Venezuela Leads Energy Stocks Out Of The Gate In 2026

Venezuela Leads Energy Stocks Out Of The Gate In 2026

2026-01-06

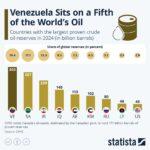

Venezuela holds 20% of the world’s proven oil reserves. Not only are they the largest, but as shown in the Statista graphic below, they hold approximately seven times that of the United States. Despite its large reserves, Venezuela has fallen well short of its ability to supply the world. US sanctions and the significant deterioration …

Continue reading »

11-19-25 Pension or Lump Sum – What’s the Smarter Move?

11-19-25 Pension or Lump Sum – What’s the Smarter Move?

2025-11-19

Choosing between a company pension and a lump-sum payout is one of the biggest financial decisions many pre-retirees will ever face—especially for workers in industries facing layoffs or restructuring, like the major oil companies in Houston right now.

Lance Roberts & Danny Ratliff break down the key factors to consider when comparing a lifetime pension annuity versus taking a lump-sum distribution you can invest or convert into a private annuity. Using a real-world scenario from a viewer—age 64, a $700,000 lump-sum offer, and a sizable 401(k)—we explore the risks, trade-offs, and questions every retiree should ask before making the call.

0:00 – INTRO

0:1 – Why Nvidia Matters

2:53 – Yes, Virginia, Draw Downs Happen

:50 – 2026 Economic Summit Preview

10:3 – It’s Just a 3% Pullback

11-18-24 The Simple Rule That Keeps You On The Right Side Of The Market

11-18-24 The Simple Rule That Keeps You On The Right Side Of The Market

2025-11-18

$SPX / $SPY just broke below its 50-day moving average, making the next support levels crucial.

In this short video, I show how to read these trend shifts so you know when to stay invested and when the weakening momentum may call for trimming exposure.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Is Strategy Dragging Bitcoin Down?

Is Strategy Dragging Bitcoin Down?

2025-11-17

Bitcoin is up 2% year to date, but the share price of the world’s largest holder of Bitcoin, Strategy (MSTR – formerly MicroStrategy), is down about 30% year to date. As we have noted in the past, Strategy is a Bitcoin holding company, a leveraged alternative to holding Bitcoin. Its original business, enterprise analytics software, …

Continue reading »

11-13-25 Everyone Thinks AI Is the Bubble — But the Real One Is the Fed

11-13-25 Everyone Thinks AI Is the Bubble — But the Real One Is the Fed

2025-11-14

For over a decade, the Fed’s endless liquidity has fueled moral hazard—pushing investors to buy every dip and keeping valuations inflated.

In this short video, @michaellebowitz and I discuss why the real bubble isn’t AI—it’s the Fed’s never-ending backstop.

📺Full episode: https://www.youtube.com/watch?v=-YZaHtreohI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

QE Is Coming: The 2008 Roots Of Fed Dominance

QE Is Coming: The 2008 Roots Of Fed Dominance

2025-11-12

Here we go again. The overnight funding markets are showing signs of stress, and the scent of QE is in the air. Per New York Fed President John Williams: Based on recent sustained repo market pressures and other growing signs of reserves moving from abundant to ample, I expect that it will not be long …

Continue reading »

An Economic Data Flood Is Coming: Does It Matter?

An Economic Data Flood Is Coming: Does It Matter?

2025-11-11

Buckle Up! With the end of the government shutdown and the return to work of government employees comes a flood of economic data. Below is a list of old economic data that should be released over the coming weeks: The list goes on. But, of more importance is whether or not the markets will care …

Continue reading »

9/24/25 Strange Recession Signals: What Markets & Odd Indicators Are Telling Us

9/24/25 Strange Recession Signals: What Markets & Odd Indicators Are Telling Us

2025-09-24

Are we really on the edge of a recession—or are investors just overthinking the signals?

Beyond unemployment and consumer spending, unusual data points like men’s underwear sales, cardboard box demand, and even giant Halloween skeleton purchases are popping up as quirky economic indicators.

Lance Roberts & Danny Ratliff break down:

• Traditional recession signals like jobless claims, consumer spending, and market fundamentals.

• Technical market warnings investors can’t ignore.

• Why strange metrics like cardboard boxes and holiday spending trends might reveal cracks in the economy.

• The psychology driving investors to go “all in” or “head for the exits.”

0:18 – The Dichotomy of Economic Data

4:43 – When Stocks are "Richly Valued"

8:42 – The Economic Indicators of Recession

16:02

3 pings