![]() What is New?

What is New?

-

Did the MMT Camp Correctly Predict the Post-Covid Economy?

9 hours agoWhat is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private...

Read more » -

Word of the Day: Performative

10 hours ago -

In diesen Städten sind die #Mieten am stärksten gestiegen #wohnen #shorts

10 hours ago -

5 Entscheidungen, von denen Dein Wohlstand abhängt

12 hours ago -

Bayer Hauptversammlung: Damit müssen Aktionäre jetzt rechnen!

12 hours ago -

Help Us Publish These Three New Books

13 hours ago -

Low Time Preference Leads to Civilization

13 hours ago

SNB and CHF

SNB and CHF

-

SNB Sight Deposits: increased by 3.4 billion francs compared to the previous week

20 hours agoThe sight deposits at the SNB increased by 3.4 billion francs compared to the previous week.

Read more » -

USD/CHF stays above 0.9100 nearing the highs since October

11 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

11 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

12 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

17 days ago -

2024-04-08 – Thomas Jordan: Towards the future monetary system

18 days ago -

Swiss Franc at risk as inflation diverges from SNB forecasts

2024-03-16

Swiss & European Macro

Swiss & European Macro

-

Brisant: Momentanes perfides Täuschungsmanöver läuft an – Ernst Wolff im Gespräch mit Krissy Rieger

1 day agoRaus aus dem System? Aber wie? Trage dich zu unserem kostenlosen Report ein: https://www.rieger-consulting.com/riegersreport Mehr zu Krissy Rieger: Finanzkanal ►► / @chrisrieger91 Zweitkanal ►► / @krissy.rieger2 Instagram ►► https://www.instagram.com/krissy.rieg... Twitter ►► https://twitter.com/krissyrieger?lang=de Telegram ►► https://t.me/KrissyRieger ____________________ 📅 Alle Termine und die Links zu meiner Vortragsreihe finden...

Read more » -

Increase of 1.7% in nominal wages in 2023 and 0.4% decline in real wages

2 days ago -

Diese Aktien sind extrem günstig!

2 days ago -

Korrektur bei Aktien! Vorsicht!

4 days ago -

Gold: Kursziel 5.092 US-Dollar?

9 days ago -

Eskalation im Nahost-Konflikt als nächster Schwarzer Schwan für die Finanzmärkte?

10 days ago -

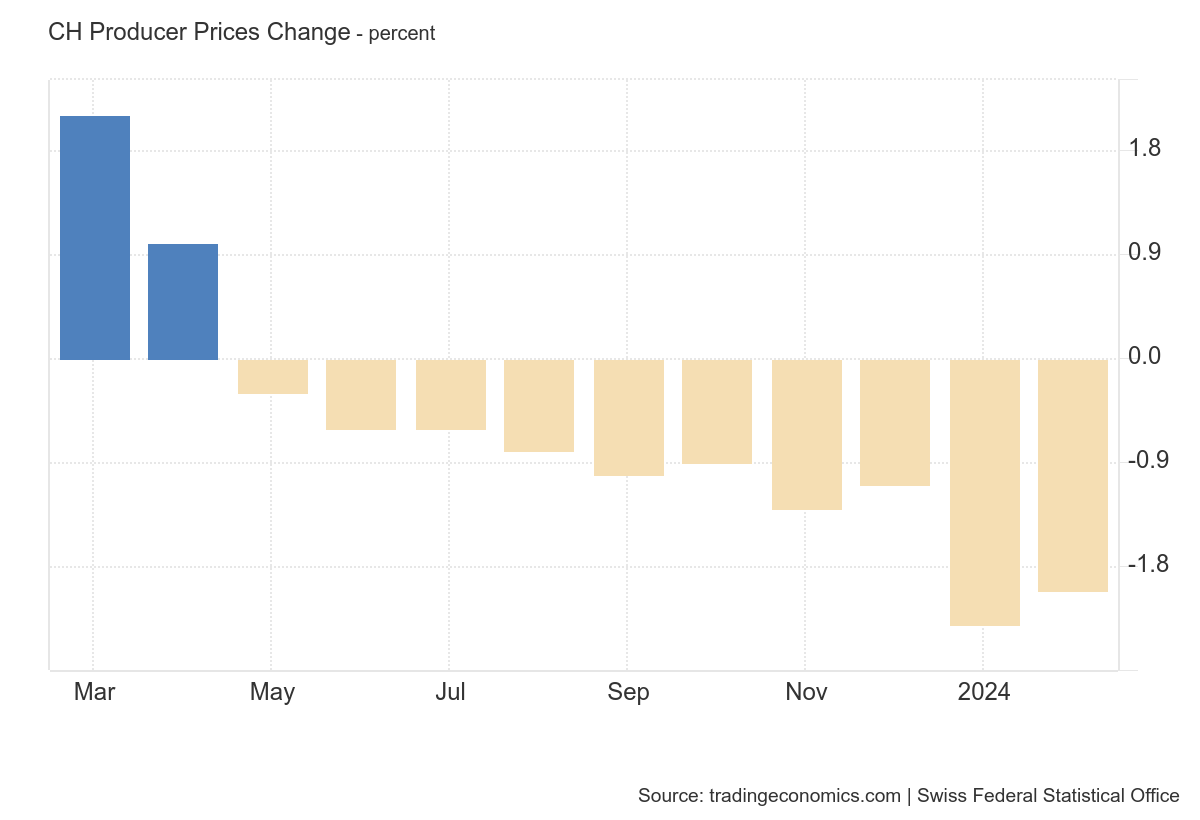

Producer and Import Price Index rose by 0.1% in March

12 days ago

Swiss Markets & News

Swiss Markets & News

-

SNB returns to quarterly profit thanks to Swiss franc weakness

2 days agoThe Swiss National Bank (SNB) returned to a quarterly profit because of the weakness of the Swiss franc, potentially helping officials to rebuild the central bank’s depleted capital base. The Zurich-based institution notched up a gain of CHF58.8 billion ($64 billion) in the first quarter, according to a statement on Thursday. That’s the strongest start to the year on record.

Read more » -

Luftfahrtindustrie: Rückblick auf 2023 und Prognose für 2024

11 days ago -

Switzerland braced for wave of bank staff layoffs

12 days ago -

UBS must build up more equity, says Swiss government

13 days ago -

Switzerland’s Growing Online Gambling Ecosystem and the Rise of iGaming White Label Solutions

16 days ago -

Investigation into collapse of Credit Suisse beset by delays

2024-03-14 -

CEO pay: can Switzerland compete with the US?

2024-03-07

Global Macro & Emerging Markets

Global Macro & Emerging Markets

-

Financial Forecast 2025-2032: Please Don’t Be Naive

11 days agoRather than attempt to evade Caesar's reach, a better strategy might be to 'go gray': blend in, appear average. Let's start by stipulating that I don't "like" this forecast. I'm not "talking my book" (for example, promoting nuclear power because I own shares in a uranium mine) or issuing this forecast because I favor it.

Read more » -

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

12 days ago -

Sound Money Vs. Fiat Currency: Trade and Credit Are the Wild Cards

15 days ago -

Global Recession’s Winners and Losers

2024-03-06 -

Who is “Europe’s last dictator”?

2024-02-29 -

Rates, Risk and Debt: The Unavoidable Reckoning Ahead

2024-02-26 -

How the Economy Changed: There’s No Bargains Left Anywhere

2024-02-23

Austrian Economics

Austrian Economics

-

Did the MMT Camp Correctly Predict the Post-Covid Economy?

9 hours agoWhat is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private...

Read more » -

Word of the Day: Performative

10 hours ago -

Help Us Publish These Three New Books

13 hours ago -

Low Time Preference Leads to Civilization

13 hours ago -

¿Cómo nos PROTEGEMOS ante una GUERRA?, con Gustavo Martínez

15 hours ago -

Opposing Military Intervention: Loving Dictators or Hating War?

16 hours ago -

Gold, Euro oder Dollar: Die Zukunft des Geldsystems | Anlageempfehlungen von Prof. Dr. Polleit

20 hours ago

![]() Buy and Hold

Buy and Hold

-

In diesen Städten sind die #Mieten am stärksten gestiegen #wohnen #shorts

10 hours agoDie Mieten steigen fast überall. Aber wo am stärksten? Leo hat die Liste der Städte dabei, wo Wohnen sich am schnellsten verteuert. Quelle: Immowelt

Read more » -

5 Entscheidungen, von denen Dein Wohlstand abhängt

12 hours ago -

Retail Sales Data Suggests A Strong Consumer Or Does It

18 hours ago -

Hier ist Wohnen günstiger geworden

1 day ago -

Schlechte Geldanlagen loswerden | Geld ganz einfach

1 day ago -

Understanding Elliott Wave Theory and Investment Strategies – Andy Tanner and Bob Prechter

2 days ago -

Die günstigsten Spritpreise Europas #shorts

2 days ago

![]() Crypto Währungen Deutsch

Crypto Währungen Deutsch

-

Bitcoin: Das darf JETZT NICHT passieren!

11 days agoDa schaut man nichtsahnend am Sonntagmorgen auf den Bitcoin-Chart und stellt fest: Ein Crash bildet sich hier gerade aus! Wobei ich zugebe, Ich denke mal, ich weiß es noch gar nicht genau, der Titel des heutigen Videos wird irgendwas mit „Crash“ oder „Absturz“ drin haben.

Read more » -

BREAKING: Krypto-Preise auf dem Vormarsch? Ledger Drama enthüllt! Bitcoin Miami Highlights!

2023-05-22 -

LEDGER RECOVERY DRAMA – DIESE 3 DINGE MUSST DU WISSEN!

2023-05-18 -

DIE NEUSTEN TRENDS – WIE INVESTIEREN?

2023-05-18 -

BITCOIN MIAMI KONFERENZ: BULLISCH ODER BÄRISCH?

2023-05-15 -

CRASHT BITCOIN MIAMI WIEDER DEN PREIS?

2023-05-15 -

FÜHREN ORDINALS ZU BITCOIN’S UNTERGANG?

2023-05-10

![]() Crypto Currencies English

Crypto Currencies English

-

Launch of the Swiss4 Application, Combining Financial Services and Lifestyle

4 days agoSwiss4, a financial player founded in Geneva in 2020, announces the launch of its application combining financial services and high-end lifestyle management services. Entirely designed, developed and hosted in Switzerland, the app guarantees security and ease of use for its customers, deposits in CHF held with the Swiss National Bank (SNB). The multi-currency account (CHF, EUR, GBP, AED, and SGD), alongside the MasterCard World Elite card,...

Read more » -

Swiss Fintech Awards 2024 Announce Top 10 Swiss Fintech Startups

8 days ago -

Blackrock Launches Its First Tokenized Fund on Ethereum

2024-03-22 -

Luzerner KB steigt in den den Handel und die Verwahrung von Kryptowährungen ein

2024-03-05 -

US Spot Bitcoin ETFs Daily Trading Volume Soars to 6 Billion USD

2024-03-01 -

SNB Study: Results of the Swiss Payment Methods Survey

2024-02-27 -

The Top Swiss Law Firms for Fintech and Blockchain Practice

2024-02-22

![]() Stock Picking & Dividends

Stock Picking & Dividends

-

Bayer Hauptversammlung: Damit müssen Aktionäre jetzt rechnen!

12 hours agoZu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read more » -

Mario Voigt Dystopie: Entzug der Meinungsfreiheit!

15 hours ago -

Eilmeldung: FDP fordert nun Habeck Rücktritt!

19 hours ago -

Supergau für Jens Spahn wegen RKI Files!

1 day ago -

BASF Hauptversammlung: DAS erwartet jetzt Anleger (2024)

1 day ago -

Habeck Files: Die Grüne Kernschmelze!

2 days ago -

Deutscher General: “Wir arbeiten an Operationsplan Deutschland”

2 days ago

![]() Mindset and Investing

Mindset and Investing

-

STARKES Umfeld, STARKE Renditen: Ein (Börsen-)Jahr voller Erfolg

1 day agoEin Jahr voller inspirierender Zusammenarbeit – unser Regionalleiter-Jubiläum! In diesem Vlog gibt es Einblicke hinter die Kulissen des Treffens und wir zeigen, wie Zusammenarbeit den Börsenerfolg fördert. Verpasse daher nicht die Highlights und lerne, wie auch du von unserer Academy profitieren kannst. http://jensrabe.de/regionalgruppen Vereinbare jetzt dein kostenfreies Beratungsgespräch: https://jensrabe.de/Q2Termin24 Tägliche Updates ab...

Read more » -

Der beste Hedge der Welt!

3 days ago -

Sport mit Jens – 22042024 – SMCI, Bitcoin Halving, Trump vs. Biden

5 days ago -

Einblick in unsere Livecalls (Video wird wieder gelöscht)

6 days ago -

Mein YouTube Einnahmen: Totale Transparenz

8 days ago -

UPDATE: Crash oder Korrektur – wie geht es jetzt weiter?

11 days ago -

Geldmaschine Volatrading? Infos zum Reverse Split im UVXY

13 days ago

![]() Day Trading

Day Trading

-

Bodemann flippt aus: “Wir brauchen mehr Kontrolle”

2 days agoKostenfreier Live-Trading-Workshop (03.-05. Mai 2024): 👉 https://oliverklemmtrading.com/workshop?utm_source=youtube1&utm_campaign=workshop Jetzt anmelden! Plätze begrenzt... Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2 ►Folge Oliver auf Instagram:...

Read more » -

Wichtige Morning News mit Oliver Klemm #288

2 days ago -

Wichtige Morning News mit Oliver Klemm #289

2 days ago -

Eklat im Bundestag: “Wir müssen die FDP stoppen”

4 days ago -

Wichtige Morning News mit Oliver Klemm #287

4 days ago -

Wichtige Morning News mit Oliver Klemm #286

5 days ago -

Eilt: dramatische Wende im Ukraine-Konflikt!

9 days ago

![]() Fund and Hedge Funds

Fund and Hedge Funds

-

Happy World Book Day!

3 days agoHappy World Book Day! Do some reading today, see what you like. #raydalio #principles #worldbookday #worldbookday2024 #reading #education #books

Read more » -

This is why we NEED to Protect the Ocean

7 days ago -

How the World can Tackle Climate Change

8 days ago -

Climate Change Efforts Must Be Practical and the Time is NOW

9 days ago -

THIS is what it will cost to fight Climate Change

10 days ago -

Ray Dalio on Stock Trading at 12 Years Old

11 days ago -

Ray Dalio on his Principles for Success

14 days ago

Gold and Monetary Metals

Gold and Monetary Metals

-

Gold Price Just Dropped! What Happened? (2024 Update)

2 days agoThe #gold price recently experienced its most significant intraday loss in nearly two years, prompting questions about its trajectory and its status as an investment. In this video, we delve into the reasons behind the drop and whether gold remains a viable investment option. Despite the recent pullback, we maintain our bullish outlook on gold. Pullbacks are a natural part of a long-term uptrend, and historical patterns suggest that gold may...

Read more » -

Who’s to Blame for Inflation?

3 days ago -

Will gold prices keep rising in 2024? #gold #inflation #goldprice #preciousmetals

3 days ago -

2024 Gold Forecast: What Investors Need to Know

3 days ago -

Sound Money Talks – A Conversation With Jeff Deist and Jp Cortez

4 days ago -

Is the gold price too high to buy?

5 days ago -

10oz STACKER Bars

6 days ago

FX Trends

FX Trends

-

EURUSD Technical Analysis – WATCH what happens around this key resistance

3 days ago#eurusd #forex #technicalanalysis In this video you will learn about the latest fundamental developments for the EURUSD pair. You will also find technical analysis across different timeframes for a better overall outlook on the market. ---------------------------------------------------------------------- Topics covered in the video: 0:00 Fundamental Outlook. 1:20 Technical Analysis with Optimal Entries. 3:02 Upcoming Economic Data....

Read more » -

EURUSD has a cap near the 38.2% retracement, but buyers are pushing.

3 days ago -

AUDUSD reacts to the weaker US data. Pair moves higher as yields move lower/stocks higher.

3 days ago -

The USDCHF is not doing much in trading today, but the buyers are trying to take control.

4 days ago -

The USDCHF is not doing much in trading today, but the buyers are trying to take control

4 days ago -

Kickstart the FX trading day for April 23 w/a technical look at EURUSD, USDJPY and GBPUSD

4 days ago -

USDJPY Technical Analysis – Key levels to watch for a pullback

4 days ago

![]() Personal Investment

Personal Investment

-

In diesen Städten sind die #Mieten am stärksten gestiegen #wohnen #shorts

10 hours agoDie Mieten steigen fast überall. Aber wo am stärksten? Leo hat die Liste der Städte dabei, wo Wohnen sich am schnellsten verteuert. Quelle: Immowelt

Read more » -

5 Entscheidungen, von denen Dein Wohlstand abhängt

12 hours ago -

Bayer Hauptversammlung: Damit müssen Aktionäre jetzt rechnen!

12 hours ago -

Mario Voigt Dystopie: Entzug der Meinungsfreiheit!

15 hours ago -

Retail Sales Data Suggests A Strong Consumer Or Does It

18 hours ago -

Eilmeldung: FDP fordert nun Habeck Rücktritt!

19 hours ago -

Supergau für Jens Spahn wegen RKI Files!

1 day ago