Berkshire Hathaway CEO Warren Buffet famously dismissed gold. “Gold has two significant shortcomings, being neither of much use nor procreative.” I have recently written about how a government with gold mining tax revenues can use gold. The benefits of issuing gold bonds include reducing risk, and getting out of debt at a discount. Pretty useful, eh?

Read More »

Tag Archive: Warren Buffet

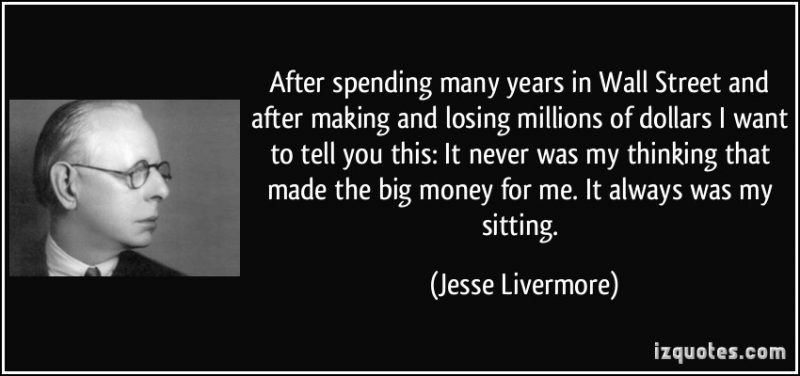

Financial Advice From Man Who Made $1+ Billion in 1929 – Importance Of Being Patient and “Sitting”

Listen to Jesse Livermore and ignore the noise of short term market movements, central bank waffle and daily headlines. Stock and bond markets are overvalued but continue to climb… for now. What goes up must come down and investors should diversify and rebalance portfolios despite market noise. Behavioural biases currently drive markets, prompting legendary investors to be confused and opt out.

Read More »

Read More »

Tim Price: Why I’m Voting To Leave The European Union

On 23 June 2016, this British citizen will be voting to leave the European Union.

To me it’s clear: the EU has not only become too big for its own good, it’s too big to do hardly anything good.

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »

Buffett: I Might Consider Taking Money Out of Banks If They Charge for Deposits

With persistently low interest rates around the globe, billionaire investor Warren Buffett told CNBC on Monday he’d consider taking money out of banks, especially if negative interest rates result in customers being charged to park their money in accounts.

Read More »

Read More »

A Tribute to the Jackass Money System

A Witless Tool of the Deep State? Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can ge...

Read More »

Read More »

Miserable week that ended a miserable year

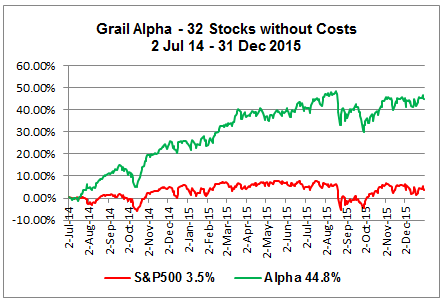

it was the S&P 500’s worst since the start of the bull market in 2009, ending the year down 0.73% at 2043.94 points. 56% of the stocks posted losses

Read More »

Read More »

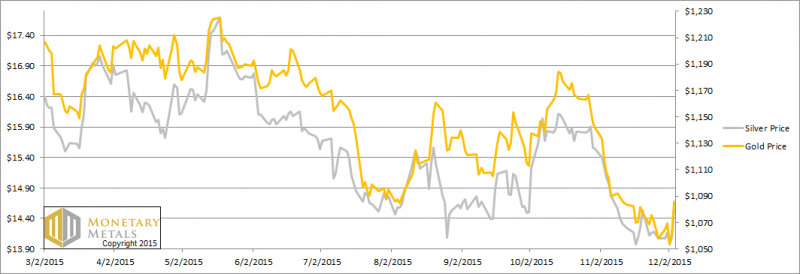

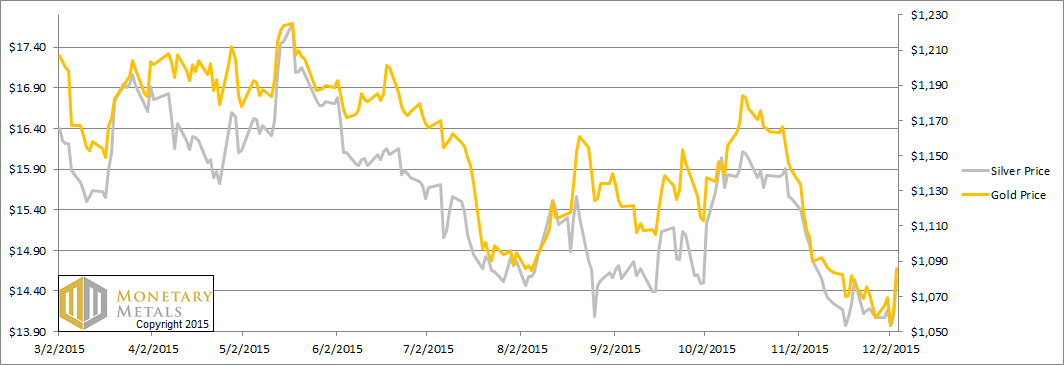

Silver Rocket Report 6 Dec, 2015

The prices of the metals moved mostly sideways this week. That is, until Friday. Then foom! (Foom is the sound of a rocket taking off.) From 6 to 10am (Arizona time, i.e. 8 to 12 NY time) the price of gold rose from $1,061 to $1,087. Not surprisingly...

Read More »

Read More »

Adjust Your Sales in today’s Choppy Market!

Dumping stocks is one of the hardest things to do. The best way to do this is to examine each stock’s earnings growth projections for significant damage. A planned 20% or 25% return might now no longer realistic, in particular when the sink even below their 200-day moving average

Read More »

Read More »

Why Can’t The Fed Spot Bubbles?

The topic of whether the Federal Reserve can see bubbles in advance, and what they can do about them, is hotly debated. The price of an earning asset depends directly on the interest rate. This is because of time preference. It is better to have your cash today than tomorrow. The Fed’s problem is that the calculation depends on a rate of interest that it heavily influences. Its analysis is therefore circular and self-fulfilling. It’s like taking a...

Read More »

Read More »