Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| Markets don’t need a crash to go down in 2026—valuation compression alone can do the damage. In this Short video, Michael Lebowitz and I discuss why stretched multiples, normal volatility, and rotation risk matter more than bullish forecasts. 📺Full episode: Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

1-5-26 2026 Market Outlook: Bullish Momentum, Valuation Risks, and What Comes Next

1-5-26 2026 Market Outlook: Bullish Momentum, Valuation Risks, and What Comes Next

2026-01-05

Markets closed 2025 with strong gains, but the path forward into 2026 is far more nuanced than headline optimism suggests.

Lance Roberts reviews what drove 2025’s market performance, why the Santa Claus Rally failed, and how shifting inflation trends, Federal Reserve policy expectations, and valuation levels are shaping market outlooks for 2026.How can investors navigate the New Year with realistic expectations, disciplined risk management, and diversified positioning, recognizing that returns may come with higher volatility than recent years.

0:00 – INTRO

0:19 – Maduro Impact on Oil; What’s Next for New Year?

4:42 – No Santa Rally!

9:58 – What to Expect in 2026

14:13 – Base Portfolio Management in Terms of a Range of Outcomes

20:02 – The Risk of Disappointment

24:00 – Full Time

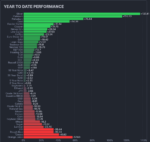

YTD Returns Highlight a Narrow Market

YTD Returns Highlight a Narrow Market

2025-12-31

YTD returns across major U.S. asset classes continue to reflect a highly concentrated market. The Finviz chart below does a nice job illustrating YTD returns across a wide array of futures contracts. Large-caps dominate YTD equity returns, while small- and mid-cap stocks lag amid tighter financial conditions and slower earnings growth. Outside of equities, YTD …

Data Center Debt: Can Oracle Hang With The Big Boys?

Data Center Debt: Can Oracle Hang With The Big Boys?

2025-11-13

Meta and Google recently borrowed a combined $55 billion in the corporate bond market. As we share below, this debt represents a new source of funding for data center expansion. Further, as shown in orange, Oracle tapped the private market for loans to secure the capital needed to sustain AI innovation and the related data …

11-12-25 December Rate Cut Back in Play

11-12-25 December Rate Cut Back in Play

2025-11-12

Soft jobs data and falling rents point to weaker inflation ahead, setting the stage for a potential Fed rate cut in December.

In this short video, I explain why this slowdown may be exactly what the market needs to keep the rally alive.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

9/18/25 The Real Reason The Market Popped After the Fed Cut

9/18/25 The Real Reason The Market Popped After the Fed Cut

2025-09-18

The Fed cut rates as expected, but Powell admitted uncertainty and insisted policy is still "restrictive."

@michaellebowitz and I discuss why markets see it as "accommodative" and are rallying on that perception, with $INTC & $NVDA helping big.

#FedRateCut #StockMarketRally #PowellSpeech #NvidiaStocks #InterestRates

2025-09-17

President Trump is pushing to reduce the SEC’s financial reporting requirements from quarterly to semiannual reporting. He’s framing the idea in a positive light: it would allow managers to focus on the business, lower compliance costs, and fight “short-termism” in markets. In reality, it would weaken one of the hallmarks of U.S. capital markets: timely …

Tags: Featured,newsletter