1-16-26 Why Silver Might Be the Next Micro-Bubble

1-16-26 Why Silver Might Be the Next Micro-Bubble

2026-01-16

$SLV recent surge looks more like a narrative-fueled micro-bubble than a durable macro trend.

In this Short video, Michael Lebowitz and I discuss why key cross-asset signals fail to confirm dollar debasement and what that means for #silver risk ahead.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Transportation Stocks Are At Odds With Truck Sales

Transportation Stocks Are At Odds With Truck Sales

2026-01-14

Yesterday’s Commentary noted the recent strength in transportation stocks. For example, the transportation ETF (XTN) has outperformed the S&P 500 by more than 9% over the last 25 trading days. The leading stocks within the ETF over this period include. ARCB (trucking), MATX (shipping), WERN (freight shipping), and FedEx (shipping). Some of the recent gains …

Continue reading »

11-22-25 How the Fed Controls Every Asset You Trade

11-22-25 How the Fed Controls Every Asset You Trade

2025-11-22

The Fed is now the single most important source of liquidity in every major market.

In this short video, Michael Lebowitz and I break down the key signals that reveal when liquidity stress is building and why they matter for every asset you trade.

📺Full episode: _r_I

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Capex Spending On AI Is Masking Economic Weakness

Capex Spending On AI Is Masking Economic Weakness

2025-11-21

The U.S. economy’s recent growth has a distinctive engine: large‑scale capital expenditures (capex) tied to artificial intelligence (AI). Firms such as Microsoft, Alphabet (Google), Meta Platforms, and Amazon have announced massive investments in data centers, servers, networking equipment, and AI infrastructure. As noted by Investing.com: “Artificial intelligence is consuming capital faster than investors can recalibrate. …

Continue reading »

Promised Recession…So Where Is It?

Promised Recession…So Where Is It?

2025-10-03

Over the past three years, the economic conversation has been a “promised recession.” If you read the headlines, tracked economist surveys, or even listened to Wall Street strategists, you would have assumed a downturn was imminent. Many investors, bloggers, and YouTubers have had a “parade of horribles” promising a recession is just on the horizon.The logic was …

Continue reading »

10/2/25 Valuations Don’t Matter… Until They Do

10/2/25 Valuations Don’t Matter… Until They Do

2025-10-02

Markets are trading at near all-time record valuations with little fundamental support.

Momentum is currently driving prices across all asset classes, but when earnings reality fails to match lofty expectations, valuations start to matter. And that’s when the music stops.

In this short video, I show why history warns against ignoring valuations and what it means for risk and returns ahead.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

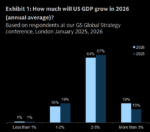

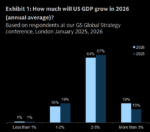

9/26/25 2026 Growth Expectations Are Ahead of Reality

9/26/25 2026 Growth Expectations Are Ahead of Reality

2025-09-29

Wall Street expects a broad earnings rebound (beyond MAG7) in 2026, but the data says otherwise.

In this short video, I discuss why hopes for strong economic growth—without stimulus, with weakening leading indicators, and with the yield curve still inverted—are ahead of reality.