Tag Archive: Weekly Market Update

Gold and Silver Hold Firm as Stocks and Oil Lower in to US Holiday Weekend

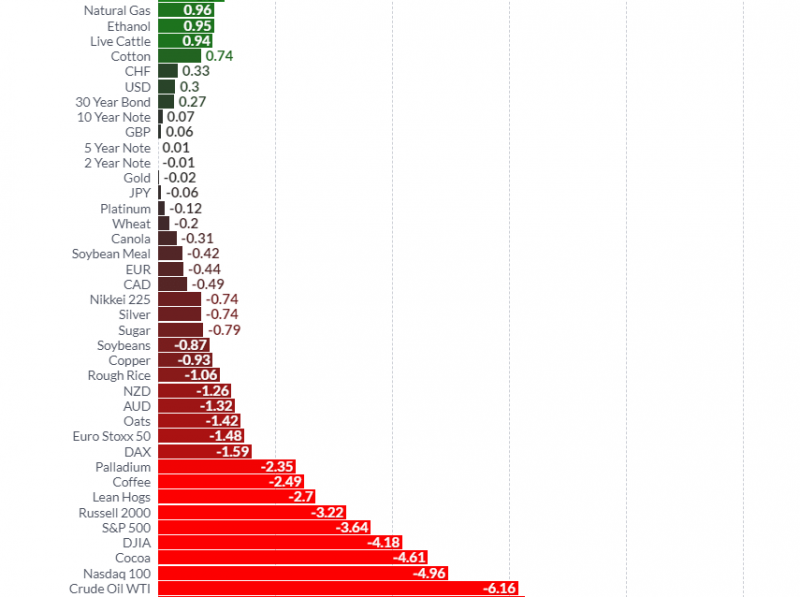

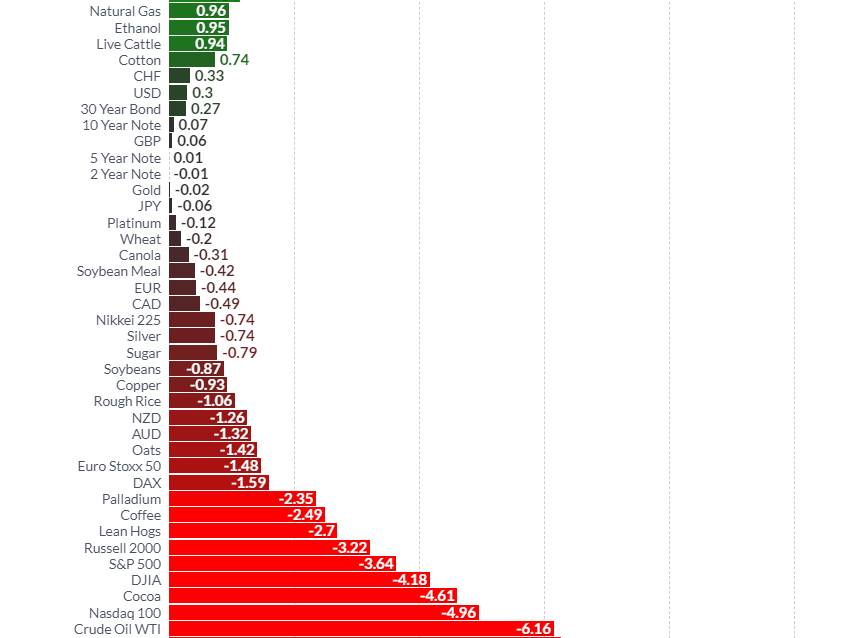

Key Gold and Precious Metals News, Commentary and Charts This Week. Gold and silver traded sideways this week as we saw stock markets take some heat and undo most of the recent recovery from the October sell off. Oil has sold off and is now at levels that we haven’t seen since 2017.

Read More »

Read More »

Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets

Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets. News, Commentary, Charts and Videos You May Have Missed. Here is our Friday digest of the important news, commentary, charts and videos we were informed by this week. Market jitters and volatility have returned this week and the sell-off in US government bonds led to sharp falls on Wall Street centered on the very overvalued tech sector and the...

Read More »

Read More »

US 10-Year Surges, Emerging Markets Implode…Where Next for Gold?

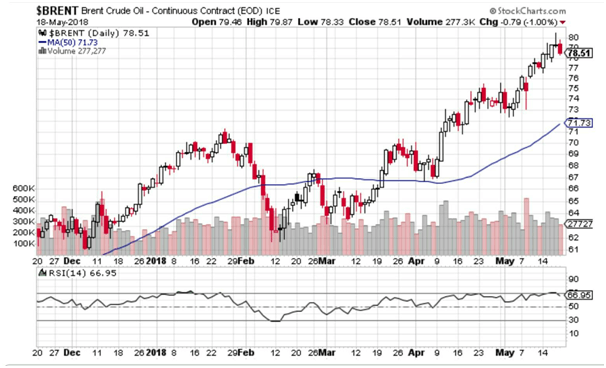

US 10-Year Yields Top 3%, US Dollar Pushes Higher. Brent Hits $80, Highest in 4 years. Emerging Market Chaos, the Lira and Peso in Freefall. Italy’s New Coalition Signal Their Plans, Yields Jump. Japanese Economy Contracts, GDP Worst Since 2015. And Where Next for Gold?

Read More »

Read More »

Welsh Gold Being Hyped Due To The Royal Wedding?

Welsh gold and the misconceptions surrounding it – GoldCore speak to China Central Television (CCTV). Welsh gold mired in misconceptions, namely that it is ‘rarest’ and most ‘sought after’ gold in world. Investors to be reminded that all mined gold is rare and homogenous. Nothing chemically different between Welsh gold and that mined elsewhere. Investors led to believe Welsh gold is more valuable, despite lack of authenticity in some Welsh gold...

Read More »

Read More »

Oil price highest in 3 years, gold ready to follow

U.S. withdraws from Iran nuclear deal. Oil jumps past $70. Argentina hikes interest rates to 40%. S. 10 year disparity. Western buying returns to gold. Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%).

Read More »

Read More »

Buy Silver And Sell Gold Now

Buy silver and sell gold now – Frisby. Gold should cost 15 times as much as silver. Silver might have disappointed in short term – But it’s time to buy. Editor’s note: Silver has outperformed stocks, bonds and gold over long term (see table).

Read More »

Read More »

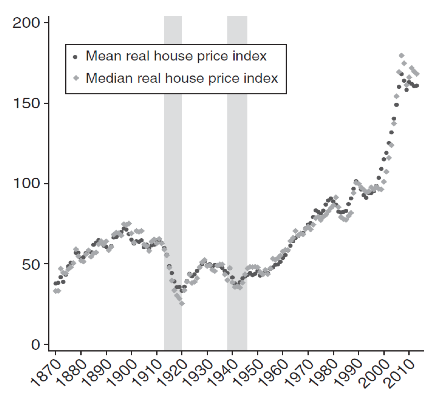

Brexit Risks Increase – London Property Market and Pound Vulnerable

Brexit Risks Increases – London Property Market and Pound Vulnerable. Brexit uncertainty deepens as UK government in disarray. BOE warns of earlier and larger rate hikes for Brexit-hit UK. UK property prices fall second month in row, London property under pressure. No deal Brexit estimated to cost UK £80bn according to government analysis. Transition period causing major uncertainty for UK and pound. Pound expected to fall as Brexit fears remain...

Read More »

Read More »

Davos – My Personal Experience of the $100,000 Event, $60 Burgers, Massive Inequality and the Blockchain Revolution

Davos elite hear warnings of complacency akin to 2007 as economic risks grow. Toxic mix of infallible belief, arrogance, megalomania and economic ignorance. Some express concern economies are vulnerable due to imbalances, trade, geo-political tensions. Soros: Trump creating ‘mafia state’ & ‘set on a course towards nuclear war’ with N Korea. Bond bear market, rising interest rates and massive $233 trillion debt are some of the many threats to...

Read More »

Read More »

It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System

Christmas film serves as reminder that savings are not guaranteed protection by banks. Savers are today more exposed to banking risks than ever before. Gold and silver investment reduce exposure to counterparty risks seen in financial system. Basket of Christmas goods has climbed since 2016 thanks to 11% climb in gold price.

Read More »

Read More »

An Interview with GoldCore Founder, Mark O’Byrne

“Uber-bull predictions of gold at over $5,000 per ounce are not beyond the realms of possibility…” So says GoldCore founder and self-confessed gold bug, Mark O’Byrne. Indeed, I recently caught up with Mark to get his thoughts on gold and what’s going on with it right now… But before we got to the nitty-gritty, I started by asking him a little about his background.

Read More »

Read More »

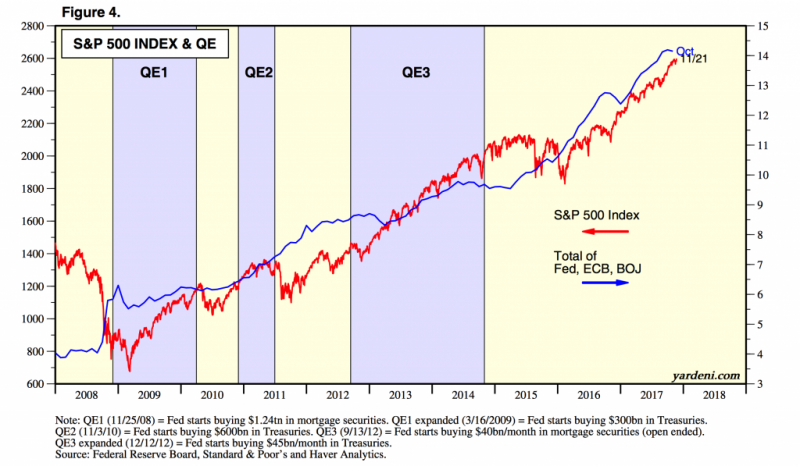

Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making. Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’. Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’. Members seem oblivious to impact of inflation on households and savings. Physical gold and silver remain the only assets for real diversification and...

Read More »

Read More »

Gold Coins and Bars Saw Demand Rise 17percent to 222T in Q3

Gold coins and bars saw demand rise 17% to 222t in Q3, driven largely by China. Chinese investors bought price dips, notching up fourth consecutive quarter of growth. Jewellery, ETF demand fell while gold coins and bars saw increased demand. Central banks bought a robust 111t of gold bullion bars (+25% y-o-y). Russia, Turkey & Kazakhstan account for 90% of 111t of central bank demand. Turkey increased gold purchases and saw broad based physical...

Read More »

Read More »

Russia Buys 34 Tonnes Of Gold In September

Russia adds 1.1 million ounces to reserves in ongoing diversification from USD. 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest. Russia’s gold reserves are at highest point in Putin’s 17-year reign. Russia’s central bank will buy gold for its reserves on the Moscow Exchange.

Read More »

Read More »

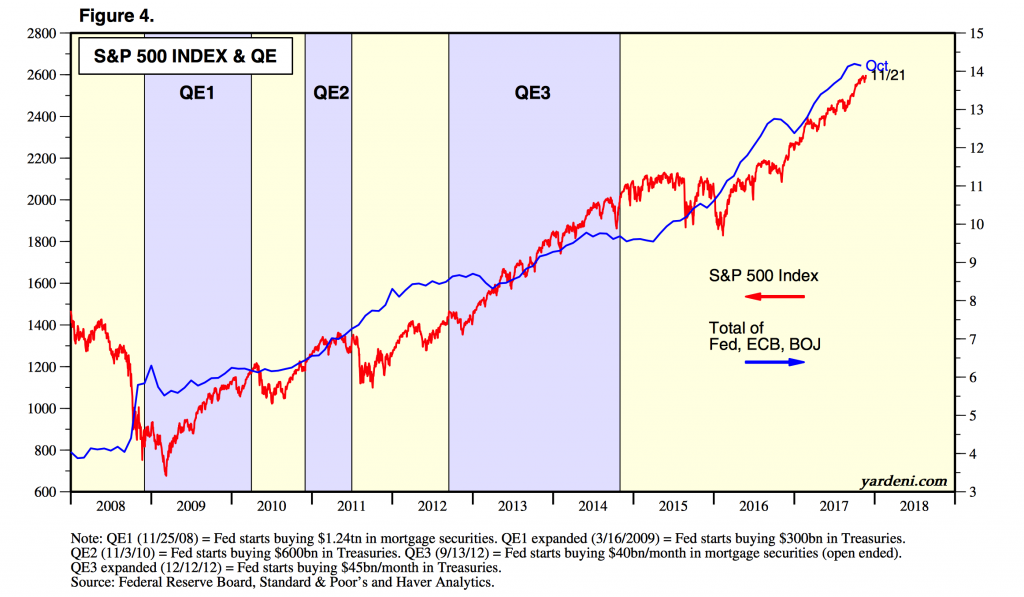

Gold Up 74percent and One Of Top Performing Assets Since Last Market Peak 10 Years Ago

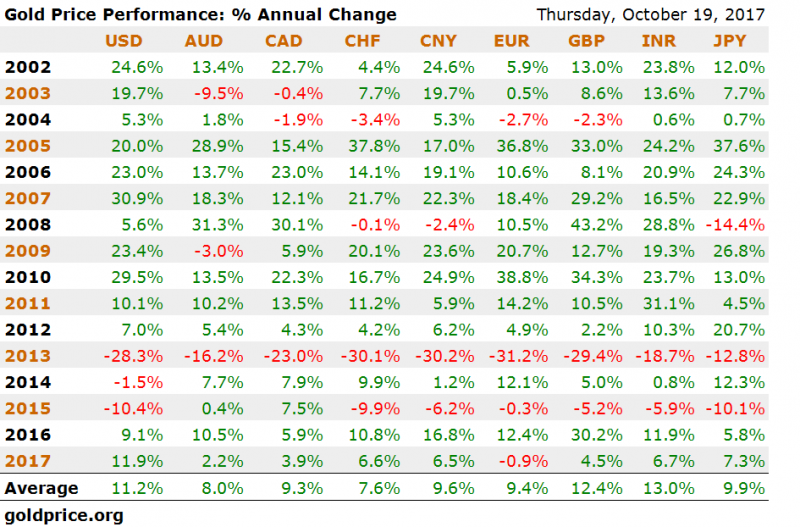

10 year anniversary of pre-Global Financial Crisis market peak in S&P 500 on October 9th. Gold up 74% since the last market peak a decade ago; 11% pa in USD, 9.4% pa in EUR and 12.4% pa in GBP. Precious metal has climbed $736/oz on Oct 9th 2007 to $1278.75 ten-years later. S&P 500’s 102% climb is thanks to asset-pumping policies by central banks, rather than value. Gold’s performance is slowly forcing mainstream to re-consider gold.

Read More »

Read More »

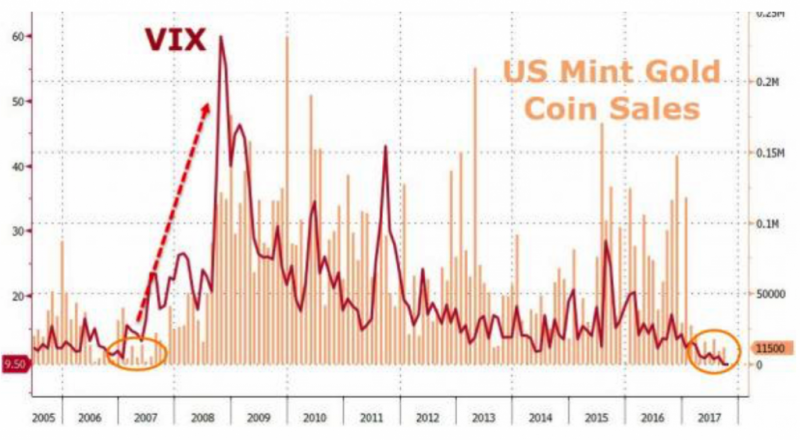

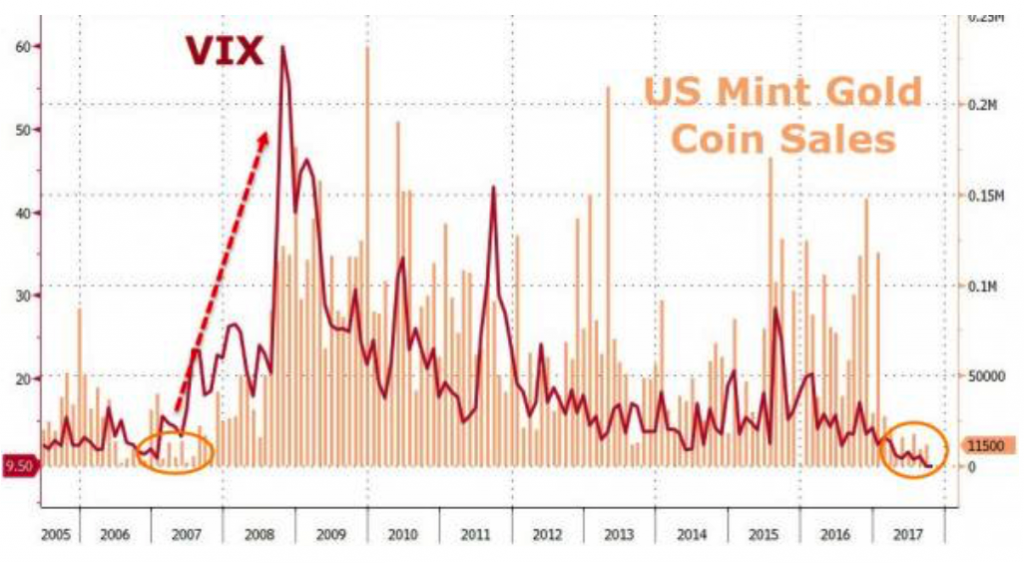

U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

US Mint gold coin sales and VIX at weakest in a decade. Very low gold coin sales and VIX signal volatility coming. Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week. U.S. Mint sales do not provide the full picture of robust global gold demand. Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe. Middle East demand likely high given geopolitical risks. Iran...

Read More »

Read More »

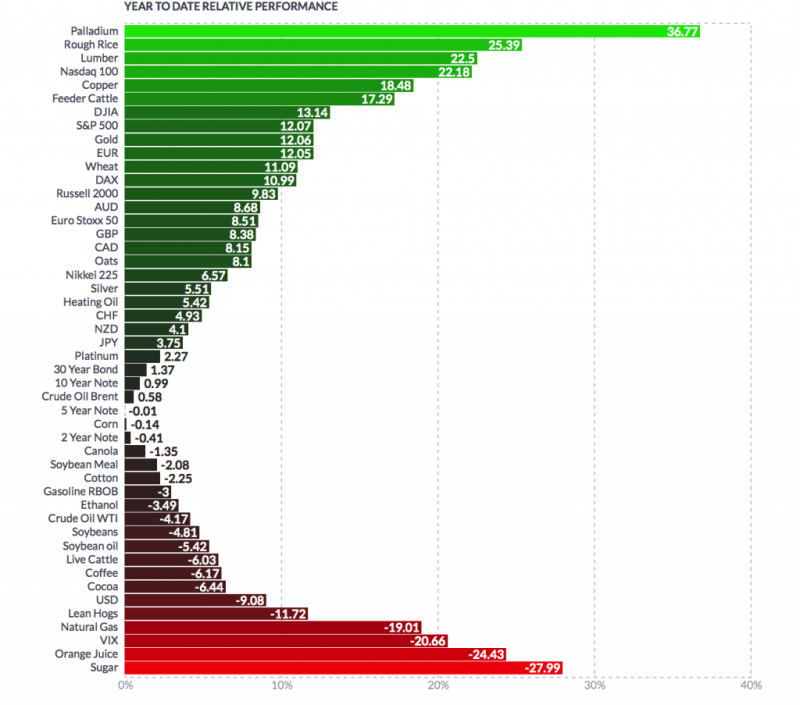

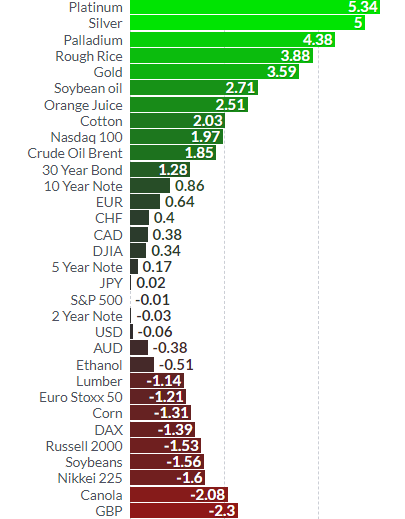

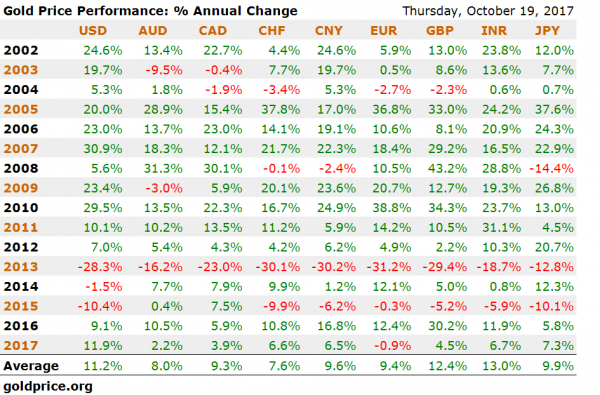

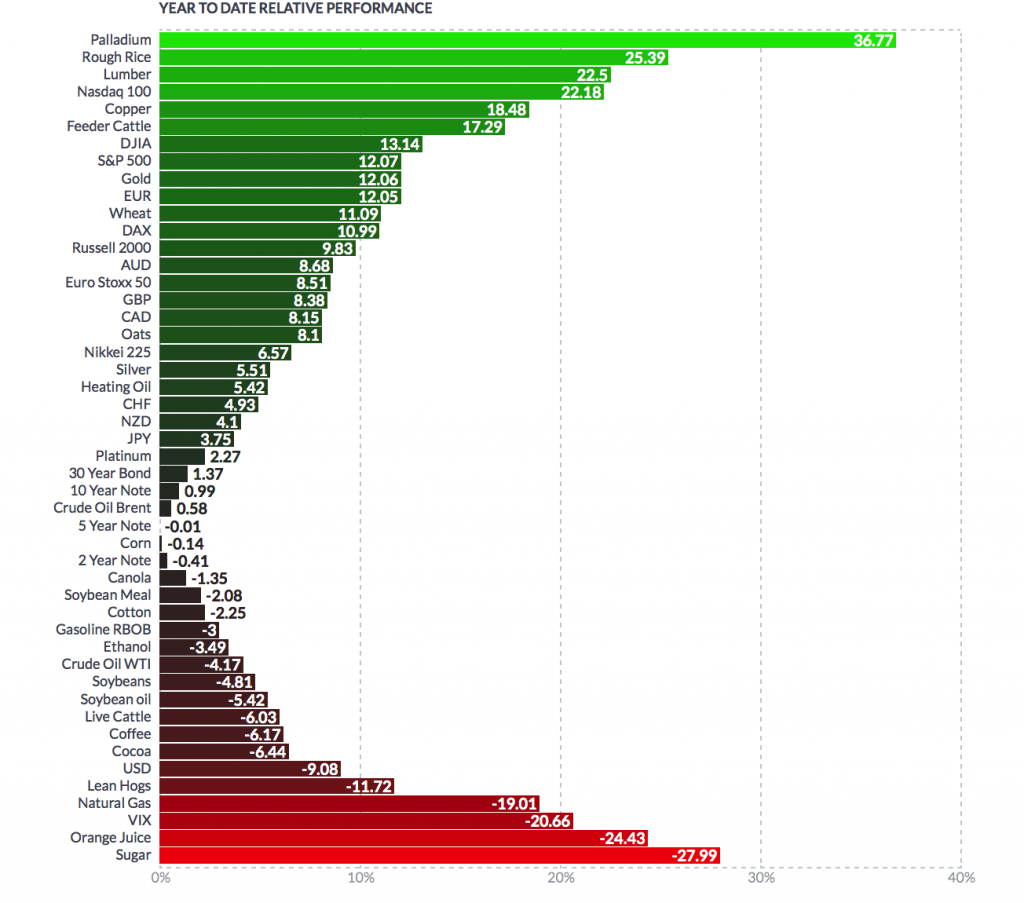

Gold Matches S&P 500 Performance In First 3 Quarters; Up 12% 2017 YTD

Gold climbs over 12% in YTD, matching S&P500 performance. Palladium best performing market, surges 36% 2017 YTD. Gold outperforms Nikkei 225, Euro Stoxx 50, FTSE and ISEQ. Geo-political concerns including Trump and North Korea supporting gold. Safe haven demand should push gold higher in Q4. Owning physical gold not dependent on third party websites and technology remains essential.

Read More »

Read More »

Pensions and Debt Time Bomb In UK: £1 Trillion Crisis Looms

£1 trillion crisis looms as pensions deficit and consumer loans snowball out of control. UK pensions deficit soared by £100B to £710B, last month. £200B unsecured consumer credit “time bomb” warn FCA. 8.3 million people in UK with debt problems. 2.2 million people in UK are in financial distress. ‘President Trump land’ there is a savings gap of $70 trillion.

Read More »

Read More »

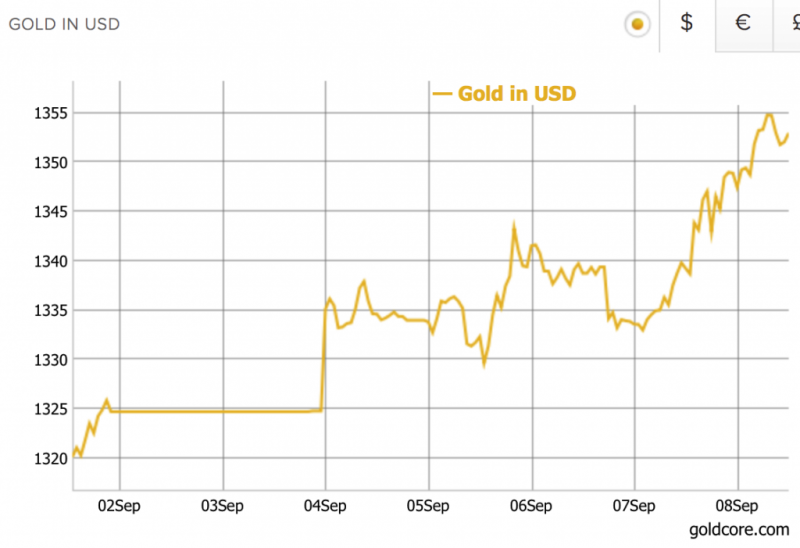

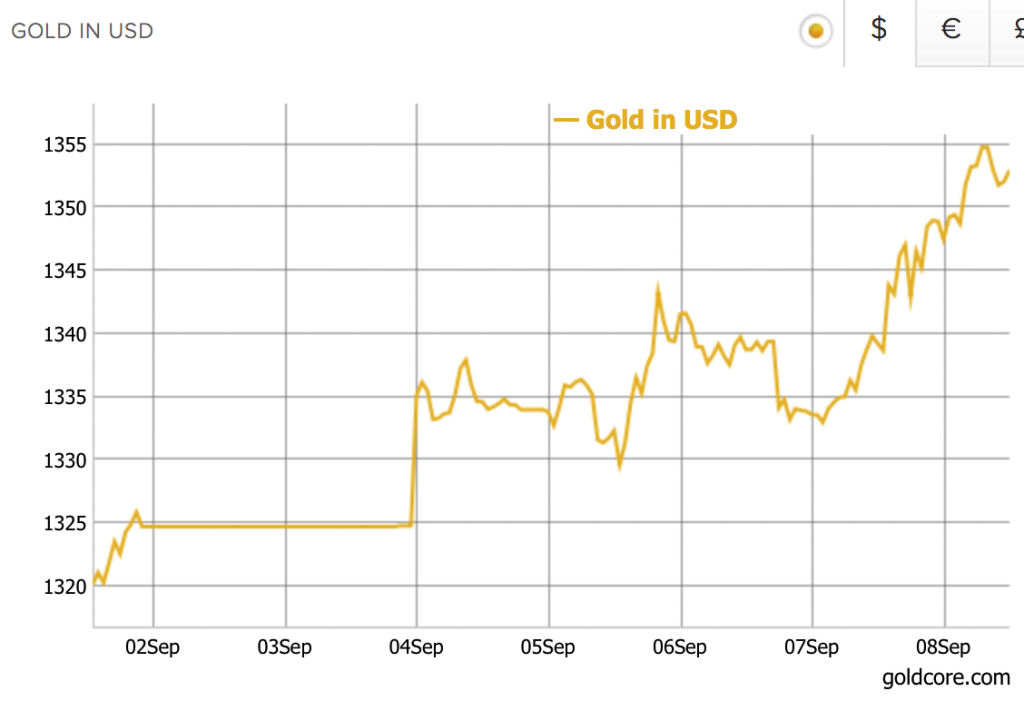

Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy. Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower. Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%. Geo-political concerns including North Korea, falling USD push gold 2.1% in week. Gold prices reach $1,355 this morning following Mexico earthquake. Safe haven demand sees gold over one year high, highest since August 2016.

Read More »

Read More »

Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August. Gold posts best month since January, up nearly 4%. Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand. S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month. Platinum is best performing metal climbing over 5%. Palladium climbs over 4% thanks to seven year supply squeeze.

Read More »

Read More »

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »