Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| Markets may be mispricing the Fed by betting too aggressively on rate cuts in 2026. In this Short video, Michael Lebowitz and I discuss why growth-driven inflation could return and derail the rate-cut thesis that’s fueling the current rally. 📺Full episode: Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

12-18-25 The Fed Turned the Liquidity Back On: Watch These Assets

12-18-25 The Fed Turned the Liquidity Back On: Watch These Assets

2025-12-19

The Fed is adding liquidity (QE), whatever label they use. The assets most tied to reserves are the ones that will move first: #Bitcoin, major indexes $SPX / $QQQ, transportation, and materials.

In contrast, defensive sectors, $GLD, and $SLV show little to no relationship to changes in reserves.

Please ❤️like and 🔁retweet

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

BLue Owl Roils The AI Narrative

BLue Owl Roils The AI Narrative

2025-12-19

Blue Owl Capital spooked AI investors on Wednesday when the Financial Times reported that the firm, one of Oracle’s larger financing partners for major U.S. data centers, decided not to provide equity backing for a $10 billion data center Oracle is building in Michigan. This planned facility is part of Oracle’s collaboration with OpenAI under …

12-25-25 Christmas Day Q & A

12-25-25 Christmas Day Q & A

2025-12-15

Our Christmas Day Best-Of episode revisits some of the most important investing and financial planning discussions of the year.

Lance Roberts, Danny Ratliff, & Jonathan Penn examine whether the traditional 60/40 portfolio still serves its original purpose of reducing volatility, and what the three legs of investing mean in today’s market environment; whether the Federal Reserve has shifted away from its inflation mandate, how to interpret 2- and 3-standard-deviation market moves using tools like Bollinger Bands, and which economic data truly matters for investors—and where to find it.

We close by addressing common misconceptions around inflation, including the real impact of tariffs and why sustainable economic growth requires some level of inflation, along with a thoughtful

Amazon And OpenAI: Yet Another Massive Investment In AI

Amazon And OpenAI: Yet Another Massive Investment In AI

2025-11-04

Yesterday morning, OpenAI announced a massive $38 billion strategic partnership with Amazon Web Services (AWS). This deal highlights OpenAI’s diversification strategy amid explosive growth and capacity demands for training advanced models like ChatGPT. Before the deal, OpenAI relied 100% on Microsoft for its cloud infrastructure. In addition to diversifying its cloud servers, the deal may …

Hindenburg Strikes: Omen Or False Alarm?

Hindenburg Strikes: Omen Or False Alarm?

2025-11-03

Last Wednesday, for the first time since November 2021, a Hindenburg Omen hit. This gauge is triggered when an upward trend is met with a growing number of stocks hitting both new 52-week highs and lows. Such indicates bad breadth, weakening momentum, and indecision. If all five conditions listed below are met, the indicator gives …

Liquidity Concerns Put An End To QT

Liquidity Concerns Put An End To QT

2025-10-30

Two weeks ago, Jerome Powell stated, “We may be approaching the end of our balance sheet contraction in the coming months.” In simple terms, as we wrote HERE, he is prepping the market for a quicker end to QT than was previously expected. While Powell was cryptic about why, the answer is obvious: liquidity concerns. …

10-29-25 A Daily Dose Of Charts & Graphs

10-29-25 A Daily Dose Of Charts & Graphs

2025-10-29

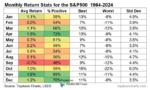

In this Short video, I cover $SPY / $QQQ breakout to new highs, $NVDA $5T surge and its potential trade-deal boost, the seasonality tailwind into year-end, and why overbought mega-cap growth may soon rotate into oversold low beta.

I also touch on the strong earnings breadth, Fed rate-cut backdrop, and sentiment parallels to the late-’90s melt-up — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

9/8/25 Why Diversification Is Failing In The Age Of Passive Investing

9/8/25 Why Diversification Is Failing In The Age Of Passive Investing

2025-09-08

NOTE: As of 10:50a CDT YouTube has yet to process this video sufficiently for us to edit or add time codes. We’ll revise all of these as soon as YouTube allows.

Lance Roberts explores how the rise of passive index funds and ETFs has reshaped markets, leading to higher correlations across asset classes and eroding the traditional benefits of diversification. Once considered the cornerstone of portfolio risk management, diversification now struggles as capital floods into passive vehicles—concentrating money in the same stocks and sectors. Lance also takes a crack at Keynesian Economics and the trouble with Government spending; what would happen if the Fed produces an intra-meeting rate cut; an examination of the dollars currently required to generate GDP growth,

SEG-1a: Economic Trends

Tags: Featured,newsletter