Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| The Fed is preparing to cut rates just as an AI-driven boom accelerates. In this short video, MIchael Lebowitz and I discuss why easing into strength is unusual, how it could stoke inflation, and what it means for the next phase of market growth. 📺Full episode: https://www.youtube.com/watch?v=-YZaHtreohI Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

10-31-25 Why Risk Tolerance Questionnaires Don’t Work

10-31-25 Why Risk Tolerance Questionnaires Don’t Work

2025-10-31

Most investors have filled out a risk tolerance questionnaire—but does it really measure how you’ll behave when markets crash? Richard Rosso & Jonathan McCarty break down why traditional risk tolerance tools fail to predict investor behavior, how emotions override risk profiles, and why time horizons, liquidity needs, and cash flow matter far more than a few survey questions.

Understand risk before markets remind you what it really feels like.

[NOTE: Use hashtags only on Substack posts!]

#FinancialPlanning #RiskManagement #InvestorBehavior #WealthStrategy #RIAAdvisors

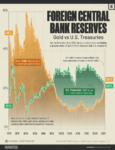

Gold Myths Luring Investors Into Risk

Gold Myths Luring Investors Into Risk

2025-10-31

In case you haven’t heard, precious metals, particularly gold, have risen sharply this year. Of course, whenever any asset class experiences a more speculative melt-up, investors are quick to rationalize why “this time is different.” In stocks, it is about “artificial intelligence” and “data centers.” The cryptocurrency community believes all fiat currencies will fail and …

10-27-25 How Greed, Innovation & Leverage Create Every Market Bubble

10-27-25 How Greed, Innovation & Leverage Create Every Market Bubble

2025-10-27

Speculative bubbles don’t appear overnight – they evolve through cycles of greed, innovation, and leverage.

In this Short video, I explain how the same cycle of easy money and speculation keeps repeating, just with new assets and fancier language each time.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Retail Leverage Goes to Extremes

Retail Leverage Goes to Extremes

2025-10-25

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you’d like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Leveraged ETFs: Yet Another Sign Of Rampant Speculation

Leveraged ETFs: Yet Another Sign Of Rampant Speculation

2025-10-22

Not only is the market chasing the most speculative of assets, but it is employing record amounts of leverage to do so. Traditionally, investors use margin loans to gain leverage. More recently, however, leveraged ETFs allow investors to get leverage in one package. To wit, the graph below, courtesy of BofA, shows that there are …

8-29-25 Profits are Good

8-29-25 Profits are Good

2025-08-29

Do you freeze up when considering selling a stock at a profit because you don’t want to pay taxes? Remember, if you have to pay taxes, you made money, and isn’t that the whole point of investing?

RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Relationship Manager, Matt Doyle, CFP

Produced by Brent Clanton, Executive Producer

——-

Sign up for Lance’s newsletter:

https://realinvestmentadvice.com/newsletter/

——-

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

——-

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

——-

Register for our next RIA Dynamic Learning Series event, "Savvy Medicare Planning," September 18, 2025:

Tags: Featured,newsletter

3 pings