Tag Archive: Weekly Market Update

Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

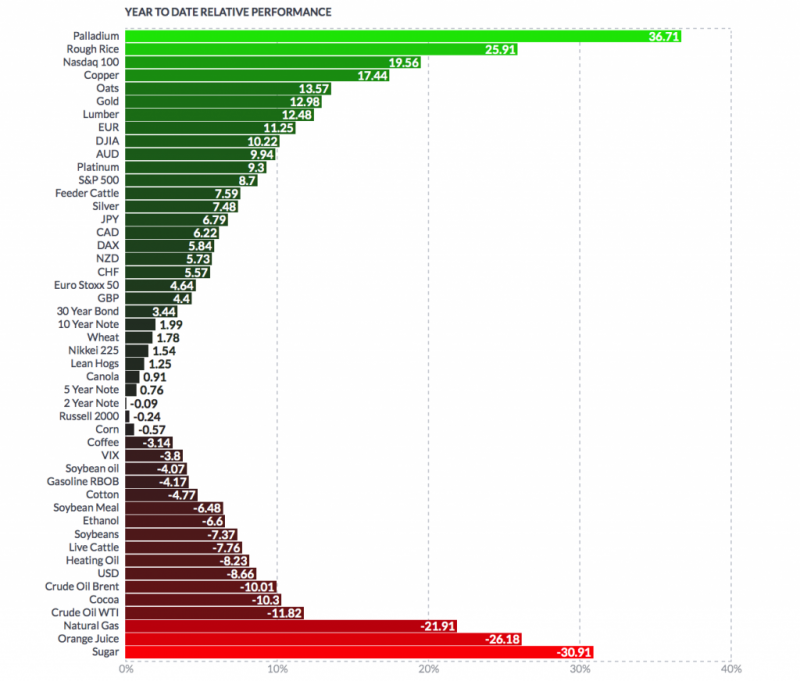

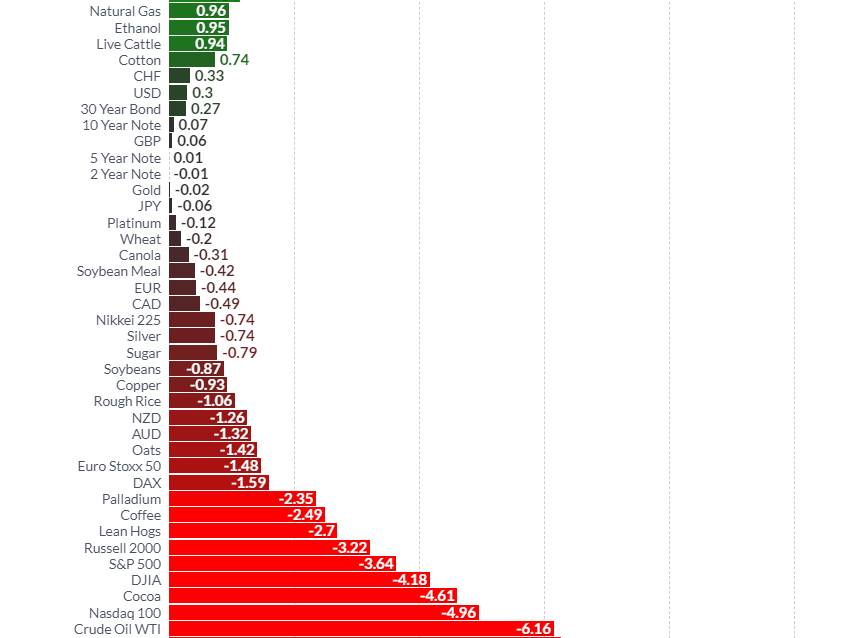

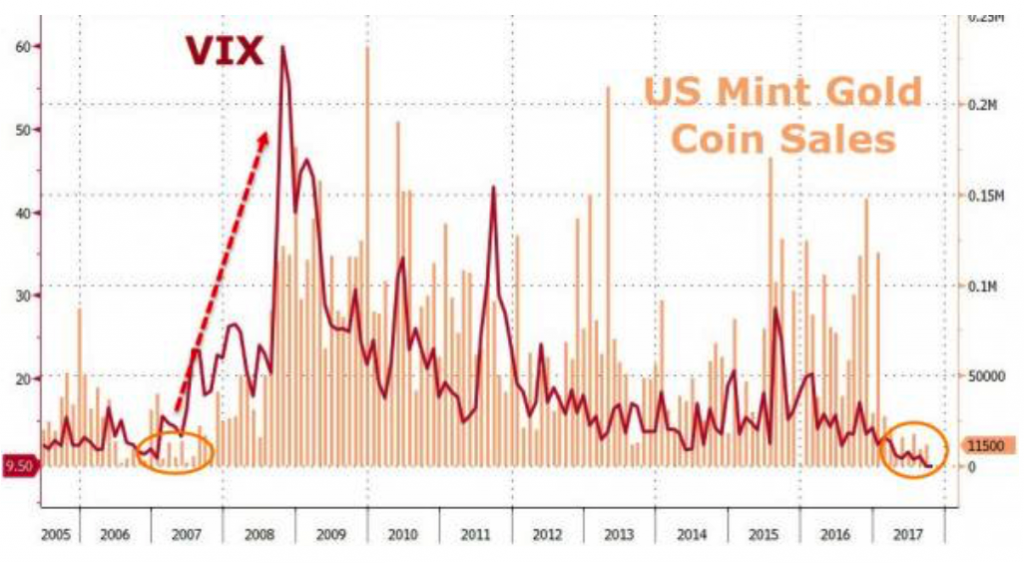

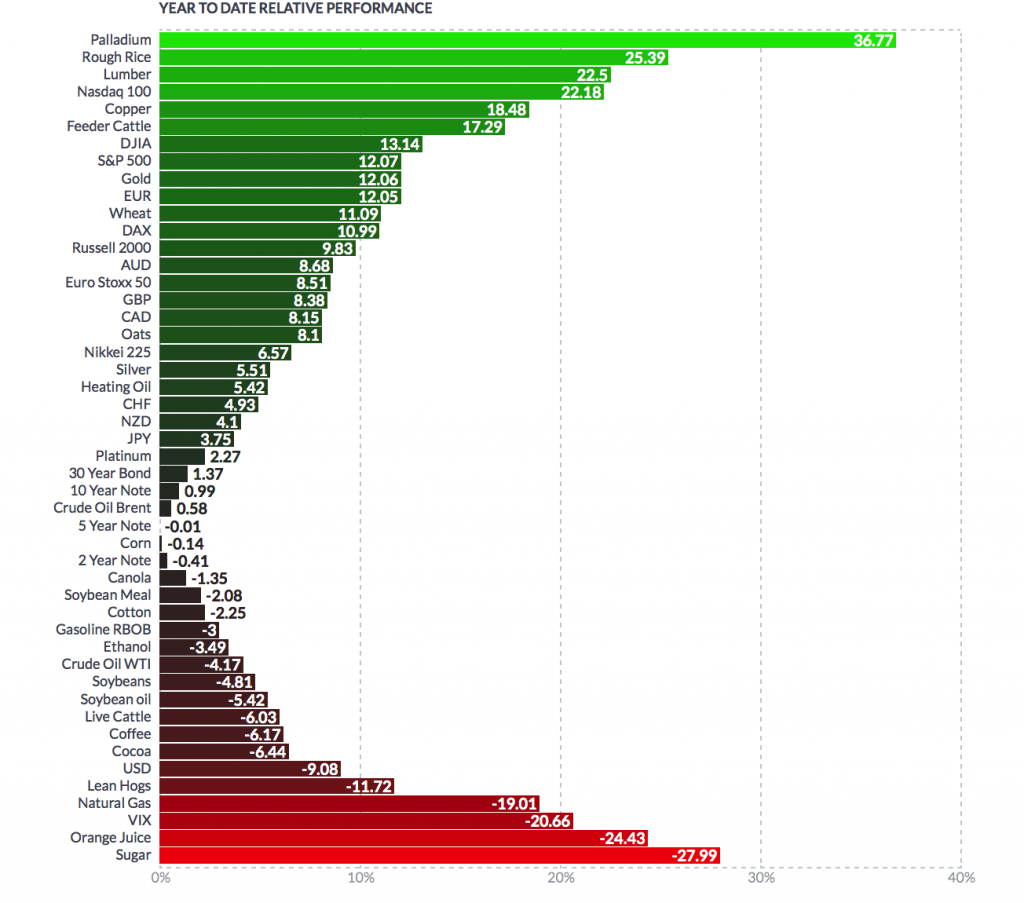

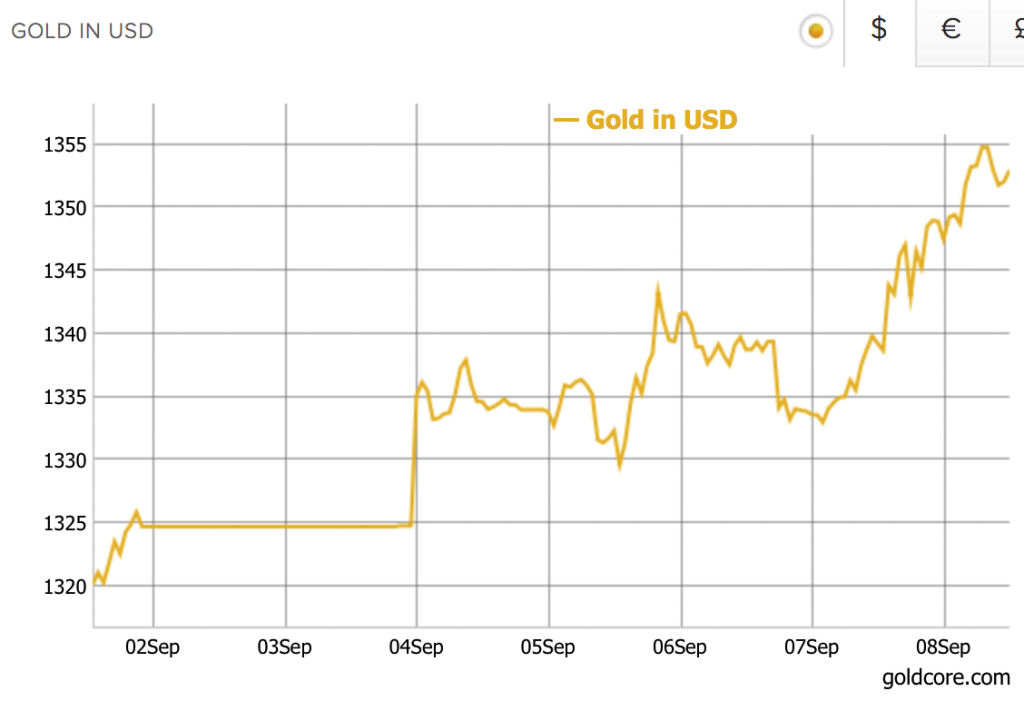

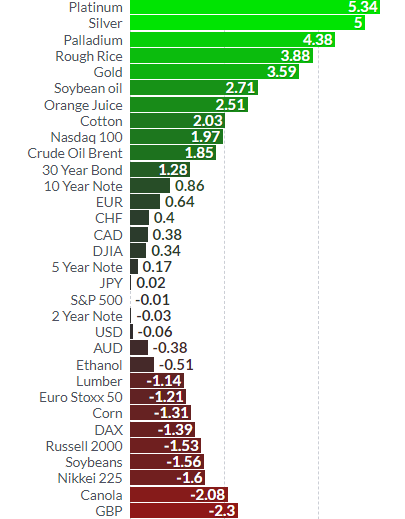

Gold and silver rise as stocks fall sharply after Barcelona attack. Gold, silver 0.6% higher in week after last weeks 2%, 5% rise. Palladium +36% ytd, breaks out & reaches 16 year high (chart). Gold to silver ratio falls to mid 75s after silver gains last week

Read More »

Read More »

Gold Consolidates On 2.5percent Gain In July After Dollar Has 5th Monthly Decline

Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline. Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar. All eyes on non farm payrolls today for further signs of weakness in U.S. economy. Gold recovers from 1.7% decline in June as dollar falls. Gold outperforms stocks and benchmark S&P 500 YTD.

Read More »

Read More »

This Is Why Shrinkflation Is Impacting Your Financial Wellbeing

Shrinkflation has hit 2,500 products in five years. Not just chocolate bars that are shrinking. Toilet rolls, coffee, fruit juice and many other goods. Effects of shrinkflation been seen for “good number of years”. Consumer Association of Ireland. Shrinkflation is stealth inflation, form of financial fraud. Punishes vulnerable working and middle classes. Gold is hedge against inflation and shrinkflation.

Read More »

Read More »

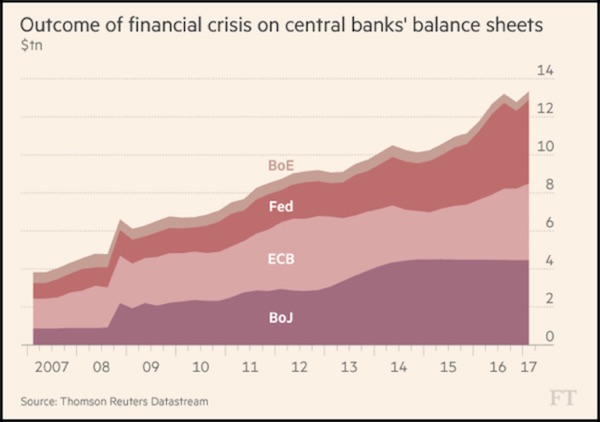

“Financial Crisis” In 2017 Or By End Of 2018 – Prepare Now

John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major financial crisis, if not later this year, then by the end of 2018 at the latest.”

Read More »

Read More »

“Financial Crisis” Of Historic Proportions Is “Bearing Down On Us”

“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us”. John Mauldin of Mauldin Economics lata“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us”.

John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis.

Read More »

Read More »

Silver Prices Bounce Higher After 7% Fall In Minute

– Silver prices ‘flash crash’ before rebound– Silver hammered 7% lower in less than minute in Asian trading– Silver fell from $16 to $14.82, before recovering to $15.89– Silver plunge blamed on another ‘trading error’– Gold similar ‘flash crash’ last week and similar recovery– Hallmarks of market manipulation as $450 million worth of silver futures sold in minute– Trading ‘errors’ always push gold and silver lower. Why never...

Read More »

Read More »

Go for Gold – Win a beautiful Gold Sovereign coin

The Irish Times has teamed up with GoldCore, Ireland’s first and leading gold broker, to offer you the chance to win a beautiful, freshly minted Gold Sovereign coin (2017) which contains nearly one quarter of an ounce of gold and is ‘investment grade’ 22 carat pure gold.

Read More »

Read More »

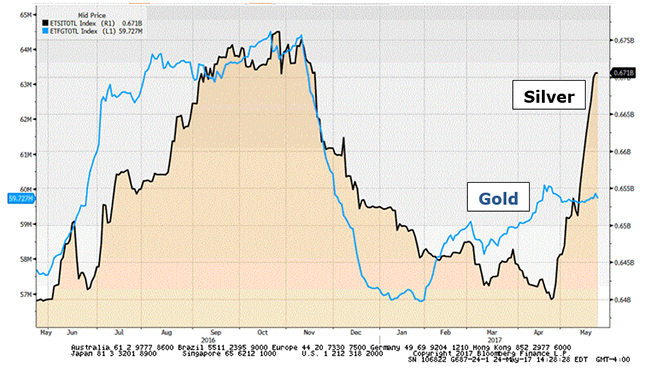

Silver Bullion In Secret Bull Market

Do you think silver is poised to go higher? I sure do. That’s because I’m watching what is going on in the world’s silver ETFs. I’m also watching the mountain of forces that are piling up to push the metal higher.

Look at this chart. It shows all the metal held by the world’s physical silver ETFs (black line). And all the metal held by the world’s physical gold ETFs (blue line) …

Read More »

Read More »

Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies

Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies – Cyberattacks expected to spread today in “second phase”– UK intelligence says scale of threat significant– Microsoft slams NSA for letting hacking tools cause global malware epidemic– Ransomware attack already crippled more than 200,000 computers in 150 countries– 1.3 million computer systems believed to be at risk

Read More »

Read More »

History of Gold – Interesting Facts and Changes Over 50 Years

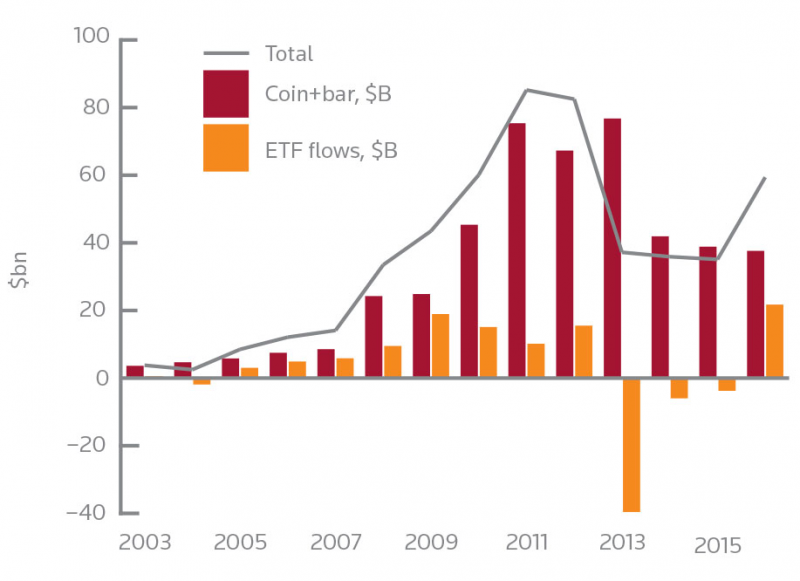

History of Gold – How the gold industry has changed over 50 years. Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: Gold market size– Gold mine production “peaked in 2015”. South African production collapse from 1,000 tonnes.

Read More »

Read More »

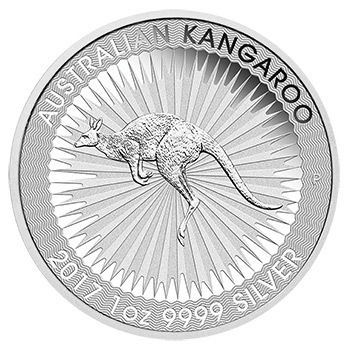

Perth Mint Silver Bullion Sales Rise 43 percent In March

Perth Mint’s silver bullion sales rise 43% in March. Perth Mint’s monthly gold coin, bars sales fall 12%. Gold silver ratio of 32 – 32 times more silver ounces sold. Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow.

Read More »

Read More »

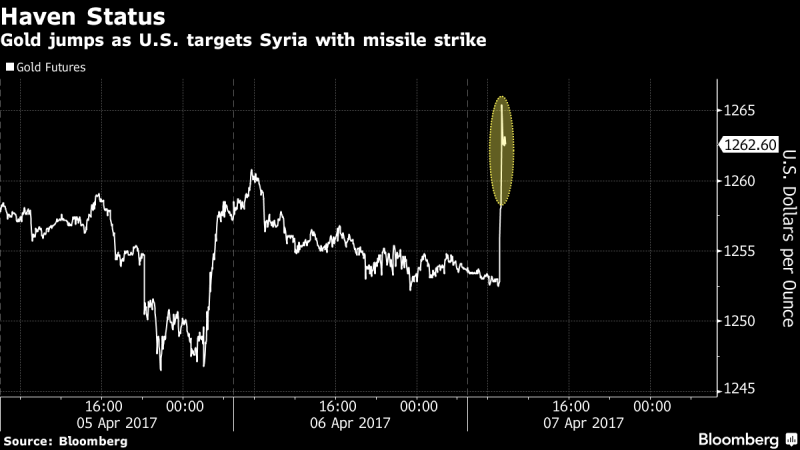

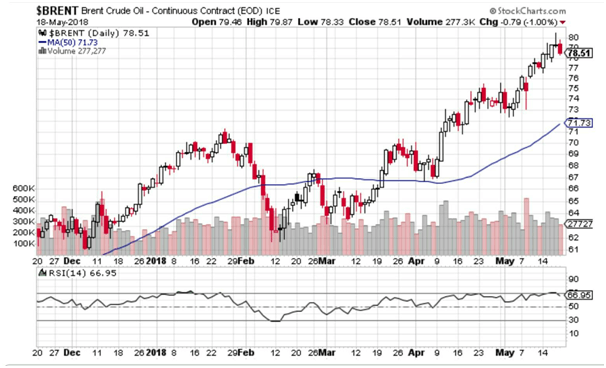

Gold Silver Oil Spike After U.S. Bombs Syria

Gold silver oil spike after U.S. bombs Syria. Gold and silver spike 1% as oil rises 1.4%. Gold breaks 200 day moving average, 4th week of gains. Stocks fall after U.S. strikes in Syria rattle markets. U.S. missiles hit airbase; Lavrov says no Russian casualties; Russia deploys cruise missile frigate to Syria.

Read More »

Read More »

Gold ETFs or Physical Gold? Dangers In Exchange Traded Funds

Considering the public’s waning trust in the banking system, many investors find themselves wondering how GLD stacks up to owning the real thing. When you look at both assets more closely, it’s clear that gold ETFs and gold bullion are very different investments.

Read More »

Read More »

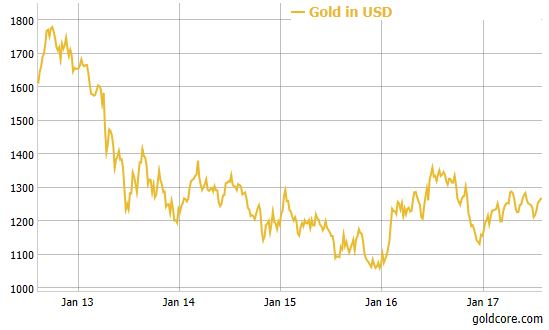

Gold Prices Up 6 percent YTD As Trump ‘Honeymoon’ Ends

Gold prices continued to shine this week reaching $1,244.70 per ounce and and has posted gains in five of the last six weeks. This week it reached a new three-month high – it’s highest since the Trump win and has climbed over 6% this year, beating the gains made in the same period in 2016.

Read More »

Read More »

Dow 20K, US Debt $20 Trillion, Trump and Gold

By Jan Skoyles, Editor Mark O’Byrne

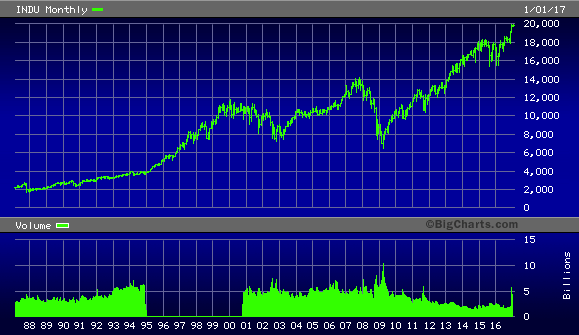

In case you’ve been hiding under a rock, the Dow Jones Industrial Average reached 20,000 earlier this week for the first time in its 132 year history to much media fanfare.

Bigcharts via Financial Sense

Since Trump’s election US market indicators, including the Dow have been ticking up – it has been labelled the Trump rally. This latest milestone is something that the new President is happy to take credit for....

Read More »

Read More »