Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| Markets are priced for perfection heading into next year. Earnings expectations are unusually high. If those forecasts get revised lower, the market will have to reprice quickly. In this short video, Lance Roberts explains why high valuations and aggressive earnings forecasts create real revision risk if results fail to measure up. 📺Full episode: -vnHx4Eg Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

Permanent Job Losers: A Worrying Facet Of Today’s Economy

Permanent Job Losers: A Worrying Facet Of Today’s Economy

2025-11-24

Given the two-month delay, Thursday’s BLS employment report on September labor market conditions was not nearly as pertinent as the BLS data typically is. Despite it being old news, it is worth sharing that the number of jobs increased by 119k, but the unemployment rate ticked up from 4.3% to 4.4%. The markets didn’t seem …

11-26-25 Confidence, Chaos, and The K-Shaped Economy

11-26-25 Confidence, Chaos, and The K-Shaped Economy

2025-11-19

Peter Atwater, one of the leading voices on confidence-driven behavior in markets and society, joins Lance Roberts to share how certainty, control, and herd mentality shape every major trend investors face today.

Lance and Peter discuss The Confidence Map, why people behave differently when they’re in the “comfort zone” versus the “stress center,” and how these shifts explain the rise of speculative investing, the bifurcated K-shaped economy, and the growing disconnect between Wall Street and Main Street.

#PeterAtwater #BehavioralFinance #KShapedEconomy #InvestorPsychology #AIandMarkets

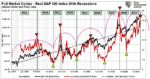

Full Market Cycles: Half Bull and Half Bear

Full Market Cycles: Half Bull and Half Bear

2025-11-17

Last week, we discussed the importance of “math” as it relates to valuations and noted the importance of understanding “full market cycles.” To wit: “The math on forward return expectations, given current valuation levels, does not hold up. The assumption that valuations can fall without the price of the markets being negatively impacted is also grossly flawed. …

10-3-25 Forget the Shutdown, Jobs Are Getting Weaker and Weaker

10-3-25 Forget the Shutdown, Jobs Are Getting Weaker and Weaker

2025-10-03

The real story isn’t the government shutdown. ADP just showed another 32,000 job losses, with prior months revised lower.

In this short video, @michaellebowitz and I discuss why the labor market is deteriorating even without the BLS report and what it means for $SPY / $QQQ.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

RSI (Relative Strength Index): Timing The Next Correction

RSI (Relative Strength Index): Timing The Next Correction

2025-09-29

In the world of technical analysis, there is one reliable indicator for measuring market risk. The relative strength index (RSI) measures overextension (in either direction). Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator. As such, it measures the velocity and magnitude of price changes, plotting those on a scale from 0 …

9/24/25 Strange Recession Signals: What Markets & Odd Indicators Are Telling Us

9/24/25 Strange Recession Signals: What Markets & Odd Indicators Are Telling Us

2025-09-24

Are we really on the edge of a recession—or are investors just overthinking the signals?

Beyond unemployment and consumer spending, unusual data points like men’s underwear sales, cardboard box demand, and even giant Halloween skeleton purchases are popping up as quirky economic indicators.

Lance Roberts & Danny Ratliff break down:

• Traditional recession signals like jobless claims, consumer spending, and market fundamentals.

• Technical market warnings investors can’t ignore.

• Why strange metrics like cardboard boxes and holiday spending trends might reveal cracks in the economy.

• The psychology driving investors to go “all in” or “head for the exits.”

0:18 – The Dichotomy of Economic Data

4:43 – When Stocks are "Richly Valued"

8:42 – The Economic Indicators of Recession

16:02

Tags: Featured,newsletter