1-7-26 Let’s Talk About Venezuela, Oil Prices & Energy Stocks

1-7-26 Let’s Talk About Venezuela, Oil Prices & Energy Stocks

2026-01-07

Energy stocks $XLE are running ahead of oil fundamentals, and that gap won’t last forever.

In this Short video, Lance Roberts explains how Venezuela, supply risk, and slowing demand could push #crudeoil prices lower and force energy stocks to catch up.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

2026 Forecast: Tis The Season For Wild Guesses

2026 Forecast: Tis The Season For Wild Guesses

2026-01-07

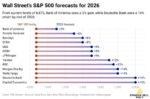

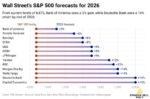

It’s that time of year when every Wall Street analyst posts their forecast for where the S&P 500 will close at the end of 2026. This year, as in every other, Wall Street expects the S&P 500 to post positive returns. As shown below, Bank of America is the most cautious, with a 3% gain, …

Continue reading »

Margin Debt Sets Records: Should We Be Concnered?

Margin Debt Sets Records: Should We Be Concnered?

2025-11-19

There is a strong historical relationship between margin debt and the stock market. Given that margin debt just set a record at $1.18 trillion, it’s worth appreciating the mechanics that support this relationship and what it may tell us about how much longer the bull market may run. When stocks rise, the wealth effect kicks …

Continue reading »

11-12-25 A Daily Dose Of Charts & Graphs

11-12-25 A Daily Dose Of Charts & Graphs

2025-11-12

In this short video, I cover the return of risk appetite, falling rents signaling disinflation, and the $5–$7T AI data-center buildout.

I also touch on $AAPL push into robotics and the massive power and funding needs driving the next tech super-cycle — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Defensive Rotation? Energy Stocks on the MoveThe Real Investment Show

Defensive Rotation? Energy Stocks on the MoveThe Real Investment Show

2025-09-26

Energy stocks $XLE are breaking out, even as oil remains flat near $64.

In this short video, I explain why a bullish golden cross and rising strength point to a potential defensive rotation from $SPY / $QQQ.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Equity Fund Outflows Soar: Blip or Warning?

Equity Fund Outflows Soar: Blip or Warning?

2025-09-23

Our friend Jim Colquitt, in his Weekly Chart Review, brought to our attention a large and irregular outflow from equity funds last week. He cites a Reuters article stating that investors withdrew $43 billion from US equity funds last week. That was the largest outflow since December 2024. The graph below shows that equity fund …

Continue reading »

9/18/25 The Real Reason The Market Popped After the Fed Cut

9/18/25 The Real Reason The Market Popped After the Fed Cut

2025-09-18

The Fed cut rates as expected, but Powell admitted uncertainty and insisted policy is still "restrictive."

@michaellebowitz and I discuss why markets see it as "accommodative" and are rallying on that perception, with $INTC & $NVDA helping big.

#FedRateCut #StockMarketRally #PowellSpeech #NvidiaStocks #InterestRates

Semiannual Reporting Requirements Are Overhyped

Semiannual Reporting Requirements Are Overhyped

2025-09-17

President Trump is pushing to reduce the SEC’s financial reporting requirements from quarterly to semiannual reporting. He’s framing the idea in a positive light: it would allow managers to focus on the business, lower compliance costs, and fight “short-termism” in markets. In reality, it would weaken one of the hallmarks of U.S. capital markets: timely …

Continue reading »

1 pings