Tag Archive: U.S. Housing Starts

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

FX Daily, June 17: Correction Phase does not Appear Over

Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the Dow Jones Stoxx 600 is firm near yesterday's highs. It has entered but not yet filled the gap created by the sharply lower opening on June 11.

Read More »

Read More »

FX Daily, May 19: Optimism Burns Eternal

Overview: Hopes for a vaccine and a German-French proposal to break the logjam at the EU for a joint recovery effort helped propel equities higher yesterday. There was strong follow-through in the Asia Pacific region, where most markets advanced by more than 1% today. However, the bloom came off the rose, so to speak, in Europe. After a higher opening, markets reversed lower, and the Dow Jones Stoxx 600 is off about 0.75% in late morning turnover.

Read More »

Read More »

FX Daily, October 17: EU-UK Deal Sends Sterling and the Euro Higher

Overview: A Brexit deal between the UK and the EU has been struck. Whether it can win Parliament's approval is a horse of a different color. Meanwhile, US-Chinese relations continue to sour. The capital markets are narrowly mixed as investors await further developments. The MSCI Asia Pacific is consolidated after gaining for the past four sessions.

Read More »

Read More »

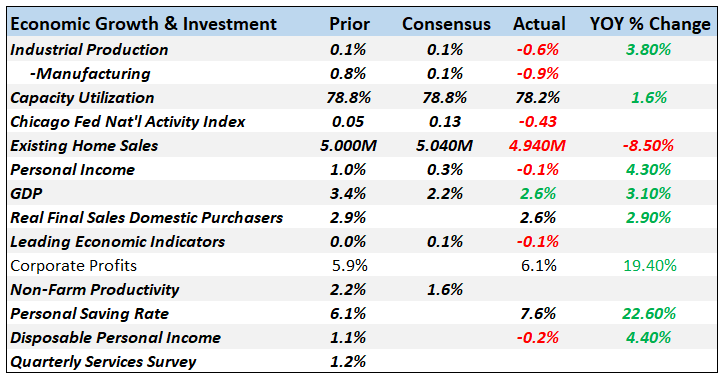

Monthly Macro Chart Review – March

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk.

Read More »

Read More »

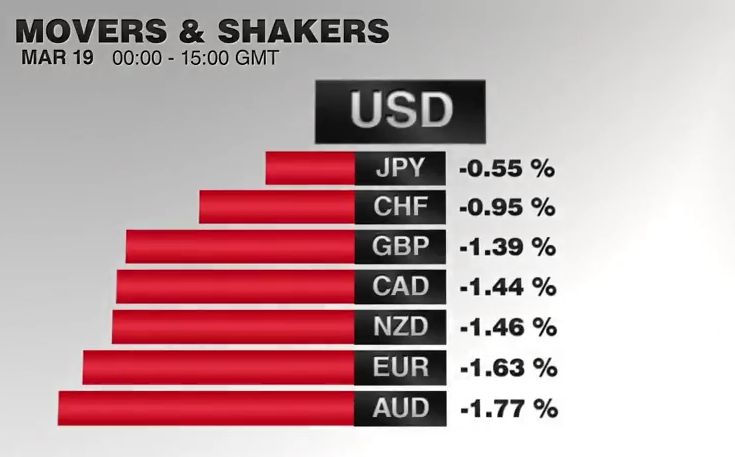

FX Daily, February 16: Worst Week for the Dollar since 2015-2016, While Stocks Continue to Recover

Nearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today's local session. Sterling is becoming another exception after disappointing retail sales. It is up just shy of two percent. The Dollar Index is off 2.3% on the week, which would be the biggest weekly loss since 2015.

Read More »

Read More »

FX Daily, January 18: Currencies Consolidate After Chop Fest

The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed's Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries.

Read More »

Read More »

FX Daily, December 19: US Equities Set Pace, While Greenback Consolidates Inside Monday’s Ranges

US tax changes appear to be providing fuel for the year-end advance that has carried the major indices to new record highs. The coattails are a bit short, and while global equity markets are firm, they are unable to match the strength of US. Despite a heavier tone in Japan, Taiwan, and Korea, the MSCI Asia Pacific Index edged higher for the second session but remains around one percent below the record highs set in late November.

Read More »

Read More »

FX Daily, November 17: Euro, Yen and Sterling Regain Footing

The US dollar is trading with a heavier bias against the euro, sterling, and yen, but is firmer against the Antipodean currencies and many of the actively traded emerging market currencies. This mixed performance is the story of the week. The US 2-10 yr yield curve is flattening further today with the two-year pushing above 1.70% for the first time since the financial crisis. The 10-year yield is slipping toward the middle of this week's...

Read More »

Read More »

FX Daily, September 19: Quiet Tuesday, Follow the Leader

Politics seems to dominate the talking points today. Boris Johnson's weekend op-ed has been rejected by May, and there is talk that Johnson may resign or fired. Sterling is consolidating after pulling back yesterday. Carney said that if the UK does hike it will be gradual and limited. The markets did respond dramatically to the BOE minutes and suggestions by even some of the doves that rates may need to be lifted, but there is still a good reason...

Read More »

Read More »

FX Daily, August 16: Swiss Franc and Yen Improve after Dovish Draghi Comments

Swiss Franc and Yen Improve after Dovish Draghi Comments, A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB's Draghi will not be discussing the central bank's monetary policy course at Jackson Hole confab, which will take place next week.

Read More »

Read More »

FX Daily, July 19: Dollar Stabilizes on Hump Day, Awaits Thursday’s BOJ and ECB Meetings

After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow's BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a three-month slide.

Read More »

Read More »

FX Daily, June 16: Dollar Slips In Consolidation, but Extends Recovery Against the Yen

As the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday's ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of the week and pushed through JPY111 in late in the Tokyo morning. The greenback is above its 20-day moving average against the yen for the first time in a month.

Read More »

Read More »

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

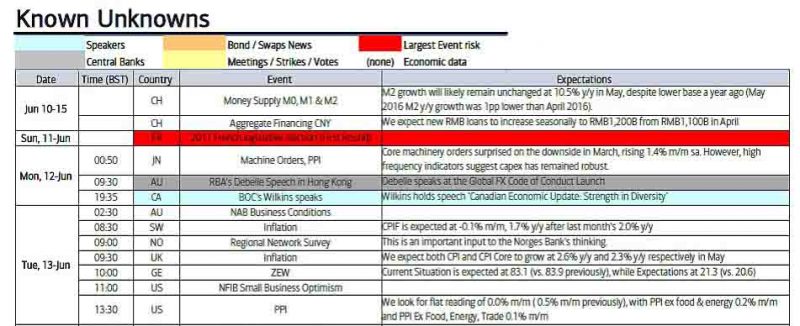

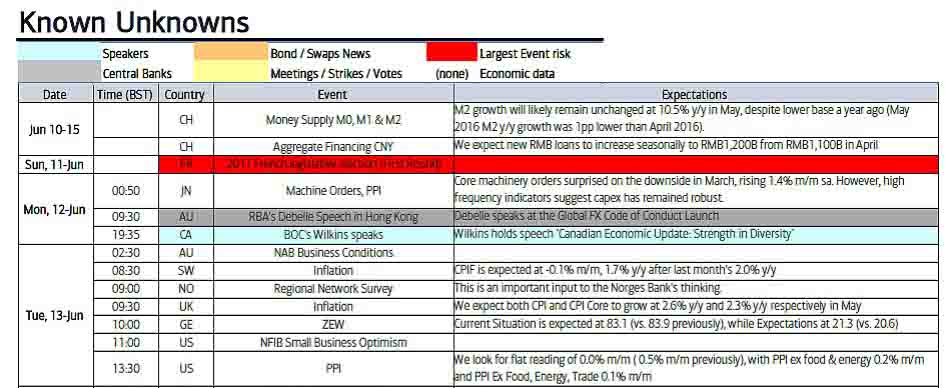

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

FX Daily, March 16: Greenback Consolidates Losses as Yields Stabilize

The US dollar remained under pressure in Asia following the disappointment that the FOMC did not signal a more aggressive stance, even though its delivered the nearly universally expected 25 bp rate hike. News that the populist-nationalist Freedom Party did worse than expected in the Dutch elections also helped underpin the euro, which rose to nearly $1.0750 from a low close to $1.06 yesterday.

Read More »

Read More »

FX Daily, February 16: Corrective Forces Emerge, Tempering the Dollar’s Rally

The Dollar Index had moved higher for ten consecutive sessions before reversing yesterday's gains to close lower. Yesterday and today's losses have seen the Dollar Index retrace 38.2% of the advance since February 2. That retracement objective was near 100.80. The 50% retracement is found near 100.50 and the 61.8% retracement by 100.20.

Read More »

Read More »

FX Daily, January 19: Dollar Gives Back Most of Yellen-Inspired Gains

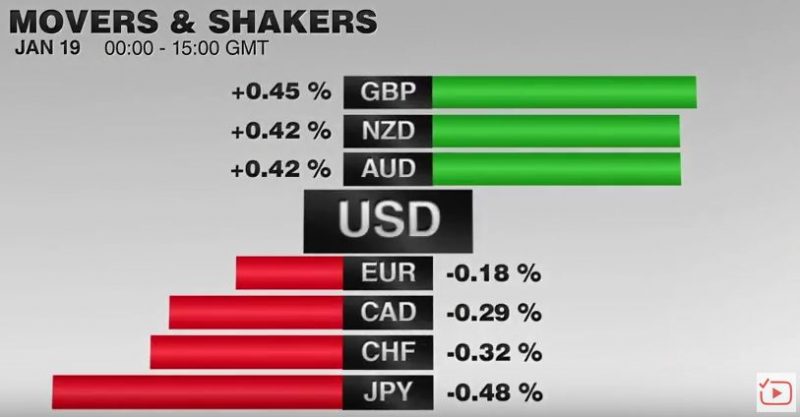

While the US 10-year yield is unchanged, the dollar is consolidating its gains against the yen in a relatively narrow range of about half a big figure below JPY115.00. It has seen its gains pared more against the euro and sterling, where most of Yellen-inspired gains have been unwound. Sterling found support near $1.2250 and was bid up to $1.2335 by early in the European sessions.

Read More »

Read More »

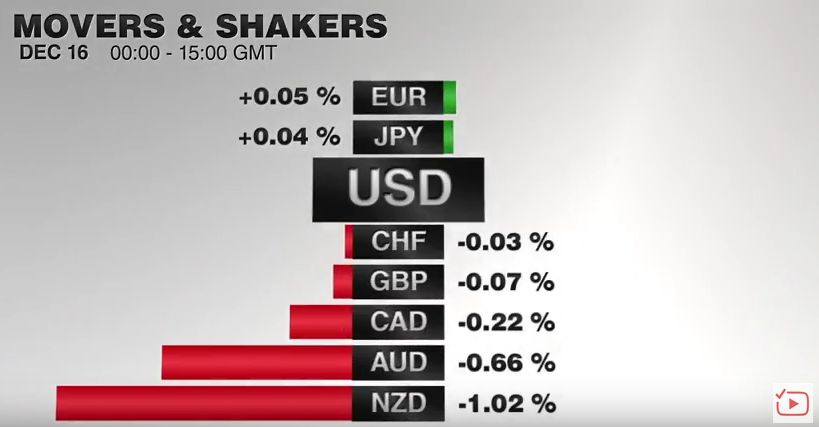

FX Daily, December 16: Markets Turn Quiet Ahead of the Weekend, Dollar Consolidates Gains

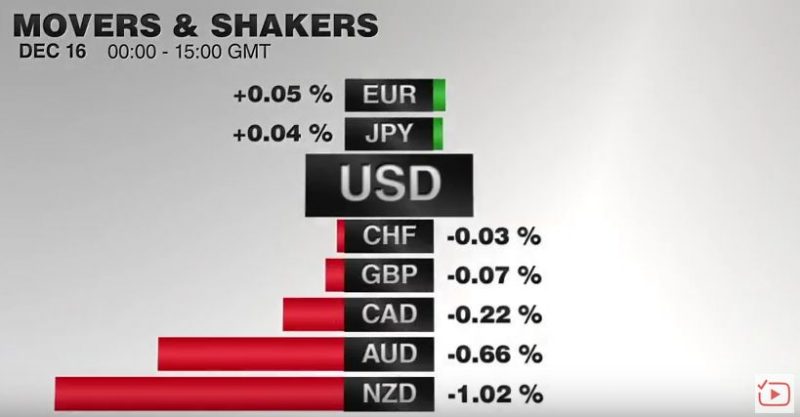

Some mild position squaring pressures are evident ahead of the weekend, and for many market participants the year is coming to an end. Outside of the BOJ meeting next week, the calendar turns light and markets are moving into holiday mode. The Dollar Index is seeing this week's gains trimmed, but it is up nearly 1.4% this week. Although the election has seen the dollar's gains accelerate, the current leg up began in early October. The Dollar...

Read More »

Read More »

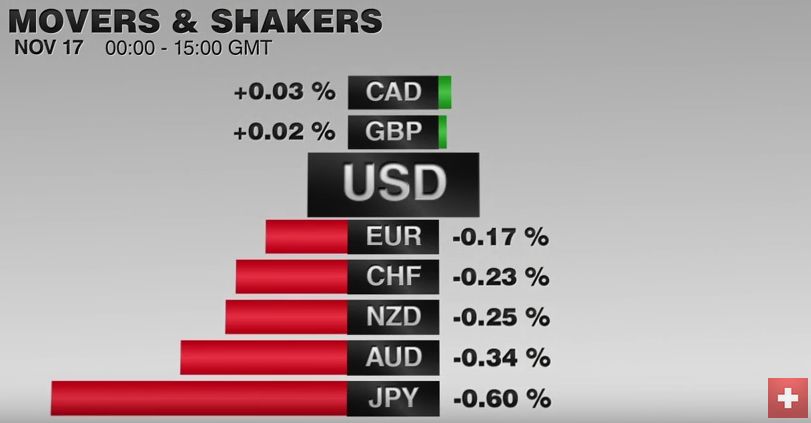

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

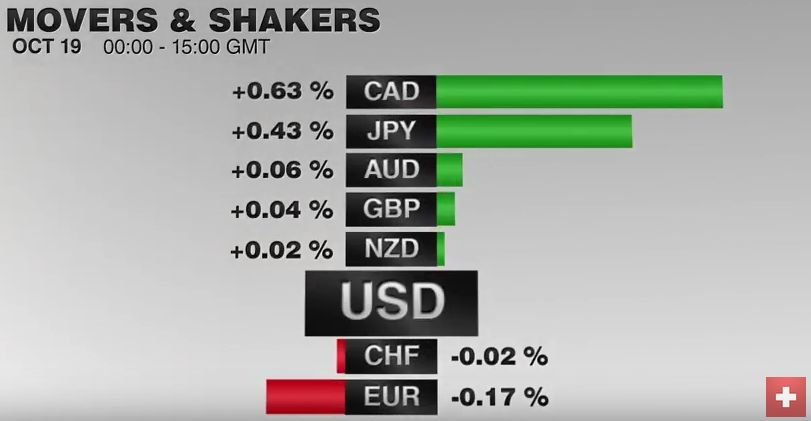

FX Daily, October 19: FX After China GDP

The Swiss Franc has strengthened against the pound as global uncertainty persists in the form of the UK’s Brexit vote and the US Presidential Election. Looking ahead it seems the CHF may soften a little as we learn of the new President, I found it very interesting that yesterday Paddy Power paid out on any bets for Hilary Clinton to become President in the United States.

Read More »

Read More »