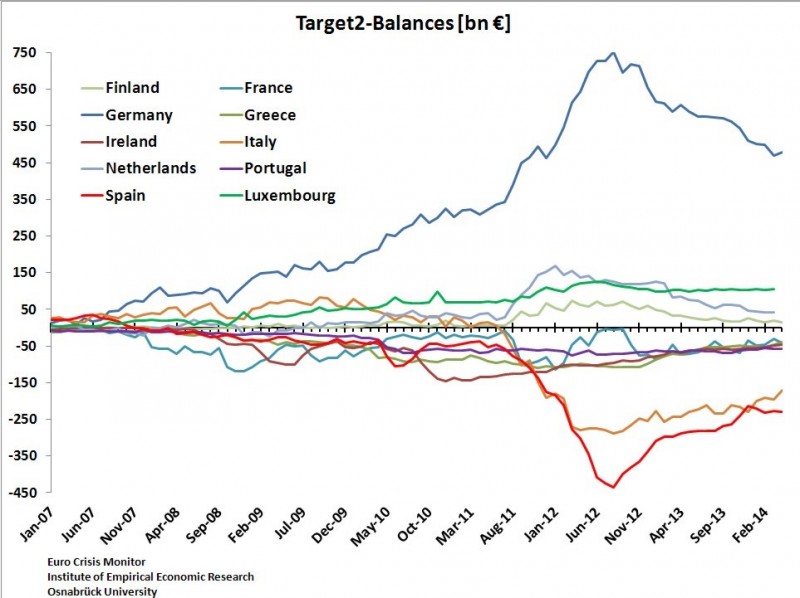

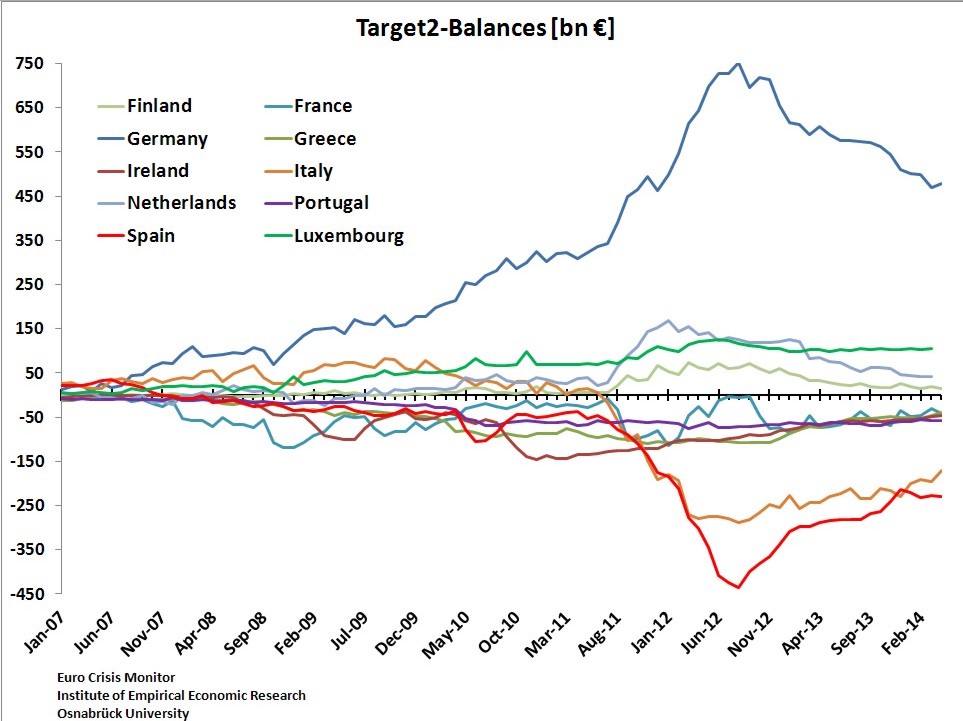

Negative Rates for Bundesbank TARGET2 Surplus?

The ECB surprised with negative rates on excess reserves, on the deposit facility and even on TARGET2. We clarify whether the Bundesbank, as a member of the euro system, must pay negative interest rates on its huge TARGET2 surplus.

Read More »

Read More »

Germany: Last European Country with Lots of Cash Under Matresses

In June 2014, the ECB decided to introduce negative rates on the excess reserves of banks. We explain that German banks had already removed most excess liquidity before the ECB meeting of June 2014, and they will continue to do so. Hence hardly any German bank will pay negative rates after the recent ECB decisions at that meeting.

Read More »

Read More »

Cleveland Fed: Price inflation is a monetary phenomenon

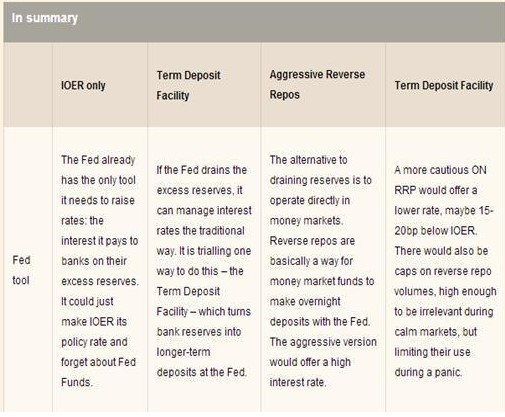

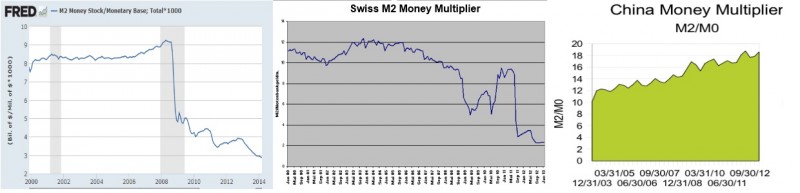

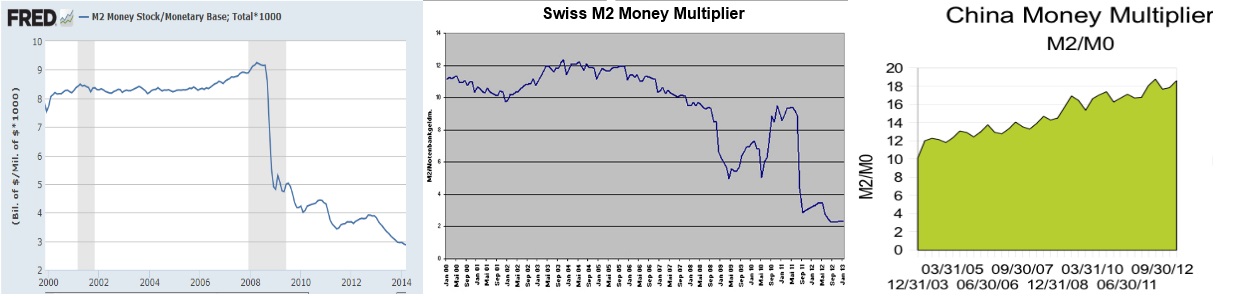

Cleveland Fed: Price inflation is a monetary phenomenon. Hence, the money multiplier theory is still valid, just not in the US and in Europe.

Read More »

Read More »

Central Banks’ Quasi-Fiscal Deficits and Potential Hyperinflation

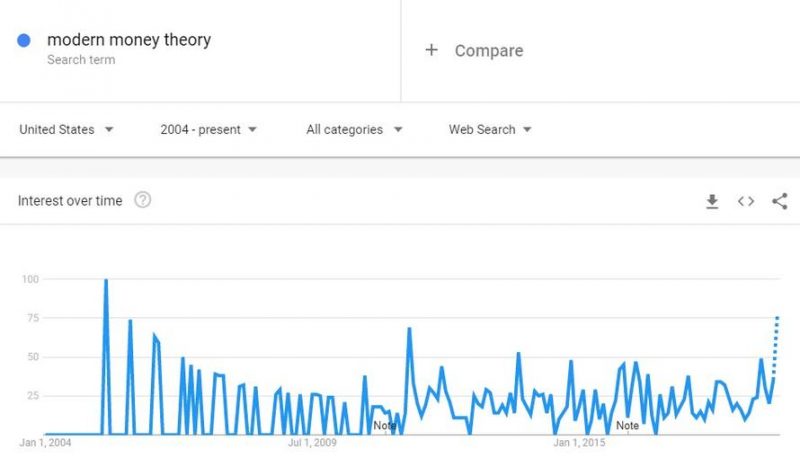

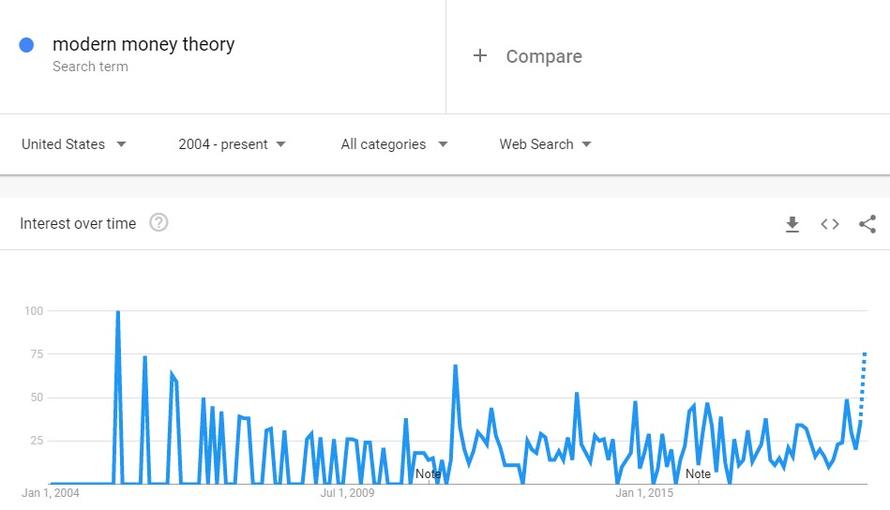

There are different discussions ongoing if a central bank may monetize debt and act of a quasi-fiscal agent. One opinion was the Modern Monetary Theory that advocates monetizing debt.

Read More »

Read More »

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

The Indian central banker Rajan recently accused his Western colleagues of lax policy until 2007. Furthermore he argued that FX intervention using so-called “quantitative easing or exchange intervention” (QEE) help to dry up the needed money supply in India. We will look on his statement from this money supply angle: In some countries, the money …

Read More »

Read More »

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

In some countries, the money multiplier is falling, in some others it is increasing, mostly due to central bank tightening. Does this justify to speak of secular stagnation?

Read More »

Read More »

SNB Bills, Chinese Repos and Reverse Repos

A repo provides liquidity to banks while the reserve repos aims to reduce liquidity and reduce inflation. In 2011, the SNB used SNB bills and reverse repos to reduce inflationary pressure. SNB bills are short-term bonds that pay a certain interest.

Read More »

Read More »

How European Leaders Are Successfully Implementing Say’s Law

The concerted actions in September 2012 between the two big central banks reflected two fundamental economic principles: The Fed opted for Keynes' law, the ECB for Say's Law with conditionality. And apparently the ECB was successful.

Read More »

Read More »