Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| Leverage drives bull markets higher—but when sentiment shifts, it accelerates the fall. In this Short video, I explain how margin debt above $1 trillion fuels gains today but can trigger a rapid, cascading selloff when the tide turns. $SPX $QQQ Full episode: Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

9/22/25 Stock Market Outlook: Bullish or Bearish?

9/22/25 Stock Market Outlook: Bullish or Bearish?

2025-09-22

Are markets set to keep climbing, or are we staring down the next pullback? Lance Roberts breaks down the bullish vs. bearish case for stocks, exploring what could fuel the rally—and what risks could trip it up.

From the Federal Reserve’s latest moves, to earnings trends, market breadth, and money flows, we’ll cover the key factors driving sentiment. Whether you lean bullish or bearish, this analysis will help you understand the forces shaping today’s market.

📺 Subscribe for daily insights on markets, risk management, and smart investing strategies:

https://www.youtube.com/c/TheRealInvestmentShow

#StockMarketOutlook #BullishVsBearish #MarketVolatility #Investing2025 #FinancialMarkets

2025-09-22

Just recently, Scott Rubner of Citadel Securities wrote an excellent piece discussing the bull versus the bear case for the markets. You look at the markets today and see a tension between expectation and reality. On one hand, equities—especially tech and growth—are pushing to fresh highs. Optimism about rate cuts, AI and productivity gains, global …

9/17/25 Big Day: Fed Day

9/17/25 Big Day: Fed Day

2025-09-17

It’s Fed Day – the most anticipated event for markets this month. The Federal Reserve’s rate decision and Jerome Powell’s press conference could shape the direction for stocks, bonds, and the economy heading into year-end.

Lance Roberts & Danny Ratliff break down:

• What the Fed is likely to announce today

• The impact on interest rates, inflation, and growth

• How markets ($SPY, $QQQ, bonds, gold) typically react to Fed decisions

• Why risk management matters as volatility rises around policy changes

Stay tuned for clear insights on how today’s FOMC meeting could set the tone for investors into Q4.

📌 Subscribe for more daily market commentary and investing insights: https://www.youtube.com/c/TheRealInvestmentShow

0:18 – The Great Asset ChaseSEG-1b: Market Movement Muted

3:13 – The

Invest Or Index – Exploring 5-Different Strategies

Invest Or Index – Exploring 5-Different Strategies

2025-09-15

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

9-12-25 The Essential Hierarchy of Money Goals

9-12-25 The Essential Hierarchy of Money Goals

2025-09-12

Where should your money go first? Too often, people skip ahead to investing or wealth strategies before laying the right foundation. Richard Rosso and Matt Doyle break down the essential hierarchy of money goals—a clear order of priorities to help you stay on track.

From emergency savings and debt reduction to investing, wealth protection, and legacy planning, this framework shows you exactly how to progress step by step.

By focusing on the right goals at the right time, you’ll reduce stress, improve financial security, and set yourself up for long-term success.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Relationship Manager, Matt Doyle, CFP

Produced by Brent Clanton, Executive Producer

——-

The latest installment of our new feature, Before

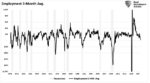

Corporate Earnings Slowdown Signaled By Employment Data

Corporate Earnings Slowdown Signaled By Employment Data

2025-09-12

The latest employment data strongly warned of a potential corporate earnings slowdown ahead. This is the first time we have warned about the employment data and its impact on corporate earnings. In May, we penned “Employment Data Confirms Economy Is Slowing.” wherein we stated: “Given the importance of consumption in the economy and that employment (production) must come …

Tags: Featured,newsletter

4 pings