Tag Archive: U.S. Markit Manufacturing PMI

United States: The ISM Conundrum

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

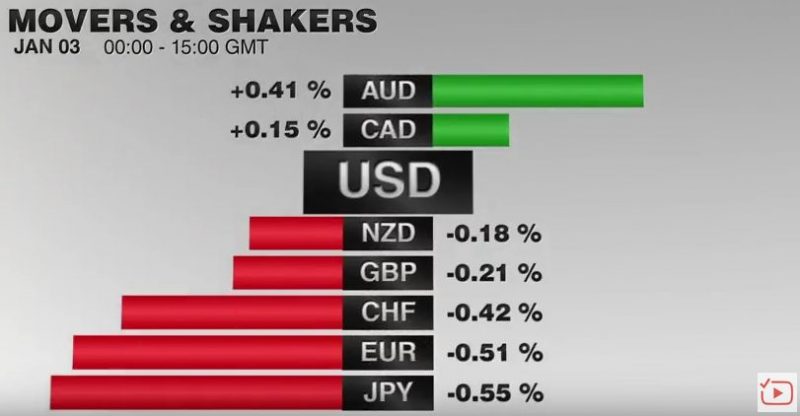

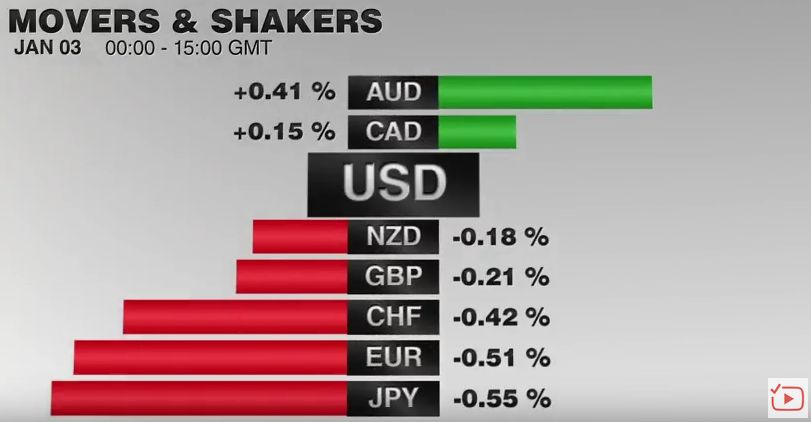

FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling's earlier losses were recouped following news that the manufacturing PMI jumped to 56.1, its highest since June 2014.

Read More »

Read More »

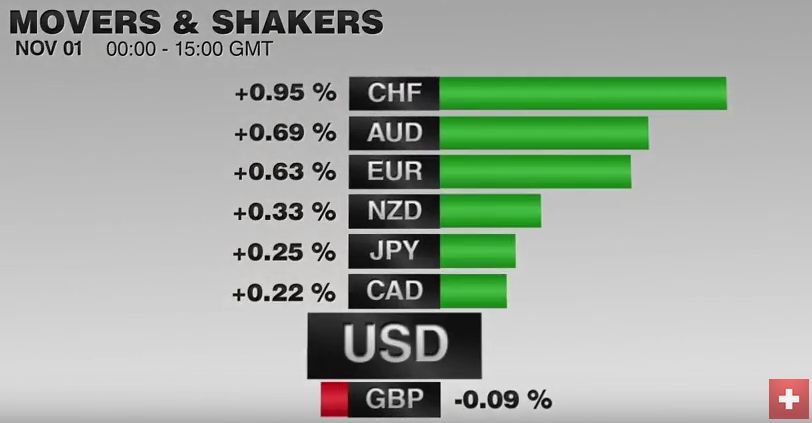

FX Daily, November 01: Dollar and Yen Slip in Quiet even if Eventful Turnover

The US dollar is posting minor losses against most of the major currencies today.The Japanese yen is the exception, as the greenback continues to straddle JPY105. There have been several developments today, and the US also has a full economic calendar today. The most important of the developments was the upbeat message from the Reserve Bank of Australia.

Read More »

Read More »

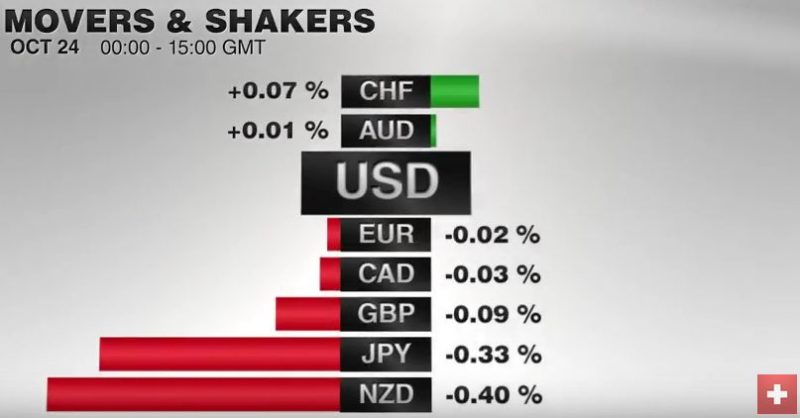

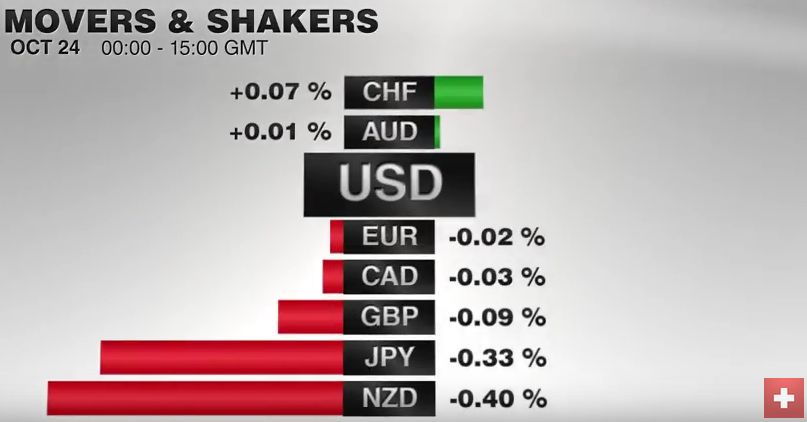

FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even further against the Swiss Franc than its current...

Read More »

Read More »

FX Daily, October 03: May’s Confirmation Sends Sterling Lower

Sterling has a bad case of the Monday blues. Even the moon looks distraught. Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time frame, though many have been skeptical that Article 50 would be triggered at all, given the complexities of the issues.

Read More »

Read More »

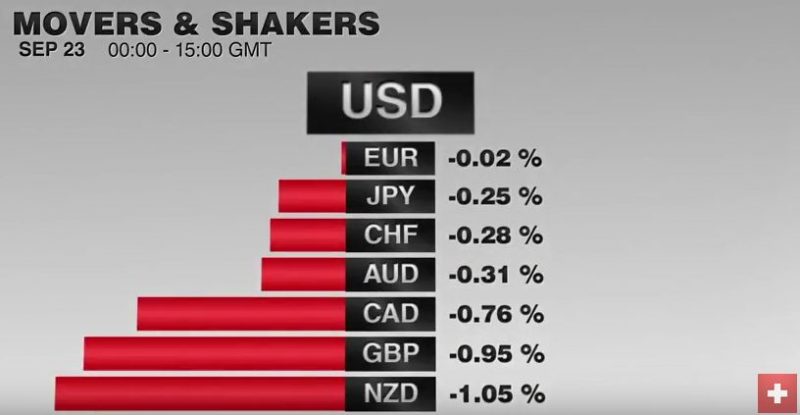

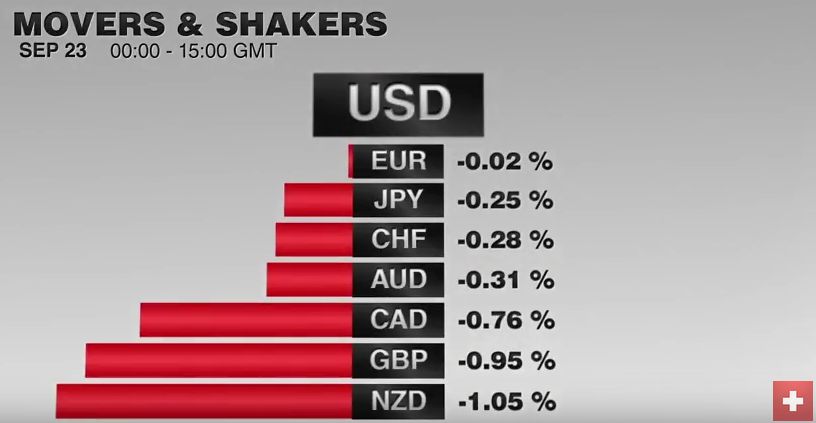

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

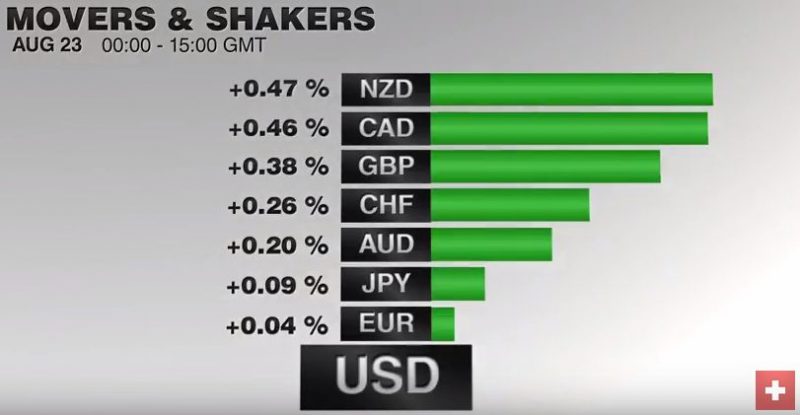

FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

The US dollar is mostly little changed against the major, as befits a summer session.There are two exceptions.The first is the New Zealand dollar. Comments by the central bank's governor played down the need for urgent monetary action and suggested that the bottom of cycle may be near 1.75% for the cash rate, which currently sits at 2.0%.This means that a cut next month is unlikely. November appears to be a more likely timeframe.

Read More »

Read More »

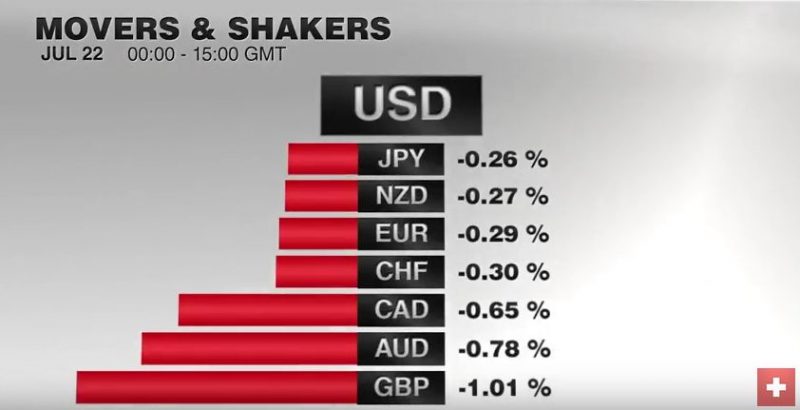

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »

FX Daily, July 01: Markets Head Quietly into the Weekend

EUR/CHF finished the week after Brexit with slight improvement of 0.18%. The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney's comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08.

Read More »

Read More »

FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK's referendum is underway. The capital markets are

continuing the move that began last week with the murder of UK MP Cox.

The tragedy seemed to mark a shift in investor sentiment. Sterling

bottomed on June 17 just ahead...

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 8

Submitted by Mark Chandler, from marctomarkets.com The Price of Protection We have been tracking the deterioration in the technical condition of the major foreign currencies in this weekly note for the past three weeks. The euro’s recovery, off the support we identified here last week near $1.2800, should not overshadow the fact that the dollar’s …

Read More »

Read More »

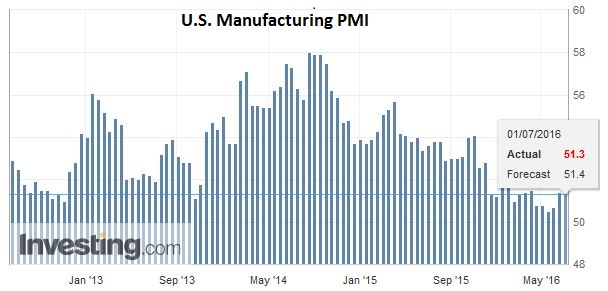

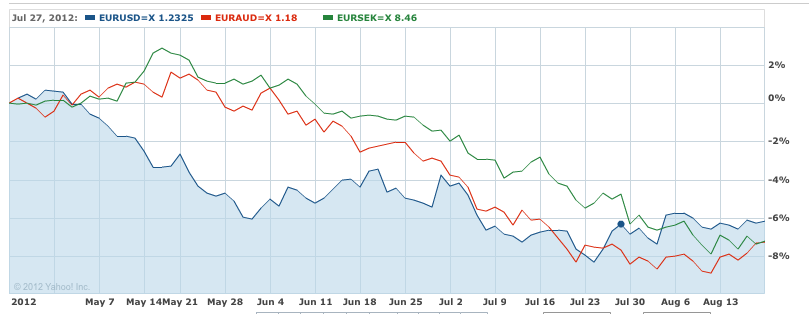

Why the euro has recovered? or are Markit PMI really reliable?

Here a follow-up of our contribution on Seeking Alpha written on August 15th, with the title “Are Markit PMIs really reliable?“. We recommended to go long the euro and the Swiss franc against the US dollar and sterling, because the Markit PMIs were not in line with trade balance data. Previously we suggested in … Continue...

Read More »

Read More »