Tag Archive: #USD

FX Daily, November 6: A Pause that Refreshens?

Investors have piled into risk assets this week, seemingly undeterred by the US elections' lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a vaccine. MSCI Asia Pacific Index rose for the fifth consecutive session today to end its best week since April.

Read More »

Read More »

FX Daily, November 5: The Dollar Slides and the Yuan Jumps

Overview: The markets did not wait for the final vote count and took stocks and bonds higher while pushing the greenback lower. While it appears Biden will be the next US President, investors seemed to like the fact that his agenda will be checked by a Senate that may remain in Republican hands. Stocks are on a tear.

Read More »

Read More »

FX Daily, November 4: Indecision Keeps Investors on Edge, but the Dollar Rides High

Initially, the markets built on Tuesday's price action, but as soon as a few counties in Florida indicated that it was not going to be the "blue wave," risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong Kong, Australia, and Indonesia advanced.

Read More »

Read More »

FX Daily, November 3: Risk Appetites Return as the US Goes to the Polls

More than 95 mln Americans voted before today, and many observers warn of a cliffhanger that could be decided in the courts. The polls sand surveys show strong odds in favor of a Democratic sweep. Looking at the capital markets, nothing looks amiss.

Read More »

Read More »

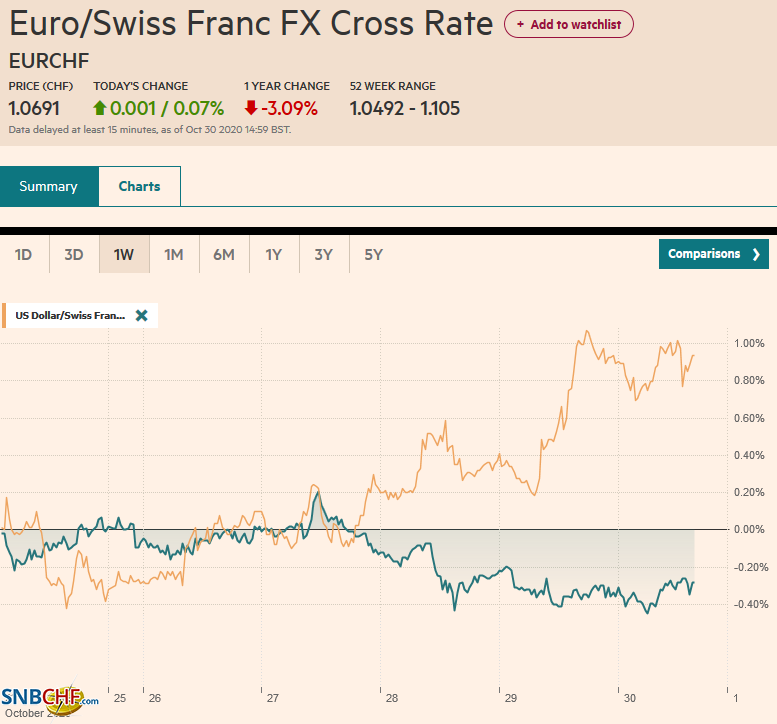

FX Daily, October 30: Investors Scared Before Halloween

Investors punished US tech giants for not delivering perfection as prices apparently had discounted, and the subsequent sell-off coupled with month-end dynamics has rocked global equities. Asia Pacific bourses were a sea of red, led by a 2.5% decline in the tech-heavy South Korean Kospi, but most major markets were off more than 1%.

Read More »

Read More »

FX Daily. October 29: Markets Continue to Struggle

The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region.

Read More »

Read More »

FX Daily, October 28: Animal Spirits Called in Sick

Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions.

Read More »

Read More »

FX Daily, October 27: Markets Take Collective Breath and Beijing Tweaks Fixing Mechanism

The surging pandemic sapped the risk-taking appetites as some investors hunker down for what could be a volatile period ahead. The S&P 500 lost nearly 3% at its lows before rebounding 1% in late dealings.

Read More »

Read More »

FX Daily, October 26: Troubling Start of the Important Week

The surging virus ravaging large parts of Europe and the United States is fanning concerns over the economic implications as new social restrictions and curfews are announced in several countries. US additional fiscal support remains elusive as aid for states and local governments remains a bone of contention.

Read More »

Read More »

FX Daily, October 22: Greenback Stabilizes

Two sets of talks have riveted attention, and both appeared to have made progress yesterday. After some words, the EC, recognizing the importance of UK sovereignty, UK Prime Minister Johnson signaled a resumption of trade talks.

Read More »

Read More »

FX Daily, October 21: Dollar Slumps as Yields Rise

Overview: The dollar is falling against most of the world's currencies today, even as long-term yields rise to the most in four months and drags global yields higher. The US 10-year yield is pushing above 0.80%, and the 30-year is above 1.60%.

Read More »

Read More »

FX Daily, October 20: Narrowly Mixed Markets as Clearer Direction Sought

The capital markets lack a clear direction today. This is reflected in narrowly mixed equities, bonds, and currencies. The spreading contagion is giving rise to new economic concerns, among other things, and the UK-EU talks are struggling to resume, while Pelosi-Mnuchin talks in the US continue to drag.

Read More »

Read More »

FX Daily, October 19: Sterling Sparkles in Dollar Setback

Investors have not let the surge of the virus or uncertainty over the UK-EU talks or US fiscal stimulus to stand in their way. Sterling is leading the major currencies higher, returning to the $1.30 area, while global equities are trading higher.

Read More »

Read More »

FX Daily, October 16: Deja Vu All Over Again

It was like deja vu all over again. First, the market reacted immodestly to headlines indicating there was little chance of pre-election fiscal stimulus in the US. It was hardly new news. Then the market seemed to react with surprise that there was no last-minute breakthrough in the UK-EU trade negotiations.

Read More »

Read More »

FX Daily, October 15: Markets Shake and Dollar Goes Bid

A combination of the surging virus, threatening the slow recovery that was already losing momentum, the lack of new stimulus in the US, and market positioning is seeing risk unwind in a big way today. Equities are selling off.

Read More »

Read More »

FX Daily, October 14: UK Blinks on Threat to Walk Away on Eve of EU Summit

Overview: Turn around Tuesday saw the dollar bounce, particularly against the Australian dollar and European currencies, among the majors. Sterling pared earlier losses on reports that the UK would not walk away from the talks just yet, while the euro remains on its back foot.

Read More »

Read More »

FX Daily, October 13: Markets Look for Fresh Incentives

The S&P 500 and NASDAQ gapped higher for the third consecutive session and continued to advance. The benchmarks reached their best level since early September. Hong Kong markets were closed due to a storm, but the MSCI Asia Pacific gained for the seventh consecutive session. Most markets were higher, though Taiwan and South Korea were exceptions.

Read More »

Read More »

FX Daily, October 12: Yuan in Spotlight in Consolidative Session

Led by 2-3% gains in Hong Kong and China, the MSCI Asia Pacific Index rose for the sixth consecutive session is pressing against the high for the year. European stocks are firmer, and the Dow Jones Stoxx 600 is up around 0.5% near midday, and shares are also trading firmer.

Read More »

Read More »

FX Daily, October 9: Animal Spirits Return

Overview: The on-again-off-again fiscal stimulus in the US is back on as the White House now supports a broad stimulus program, but not as big as the Democrats $2.2 trillion package. It is the narrative being cited as the rebuilding of risk appetites is the wobble earlier in the week.

Read More »

Read More »

FX Daily, October 08: Markets Catch Collective Breath

The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday's presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before the election, but the near round-trip seen in stocks and bonds was surprising.

Read More »

Read More »