Mainstream Expectations: Hope Vs. Potential Risk

Mainstream Expectations: Hope Vs. Potential Risk

2026-01-30

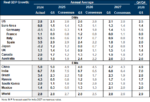

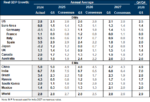

Mainstream expectations, those from Wall Street, economists, and corporate strategists, have congealed around a bullish economic outlook for 2026. Most forecasts project stronger economic growth, with contained inflation, and continued investment in technology and capital expenditure. As such, many institutional investors interpret this as a year of opportunity for markets and corporate earnings.That was a …

Continue reading »

The Reflation Narrative Stumbles Out Of The Gate

The Reflation Narrative Stumbles Out Of The Gate

2026-01-26

With a 4.4% increase in economic growth in the third quarter and expectations that it could be higher in the fourth quarter, the so-called reflation narrative appears primed to dash out of the gates in 2026 at its current strong pace. The problem with assuming the reflation narrative will hold in 2026 is that it …

Continue reading »

Bull Market Genius Is A Dangerous Thing

Bull Market Genius Is A Dangerous Thing

2025-12-15

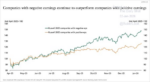

During extended upward-trending markets that reward risk-takers and punish caution, everyone is a “bull market genius.” That dynamic flips investor psychology and, over time, creates a false sense of control. As the market continues to climb, risk appears to vanish, and investors believe that nothing can go wrong, leading them to take on increasing levels …

Continue reading »

A Third Of US Debt Matures In 2026

A Third Of US Debt Matures In 2026

2025-12-12

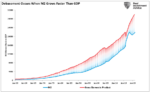

We received the following question from a client: “I was at a conference where they showed that roughly a third of the currently existing US Government debt is set to mature in the next few years. How can we pay it back?” A third of the approximately $30 trillion in US Treasury debt equates to …

Continue reading »

Money Supply Growth: A Thesis With A Fatal Flaw

Money Supply Growth: A Thesis With A Fatal Flaw

2025-10-24

Recently, MarketWatch ran a provocative headline: “When the world’s largest asset manager and the Bond King both agree: Run to gold, silver, and bitcoin.” The article highlighted how Larry Fink’s BlackRock and Jeffrey Gundlach, often dubbed the “Bond King,” see deficits and “money printing” as reasons for investors to escape fiat currencies and pile into …

Continue reading »

10-23-25 Dollar Debasement: Reality Or Dangerous Narrative?

10-23-25 Dollar Debasement: Reality Or Dangerous Narrative?

2025-10-23

Gold’s rally has investors shouting “dollar debasement!” — but is the narrative real, or just a speculative illusion?

Lance Roberts & Michael Lebowitz break down the popular debasement argument and expose the facts behind the gold surge. From money supply trends to Fed policy and global confidence in the U.S. dollar, we separate the data from the hype.

0:19 – Stresses Emerging in Lower End of Economy

4:45 – The Oil Price Pop

6:35 -Good News – Bads News on Wall Street

10:38 -CPI Preview Despite Government Furlough

15:32 – Bond Market Expectations for Economic Growth

17:58 – The Challenge of Managing Money for the Future

20:11 – Wall Street is Selling 5x Leverage

24:47 – Liquidity is Showing Signs of Drying Up

26:42 – Debasement is Not a Room in Your House

29:42 – Where Does Money Come

Why Keynes’ Economic Theories Failed In Reality

Why Keynes’ Economic Theories Failed In Reality

2025-09-05

A recent post from Daniel Lacalle, “How Keynesians Got The US Economy Wrong Again,” exposed the widening gap between John Maynard Keynes’ economic theory and reality. Despite the confident forecasts of leading Keynesian economists, the U.S. economy in 2025 continues to defy expectations. The Federal Reserve’s tightening cycle failed to trigger the widely predicted “hard …

Continue reading »

9-3-25 Why Most People Fail at Day Trading

9-3-25 Why Most People Fail at Day Trading

2025-09-03

It’s an interesting conundrum that some retirees go into day trading as a "side gig," which in turn becomes another full time job, monitoring all of the data and news. Just because you have access to information doesn’t mean you have to act upon it. Sometimes it’s better to let the dust settle before making a move.

RIS Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisors, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

——-

Sign up for Lance’s newsletter:

https://realinvestmentadvice.com/newsletter/

——-

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

——-

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

2 pings