Tag Archive: U.S. Disposable Personal Income

Personal Income measures the change in the total value of income received from all sources by consumers. Income is closely correlated with consumer spending, which accounts for a majority of overall economic activity.

Is This Why Productivity Has Tanked and Wealth Inequality Has Soared?

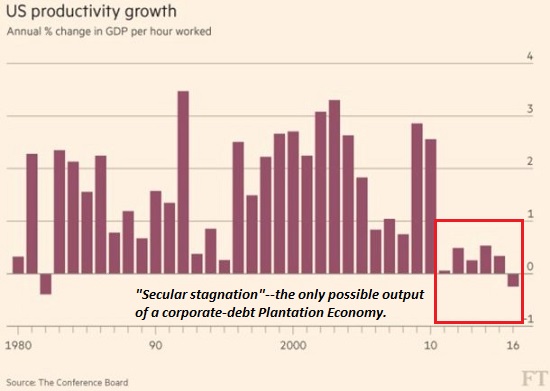

Needless but highly profitable forced-upgrades are the bread and butter of the tech industry. One of the enduring mysteries in conventional economics (along with why wages for the bottom 95% have stagnated) is the recent decline in productivity gains (see chart).

Read More »

Read More »

The Savings Rate Conundrum

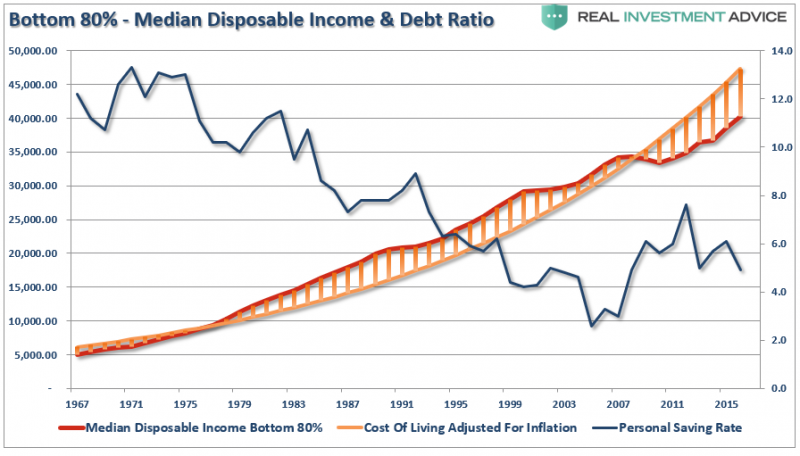

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth.

Read More »

Read More »

The (Economic) Difference Between Stocks and Bonds

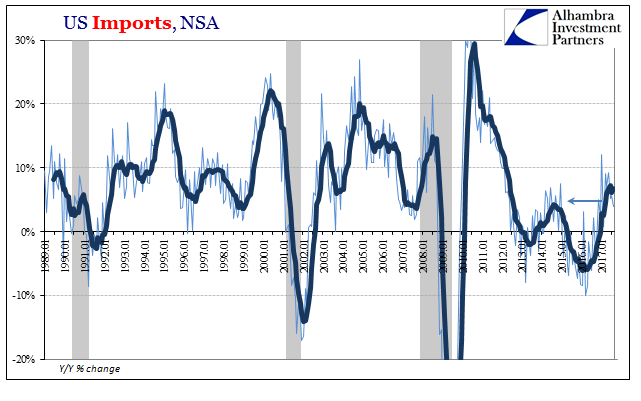

Real Personal Consumption Expenditures (PCE) rose 0.6% in September 2017 above August. That was the largest monthly increase (SAAR) in almost three years. Given that Real PCE declined month-over-month in August, it is reasonable to assume hurricane effects for both. Across the two months, Real PCE rose by a far more modest 0.5% total, or an annual rate of just 3.4%, only slightly greater the prevailing average.

Read More »

Read More »

The Damage Started Months Before Harvey And Irma

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe.

Read More »

Read More »

Money In America

In 1830, France was once more swept up in revolution, only this time at the end of it was installed one king to replace another. Louis-Phillipe became, in fact, France’s last king as a result of that July Revolution. The country was trying to make sense of its imperial past with the growing democratic sentiments of the 19th century.

Read More »

Read More »

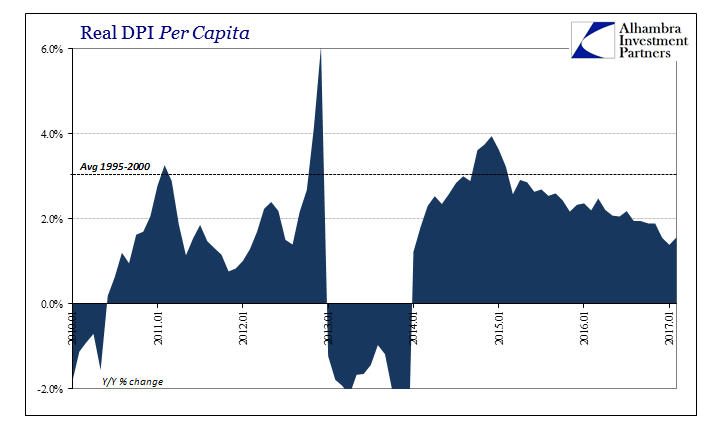

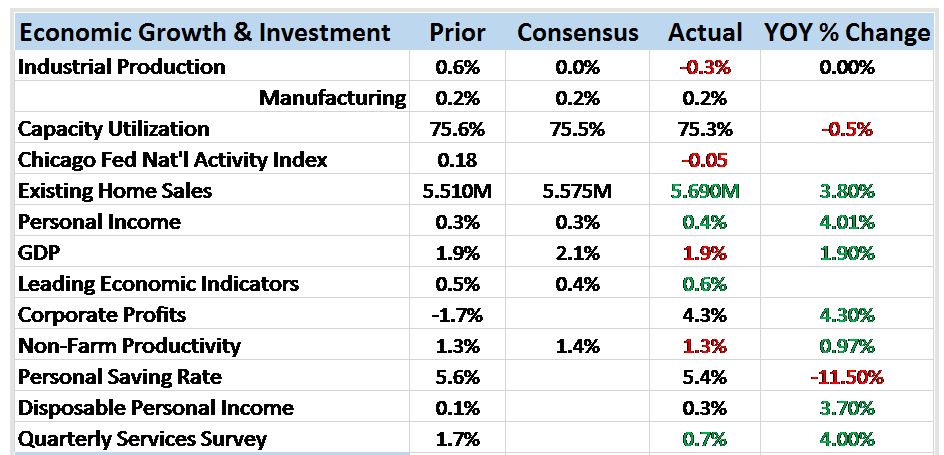

Incomes Always Deviate Negative

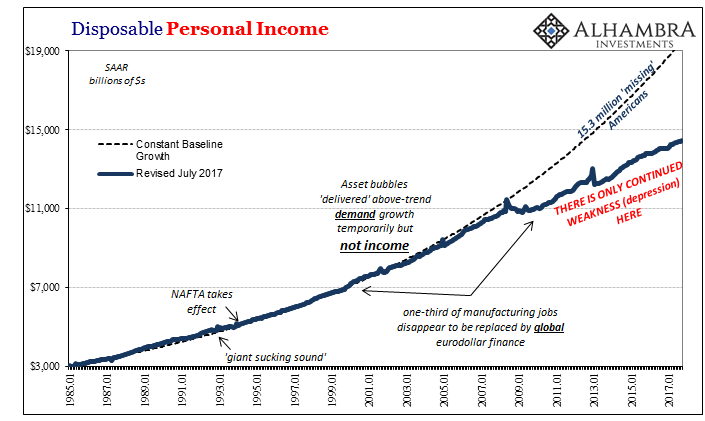

Personal Income growth in February 2017 was more mixed than it had been of recent months. Nominal Disposable Per Capita Income increased 3.73% year-over-year, while in real terms Per Capita Income was up 1.57%. For the former, that was among the better monthly results over the past year, while the latter was near the worst.

Read More »

Read More »

Ending The Fed’s Drug Problem

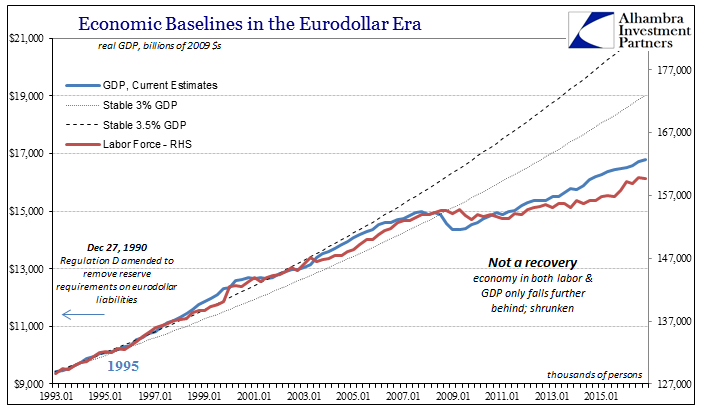

Gross Domestic Product was revised slightly higher for Q4 2016, which is to say it wasn’t meaningfully different. At 2.05842%, real GDP projects output growing for one quarter close to its projected potential, a less than desirable result. It is fashionable of late to discuss 2% or 2.1% as if these are good numbers consistent with a healthy economy.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

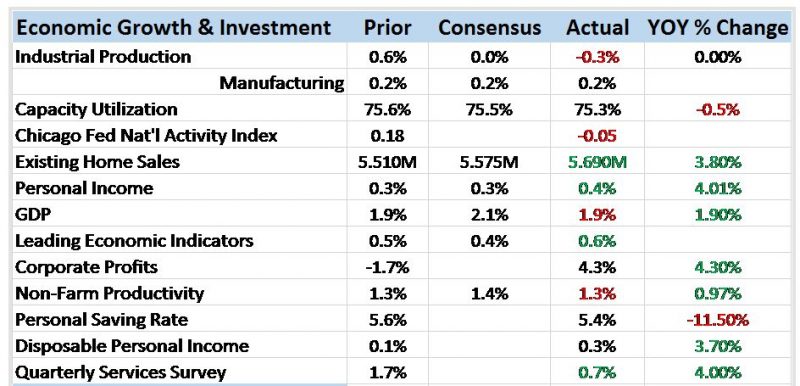

Bi-Weekly Economic Review

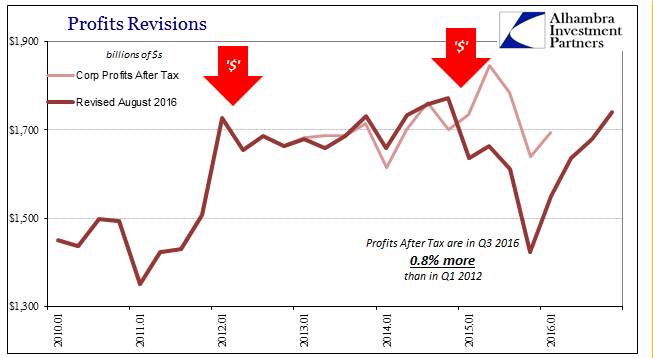

The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed.

Read More »

Read More »

Real Disposable Income: Headwinds of the Negative

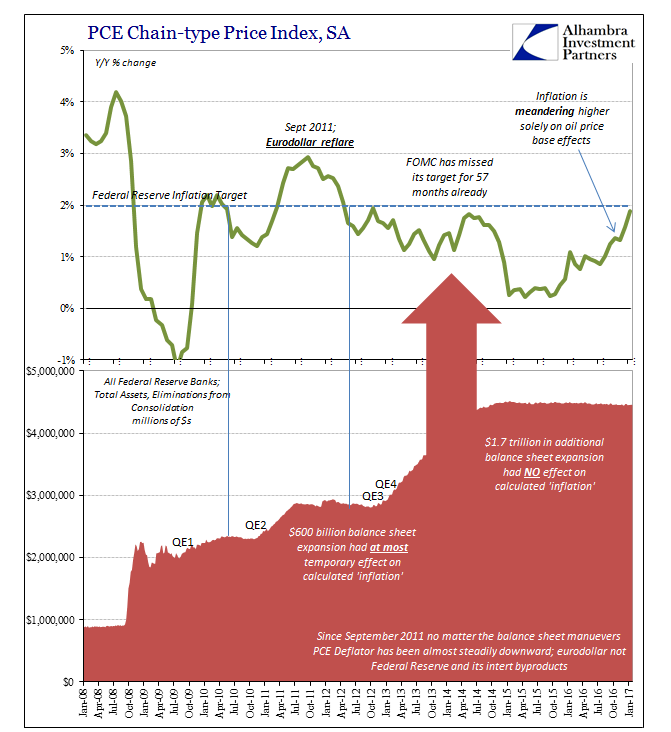

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability).

Read More »

Read More »

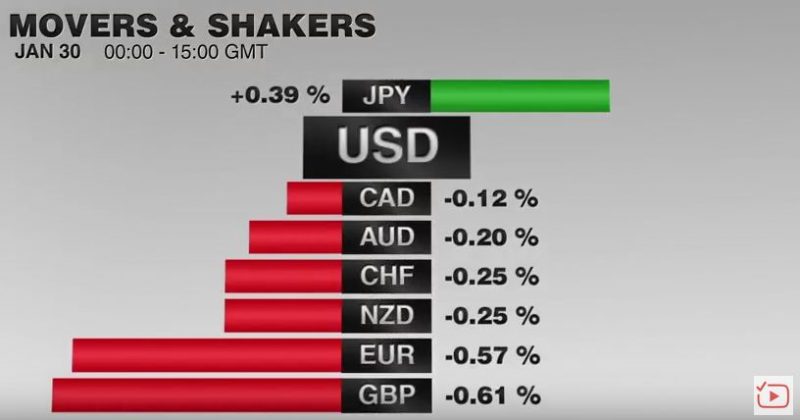

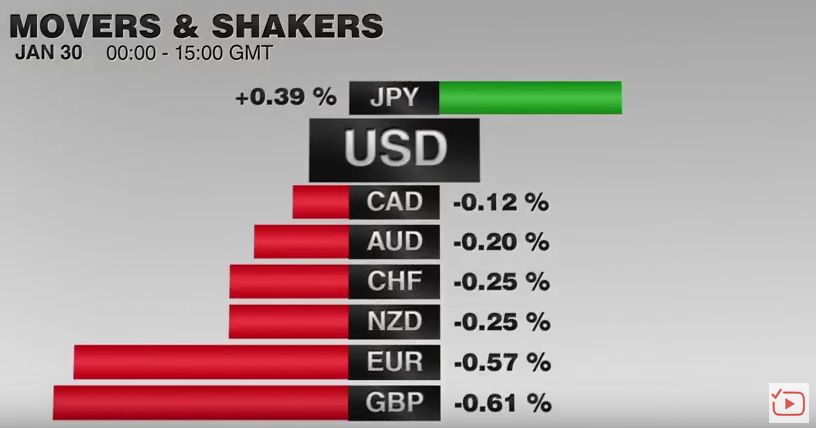

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

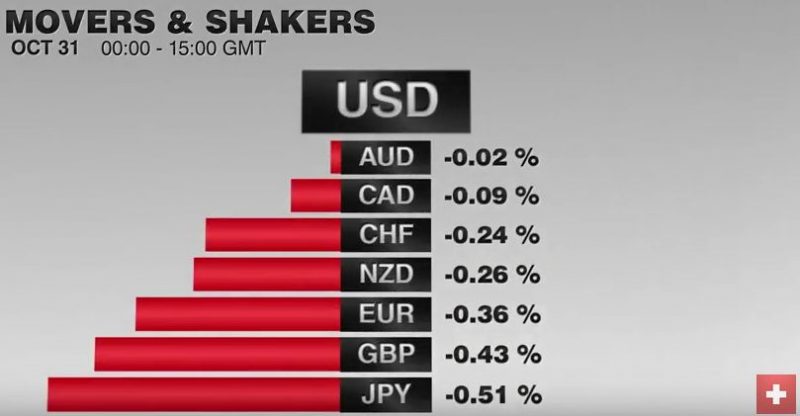

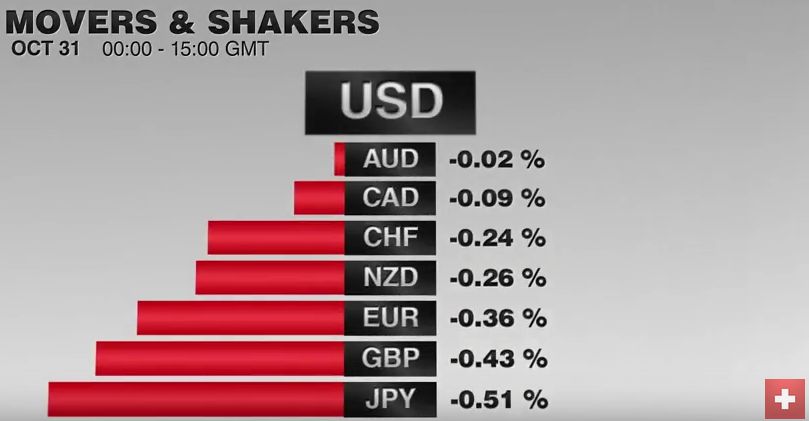

FX Daily, October 31: Respite for Market Nerves Lifts Peso, Rand, and US Dollar

he latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump's fortune in the polls had bottomed prior to the re-opening of the investigation into Clinton's emails and the national polls have narrowed.

Read More »

Read More »

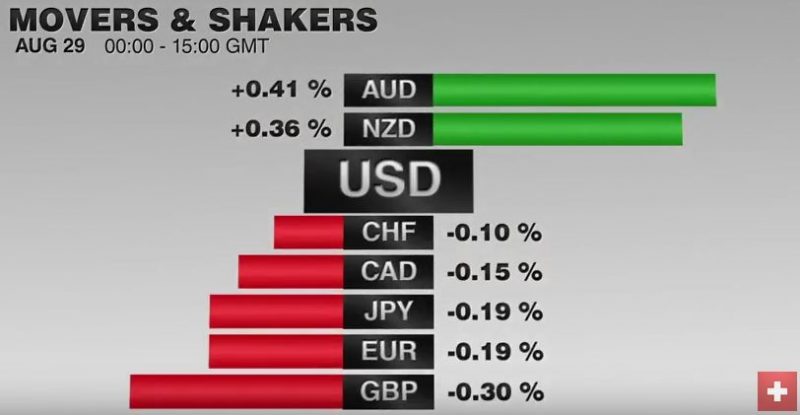

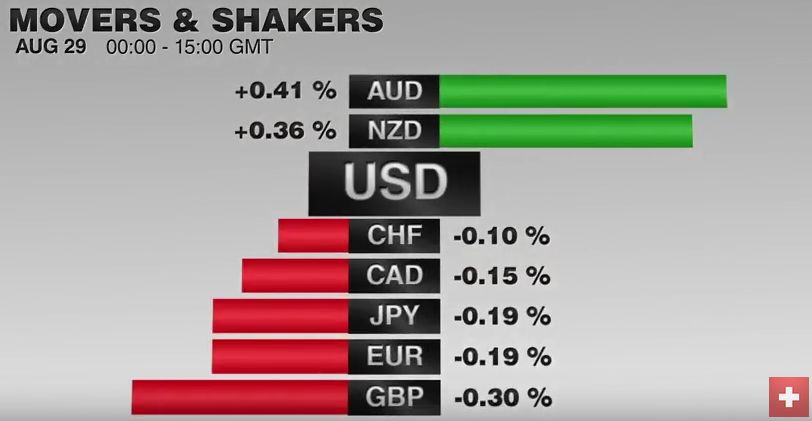

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »